Talk:National debt of the United States/Archive 2

| This is an archive of past discussions about National debt of the United States. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 | Archive 2 | Archive 3 |

Admission of bias

As one of the main contributors to this page, I do want to admit that I realize my opinion is based on the works of Austrian Economists, and I therefore tend to look through this topic through that lense. I find the Austrain School's explanation of currency and the history of trade among nations to have allowed me to grasp in concrete terms what has otherwise become a murkey and unintellegable topic. I feel that the reader would be enlightened to at least understand the basics of how the economy used to function before we went to an entirely fiat money paper system. Prestonp 21:40, 8 October 2006 (UTC)

- Wiki has rules: fringe groups get very brief mention.. No one is allowed to make POV arguments. Rjensen 21:45, 8 October 2006 (UTC)

- The idea's referenced are fairly straight forward- as the money supply expands, inflation arises. Furthermore, Rothbard meticulously cites his works for historical accuracy. He was a Professor of economics at UNLV. Any ideas presented deserve to be dealty with on their own merits as opposed to your ad hominen attacks on the speaker. Furthermore, the field of economics is rather subjective and has different POV's reflected in different schools of thought- of which Austrian is one. To say no POV arguments is ludicrous given that nothing in economics is truely free of the school of thought from which the observer subscribes. On my "To Do" list is to read Milton Friedman and become familiar with the Chicago School of Economics but these are rather dry texts that take a while to consume and understand, and I welcome anyone to present the POVs of the other school of thoughts. Prestonp 00:00, 9 October 2006 (UTC)

- Wiki has rules: fringe groups get very brief mention.. No one is allowed to make POV arguments. Rjensen 21:45, 8 October 2006 (UTC)

- NO wiki is not a debating forum. We are only allowed to present the consensus of the economics profession---not the 1001 fringe ideas that abound. This is an encyclopedia. Rjensen 23:58, 8 October 2006 (UTC)

- As I said, economics is a subjective science. Ideas are best analyzed on their own merits rather than labeling things as best left unexamined because you feel someone with a PhD was too fringe.

- NO wiki is not a debating forum. We are only allowed to present the consensus of the economics profession---not the 1001 fringe ideas that abound. This is an encyclopedia. Rjensen 23:58, 8 October 2006 (UTC)

Debatus.com link

Is anyone interested in making an external link out to a related wiki debates on this topic on www.debatus.com, a site founded by myself and a team of Georgetown students. The first is "Is there a "fiscal crisis" on the Horizon for the United States?" and the other is "Has the Bush administration demonstrated fiscal responsibility?" I think that doing so would fit the criteria of "improving" this article because Wikipedia does not seek to cover the entire scope of the arguments made on controversial issues, and traditional mediums that are provided as external links do not present all of the arguments of the debate in a kind of concise bird’s-eye way. In addition, Debatus, being a wiki, follows the same philosophy as Wikipedia, producing refined debate content, which should be considered in favor of doing this.Loudsirens 16:55, 26 September 2006 (UTC)

New Shortened Discussion Section

This page used to be 54 Kb long. Much of which was discussing section of the article that are no longer present. I have removed the bulk of this text.Prestonp 04:18, 7 August 2006 (UTC)

This Wikipedia help page states: "When a talk page has become too large or a particular subject is no longer being discussed, don't delete the content — archive it." Hence, I added a link to an archive of the prior talk page above. Lineman 05:31, 23 August 2006 (UTC)

Net debt position

I'm surprised to see that there's no section about the US's net debt position. Back in high school, someone in my U.S. history class yelled that other countries owed us because of wars. The BBC has an article about the UK paying off the last of its loans from the US for WWII. The following is the link and the purpose is to clarify and stimulate thinking about this matter so that hopefully someone writes about it in this article. -Amit[1]

The cross-reference to the Wikipedia article on "external debt" is misleading. Instead, the article should be re-edited to distinguish between the U.S. Government's nominal debt and the U.S. Government's "publicly held" debt.

For reference, see http://www.cbo.gov/Spreadsheet/7731_Tables.xls.

The U.S. nominal debt of about $8.6 trillion consists of two parts, debt that conforms to the commonsense definition of "debt", which is termed publicly held debt, and 2) debt that really is in accounting terms a "reserve," primarily reflecting Social Security tax surpluses. In 2006, of the $8.5 trillion in total nominal debt, about $4.8 trillion was "publicly held." Consequently, U.S. publicly held debt was only 37% of U.S. GDP and, the the Congressional Budget Office's projections are correct, that percentage will diminish through 2017 to about 20%. It is the "publicly held" dept percentage of GDP which should be used in comparing the U.S. to other countries, because governments like the U.K or France and most others would not report as "debt" their future governmental expenditures on healthcare and pensions.

U.S. "publicly held" debt is in part held by U.S. people and institutions and in part is held by foriegn central banks and foreign private institutions. Of that $4.8 trillion, some fraction is indeed "external" debt, being held by persons or institutions outside the U.S.Fultonwilcox 16:56, 23 April 2007 (UTC)

- Well the article begins by discussing the composition of the debt and making the internal versus external distinction. As far as using only the external as a comparison benchmark, I'm not sure if that's really presenting a true picture. Prestonp 15:30, 24 April 2007 (UTC)

- It makes a misleading "external" distinction and, as it happens, the CIA is wrong in its rankings because of inconsistency with how other countries report debt (and other countries way makes more common sense). The U.S. government's total nominal debt is about $8.4 trillion, but it has issued to the public only about $4.8 trillion. Therefore, U.S. "public debt" is 37% of GDP, not 67%. If one compares the U.S. with the U.K, the apples to apples comparison is between the U.K.'s 42.2% of GDP and the U.S. figure of 37%. Note that "external debt" is yet another category and is mostly non-governmental in nature. For example, the CIA factbook entry for U.S. external debt shows $10.4 trillion of "external" debt, a figure that includes (mostly) private debt along with some fraction of governmental debt. If a foreign bank buys a U.S. corporations bonds, that would show up as U.S. external debt. Fultonwilcox 00:46, 27 April 2007 (UTC)

- But that figure would be far larger if the country's accounting were subject to Generally Accepted Accounting Principles (GAAP). Under those rules, unfunded debt obligations would have to be included. As it is, David Walker of the General Accounting Office is arguing our position is worse than we've been lead to believe. In these discussions, people are always tempted to bring in their own numbers, but we are more or less stuck with what the government itself is publishing. If you want to revise the article to add a sentence arguing that it's not as bad as the CIA says, go ahead. But that can't be the thrust of the article. Prestonp 17:05, 27 April 2007 (UTC)

Extremely biased article

I just read the "United States public debt" article for the first time. It is very biased and political in nature, much more so than most Wikipedia articles. The section on foreign holdings of US debt is a particularly egregious example. There is absolutely no discussion of the benefits of foreign holdings of dollar assets, including government debt, or of the unlikelihood that foreign investors would dump their dollar assets. Does anybody else agree that this article needs a major rewrite? --Bond Head 16:15, 7 June 2006 (UTC)

Reply: Well, since Italy's Central Bank just announced a major sell-off of their US Securities, I think we can say it's not all that unlikely. [2]Prestonp 04:28, 7 August 2006 (UTC)

- One way we address such proposals is to create a temp page (e.g. United States public debt/temp) and editors can re-write the article there and present it to the interested community for review. bd2412 T 16:33, 7 June 2006 (UTC)

I'll look at whatever major re-write you propose, but that idea that foriegn ownership of US assetts is some great thing is itself a biased standpoint.Prestonp 05:32, 7 August 2006 (UTC)

- OK, thanks for the feedback. I wasn't suggesting that the article present only the arguments in favor of non-US investment, but rather that it present both sides, in contrast to the current version, which only presents the arguments against foreign holdings. I'll start working up some ideas. Bond Head 05:57, 21 June 2006 (UTC)

Can the U.S. go bankrupt?

Hey, everyone, I revised the "Risks" category (adding some sub-categories) and added a new paragraph asking "Can the U.S. go bankrupt?" The paragraph has a source from a Federal Reserve Bank of St. Louis official (via the London Telegraph). The source is here: [3]

I also added this source to the "External links" section. Keep up the good work. ProfessorPaul 17:43, 15 July 2006 (UTC)

The accrual basis national debt is $46 Trillion as of 2005 (according to the Financial Statement of the United States Government) and individual wealth (the only real kind) is estimated at $45 Trillion in 2005. So, yes, I think a country can go bankrupt, that is unless it resorts to unleashing war and transfering wealth back to the Treasury. Borrowing by Nation States only has efficacy as long as it has the power to use force.

You haven't read the book, which contains the exact information you claim to want. You cite Rome, Colonial US, the British Empire and Latin America, though you have no idea what happened to them. You don't seem to realize how much the financial world has changed in just the past 30 years.

I've been puzzled by all this until I read the telling statement: You were 7 during the Reagan administration. That explains everything.

Rodger Malcolm Mitchell

- Dear Mr. Mitchell,

- I don't have enough time in my life to read the books of all the crackpots who believe that they have reinvented everything in a field of science despite possessing no formal training. I am well aware of what happened in Rome, Colonial US, British Empire, and Latin America because I have read books detailing their history. And I am aware that these historical precidents totally and completely refute your argument that money can created out of nothing and not lose value. I have given you ample opportunity to present your arguments, but the fact of the matter is, you seem to be a one-trick pony. You basically claim that: 1. The modern financially system can perpetually create money out of nothing 2.This money will never lose it's value. And have no fall back position if we don't buy your arguments. I do want to applaud you, however, for finally attaching your name to a post as opposed to writing of yourself in third person as you used to do. Prestonp 22:18, 29 January 2007 (UTC)

Zimbabwe and an "Expert tag"

There is an interesting story about the Zimbabwe cash crisis of 2006 that I believe does relate to this article (here [4]). I may attempt to add it to this article. Also, Wikipedia has an expert tag; do you think this article would benefit from "an expert"? I teach Economics at the college level, and I think it would benefit. ProfessorPaul 02:45, 7 August 2006 (UTC)

Reply: Hey Paul. Welcome aboard, although you're really been adding for a while. I removed the expert tag since we now have you here. Prestonp 04:13, 7 August 2006 (UTC)

Mixing of different measurements of the debt

I removed the following edit made at 05:22 on 12 August 2006:

Between 1980 and 1993, the debt went from 30.3% of GDP to 58.8%. In 2006 it was down to 48.0% of GDP. [5]

The reason I removed it is that it is comparing apples and oranges. First of all, the paragraph up to this point is looking at current dollars, not dollars as a percentage of GDP. The third paragraph after this one is looking at percentages of GDP so any discussion of this should be moved there. Secondly, the given source is looking at something called "Government Net Debt". This is defined on the International Monetary Fund web site as follows:

Government net debt comprises the stock (at year-end) of all government gross liabilities (both to residents and nonresidents) minus all government assets (domestic as well as foreign). Gross debt includes government assets. To avoid double counting, the data are based on a consolidated account (eliminating liabilities and assets between components of the government, such as budgetary units and social security funds). Net debt of the general government should reflect a consolidated account of central government plus state, provincial, or local governments. [6]

Looking at the numbers, the net debt appears to be much less than the gross federal debt and somewhat more than the debt held by the public as shown in Historical Table 7.1 of the 2007 U.S. Budget. [7] Hence, it likely does not include all of the money owed to Social Security and other trust funds. In any event, it is not the gross federal debt that is being discussed in this article. Lineman 05:11, 14 August 2006 (UTC)

Regarding Rodger Malcom Mitchell

Mr. Mitchell has published a book which advocates the abolishment of all government taxes and has instead given a vision of the United States freely printing and using all the money it wants. From an historical standpoint, this has been tried and failed by every major empire from Rome onward.

- [Absolutely untrue. Clearly the writer has absolutely no idea about what "every major empire" has done, and this misstatement is typical of his entire article]

- Mr. Mitchell

- Let's see, who has engaged in the practice of printing money/debasement of metalic currency in order to support an empire. Ancient Rome, the United Kingdom (cited by Nobel Laureate Milton Friedman as one of the causes of the Great Depression), the Colonial United States (origin of the term, "Not worth a Continental") are notorious offenders. In addition, several European Kingdoms debased the metal content of their currency in order to coin more (France with the livre tournois from 1200-1600, Spain with the dinar in the 1200, etc). In each case, printing more money/debasing the currency of coinage lead to a devaluation of that currency over time. Prestonp 04:02, 19 January 2007 (UTC)

He periodically posts his viewpoints here and uses a great deal of verbage. The discussion archieve shows that I tried to have a dialogue with him but he is unshakable in his fervent belief that the his way is the right way (perhaps because it will sell more books). After a self imposed exile, I noticed Mr. Mitchell is back. I deleted his comments in the discussion section because I didn't want another 52kb diatribe of everyone trying to talk sense into Mr. Mitchell. Prestonp 06:20, 5 September 2006 (UTC)

- In fact, Preston posts no facts. He merely parrots the ancient, common knowledge "debt is bad; surplus is good," without demonstrating why this is so. He is so fearful of facts, that he immediately deletes any postings that contain facts disproving his beliefs. Then he excuses his actions by claiming he is deleting "verbage" (which he probably doesn't understand), and claims he tried to have a "dialog." Now, Preston, it's time to put up your facts. Please show everyone, when in the past 75 years, a decrease in Total Debt has benefitted the American economy and an increase has hurt the economy. Also, show when the U.S. government has had difficulty borrowing, as you claim. Dates and figures, please. No vague, common-knowledge generalities. Do it or forever hold your peace. - Mr. Mitchell

- You are cherry picking your time frame. The last 75 years coincides with the end of the second World War and the Bretton Woods agreement in particular. Under those agreements, the United States was in the unique position of printing the world's reserve currency. But this situation is untennable from a historic stand point. To argue otherwise is to argue (as you do) that the US Government can keep printing as much money as it wants forever and everyone else will accept it as being worth exactly the same value- a ludicrous proposition. As far as holding my peace, it's you who is adopting a ridiculous and provative POV just to sell some books. Prestonp 04:02, 19 January 2007 (UTC)

- Actually, Mr. Mitchell should have "cherry picked" the past 30 years, because the world of money changed completely, back then. Mr. Preston has no idea what happened -- and by the way, still no facts from Mr. Preston. Will we ever see any facts? - Mitchell

- Mr. Mitchell, I have provided nothing but cited facts. It is you who has invented theories out of thin air such as "a growing economy requires a growing amount of money" without any substantiation whatsoever. I have pointed out several times in US and World history where your ideas completely fall apart. You reply by ignoring, as you always have. Prestonp 05:58, 20 January 2007 (UTC)

Refund on Government Debt

I would like to add that the U.S. gets a refund of 98% on all interest it pays on the debt. Even foreign debt is subject to this since it must be paid in newly minted reserve notes. The federal reserve is part of the U.S. Government because it's stock acts as bonds. Very useful and very clever of our government. Peatiedog 09:03, 6 December 2006 (UTC)

- That's just not so. Someone buys a T-Note, they get their money back plus interest. How do you figure the government get's a refund? Prestonp 05:33, 3 January 2007 (UTC)

Hey, I agree with Preston on this one. Peatiedog, what the heck are you talking about? Rodger Malcolm Mitchell

- I think what Peatiedog was misunderstanding is that the Fedearl Reserve gives a refund of all interest collected on the bonds it holds. They only keep money equal to their operating expenses. But bonds held outside of the Fedearl Reserve collect interest as normal. Prestonp 02:12, 29 June 2007 (UTC)

Estimates of US debt by Bush

Hi all, I feel that the Bush estimates of future debt are a particularly bad example of why it is difficult to predict swings in future debt. While trying not to sound partisan, I don't think that its stated reasons really explain why the estimate of the swing from surplus to debt was so far off.

Look at the reasons: "Technical" reasons are responsible for more than half. That is akin to saying "Oops, we lost a trillion dollars, our bad." That is not plausibly due to the difficulty of predicting the future, rather, it is just an admission that their accounting was bad (trillion dollars bad, 10% of GNP bad).

The effect of the tax cuts is responsible for an additional 29%. How can Bush say these tax cuts were not predicted? Did the Republican congress force him to sign tax cuts that he never dreamed would pass? Did they pop out of the sky?

The only parts that he could reliably say were not predicted were the recession, which is now over, and the effects of the wars and terrorism, which were only responsible for a combined 22% of the swing.

Several commentators said beforehand that Bush's economic policies would greatly increase the debt were they enacted. The impact of his economic policies was "both predictable and predicted" like that of many other of his policies.

David s graff 22:24, 11 February 2007 (UTC)

Splitting Up The US

Wouldn't the ultimate consequence of the national debt be the total control of federal property by foreign bankers ? In this worst-case scenario, America would be brought back to pre-revolutionary times because its national assets would have to be divided among its many shareholders. On the other hand, resisting debt payments could cause major wars, like when Napoleon got mad at all his creditors. 69.157.247.71

in the event of a surplus

I am new to wikipedia, sorry if this comment is not appropriate, or too ignorant for this forum.

What would the US government do if it were to eliminate the budget deficit, thus running positive net cashflow, effectively rendering the US government a profitable institution. Alan Greenspan discussed this possibility briefly in his recent book, and used this "frightening" prospect as justification for endorsing the Bush tax-cuts. Indeed, tax cuts have been the conventional method for diffusing excess govt revenue. But is a tax cut the most efficient use of capital? Could the US Government become the worlds biggest investment bank? Who would decide where or how the US government allocates its capital? Could it issue equity? on public stock exchanges?? what would stop politicians from going about buying out the world's assets? is the current system of checks and balances strong enough to avoid the potential catastrophy of Congress and the President being in control of trillions of dollars. The current system is that congress reserves the right to 'earmark' federal money to political benificiaries and friends, as well as tax cuts. Is there any ongoing discussion about whether this is really the most efficient way of distributing capital??

Doug —Preceding unsigned comment added by 41.210.24.246 (talk) 21:51, 12 January 2008 (UTC)

- That seems highly unlikely and is beyond the scope of this article at any rate. Prestonp (talk) 01:59, 13 January 2008 (UTC)

quibbles

Hello $9 trillion. —Preceding unsigned comment added by 149.159.113.25 (talk) 13:45, 7 September 2007 (UTC)

Yes, that $9tril is what I've read & is shown in a table, mid-way in the article. However, the first paragraph lists a much smaller figure. If that figure is to be used, the discrepancy of public vs intergovernmental transfers (i.e. S.S.) should be explained. 68.180.38.41 21:11, 9 November 2007 (UTC)

- As it says in the article, $5t is the debt held by the public. $9T is the $5T figure plus the intragovernment amount of roughly $4T. Prestonp 00:34, 11 November 2007 (UTC)

Major Error

The chart for this page shows total debt as a percentage of GDP, not public debt. The public debt as a percentage of GDP is much lower, around 40%. See http://www.aaas.org/spp/rd/debt04b.pdf for some accurate data for both total debt and public debt.

Yes. In the section entitled "A Brief History of the Debt," the table with columns entitled "US Public Debt USD billions" and "% of GDP" apparently shows data for the Gross Debt, not the Public Debt.Scot008 (talk) 17:54, 20 February 2008 (UTC)

CItations

I am currently taking courses in Intermediate Micro and Macro Economics and will add the appropriate textbook citations to whatever area people feel are weak. You can just post it here and not delete them wholesale. Prestonp 05:00, 7 September 2007 (UTC)

We don't need more students contributing from textbooks or from what they learned in class today. If you can't find sources in reputable mainstream media sources, it doesn't belong on Wiki. --24.15.249.123 18:59, 14 September 2007 (UTC)JasonW

- Jason. First off, you're wrong. College textbooks related to the subject are more authoritative than a main stream article in terms of theory. Secondly, you display really bizarre behavior coming in with a flurry of reference free editorializing and then disappearing for a while refusing to discuss it. Prestonp 20:48, 14 September 2007 (UTC)

College textbooks are a waste of time and written with a political bias based entirely on theory, not reality. In any event, whatever under-educated teengers in school think, opinions are irrelvant. Cite written sources. Personal opinions are of zero value. No sources, and it will be removed. --Jasoncward 21:21, 14 September 2007 (UTC)JasonW

- Jason, you seem to feel that your opinion needs no citation and is somehow free of bias. You are mistaken. I have reverted your edits and issues a warning. Prestonp 22:54, 14 September 2007 (UTC)

Issue all the warnings you want. There are NO OPINIONS in my version of the edit. Your [professor's] opinions, your errors, and your sloppiness belong no where in Wikipedia:

- the idea that social security, medicare, and personal debt should be included in the well-established definition of national debt

- an uncited "intragovernmental debt" figure of 9 trillion in the first week of September

- The "China Nuclear Option" is a complete idiocy which cites a dead link - you learned one day from the same source - your college professor. and this is not a mainstream idea, it is not even part of any rational discussion, and worst of all, IT IS A HYPOTHETICAL and an idea REJECTED by the Chinese government itself

- wording like " Replies to arguments against paying down the debt", which indicates poor written English skills, is a double negative, and is better written as "Reasons to pay down the debt"

- US DEBT IS OVERWHELMINGLY OWNED by Americans, and foreign ownership of US debt is DECLINING, as you are so happy to mention with regards to Japan, China, Kuwait, etc... yet you insist on reverting to your politically spinned phrase that it is "increasingly not true" that Americans owe the debt to themselves.

- The discussion of Sweden, Kuwait, etc... is misleading; no country "abandoned" the dollar, they simply VERY SLIGHTLY reduced their dollar holdings, in the case of Sweden the dollar formerly held 90% of their foreign reserves, and now it holds 85%

If you want to propel your political beliefs given to you by your economics class, kindly build a website. Your personal situation is driving this problem: you discovered economics in a class you're in, you think your professor is a genius, and you feel that you are among a tiny minority who have discovered things no one else in the world knows...in actuality you are merely repeating opinions given to you by others to forward their political beliefs.

This subject is almost purely FACTUAL, any opinions or hypotheticals you want to provide can only be included if they are mainstream, documented by multiple sources, and, most of all, PRESENTED WITH THE OPPOSING VIEW POINT AS WELL. Mainly, the opinions, hypotheticals and the re-definition of 'national debt' belong no where in wiki. But, even though I think most of what you written is 100% POV and original research, we can go line by line through the problems in this discussion. --24.15.249.123 23:16, 14 September 2007 (UTC) JasonW

- Dear Jason, the citation for US debt being $9 Trillion is right here. [[8]] Various world government's abandoning pegging their currency to the US Dollar constitues far more than a "slight reduction in dollar holdings." In response to your criticism of various people posting their political beliefs here, all I can say is that that is a case of the pot calling the kettle black. I do appreciate that you stopped making a flurry of edits all at once. In response to your idea that the amount of US public debt being held by foriengers is going down, I'd invite you to bring a citation of your own. Prestonp 23:57, 14 September 2007 (UTC)

- JasonW, foreign reserve is not the same as debt. Akinkhoo (talk) 00:49, 21 February 2008 (UTC)

Fraction of GDP

The statistics presented here need to be put in context of what percentage of GDP a given level of debt in a given year represents. -- Beland 22:00, 11 November 2007 (UTC)

Percentage of Interest Paid by the National Budget

I would think that the more important figure would be what percentage of the yearly budget is paid to the interest of the national debt.--84.154.94.25 04:33, 13 November 2007 (UTC)Jahns

This $318 billion conclusion should be further explained, as the information is not available at the provided reference link:

- In 2003, $318 billion was spent on interest payments servicing the debt, out of a total tax revenue of $1,952 billion. (Unsigned Comment)

The calculation

In 2006 the tax revenue was $2,518 billion.[9] According to National debt by U.S. presidential terms, spending that year was $2,655 billion (i.e. $137 billion deficit). The national debt that year increased from $7,905 billion to $8,451 billion (i.e. $546 billion). Therefore the interest on the national debt must have been $409 billion by my calculations (and I am by no means an expert). This site gives $406 billion. This would represent 16.1% of the total tax revenue. Corleonebrother (talk) 21:23, 26 February 2008 (UTC)

Table in section 'A brief history of the debt' has unverifiable figures

The table in the section 'A brief history of the debt' provides figures for the US national debt (total = public + government held debt) not only in US dollars, but in Euros and 'ounces of gold.' The figures denominating the US debt into euros and 'ounces' of gold are unreliable and invalid.

The euro numbers are unreliable for two reasons. First, the exchange rate used to convert US dollars to euros is not specified either in the wikipedia entry or on the webpage cited as the source of the exchange rate. Second, the date the exchange rate was valid is not specified. Therefore, the figures denominating the US debt into euros are unverifiable since the rate used for the calculation and the date it was valid are not provided.

Moving onto gold: First, there are several different mass units called an ounce: English units, Imperial units, United States customary units, Troy ounce, etc. The specific ounce being used is not specified and should not be assumed to be the customary Troy ounce. Second, the price of gold relative to the dollar fluctuates daily, and the spot price used to convert between dollars and the aforementioned unknown reference ounces of gold is not given. Third, the date on which the spot price was valid is not given. Therefore, the figures denominating the US debt into 'ounces' of gold are unverifiable since the units and prices used are not provided so the calculation cannot be checked.

This is not a personal attack on whoever put those figures up. Personally, I applaud the thoughtfulness and effort that was put into the work, but without explicitly stating the exchange rates, spot prices, dates and system of measurement used for the calculations the figures produced are meaningless and are not verifiable.

I'm deleting the euro and gold figures for the above reasons. Furthermore the calculations of these figures may be viewed as original research.

Mtiffany71 (talk) 23:16, 18 November 2007 (UTC)

Consequences of Foreign Countries Owning U.S. Debt

This section doesn't explain what the consequences are. It only mentions that foreign countries do indeed own a substantial amount of our debt. Either expand, or change heading. ydesai2008 23:57, 25 November 2007 (UTC)

Arguments against paying down the national debt

I removed a series of debdt pay-down periods and the following recessions. Three reasons:(1) There was not a good source; (2) Before world war II, there was no good understanding of how a central bank should operate, so who knows how many silly things they were doing without a really great analysis; (3) the ideal fiscal policy dictated by current thought on deficit spending is that the debt should be paid down when the economy is good, then the economy will eventually go south, and the debt should be increased--so if the economy causes the debt to change, it will look like the other way around to an observer who doesn't realize who's changing things and which is just hapening (you could say the same thing about a car--turning the car is associated with turns in the steering wheel--thus the car turning causes steering wheel changes.) Pdbailey (talk) 02:29, 30 November 2007 (UTC)

- PDBailey, the argument you are making seems largely hersay. There are good arguments for paying down the debt, which is present in that section, which is well cited. Prestonp (talk) 00:28, 16 December 2007 (UTC)

- Prestonp, I can't make sense of your claim, can you explain it? The word, hearsay regards something one person says to another and the second person repeats the same in a court. I'm not sure where the court is, or who said something to me. In addition, my main point was the first, ("There was not a good source"), I guess this is something that I saw on the main page and then repeated here, but the claim of hearsay becomes a little nonsensical, don't you think? Pdbailey (talk) 16:31, 24 January 2008 (UTC)

- No, I think it was a fine use of the word. Wikipedia being the metaphorical court and the statement that "before world war II, central banks had no good understanding of how a central bank should operate" being the statement which someone must have told you which you are now introducing as a factual argument that needs no support. Incidentally, you are citing Keynesian economics as gospel and there is no clear agreement that it is the job of a central bank and government to use counter-cyclical spending policies. Prestonp (talk) 04:15, 26 January 2008 (UTC)

Innaugulation

I've never heard of this word before (please forgive me, I'm not an econ guy). It doesn't show up on dictionary.com. Google has 4 hits. This article, another site in which it is used in the same exact sentence, and two sites where it appears to be a mistaken spelling of "inauguration." Might someone explain that word in this article, create a new article for it, or yank it?

- I did a search on EconLit (the main database for economics articles) and even "currency and exportation" gave no English language hits. So I yanked lots of what looked like babel to me. Without a reference, I can't tell if it's made up or not. Pdbailey 13:31, 30 November 2007 (UTC)

CIA lies?

If you look at the CIA World Factbook (https://www.cia.gov/library/publications/the-world-factbook/rankorder/2186rank.html) US national debt, as of 2007 is 36.80% of GDP...a rather remarkable drop and down to the level when Bush Jr came to power. Any guesses for this? 62.56.107.49 (talk) 14:31, 23 January 2008 (UTC)

- There are many ways to measure both debt and gdp. Which measure you choose impacts the results. For a change that big I'd say they were not consistent year to year in which variables they used. 24.222.54.66 (talk) 16:09, 24 January 2008 (UTC)

If you look at the graph in the next section, you will see where this result is from (public debt per gdp) so it neglects the Social Security trust fund (among others). It might make sense for comparability between nations for the CIA to do accounting this way. Pdbailey (talk) 02:14, 4 February 2008 (UTC)

- some part of the factbook is not very accurate or always up-to-date. i don't see any lies; you can find mistake on many countries on it, it is more likely that the factbook is maintain by a fairly small crew who gather data from newspapers and such. i doubt they are allow to use internal material from CIA as source as that would be a security risk. Akinkhoo (talk) 00:58, 21 February 2008 (UTC)

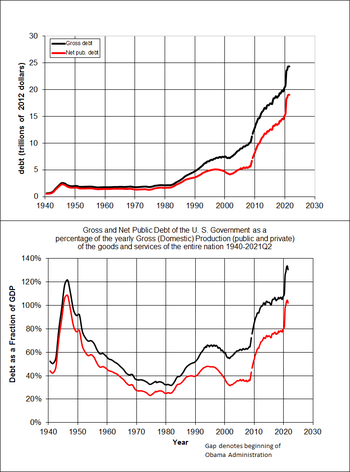

Images

Does anyone think the two images, Image:US Public debt per GDP 1791-2006.svg and Image:USDebt.png, are redundant? I prefer the former, because it is given as a percentage of GDP. Also, the latter should be remade as an SVG. Superm401 - Talk 10:31, 27 January 2008 (UTC)

- Yes they are, and yes I favor the one that features the percentage of GDP. Prestonp (talk) 21:25, 27 January 2008 (UTC)

- I'm most disturbed by the difference between them (why does the svg have a dip near 2000 while the png doesn't?) It would be nice if Image:US Public debt per GDP 1791-2006.svg listed the source of the data. Pdbailey (talk) 00:09, 4 February 2008 (UTC)

- If you read the description, it tells you there is a slight discrepancy in the calculations from using Fiscal year debt data, and calendar year GDP. It's probably necessary in order to maintain consistency with the year-fixed early historical estimates used for GDP. As a broad guide it could be of considerable value to readers. I placed it under one of the subheadings. 216.165.199.50 (talk) 08:17, 7 February 2008 (UTC)

I updated the old image to (a) include the fraction of gdp data, (b) include public and gross debt, (c) use a deflator for the dollar denominated debt. the result is still at Image:USDebt.png. I'm also going to replace the existing because of (c) unless others object. Pdbailey (talk) 02:11, 4 February 2008 (UTC)

surplus = govt takes in more money than it pushes out

I just removed this:

Paying down the federal debt requires the federal government to run a federal surplus. "Federal surplus" means the economy sends more money to the government than the government sends to the economy, thus reducing the amount of money in the economy. This reduction of money in the economy reduces the amount of lending funds.

When the government pays down the debt, it does so by paying back more bonds than it sells, so that it is putting more money in the economy. The flip side of this (as is noted above) is that it is taxing more than it is spending. In the strictest sense, the net is a wash.Pdbailey (talk) 02:45, 18 February 2008 (UTC)

China's Nuclear Option

There is no such thing as "China's Nuclear Option" and it has rightfully been deleted from this article. It is an internet rumour found only on fringe chat boards. There is no article citing this as a real option in reputable media sources.--24.15.249.123 18:58, 14 September 2007 (UTC)JasonW

I have heard of China using the threat of selling of it's bonds from other author's. It's common sense really. They've paid a lot for that particular stick and it continues to lose value through inflation the longer they hold it and do nothing. Prestonp 17:15, 14 August 2007 (UTC)

This is not correct. There is no official campaign of threat of selling bonds and it didn't start in August (The article was published in August), the original writer simply posted it because he read it from that article. Also, it is not described as the "Nuclear Option" in the state media, it was described as that by the author of the article. If you wish to put this in, please rewrite it and discuss the possibilities of China using it's reserves against the U.S., but until then please do not continue to revert this secion. — Preceding unsigned comment added by IP address (talk) date

- The article provided is a citiation by a reputable source saying that "Described as China's "nuclear option" in the state media,". So, unless you can provide some citations to back up your claims, I don't see why any rewrite is necessary. Prestonp 01:45, 15 August 2007 (UTC)

http://www.chinadaily.com.cn/bizchina/2007-08/13/content_6023228.htm

- It has been rebuked by Chinese state media. China has not threatened to sell off dollars and bonds and there is no official campaign to threaten the U.S. — Preceding unsigned comment added by 210.84.9.134 (talk) 15 August 2007

It also strikes me that the difficulty in such a threat is that if China's holdings are significant enough to be a real risk (and here the TIC data and data on daily Treasuries trading volume are useful), that it would be difficult to unwind a position fast enough to beat the collapse in prices. That is, China could sell part of their position, but in so doing, they would wipe out the remaining value of their portfolio that could not be sold in time. If the collapse does not follow the unwinding of their position, then no real nuclear option existed. In fact, nuclear is a good analogy, since fallout is likely to rain back on the initiator of the action.Vajs 01:20, 28 August 2007 (UTC)

- Very true. Essentially US Bonds are not a liquid asset for China and I'm sure they probably realize that just as I'm sure they know that the bonds are not in and of themselves a good investment. However by buying US bonds it drives the dollar up in comparison to the yuan which is part of their whole game plan in terms of trade. If we up and decide we're not trading with them anymore, they really have no need for the things. Prestonp 22:30, 29 August 2007 (UTC)

- Oh man, talk about fear mongering to the extreme. If the dollar drops, China could lose trillions in foreign reserve! They will never let that happen. The old saying are still true: "if you owe the bank $100, that's your problem. If you owe the bank $1 million, that's the bank's problem". 24.89.245.62 02:27, 15 September 2007 (UTC)

- that is not true, you must compare if the lost of USD 1.4 trillion is worth the damage of keeping it. USD is falling anyway, it is not like China expect to be able to recollect the money anyway! also China is not short on money, it doesn't need USD because the US is not willing to sell China anything useful anyway... if China itself is under risk, it wouldn't care about 1.4 trillion dolar. what is more important, your life or your money? this is seriously enough for the fed to travel to china to reassure them last christmas. the fact is even if china doesn't sell out, that it just stop the 1 billion dollar it is pumping into the reserve DAILY! USD will crash. it cost china as much money to keep USD everyday as if it was to just give it up.

- "However by buying US bonds it drives the dollar up in comparison to the yuan which is part of their whole game plan in terms of trade." correct, but China does has alternative to keeping the yuan peg, it can divest to European market, middle east and the rest of asia. to keep the yuan at the same value, you just need to grow your foreign reserve at the same rate as the demand of yuan, it doesn't mean USD is the only market you can invest into. i wouldn't be surprise to learn that China is secretly building foreign reserve in other currency now. Akinkhoo (talk) 00:15, 21 February 2008 (UTC)

If there were such a thing as a "China Nuclear Option," it would be best described as Beijing assuming the (later abandon) role of Chairman Greenspan. Dr Alan, back in the early 1990s, threatened to raise interest rates if the budget deficit wasn't brought under control, and so it was. Get the federal budget under control, and there would be no need for anyone to threaten to sell T-bills. DOR (HK) (talk) 06:11, 4 June 2008 (UTC)

NYC Debt Clock

Is it too much to ask for to provide more current stats for the national debt. Just a few hours ago I stood in front of the NYC Debt clock and took a picture valueing the national debt at nearly $8.895 Trillion, with the Family Share at $96,782. That's a large disparity compared to the end-of-2006 stats currently stated. Alan 24.184.184.177 05:30, 25 September 2007 (UTC)

Can someone add a picture of this supposed debt clock because I think they're referring to the clock that is on the South end of Union Square. It counts in military time, down to the tiniest fractions of seconds. —Preceding unsigned comment added by 70.112.190.54 (talk) 06:01, 22 January 2008 (UTC)

The Debt Clock is in Times Square, not Union Square. Made fix and added ref.Sam (talk) 18:21, 23 January 2008 (UTC)

why do these graphs never go back to before 1913, when control if the money supply was usurped by the federal reserve? i believe the national debt was quite small before they began to steal everyone's money. —Preceding unsigned comment added by 91.110.12.229 (talk) 15:43, 8 May 2008 (UTC)

GDP?

According to the "A brief history of the debt" section, it states that in 2007, the debt was 9008 Billion (9 trillion), which was 36.8% of the GDP. Yet according to List of countries by GDP (nominal) the US's GDP is 13.79 Trillion. Now, using some simple Math, I can say with certain assurance, that 9 trillion is more then 36.9% of 13 trillion. Or is there something that I am missing here?--Passerby25 (talk) 22:27, 4 March 2008 (UTC)

- the source provided is CIA factbook, maybe someone is messing with it >:) factbook is not a good source as they never claim it is verified data anyway. ok proper answer, because public debt refers to only the debt that is held in public US dollars. which is around 5 trillions. the total debt the government own is 9 trillion dollars. i include the following link for anyone interested in both figures:

- http://www.optimist123.com/optimist/2006/04/the_best_debt_c.html

- - Akinkhoo (talk) 15:05, 6 March 2008 (UTC)

The same paragraph says "The total debt is currently 66.5% of GNP." Since Wikipedia says GNP is becoming a less popular measure and the numbers are essentially the same, I have edited to use latest figures and GDP instead of GNP. Misterjosh (talk) 07:13, 18 June 2008 (UTC)

misleading presentation

The second paragraph, beginning 'As of April' is misleading. The writing makes it appear that if all the federal IOUs to the federal entitlement trust funds, such as social security, were to be included in the public debt, the federal debt would balloon to $59 trillion. However, Ref. 4 makes clear that the federal portion is just 0.85 of $59 trillion, which is about $50 trillion. (65.19.22.86 (talk) 23:13, 30 July 2008 (UTC))

Error in introduction

The introduction states that:

"In 2007 the public debt was 36.8 percent of GDP ranking 26th in the world,"

and references the CIA factbook. Following the link, the US indeed ranks 26th, but with a debt level of 60.8%. —Preceding unsigned comment added by 68.175.33.116 (talk) 17:02, 18 July 2008 (UTC)

Fixed. Thanks.Farcaster (talk) 03:25, 21 July 2008 (UTC) The confusion arises from a lack of understanding of the difference between national debt and public debt. The 36.8 figure is correct for U. S. public debt (the federal debt not owed by the government to itself--the link uses the wrong term)and the higher figure is correct for national debt. Every country except the United States refers to its public debt as national debt, which causes misleading comparisons. —Preceding unsigned comment added by 70.233.151.49 (talk) 17:30, 30 August 2008 (UTC)

auto archive?

This page could use an auto archive, would anyone mind if i added one. Say MiszaBot with maxarchivesize = 250K, algo = old(28d)? Pdbailey (talk) 23:06, 10 September 2008 (UTC)

- How about 120 days. It's not that active. Or you could manually do it yourself. -- Yellowdesk (talk) 18:08, 12 September 2008 (UTC)

- I threw it in at 180 days. Feel free to object or just remove it if you don't like this. Pdbailey (talk) 22:44, 14 September 2008 (UTC)

National Debt Decreasing?

The article states that the national debt has decreased for the last three years.

(1) Will this statement be automatically updated each year? With no mention of the year in the statement, it seems to be a recipe for outdatedness.t

(2) How does the debt decrease in a year when we are running a deficit? My understanding is that the RATE OF INCREASE in the deficit has been declining lately, not the total amount of debt, which has been increasing in every year in which there is an additional deficit.Geneven (talk) 09:49, 19 June 2008 (UTC)

- The gross federal debt in the US has never decreased since the 1950s according to White House documents released which display debt data from 1940 to 2007. Editors of this article have done a poor job distinguishing between public and gross federal debt as well as debt in terms dollars versus debt in terms of a percentage in GDP. Many times, editors are referring to one specific type of debt as increasing or decreasing but fail to specify which type of debt they are talking about. The History section of this article is a clear example of this. I have also found that the debt numbers are easily skewed depending on which deflators are being used. Gaytan (talk) 15:19, 25 September 2008 (UTC)

The October 3rd, 2008 bailout bill (H.R.1424), in section 122, raised the federal debt ceiling from 10 trillion to 11.3 trillion. So, this is PURE evidence that the debt is increasing.

Collapse of social security in 2030-2040

I am an American who understands these debt issues and the fact that it will grow beyond the ability of the federal government to pay for it. I generally accept that when I reach retirement age in about 2040, that the government's response to the problem is going to be "Well, I guess we'll just have to stop paying Social Security / Medicaid / Medicare / etc". Either that or the government is going to introduce creative new solutions to the fiscal problem like raising the age of retirement to 75 or 80, or only providing services to the most desperately poor or infirm.

I already accept that the money I am paying right now into Social Security / Medicare / etc withholding is about as good as mounding the paper bills in the backyard and burning them. I will never see any of that money when I reach retirement age.. the government is taking it to spend on stupid things now and it will not be there for me in the future.

Interestingly, I don't think it is possible for an American citizen to completely cash out of Social Security and put that money in a personal retirement account instead. The government must have that continuous influx of money now from its income tax subjects, or the whole IOU shell game it is running will collapse even quicker than 2030. Allowing people to get out now before it all comes crashing down in 30 years would be just simply unacceptable to Washington.

It would be nice if someone could recalculate these figures to show what happens if Social Security, etc payouts decline starting in 2030, or just disappear from the graph entirely. I bet that debt won't be so hard to manage, once most of the American people have been forced to fend for themselves in retirement, and have let go of that pipe dream of a government that will take care of them in their old age.

DMahalko (talk) 08:49, 22 September 2008 (UTC)

Hello DMahalko; read the Social Security debate (United States) article and you will feel better! It won't take much to make Social Security be solvent forever. Further, if the program is NOT reformed payroll taxes (which are dedicated to Social Security first) will pay about 75% of benefits for us and our kids. Because Social Security is mandatory, unless the government changes the law, it will be there for you. AARP and the growing number of seniors are not about to let the payments go down much. What is more likely is that you will see massive cuts in discretionary categories such as defense spending and federal programs that states can handle, like education. Further, Medicare is a much worse problem (about 5X as bad). That is the one that must be reformed soon.Farcaster (talk) 19:53, 22 September 2008 (UTC)

- Sorry Forecaster, I have to disagree. Federal Spending never gets cuts much (as you can see from my efforts to show that the gross federal debt has not decreased significantly since the 19th century and has not decreased at all since the 1950s). Special interests have a strangle hold on our government. If you think federal education spending will be cut anytime soon, I have some property I would like to sell you. No one is giving up their piece of the federal spending pie. And knowing politicians (who care only to increase their votes so they can stay in office to continue reaping their special interest perks and benefits), they will simply take the easy way out: print more dollars to pay for every federal program imaginable thereby continuing the steady increase of inflation. Politicians prefer inflating the currency because this is a method of "making their cake and eating it too", with no immediate consequences with respect to the public sentiment or in the economy. But soon, this will become hyperinflation and the economy will be severely effected. As a matter of fact, we are seeing some clear effects of overprinting dollars in the US economy today. Wall Street is now asking for a bailout for the risky investments they dove into made possible by the flood of dollars the goverment (the Federal Reserve) created for them. How will this bailout be accomplished? By printing up more dollars and creating more inflation, of course. That's been the American way ever since 1913. Gaytan (talk) 16:04, 25 September 2008 (UTC)

Paying off national debt with land?

Can the USA government pay off the national debt with land? Like if the US government gave Japan a piece of California. —Preceding unsigned comment added by 70.106.219.166 (talk) 02:01, 7 August 2008 (UTC)

LOL. Very funny--but not out of the question in about 40 years. I was thinking Alaska; closer and not part of the continental USA. Or maybe Hawaii. In the meantime, we just sell companies, not land. Note that the more the Republicans cut taxes, the weaker the dollar gets, the more interest we pay, and the more likely both are to happen.Farcaster (talk) 04:02, 7 August 2008 (UTC)

This appears more and more likely the value of the dollar has decreased as well as the value of land. China and Japan who are the biggest debt holders are also a little crowded so this would be a good explanation of why they would continue to buy US junk debt. After all when it gets down to it the land is really all there is. 99.228.151.16 (talk) 14:02, 29 September 2008 (UTC)

Last Year Debt Lowered?

Hey should it be noted that the last fiscal year the debt was lowered was in 1957 and has only gone up since than? You can see it's true here: http://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt.htm just click on the years 1950 - 1999 & # 2000 - 2007 and it shows the last fiscal year the debt actually went down was 1957. So should it be added? —Preceding unsigned comment added by Mrjason22303 (talk • contribs) 04:46, 29 September 2008 (UTC)

Debt held by the public does matter

This may have been discussed here before, but the concept isn't really reflected in the article, so I'll throw it out. You can argue that in an economic sense, the gross federal debt isn't really important. What's important is debt held by the public. Debt held in government trust funds is just money the government owes itself. If you talk about the OASI trust fund (and other governmemt funds) debt as liabilities, you also have to talk about it as assets, which quickly becomes kind of silly. When the trust funds "buy" securities with their excess payroll tax collections (or other "funds"), there is no arm's length transaction where actual money changes hands. If the trust find debt is real government debt, whom is it owed to? Bond Head (talk) 06:58, 7 October 2008 (UTC)

- Hello Mdeckerz and thanks for many good edits I've seen from you out here. The trust fund debt is owed to American citizens for Social Security. The government will have to pay it back to the U.S. citizens, mostly between 2017 and 2041 once Social Security goes into deficit. See the Social Security debate (United States) article for more explanation on the trust fund. What is likely to happen is that what is currently in these trust funds as intergovernmental debt will become debt owed to the public, because the U.S. government will likely borrow the funds (through public debt channels) to pay for the Social Security. Your statement would be correct if the U.S. government paid off the trust funds while the budget was balanced, but that is unlikely to be the case. I hope that makes sense. If you want to explain this in the article, that would be helpful and I'll pitch in...gives you some practice understanding the trust fund, if you need "homework" lolFarcaster (talk) 14:08, 7 October 2008 (UTC)

- Oh, thanks, but I'm pretty familiar with the trust funds. What's owed to Social Security program participants--"American citizens"--are cash benefits, not debt. And those benefits are paid from current revenues, not accumulated assets. It's true that when aggregate benefit payments begin to exceed payroll tax collections, benefit payments will begin to be paid in part from the proceeds of borrowing from the public (absent any change in law). But that doesn't bear any relation to the current trust fund balances except in an accounting sense. See the Social Security Trust Fund article for more explanation on the trust fund and the debate over whether it is "real." Your statement would be correct if the budget were in balance net of the annual payroll tax surplus or if the trust fund held "real assets" other than "special treasury securities" or if the fund managers had the ability to diversify the trust fund's investments into other asset classes. What the article may need is an explanation of why intergovernmental debt isn't really debt in an economic sense. If you loan yourself a dollar, do you really owe anything? Bond Head (talk) 20:52, 8 October 2008 (UTC)

- Let me try it this way. Starting in 2017, payroll taxes don't cover all social security benefits. So the government will start to draw money from the general tax revenues. It will need to borrow to do this. So while it is drawing down the Social Security trust fund (the intragov debt) it will be increasing the public debt. In other words, between 2017 and 2041, when the trust funds are liquidated, the government will be replacing the intragov debt with "real" public debt. That is why the trust funds should be treated as "real" or public debt. The government does not owe it to itself, it owes it to citizens, just as if we held treasury bills that we could cash in during that time. The government will be diverting an average of $200 billion or so each year from the general funds to social security between 2017 and 2041. It won't have the money (unless we cut spending in all other categories like 10%), so it will borrow it.Farcaster (talk) 22:06, 8 October 2008 (UTC)

- I think you're missing something. Let me break it down. The government takes in cash from many sources: income taxes, FICA payroll taxes, user fees, proceeds of borrowing from the public, etc. Then the government spends that cash on a variety of expenses: Social Security benefits, jet fighters, bureaucrats' salaries, whatever. At the same time, somebody makes a bookkeeping entry that adds to the "balance" of the "trust funds" and adds to the "debt." But they're not real transactions because no money changes hands. The credit to the trust fund is just a bookkeeping entry. It's like moving some of your own money from one of your bank accounts to another; it doesn't increase your net worth. Or like Enron pretending one of its "special purpose" subsidiaries is really a separate entity with its own assets and income.

- Now suppose there were no trust fund. The government took in cash and spent cash the same as it does now, but there were no bookkeeping entries related to the trust funds or phantom debt issuance. It wouldn't change anything in an economic sense. The government's net assets and liabilities would be the same. The trust fund, its "assets," and the associated debt don't matter.

- I'll bet you won't see my point. That's OK. It just demonstrates that there is a legitimate debate over whether the trust fund assets and the associated "debt" matter. That debate should be reflected in the article. When I have time, I'll write my side, and perhaps you can write yours. Bond Head (talk) 00:46, 11 October 2008 (UTC)

- I'll try one last time; once we get on the same page, there is no debate. Payroll tax revenues (every dime) are owed to the people, because Social Security law says so; the program is mandatory (not discretionary like defense). When the government gets a payroll tax surplus, it borrows and spends the money and credits the trust fund. Between 2017 and 2041, not only will all payroll taxes go directly to Social Security, but an additional $200 billion (on average) will be pulled from the general fund each year and paid to retirees to pay back the trust fund. The government will issue treasury bills (public debt) to get that $200 billion. As those amounts are paid to us, the trust fund goes down. Essentially, the intragov debt becomes public debt between 2017 and 2041. The total won't go up, but the components will be almost entirely debt owed to the public by 2041. Using another analogy, suppose the government decided to take the $2.2 trillion trust fund today and create personal accounts in our name (it's our money, right?) The government wipes out the intragov debt, but has to issue $2.2 trillion worth of t-bills (public debt) to fund that. Works the same way, only slower for real. In short, the only way for the govt. to pay that intragov debt off is to trade it in for public debt. So the total debt is real; it will become more real each year between 2017 and 2041 as the trust fund is liquidated by the issuance of real t-bills.Farcaster (talk) 01:18, 11 October 2008 (UTC)

- OK, well, we're definitely not on the same page, so I guess I'll have to write both sides. Keep thinking it through. You'll come around. Bond Head (talk) 01:49, 11 October 2008 (UTC)

- There is a scenario where you are correct, but it is unlikely to occur. That would be if the non-payroll taxes (income, corporate, excise primarily) represented a $200 billion surplus each year during 2017 to 2041 against non-social security expenses. During the 2017-2041 period, all payroll taxes go to Social Security, which can also claim about $200 billion each year on top of that from the general fund. If the government can pay that from the non-payroll tax base, it can pay down the trust fund without adding to the public debt. But we'd have to cut all non-social security programs by about 10% to do that.Farcaster (talk) 02:27, 11 October 2008 (UTC)

Off-topic sections deleted

I've deleted the following sections, which are not NPOV and which are substantially off-topic. ... Kenosis (talk) 19:40, 25 October 2008 (UTC)

The mechanics of U.S. Government debt, according to the Austrian School

This section may contain material not related to the topic of the article. (October 2008) |

When the expenses of the U.S. Government exceed the revenue collected, it issues new debt to cover the deficit. This debt typically takes the form of new issues of government bonds which are sold on the open market. However, the debt can also be monetized by which the Federal Reserve creates an entry on its books to credit the US Government for an amount equal to the dollar amount of the bonds the Federal Reserve is acquiring. The money created in this process not only includes the new dollars that came into existence just to purchase the bonds, but much more because this new money is now sitting in the form of checkbook money at the Federal Reserve. Under the practice of Fractional Reserve Banking this new checkbook money is treated as an asset to lend against. Economists estimate the expansion of the money supply as being many times the amount of the initial money created with the exact amount being a function of what percentage of deposits banks must set aside as "reserves".[1][2]

The ultimate consequence of monetizing U.S. debt is that it expands the money supply which will tend to dilute the value of dollars already in circulation. Thus, expanding the pool of money puts downward pressure on the dollar, downward pressure on short-term interest rates (the banks have more to lend) and upward pressure on inflation. Typically this causes an inflationary boom that ends in a deflationary bust to complete the business cycle. Note that money supply expansion is not the only force at work in inflation or interest rates. United States Dollars are essentially a commodity on the world market and the value of the dollar at any given time is subject to the law of supply and demand. In recent years, the debt has soared and inflation has stayed relatively low in part because China has been willing to accumulate reserves denominated in U.S. Dollars. Currently, China holds over $1 trillion in dollar denominated assets (of which $330 billion are U.S. Treasury notes). In comparison, $1.4 trillion represents M1 or the "tight money supply" of U.S. Dollars which suggests that the value of the U.S. Dollar could change dramatically should China ever choose to divest itself of a large portion of those reserves. 19:40, 25 October 2008 (UTC)

Arguments for paying down the national debt

This section may contain material not related to the topic of the article. (October 2008) |

Economists from the Austrian School point out that the United States experienced depreciation CPI from 1800-1912 in two spurts from 1810 to 1820 and 1860-1870[3] : a period of strong economic growth in U.S. history.[citation needed]

Furthermore, it is not always true that an increase in the money supply leads to an expansion of the economy. For example, consider the failure of Japan's Central Bank to do just that. In an attempt to follow Keynesian economics and spend itself out of a recession, Japan's central bank engaged in ten stimulus programs over the 1990s that totaled over 100 trillion yen.[4] Because of these large deficits, Japan has a national debt that is 194% of GDP [10].

In the absence of debt monetization, when the Government borrows money from the savings of others, it consumes the amount of savings there are to lend. If the government were to borrow less, that money would be freed to work in the private sector and would lower interest rates overall.

Lastly, raising interest rates is one of the traditional ways that the U.S. Federal Reserve uses to combat inflation (which can be brought on by government debt), but a large national debt figure makes it difficult to do so because it raises the interest paid in servicing that debt.

Net interest on the public debt was approximately $239 billion in fiscal years 2007 and 2008. This represented approximately 9.5% of government spending. Interest was the fourth largest single budgeted disbursement category, after defense, Social Security, and Medicare.[5]In addition, the government accrued a non-cash interest expense of $194 billion for intra-governmental debt, primarily the Social Security trust fund, for a total interest expense of $433 billion.[6] This accrued interest will be paid to Social Security recipients in the future. Paying off the national debt would free up these funds for other purposes.19:43, 25 October 2008 (UTC)

Arguments for repudiating the national debt or declaring bankruptcy

This section may contain material not related to the topic of the article. (October 2008) |

Murray Rothbard proposed simply repudiating the national debt or declaring bankruptcy. He noted that the creditors knew all along that the debt could only be paid off through taxation (or through the hidden taxation of inflation), which Rothbard regarded as tantamount to theft:

| “ | The government gets the money by tax-coercion; and the public creditors, far from being innocents, know full well that their proceeds will come out of that selfsame coercion. In short, public creditors are willing to hand over money to the government now in order to receive a share of tax loot in the future. This is the opposite of a free market, or a genuinely voluntary transaction. Both parties are immorally contracting to participate in the violation of the property rights of citizens in the future. Both parties, therefore, are making agreements about other people's property, and both deserve the back of our hand. The public credit transaction is not a genuine contract that need be considered sacrosanct, any more than robbers parceling out their shares of loot in advance should be treated as some sort of sanctified contract. | ” |

Rothbard also pointed out that repudiation could help prevent the government from borrowing such large amounts in the future. However, noting that some might view this as too draconian, he proposed as an alternative that the U.S. Government be treated like any other bankrupt organization, with its assets being liquidated via auction in order to pay the creditors a pro-rata share of those assets.[7] 19:45, 25 October 2008 (UTC)

Austrian School Material

I'm an Austrian School man myself, but all of the material dealing with the Austrian School needs to be moved or removed. It's a bit too specific and oblique to earn mentioning in this article. Further, I think that it's inclusion here borders near being unneuteral.

--Nogburt (talk) 19:17, 25 October 2008 (UTC)

You don't wish to associate yourselves with the burgeoning debt. I understand. 87.194.21.39 (talk) 14:06, 27 October 2008 (UTC)

Graph

What is the source for the graph on this article? Using the GDP numbers from here, I come up with:

2000: $5,674.2 bil Debt / $9817.0 bil GDP = 54.8%

2006: $8,506.9 bil Debt / $11319.4 bil GDP = 75.2%

This should look more like sudden spike, however the graph shows just a small bumb. What source is the graph using? Neitherday 03:53, 23 September 2007 (UTC)

- If the graph can't be sourced, I move that it be removed as possibly misleading. Neitherday 22:34, 24 September 2007 (UTC)

- I'm removing the graph as misleading and POV. If anyone can explain why it is not, they can always readd it to the page. Neitherday 00:12, 26 September 2007 (UTC)

Hi Neitherday, I'm the one who made that graph. I used those same GDP values from EH.net -- and have now added the source data to the image page. (You're right -- I should have included source data in my first version!) But note that the relevant GDP values must be nominal, not real. Federal debt values are given in nominal values, and must be compared with nominal GDP values. So the value for 2000 is $5,674.2 bil Debt / $9817.0 bil GDP = 54.8% while for 2006 it is $8,506.9 bil Debt / $13194.7 bil GDP = 64.5%. This is exactly what the graph shows. Also, if you have problems with a graph, why not contact the person who made the graph? Let me know if you have any other questions. Citynoise 13:34, 7 October 2007 (UTC)

- I just noticed that the graphs depicting total debt (public or gross) all reflect a decrease in debt roughly between 1997 and 2001. This decrease in debt is not found on any of the referenced tabular data included with these graphs. There was no decrease in debt in those years. Anyone suggesting there was will need to come up with some tabular data supporting this claim; for now I rule it as POV. Provide some data that backs up this claim before including into article. And at the same time, you will have to debunk the debt data that shows there was no decrease in debt over that period. But I don't think data showing a decrease exists anyways (since there was no decrease in debt in the last couple decades). -Gaytan (talk) 21:47, 6 August 2008 (UTC)

Gaytan, clarify your comments before you attack the tables please. I reverted. First, the graph with deficit and debt comparisons by year is accurate and sourced, so don't remove that. The ones showing public and total debt to GDP I didn't put there personally, but look about right as they are vs. GDP.Farcaster (talk) 23:32, 6 August 2008 (UTC)

- Farcaster, there is a serious problem with the gross federal debt portrayed in these graphs (a close look at the late 1990s data will reveal this). A common argument in favor of President Clinton is that he managed the federal budget well. According to data at various government sites, the gross federal debt steadily increased under his tenure as it did under every president since the 70s. To display graphical data which matches well with tabular data prior to the 1990 but is then skewed after that, is simply sneaky POV (and the author of this graph even cites the tabular data which does not match his graphs!).

- USDebt.png data displayed on Wiki shows the following (which is referenced to and matches data found in Table 7.1 at http://www.whitehouse.gov/omb/budget/fy2007/pdf/hist.pdf) for total federal debt (data in millions):

1990,3206290 1991,3598178 1992,4001787 1993,4351044 1994,4643307 1995,4920586 1996,5181465 1997,5369206 1998,5478189 1999,5605523 2000,5628700 2001,5769881 2002,6198401 2003,6760014 2004,7354673 2005,7905316 2006,8451350 2007,8950744

- Yet the graph displays a decrease in the debt in the late 1990s lasting through to 2001 (aligning very closely with President Clinton's second term in office). This is completely at odds with the above cited data.

- The Table in the 'History' section of this article displays numbers very similar to the above table (and to the referenced data at http://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt.htm) (data in billions):

1910,2.6 1920,25.9 1930,16.2 1940,43.0 1950,257.4 1960,290.2 1970,389.2 1980,930.2 1990,3233 2000,5674 2005,7933 2007,9008

- US Public debt per GDP 1791-2006.svg has the same dip in the debt curve at the latter half of the 1990s which is clearly suspect because of the case above. Again, please Provide some data that backs up these skewed grpahs prior to re-inserting them into the article. Additionally, debt data currently referenced in the article will have to be debunked somehow. For now I will remove this blatant yet disguised POV from the article. Blatant POV has no place in Wikipedia. We should not wait for a correction. Let the graphs be re-inserted after the corrections have been made. -Gaytan (talk) 16:51, 7 August 2008 (UTC)

OK, seems like you are on to something. I put in a placeholder we should agree on. I'll look into this over the weekend and see if we can do better. I've always thought looking at debt relative to GDP was misleading anyway, as one would hope the government increasingly is a smaller part of it. More important to those of us who want Social Security, Medicare, defense, etc. is how much the debt is relative to tax revenue, more like a corporation. I've often thought the debt to GDP argument was from the "debt doesn't matter school" of conservative thought, which is fine if you are wealthy.Farcaster (talk) 18:51, 7 August 2008 (UTC)

- Alright. I have proven my point. I agree that the ratio of debt to GDP is misleading primarily because many economists disagree on the manner at which the GDP is calculated (as is inflation and other economic parameters). The primary focus of this article is the U.S. debt, so gross debt should be portrayed accurately; ratios should be used with caution because they could very well be skewed depending on the economists' bias. Gaytan (talk) 19:08, 7 August 2008 (UTC)

You like this chart for the comparison?Farcaster (talk) 04:57, 8 August 2008 (UTC)

- Your new chart looks reasonable but I would have to check the numbers to make sure its accurate. But that is the problem with the Debt % GDP charts. These are difficult to verify because you need two data sets, one for GDP and one for total debt. Then after one takes the ratio between the two data sets and is finally enabled to verify data. But why all the trouble?? Because for some reason, politically tied economists don't like the fact that every single president and congress in recent history has done nothing to control our unmanageable debt and continues to do nothing, eventually leading the U.S. down a road many other nations pursued on their way out of existence. That is why I prefer a clear, blunt graph on total debt - pure, unadulterated, ubiased and simple. I could make one myself based on the data available from the referenced cites I just don't know how to get it onto Wiki yet. Gaytan (talk) 15:54, 12 August 2008 (UTC)

The reference I cited actually has the debt and the ratio right together, so easy to verify. You could use that to build your chart. What I do is build them in excel, then transfer to powerpoint. You can "ungroup" in PowerPoint to pretty the charts up. There is an "Upload file" button on the left when you are looking at any article on wikipedia. It walks you through the process of uploading; very easy.Farcaster (talk) 17:21, 12 August 2008 (UTC)

- Now that I took a close look at your image, I don't like the fact that the resolution of your x-scale abruptly changes for the latter part of the 1990s; the data gets distorted that way. Here I finally made a graph and uploaded it. No funny stuff going on here. I took the data from the report and simply plotted. No manipulation whatsoever. Let me know what you think. Gaytan (talk) 17:36, 14 August 2008 (UTC)

- Uploading is not as easy as you explained. Gaytan (talk) 17:37, 14 August 2008 (UTC)

I like the chart...very nice! I would suggest changing the color scheme or perhaps using dotted lines for one series or the other, as they overlap at certain inflection points. Easier to do in powerpoint.Farcaster (talk) 19:27, 14 August 2008 (UTC)

- This graph lacks the property of looking good at three inches on a side. Can you fix the axis labels to make it look good as it appears in the article? Pdbailey (talk) 23:38, 14 August 2008 (UTC)

Farcaster, I finally updated the graph as you recommended and placed it at the top of the article. Gaytan (talk) 18:35, 10 September 2008 (UTC)

- Looks great! Thank youFarcaster (talk) 19:16, 10 September 2008 (UTC)

Debt figure illegible

The figure, as it currently stands is illegible. The first question a reader asks when looking at a figure is, what am I looking at. The x and y labels, and the header should answer that question quickly. More detail should be provided in the caption so that, with caption the figure stands on its own. As is, I can not clearly read either label, but i can guess the X-label is year; the actual tick labels are beyond hope. In addition, there are four lines, so they need to be clearly delineated. The two axes makes these problems even worse. Fianally, it is lost on me what the advantage of the current version is over the version on the right. Pdbailey (talk) 19:35, 10 September 2008 (UTC)