Talk:Taxation in the United States/Archive 1

| This is an archive of past discussions about Taxation in the United States. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 | Archive 2 | Archive 3 |

Taxation History

The history of federal taxation DOES NOT start in 1863!!!!

There were multiple forms of federal taxation before that, which are casually ignored by this article. If there is a momentary refference to them, somewhere in that block of facts, it need to be moved tot he beginning of the section.—Preceding unsigned comment added by 68.158.69.171 (talk • contribs)

- I agree that this section needs to be expanded to include earlier taxation and such topics like the Boston tea party. I proposed a split since this section was getting a little large and could probably justify an article of its own but no one has responded to the suggestion. We could spend a good deal of time getting information from http://www.taxhistory.org/ and http://www.tax.org/Museum/default.htm. Morphh (talk) 2:35, 25 April 2007 (UTC)

I've heard of a misconception that the 16th amendment was not ratified by enough states. Is there any validity to this?

Max —Preceding unsigned comment added by 76.167.97.145 (talk) 20:52, 8 February 2008 (UTC)

- This misconception is thoroughly debunked at Tax protester constitutional arguments. Cheers! bd2412 T 20:55, 8 February 2008 (UTC)

Start

..."The income tax forms the bulk of taxes."...

There are two possible interpretations of that; one is true for most people and one is false. It could mean that the largest portion of the average taxpayer's burden is the income tax (true for most people, but not all), or it could mean that the largest source of revenue for the US government is the income tax (which is false). Please calrify. --LDC

This needs to be put on a different page. I'm not sure what, though. Perhaps United States/Taxation (!!) or perhaps Taxation in the United States or perhaps United States--Taxation. KQ should know the answer. :-) --LMS

"Taxation in the United States" sounds like a great article title to me, and of course it has to have sections (or subpages) of its own for different historical periods). --LDC

The best available information about U.S. total revenues is probably: http://www.fms.treas.gov/mts/mts0601.pdf Which does indicate that income taxes are the bulk of Treasury revenue. It's fine with me if it moves... Ray Van De Walker

Sure enough (though Social Security is pretty close); I guess my impression was out-of-date (I know that in the past, individual income tax wasn't the biggest source of revenue--I'll have to look that up). --LDC

A grammer/clarity request: is there a word or two missing from the phrase:

' Self employed people pay the entire 15.3%. Above these payroll taxes presumably pay into the Social Security Trust Fund and Medicare Trust Funds that they will then draw on when the worker grows older. ' ?

I get the idea of what the author is trying to say but clearer wording would be great. Thanks! -JMH

Well, please do move it then. (See naming conventions.)

According to that document, p. 5, the estimate for the next year is about half. Perhaps we can be more specific, anyway. I think the subject of this article is payroll taxes. It ignores all the "hidden" taxes and tariffs that are also paid by various entities (and passed on to the consumer), such as business taxes and taxes on alcohol.

Also, it needs to be clarified if the subject of the article is U.S. federal government taxation, or any taxation that occurs within the borders of the U.S.

Finally, the percentages here need to be dated (was that all last year, or what?) --LMS

As a new and anonymous user I am hesitant to edit straight to the article, but here is a relavent bit to the above notes: the textbook "Individual income taxes", by Hoffman/Smith/Willis (c) 2007 Thomson South-Western, provides the following table concerning the total 2006 Federal budget receipts, broken down by category and percentage (Figure 1-1, p.1-4):

Individual income taxes 44%; Corporation income taxes 11%; Social insurance taxes and contributions 38%; Excise taxes 3%; Other 4%.

I hope a numeric table like this does not constitute copyright infringement. I apologize if it does. -JMH

Haha, no, "of course" I don't know the answer. "Taxation in the United States" sounds good. It could also go into more on sales tax, also the "non"tax on gasoline which is part of the final price and helps to offset the cost of new road construction. --Koyaanis Qatsi

Are the percentages and ceilings quoted in this article current? I thought the Social security tax was raised to over 7% more than a decade ago. some please confirm and correct.

They were the last month when I paid them... At one point Social Security was 7.6%, I seem to recall, but it was deducted up to a smaller maximum salary. Don't forget the hidden part of the tax: The same amount of tax is -also- paid by the employer, so you're losing a net of 12.4%. You're being silently screwed by that, because the employer could use that for your salary/wages- it's part of the same human-resources budget item. R.G. Van De Walker

Florida does not have a state personal income tax but it does have a crporate income tax. I'me changing to a more appropriate state for the example.

Shouldn't this article at least mention non-income taxes, such as tarrifs and exise taxes?

-Ben

This article is so inaccurate that it should be removed from the Wikipedia. I don't understand why people who don't understand it want to write an article on a topic this complex anyhow, but since you obviously do, will you people PLEASE move this to some sort of a 'project' page where you can fiddle with it to your hearts' content without misleading the people who might actually look at this article in the meantime trying to learn something about taxes? And then not bring it back here until you get at least one tax expert to review it for gross misstatements that could lead readers into criminal violations of the tax law? -- isis 18:24 Dec 9, 2002 (UTC)

- The article seems to be going in three directions at once. On one hand, it's a description of how taxation works in the US, in a largely political context -- i.e. here is how the government collects revenue. On the other, it seems to also try to be a description of how the tax code affects the individual taxpayer. And then there's the rant in the middle about the unfairness of the ISO provisions of the AMT.

- I suspect that you're really only objecting to the second and third points, and not the first, which strikes me as perfectly reasonable for a public work-in-progress.

pity the IRS cites case law and not the actual laws requested. oh well. (As a Canadian, I have no stake one way or the other; I'm just amused at the total mess the US has gotten itself into[1][2][3] =) I also wonder whether the wikipedian so quick to repeat what the IRS says read the heterodox material at all. I find WPians tend to lack that objectivity...see fluoride, in which I put more effort 'cause fluoridation can happen to me.)

Case law is actual law. U.S. law includes statutes, regulations, and case law. They're all law, and they're all binding. It's completely appropriate for the IRS to cite rules of law determined by courts in cases.

Tax Protestors

It seems to me that all those described in this section are people working out weird ways to avoid tax. They are all tax evaders pretending to be tax avoiders. A tax protestor is not this. A tax protestor is one who refuses to pay tax in order to protest something e.g. the liberation/invasion of Iraq. A true tax protestor files his/her tax return correctly working out the tax due and then refuses to pay some or all of that tax. What say you all? Am I right that these so called tax protestors are really tax refuseniks? Paul Beardsell 18:16, 1 Jun 2004 (UTC)

- I'm pretty sure that's not the standard definition of Tax Protester. I've always heard the term used to describe people who dispute the legality of the tax, rather than people like Thoreau who acknoledge a tax's formal legitimacy but refuse to pay as an act of moral or political protest. Personally, I agree that these guys are really tax evaders who have convinced themselves of a convenient delusion, but the term "Tax Protester" really should refer to them.

- A quick Google search shows the entire first page to be composed of these evasion-style Tax Protestors, rather than of any other sort. For more on this, see the Tax Protestor FAQ: http://evans-legal.com/dan/tpfaq.html, from which the following quote from the Seventh Circuit comes:

- "Some people believe with great fervor preposterous things that just happen to coincide with their self-interest. 'Tax protesters' have convinced themselves that wages are not income, that only gold is money, that the Sixteenth Amendment is unconstitutional, and so on. These beliefs all lead--so tax protesters think--to the elimination of their obligation to pay taxes." Coleman v. Commissioner, 791 F.2d 68, 69 (7th Cir. 1986).

- Ben 18:43, 4 Jun 2004 (UTC)

Haha! Thanks for the link to the FAQ from which I quote below. He specifically only addresses one of the two types of "tax protester":

- What is a "tax protester"?

- The phrase "tax protester" is commonly applied to two types of people:

- People who refuse to pay taxes in order to protest policies of the federal government that are supported by those taxes (such as people who refused to pay taxes during the Vietnam War); and

- People who refuse to pay taxes or file tax returns out of a mistaken belief, firmly held, that the federal income tax is unconstitutional, invalid, voluntary, or otherwise does not apply to them under one of a number of bizarre arguments, most of which are described in this FAQ.

- This FAQ uses the phrase "tax protester" in the second sense, referring to people who refuse to file returns or pay taxes because of ridiculous and far-fetched arguments against the validity or application of the tax laws. (See the above explanation of the purpose of this FAQ.)

Paul Beardsell 04:27, 5 Jun 2004 (UTC)

Federal Withholding Tax

Since there is no mention of Federal Withholding Tax in the current version of this article, I'm going to go ahead and add something in. Why should the current tax article mention direct withholding but this article on U.S. taxation does not? Zzyzx11 03:51, 14 Feb 2005 (UTC)

State sales tax

I came to this page looking for information on the cross-state issues related to state taxes:

- What happens when someone lives in one state an works in another, or moves around a lot, or has more than one residence.

- What happens when purchasing goods from other states? E.g., over the internet?

- 1. It varies by state. Say you live in Massachusetts (a state with income tax) and work in New Hampshire (a state with no income tax). You'd still owe income tax to Massachusetts. If you work and live in two different states with income taxes, you may owe tax to both states. However you'll receive a credit for tax paid to other jurisdictions, meaning you won't be taxed twice for the same income. 2. When you buy goods from other states, there is no sales tax if the business has no presence in your home state. However you may still owe use taxes to your home state. As people buy more stuff over the Internet, expect states to crack down on people who don't pay use taxes on big ticket out-of-state purchases.

- Yep, you're right. All this stuff should be in the article. This article could use a revamping. Rhobite 21:05, Apr 3, 2005 (UTC)

I feel compelled to edit this paragraph in particular:

- Inflation and Tax Brackets

"Most tax laws are not accurately indexed to inflation. Either they ignore inflation completely, or they are indexed to the consumer price index, which tends to understate real inflation. In a progressive tax system, not indexing the brackets to inflation has the effect that there is a tax increase every year, even if Congress passes no tax law. That is because an individual's income will naturally go up at the inflation rate, and the progressive taxation system causes him to pay a greater percentage of his income in taxes."

I thought the consumer price index overstated inflation, since it tracks the prices of a fixed 'basket' of items, whereas in fact people will buy similar substitute items is the price of one of them rises too much. (One frequently cited example would be buying margarine instead of butter.)

I'd like to change 'understate' to 'overstate' and also modify the line 'an individual's income will naturally go up at the inflation rate' to something like 'an individual's income will often rise at the inflation rate'. Many people receive annual raises, but these are more closely tied to increases in skill than to inflation. --Heian-794 2 July 2005 11:11 (UTC)Heian-794

- I agree with the suggestion to change 'understate' to 'overstate' since it agrees with what I was taught in Economics. I did a quick Google search and that found most sites to support this, although there were a few skeptics. However, I didn't find anything that stated that the CPI understates inflation, so I think it is safe to make this change. Also, I think that the second change suggested about some of the wording is appropriate, although not critical. Since I am not a member, I am hesitant to make any direct changes to the article, so someone else probably should. --66.69.209.199 18:52, 29 July 2006 (UTC)

Tax "Burden"

I think this term needs to be explained. Reading this article, without much knowledge about taxation, makes it sound POV; but from hearing the term elsewhere, I'm assuming it's probably an acceptable term, though it sounds like POV to someone who isn't familiar with it, namely that people are overtaxed. If this is the case, I recommend moving it (not everyone believes we are overtaxed, a case in point was Bush's wanting to lower taxes when many polls showed most Americans felt taxes were at the proper level). It essentially becomes a political statement (that is, conservative vs. liberal). --Rt66lt, August 24, 2005

- One of the definitions of "burden" is "a responsibility or duty;" for example, the "burden of proof." In taxation parlance, the term "burden" carries that connotation and (usually) no more; in all of my taxation classes and work experience, the term is used as a description of someone's obligation to pay, not as a political commentary. Perhaps I've become inured to the potential misinterpretation, but if others feel the same way I'll add an explanation to the article.

- --Nathan Patterson, May 4, 2006

- The term "tax burden" may have some remote prejudicial connotations but it is the accepted term for the direct obligation to pay taxes. Note that this usually means the legal incident of taxaction (e.g. social security is paid 50% by employee and 50% by emplyer), not the economic or effective incident (which in case of payroll taxes is more like a 20/80 split in favor of employers). sebmol 08:47, 4 May 2006 (UTC)

Tax "Code"

The use of the term "tax code" in the opening paragraphs is confusing for a UK reader because a "tax code" in the UK is a number allocated to each individual by HM Revenue and Customs and used in the PAYE system.

- Thanks for the suggestion, I added a parenthetical explanation of the term. Turnstep 12:58, 1 December 2005 (UTC)

POV

I don't know anything about tax law, but to my ear, the following sentence sounds POV: "Often the receipts intended to be placed "trust" funds are used for other purposes, with the government posting an IOU ('I owe you') in the form of a federal bond or other accounting instrument, then spending the money on unrelated current expenditures." I suspect it because, I think, some people have an ideological opposition to government taxation, and "IOU" and "unrelated" seem unnecessarily, ah, sarcastic. I don't ever post on talk pages, so if someone qualified on this topic thinks this is silly, please delete.

- No need to delete, it's a valid concern. I don't agree, however, that it is POV. Poorly worded, perhaps, but a generally accurate statement. Turnstep 12:58, 1 December 2005 (UTC)

Minor edit regarding Form W-4

I removed the language to the effect that the W-4 is "maybe the most important tax form the employee will ever prepare". Yes, it's an important form, but I argue that it pales in signficance when compared with the individual's Form 1040 return. Signing and submitting a Form W-4 to an employer does not impair any significant right of the taxpayer. The W-4 is simply an instruction to the employer as to how much Federal income tax to withhold, and of course does not determine the taxpayer's tax liability.

On the other hand, filing an incorrect Form 1040 can have massive legal consequences for a taxpayer, even if the error is unintentional. The classic example is filing a Form 1040 that incorrectly overstates the tax liability. Once the Internal Revenue Service processes that return, the incorrect tax amount is formally "assessed" -- and the right of the taxpayer to contend with the IRS over the correct amount of tax is thereafter sharply curtailed. Filing a Form 1040 is arguably a much more serious proposition for taxpayer than submitting a Form W-4 to an employer. Famspear 15:09, 19 January 2006 (UTC)

W-4 vs. 1040 What do they do, which is more important, and why? The W-4 controls the timing and amount of movement of money to the govenment. The Form 1040 is a reconciliation which advises the government how much the taxpayer says is OK to collect. The Form 1040 is not intended to impair any significant right of the taxpayer.

The filing of an incorrect Form 1040 can be corrected if errors are made, and there is a process for doing so. The right to correct a return that has been "processed" and tax "assessed" is not intended to be curtailed by the IRS activity.

The determination of the correct amount of tax to be assessed is the final step in the process of determining the amount of money the government may collect from the taxpayer each year. While penalties may be assessed related to amounts shown on the Form 1040, they may be avoided by the use of a Form W-4 or simliar form. Form W-4 makes money move, 1040 makes money stick. Which is more important is a decision each person can make. Ken 01:37, 21 January 2006 (UTC)

"Progressive Nature of Income Tax" section is problematic

The two central claims here are that "the U.S. income tax is highly progressive" and that its progressivity "has gradually increased over recent decades". The section does not back these claims with a single fact or citation. Saying that "the top 20 % of taxpayers paid approximately 56 % of all taxes in 1980, and this figure gradually has risen to 65 %, as of 2001" doesn't prove anything. The fact that a small minority pays bulk of the total tax volume, and that that bulk is becoming bigger and bigger might as well be explained as follows: 1) there exists a super-rich minority, and 2) that super-rich minority is getting richer and richer (and hence paying more and more taxes). That would have nothing to do with "progressivity"; in fact, same situation would entail the same outcome even with a perfectly flat tax. GregorB 11:57, 4 March 2006 (UTC)

I think if the word "highly" were dropped [which I would have done myself if there wasn't a dispute flag on this section], it would eliminate the POV issue. "Highly Progressive" is an opinion. "Progressive" is a fact by defination since a "progressive income tax" is defined as an income tax system with multiple rates where the declared rate increases as income does. Joncnunn 16:35, 11 April 2006 (UTC)

- I agree: it is progressive by definition. But still: is it more progressive now than e.g. a decade ago? The section attempts to "show" that it is, but the citations are misleading in that respect. Numbers quoted are irrelevant to the subject ("Progressive Nature of Income Tax"). Removing "highly" would help, but unfortunately not much. Ripping quotations altogether would be better, but these are actually useful pieces of information (if used elsewhere in the article, that is), so I'm really reluctant about doing it... GregorB 16:36, 12 April 2006 (UTC)

Another problem with the so-called progressive nature of the US system: The brackets basically divide the population into the poor, lower- and mid- middle class, and then upper-middle class and up. Thus, the top bracket is decidedly UNprogressive, as it includes a large spectrum, from people in the upper-middle class to the ultra-rich. Furthermore, the system is even less progressive at higher incomes, due to legal forms of tax evasion, primarily incorporation.

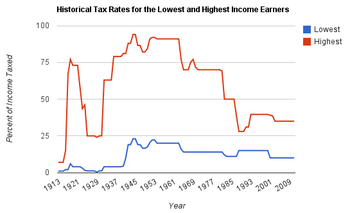

A brief history of Federal income tax rates and brackets

On the question of progressivity of the Federal income tax in the United States. As far as progressivity in the sense of the number of income brackets and the progression of rates from lower rates to higher rates as income increases, here are some statistics.

For what it’s worth, I believe the highest marginal tax rate in the early 1950s was above 90%.

Here is a partial history of changes in the Federal income tax rates since 1979:

Year 1979: 15 income brackets; rates ranged from 14%-70%

1982: 12 brackets; 12%-50%

1987: 5 brackets; 11%-38.5%

1988: 3 brackets; 15%-33%

1991: 3 brackets; 15%-31%

1993: 5 brackets; 15%-39.6%

2001: 5 brackets; 15%-39.1%

2002: 6 brackets; 10%-38.6%

2003-2005: 6 brackets; 10%-35%

Source: Internal Revenue Service, Instructions for Form 1040 (for each year listed)

Yours, Famspear 03:29, 13 April 2006 (UTC)

- Thank you, this is very illustrative... The data you quote seems to refute the article's thesis: there is no apparent trend towards higher progressivity - on the contrary. However, there are still some unknowns left:

- Bracket cutoff

- What is deductible and what isn't

- How do taxes other than Federal income tax (sales tax in particular) come into picture

- This is very complex stuff: many variables subtly affect the outcome... GregorB 20:06, 14 April 2006 (UTC)

Year 1978 tax rate schedule for single (unmarried) individual

Yes, it's exceeding complex all right. And here are some more goodies to chew on: the tax rate schedule, for U.S. Federal income tax purposes, for the calendar year 1978 for a single person:

If the taxable income is: The tax is:

Not over $2,200 ....................... No tax.

Over $2,200 but not over $2,700 ....... 14% of the excess over $2,200.

Over $2,700 but not over $3,200 ....... $70, plus 15% of excess over $2,700.

Over $3,200 but not over $3,700 ....... $145, plus 16% of excess over $3,200.

Over $3,700 but not over $4,200 ....... $225, Plus 17% of excess over $3,700.

Over $4,200 but not over $6,200 ....... $310, plus 19% of excess over $4,200.

Over $6,200 but not over $8,200 ....... $690, plus 21% of excess over $6,200.

Over $8,200 but not over $10,200 ...... $1,110, plus 24% of excess over $8,200.

Over $10,200 but not over $12,200 ..... $1,590, plus 25% of excess over $10,200.

Over $12,200 but not over $14,200 ..... $2,090, plus 27% of excess over $12,200.

Over $14,200 but not over $16,200 ..... $2,630, plus 29% of excess over $14,200.

Over $16,200 but not over $18,200 ..... $3,210, plus 31% of excess over $16,200.

Over $18,200 but not over $20,200 ..... $3,830, plus 34% of excess over $18,200.

Over $20,200 but not over $22,200 ..... $4,510, plus 36% of excess over $20,200.

Over $22,200 but not over $24,200 ..... $5,230, plus 38% of excess over $22,200.

Over $24,200 but not over $28,200 ..... $5,990, plus 40% of excess over $24,200.

Over $28,200 but not over $34,200 ..... $7,590, plus 45% of excess over $28,200.

Over $34,200 but not over $40,200 ..... $10,290, plus 50% of excess over $34,200.

Over $40,200 but not over $46,200 ..... $13,290, plus 55% of excess over $40,200.

Over $46,200 but not over $52,200 ..... $16,590, plus 60% of excess over $46,200.

Over $52,200 but not over $62,200 ..... $20,190, plus 62% of excess over $52,200.

Over $62,200 but not over $72,200 ..... $26,390, plus 64% of excess over $62,200.

Over $72,200 but not over $82,200 ..... $32,790, plus 66% of excess over $72,200.

Over $82,200 but not over $92,200 ..... $39,390, plus 68% of excess over $82,200.

Over $92,200 but not over $102,200 .... $46,190, plus 69% of excess over $92,200.

Over $102,200 ......................... $53,090, plus 70% of excess over $102,200.

Source: CCH Tax Research Network. Yours, Famspear 22:59, 14 April 2006 (UTC)

- Famspear, I think I'm your fan... GregorB 09:35, 15 April 2006 (UTC)

OK, now I have added a chart showing the Federal income tax rates imposed on a single (unmarried) individual by the original '54 Code -- see the article on the Internal Revenue Code of 1954. The highest rate was 91%. Yours, Famspear 22:37, 19 April 2006 (UTC)

Tax year followed by top tax rate for that year follwed by the level at which the top tax rate was imposed.

1913 7 500,000

1914 7 500,000

1915 7 500,000

1916 15 2,000,000

1917 67 2,000,000

1918 77 1,000,000

1919 73 1,000,000

1920 73 1,000,000

1921 73 1,000,000

1922 58 200,000

1923 43.5 200,000

1924 46 500,000

1925 25 100,000

1926 25 100,000

1927 25 100,000

1928 25 100,000

1929 24 100,000

1930 25 100,000

1931 25 100,000

1932 63 1,000,000

1933 63 1,000,000

1934 63 1,000,000

1935 63 1,000,000

1936 79 5,000,000

1937 79 5,000,000

1938 79 5,000,000

1939 79 5,000,000

1940 81.1 5,000,000

1941 81 5,000,000

1942 88 200,000

1943 88 200,000

1944 94 200,000

1945 94 200,000

1946 86.45 200,000

1947 86.45 200,000

1948 82.13 400,000

1949 82.13 400,000

1950 84.36 400,000

1951 91 400,000

1952 92 400,000

1953 92 400,000

1954 91 400,000

1955 91 400,000

1956 91 400,000

1957 91 400,000

1958 91 400,000

1959 91 400,000

1960 91 400,000

1961 91 400,000

1962 91 400,000

1963 91 400,000

1964 77 400,000

1965 70 200,000

1966 70 200,000

1967 70 200,000

1968 75.25 200,000

1969 77 200,000

1970 71.75 200,000

1971 70 200,000

1972 70 200,000

1973 70 200,000

1974 70 200,000

1975 70 200,000

1976 70 200,000

1977 70 203,200

1978 70 203,200

1979 70 215,400

1980 70 215,400

1981 69.13 215,400

1982 50 85,600

1983 50 109,400

1984 50 162,400

1985 50 169,020

1986 50 175,250

1987 38.5 90,000

1988 28 29,750

1989 28 30,950

1990 28 32,450

1991 31 82,150

1992 31 86,500

1993 39.6 89,150

1994 39.6 250,000

1995 39.6 256,500

1996 39.6 263,750

1997 39.6 271,050

1998 39.6 278,450

1999 39.6 283,150

2000 39.6 288,350

2001 39.1 297,350

2002 38.6 307,050

2003 35 311,950

2004 35 319,101

2005 35 326,450

The article reads a little anti-tax to me.

Sources of Tax Statistics

Since federal income tax return information is protected from disclosure by law (such as IRC 7216) the best (and often only) source of statistics is the Internal Revenue Service. Such statistics are reported in excrutiating detail in the quarterly IRS Publication 1136, "The Statistics of Income Bulletin". Questions can be resolved by contating the Statistical Information Services of the IRS at sis@irs.gov. This publication is available on line (current issue at http://www.irs.gov/taxstats/productsandpubs/article/0,,id=151971,00.html). For those such as myself who began before the IRS had a website, or who wish to keep earlier volumes for reference, the subscription cost is $53 per year for paper copy.

The SOI runs about 350 pages per edition, contains numerous charts and tables, and has footnotes regarding methodology for researchers. Especially useful would be the 80+ pages of historical and time-series data at the end of each bulletin. Often information is broken down by level of income reported (either Adjusted Gross Income or Total Positive Income, depending on application). Table 18 entitled "Treasury Department Gross Tax Collections: Amount Collected by Quarter and Fiscal Year, 1987--2004" is displayed in Excel format at www.irs.gov/pub/irs-soi/histab18.xls. This table indicates that in fiscal 2004, total tax collections were $2,035,472 million; of which $717,247 million were employment taxes which pass directly to the Social Security trust fund and the FUTA trust fund. Individual income taxes accounted for $990,249 miillion and corporate income taxes were $230,619 million.

Read and enjoy.

Disproportionate?

History: "The lowest earning workers ($20,000 in 2000) pay no income taxes as a group and actually get a small subsidy from the federal government because of child credits and the Earned Income Tax Credit. Notably, however, lower income individuals pay a disproportionate share of payroll taxes for Social Security, Medicare, Unemployment Insurance, and the like. All income earned is taxed at 7.65% on the employee with an addition 7.65% payment incurred by the employer." (emphasis added)

Is it really disproportionate? If everybody pays 7.65% regardless of income level, isn't that one of the few taxes that is proportionate? Furthermore, lower income individuals receive the Earned income tax credit. Either I am mistaken or the relative value of "disproportionate" when it comes to taxation has become so perverted that I am surprised there has not been a revolt. Regardless, this statement is unclear and needs revision or clarification. 64.3.57.179 19:47, 13 March 2006 (UTC)

- Dear fellow readers: Here's the answer. Lower income workers do pay a disproportionately larger share of Federal payroll taxes (Social Security tax withheld and Medicare tax withheld) in terms of what is called the "effective tax rate." Here's why.

- The statement "[a]ll income earned is taxed at 7.65%" is incorrect. Of the 7.65%, a total of 6.2% (i.e., the Social Security tax) applies only to earnings up to a point, adjusted for inflation each year (the income amount is $94,200 for the year 2006, for example).

- So, comparing a worker with gross wages of $20,000 versus one with $200,000 for 2006, the $20,000 wage earner is paying payroll tax at a 7.65% effective rate, while the $200,000 wage earner is paying payroll tax at about 4.37%, as follows:

- Worker earning $20,000:

- Social Security tax = $20,000 x 6.2% = $1,240.00

- Medicare tax = $20,000 x 1.45% = 290.00

- Total SS & Med tax withheld: $1,530.00, which is 7.65% of $20,000.

- Worker earning $200,000:

- Social Security tax = $94,200 x 6.2% = $5,840.40

- Medicare tax = $200,000 x 1.45% = 2,900.00

- Total SS & Med tax withheld: $8,740.40, which is only about 4.37% of $200,000.

- By the way, workers generally pay no Federal or state unemployment insurance tax. I don't know the law of every state, but every state of which I am aware (as well as the Federal law) imposes the tax only on the employer. Yours, Famspear 21:41, 13 March 2006 (UTC)

That's very helpful Famspear, thanks for clarifying. Best, 68.80.237.199 23:30, 13 March 2006 (UTC)

- Wow. I just found a mistake in my March 13, 2006 edits on the payroll taxes. Obviously, since the worker with lower income is paying at a 7.65% effective rate while the worker with the higher income is paying (in the example given) at only a 4.37% effective rate, the lower income worker is paying at HIGHER rate than the high income person. My March 13th edits incorrectly said the low income person was paying "lower." I have made the correction in the article. Yours, Famspear 01:57, 20 April 2006 (UTC)

Merge?

There is another income tax in USA article. John wesley 15:22, 28 April 2006 (UTC)

- Ah, but this article is not on income tax, but all forms of taxation used in the U.S. (property tax, estate tax, sales tax, etc.). This article should remain separate, but redundancy between the two should be minimized. Cheers! bd2412 T 15:28, 28 April 2006 (UTC)

- Excise taxes and tariffs eh? John wesley 15:29, 28 April 2006 (UTC)

- Those too, I suppose. bd2412 T 15:39, 28 April 2006 (UTC)

- Excise taxes and tariffs eh? John wesley 15:29, 28 April 2006 (UTC)

Tax Advice

Wikipedia is a great resource tool and a growing community. However, as tempting as it is to solicit legal or financial advice from a community of helpful individuals, most accountants and lawyers will tell you that they cannot offer you much advice over the Internet. There are simply too many variables that factor into an individual's situation for advice to be complete based off of limited interaction and knowledge of relevant facts.

To the anonymous user who asked about taxation of a corporation in San Francisco, CA, United States, and who was evidently located in Russia: you could probably start by searching for an accountant in San Francisco. This could be accomplished by Googling the term "San Francisco CPA." A San Francisco-based CPA may be able to point you in the right direction; however, you should start there, not an online encyclopedia.

Additionally, please direct any future comments to me to my personal talk page, not this article. NathanPatterson 10:15, 17 May 2006 (UTC)

Tax return

What will happened, if tax return not ready yet? Where can i find information about this question?

- Actually, the IRS has a FAQ on just such a situation - The Deadline's Passed. Now What? bd2412 T 13:11, 8 May 2006 (UTC)

Revert apparent copyright violation

On 24 June 2006 certain material was added to the article, much of it apparently copied from http://www.papillonsartpalace.com/decoding.htm

for which copyright is claimed by WorldNetDaily.com

I removed the inserted material.

Yours, Famspear 23:03, 24 June 2006 (UTC)

More progressive, less progressive - ah, let's call the whole thing off

I have made some edits to the article to remove what I contend are some unverifiable comments regarding progressivity. I argue that enough actual data has now been printed in the relevant articles that each reader can evaluate the increases or decreases in the "progressivity" of the Federal income tax in the USA over the years.

Obviously, in "recent decades" the top marginal rates (for example) have gone both up and down. And just as obviously, the top marginal rates are a lot lower than they were in 1954 or in the late 1970s. Whether you argue that the income tax is currently "too progressive" or "not progressive enough," you can now perhaps find some "data" in Wikipedia to provide some support for your position. However, I argue we should try to keep the texts of the articles themselves as neutral as possible. See Progressive tax and Internal Revenue Code of 1954. Yours, Famspear 20:20, 5 July 2006 (UTC)

PS: In commenting on the top margin rates, I do not mean to imply that comparing the top tax rate in year A with the top rate in year B would be the only possible way to measure "progressivity." Also, I don't have a strong personal opinion one way or the other about whether the U.S. Federal income tax is "too progressive" or "not progressive enough." Famspear 20:30, 5 July 2006 (UTC)

Table

Although I think the table at the top of the article is pretty helpful for comparison etc. From looking at the page it has been lifted from, some of it appears, to me at least, to be slightly misleading, or a little unclear.

The source says that it uses "the combined effects of personal income tax, employee and employer social security contributions, payroll taxes and cash benefits". I am only approaching this from the point of view of taxation in the United Kingdom (the only system I know) but with "a family with one wage-earner and two children", as stated in the linked article, on the UK average wage of $30,470 would pay $4,114 in Income Tax and $2,261 in National Insurance contributions bringing it to a total of $6,375. This would translate rougly into 21% of earnings and not 27.1%, and with two children would be entitled to $4,971 in Child Tax Credit (a "cash benefit"?) which would result in a net liability of $1,404.

Perhaps the table has factored in comparable child tax credits and the like from the United States and the other nations but this is not mentioned although the article does have a quote saying "Citizens in these other countries are paying more money, but they are getting more back, in terms of social programs", I do not know if the UK Child Tax Credit is included as a social program rather than a "cash benefit".

Obviously local taxes, sales taxes and motoring taxation would mean that a citizen of the UK would pay more than the net of $1,404 over a year, but these do not come under "personal income tax, employee and employer social security contributions, payroll taxes and cash benefits".

I appreciate that the Organisation for Economic Co-operation and Development is a pretty reliable source, and I am not, nor pretend to be, an expert in economics but I wondered if anyone else thought the table was a little misleading? Benson85 00:38, 13 August 2006 (UTC)

Exemption for Churches - History

I don't know the history, but it would be useful to see it here. When were churches given tax-exempt status? I think that a law in the 1940s created the non-profit exemption, but I suspect churches had exemptions before that, even if only on a state-by-state basis. I'm not sure if any court cases have come up against this, either, but they'd be useful links for that, since there is a clear contradiction between the 1st Amendment and this exemption.

Different source?

From the article: "The argument that the Sixteenth Amendment was "never ratified" has been rejected by the Internal Revenue Service and by the courts [5] and found to be a frivolous argument."

Refering to a court decision by linking to an IRS.gov article is pretty ridiculous from a NPOV, it also doesn't convince the income tax protestors. I changed it into "[...] Internal Revenue Service [5] and the courts (source?) [...]". I suggest linking to court orders directly (or authorative summaries) instead of a huge 63 page document by the IRS. [Preceding commentary added by anonymous user at IP 194.109.22.149 on 2 October 2006.]

- Dear fellow editors: I have added citations to court cases where the courts specifically rejected the "Sixteenth Amendment was not properly ratified" argument.

- Also, Wikipedia is here to inform, not to "convince" or persuade. Linking to or citing an IRS document regarding tax matters is in no way "ridiculous," and has nothing to do with non-neutral point of view. Please go back and read the Wikipedia guidelines. However, the anonymous user is correct to the extent he or she implies that actual court decisions are, from a legal standpoint, much better authority than an assertion by the IRS on its web site. Court decisions are Primary authority. The material on the IRS web site consists of mixtures of primary authority and Secondary authority. Actual texts of statutes, regulations, actual holdings (rulings) by Federal courts, etc., are much better. Yours, Famspear 17:07, 2 October 2006 (UTC)

- Thank you very much, Famspear. One point though: would you agree with me that this information fits better together with other arguments from tax protestors, at Tax_protester_arguments, no matter if they are pro or anti their (specific) argument? I mean, why is one arguments here, and others there? I'd say, put them all together at Tax_protester_arguments instead. 194.109.22.147 03:46, 3 October 2006 (UTC)

Well, I pretty much agree. The situation in Wikipedia is that tax protester arguments keep getting inserted by new editors in the general tax articles such as Taxation in the United States, rather than in the related articles such as Tax protester, Tax protester arguments, Tax protester constitutional arguments, Tax protester statutory arguments, Tax protester conspiracy arguments, and Tax protester history. I am repeatedly moving material from the general tax articles to the tax protester articles where it can be presented more comprehensively. However it might not be feasible to put all tax protester material in one of the "tax protester" articles. Ironically much of the material I added here was copied and adapted from one of the other articles. I guess this is more of an "art" than a "hard science", as far as trying to figure where stuff fits the best. The material I added here is certainly duplicated elsewhere, so maybe some other editors may have some ideas. Should we just pare the tax protester stuff back down in this article, since it's already covered elsewhere? Any thoughts, anyone? Yours, Famspear 04:25, 3 October 2006 (UTC)

History split

I think this section requires a lot of expansion and is currently sufficient to start its own article titled something like Taxation history of the United States. It should cover early American history as well such as the Boston tea party. Morphh (talk) 16:33, 5 January 2007 (UTC)

- Oppose

Done

Since no one opposed I took the liberty of creating the article. I have not yet made a reference to this article because the separate history article requires a lot more work.EECavazos 23:38, 14 July 2007 (UTC)

Mention of Fair tax?

I was wondering if it would be appropriate to mention the FairTax as an alternative which has been proposed. Brian Pearson 00:17, 11 September 2007 (UTC)

- There is a brief mention of it under "Federal tax reform". I'm not sure we should give it any additional weight in this article. Perhaps we could give it a brief definition, but we would likewise need to do so for the Flat tax. Morphh (talk) 13:13, 11 September 2007 (UTC)

- Easier said than done.:) I'd have to give it some thought. Brian Pearson 01:57, 13 September 2007 (UTC)

Tax distribution—Commentary/NPOV dispute

On Dec. 9, 2006, an editor inserted commentary about the section "Tax distribution" into that section (the new material is the part after the bullets):

Tax distribution

In the United States, the Congressional Budget Office produces a number of reports on the share of all federal taxes paid by taxpayers of various income levels. Their data for 2002 shows the following: (Table 2)

- The top 1% of taxpayers by income pay 33% of all individual income taxes, and 22.7% of all federal taxes.

- The top 5% of taxpayers pay 54.5% of all individual income taxes, and 38.5% of all federal taxes.

- The top 10% of taxpayers pay 67.4% of all individual income taxes, and 50% of all federal taxes.

- The top quintile (20%) pays 82.5% of all individual income taxes, and 65.3% of all federal

This interruption is to protest the bias in these statistics, and ask that the total amount of income earned for each of these groups be listed. For example: The top 1% of taxpayers by income pay 33% of all individual income taxes, and 22.7% of all federal taxes, and earn approximately XX% of all income. One will find that the taxes paid by group is equally near the percentage of national income earned by group. As stated, there is a misperception that the top 1% to 20% of the population is paying a disproportionate amount of the taxes, yet they earn most of the national income. The misrepresentation is commonly argued on political forums, on behalf of reducing taxes for the wealthy.

The added material is a commentary/discussion about the article and should be included on this talk page, not in the article itself. I've therefore moved it here.—Mateo SA (talk | contribs) 01:30, 10 December 2006 (UTC)

- Postscript: Since the editor's concern seems to be that the above-mentioned section is biased, I've added the POV tag to that section.—Mateo SA (talk | contribs) 01:36, 10 December 2006 (UTC)

- I've tried to update this per these comments. However, we may be duplicating the section "Progressive nature of income tax" - perhaps we should combine these and maybe rename the header. Morphh (talk) 14:00, 10 December 2006 (UTC)

- I agree. Progressive/regressive nature of a tax system is tax distribution. It belongs in this section.Gmb92 07:26, 8 November 2007 (UTC)

- It looks like some are trying to substitute one biased POV for another in the name of NPOV. We won't get anywhere on tax distribution until we talk EFFECTIVE tax (tax over income) to filter out the impact of tax complexity. See the third graph presented here (source data is CBO): http://economix.blogs.nytimes.com/2009/04/08/how-much-americans-actually-pay-in-taxes/.MrJ 4:07, 20 March 2011 (UTC)

Effective tax rates

As suggested earlier by another poster, I think it makes sense to combine "Progressive nature" with "Tax distribution". Progressive/regressive are general descriptions of tax distribution. Also, I want to suggest a couple of sources regarding effective tax rates. The first deals with effective federal tax rates from the Congressional Budget Office. Table 1A lists the total federal effective tax rates from 1979-2001 for 5 income quintiles and the top 10%, 5% and 1% of incomes. [[4]] A similar 2004 CBO study continued this analysis. Since it assumed expiration of various 2001 and 2003 tax act provisions, estimates for years beyond 2004 are not accurate. However, since no major changes to the tax code have taken place since 2003, 2004's numbers are reasonably accurate for this article. Table 2: [[5]]

For regressive state taxes, this study lists the estimated average effective rates in graph form. This is for the year 1996, which should be noted if included in this article. I don't see any better reference in this article that covers this topic. Figure 5, page 6 of the PDF lists the graph. [[6]] For the lowest income group, the average effective rate (U.S.) is about 12.5%. For the highest income group (top 1%), the average effective rate is 6%.

Gmb92 07:46, 8 November 2007 (UTC)

Major culling needed

Editor Eastlaw has pointed out that the list of taxes and fees was fairly problematic. I have deleted some of the more obviously-undocumented items. That does not mean that these taxes or "fees" don't exist. It just means that we need to limit this list to taxes -- and just to taxes that we can actually document. This still needs work. Stay tuned. Famspear (talk) 23:34, 21 November 2007 (UTC)

Peer-review notice

I think we're close to submitting Tax protester constitutional arguments for Featured Article status. Please help in the peer-review of this article to get it ready for submission. Thanks Morphh (talk) 19:24, 14 February 2008 (UTC)

Idea for New Article

I am considering writing an article on timing concepts in Federal income taxation and related case law. For example, the constructive receipt, economic benefit, and claim of right doctrines, an elaboration on cases regarding the cash method versus accrual method of accounting, etc. Does anyone think this would be worthwhile or appropriate for Wikipedians? I would outline the various doctrines at a high level and give some of the landmark cases in each category. Nathanpatterson 04:48, 30 May 2006 (UTC)

I think you guys ought to explain ways that tax money is used. —Preceding unsigned comment added by 71.191.199.175 (talk) 22:58, 26 February 2008 (UTC)

- That would be covered under the area of government spending and United States federal budget. Morphh (talk) 14:10, 27 February 2008 (UTC)

- I agree with editor Morphh. "Taxing" (bringing the money into the government treasury) and "spending" (appropriations, or paying the money out of the government treasury) are opposite concepts, and the "spending" side of things (how the government uses the money) should be kept separate -- with separate Wikipedia articles. Famspear (talk) 16:19, 27 February 2008 (UTC)

Lead section

Lead section can be expanded. Per WP:Lead section, the lead should be able to stand alone as a concise overview of the article. The lead should

1. establish context;

2. summarize the most important points;

3. explain why the subject is interesting or notable, and

4. briefly describe its notable controversies, if there are any.

Per Wikipedia guidelines, the "emphasis given to material in the lead should roughly reflect its importance to the topic according to reliable, published sources. The lead should not 'tease' the reader by hinting at but not explaining important facts that will appear later in the article. It should contain up to four paragraphs, should be carefully sourced as appropriate, and should be written in a clear, accessible style so as to invite a reading of the full article." Yours, Famspear (talk) 18:22, 27 February 2008 (UTC)

- I left a message on the users talk as well. Morphh (talk) 18:26, 27 February 2008 (UTC)

POV intro tag

(After some edit conflict) The second paragraph cats a negative light on taxation by choosing examples that are favorable to their view. It's done elegantly, but it is obvious and should be rewritten or deleted. ☆ CieloEstrellado 16:31, 30 March 2008 (UTC)

- I removed the quote and did some copyedits. Perhaps this will address the concern. Morphh (talk) 16:30, 30 March 2008 (UTC)

- Ok, I've removed the tag. Good job there, but there's still some hidden cry against the "government taking away our money," even if it's very subtle. ☆ CieloEstrellado 16:35, 30 March 2008 (UTC)

- I guess such would be based on the readers view regarding levels of government spending, which is a different article. We definitely need to expand the lead to summarize the article, which may help this (such that we discuss progressive aspects on income). Morphh (talk) 16:47, 30 March 2008 (UTC)

Suggested move

How would the editors here feel about moving this article to Tax policy of the United States to be more along the lines of the titles of other policy articles (Category:United States federal policy). The pros would be that it would give this article a more narrowly-defined scope (it seems to have grown rather large), and that it would draw the article into a framework parallel to the other policy articles. Cons: The State-specific material may need to be farmed out to another article. johnpseudo 22:39, 2 May 2008 (UTC)

- Right now, the article title parallels the tax articles of other countries (Category:Taxation by country). I prefer it the way it is based on Wikipedia guidelines (see WP:TITLE). Generally, article naming should prefer what the greatest number of English speakers would most easily recognize, with a reasonable minimum of ambiguity, while at the same time making linking to those articles easy and second nature. I wouldn't think "tax policy" would be the first thought when searching for most. I would suggest turning your suggested link into a redirect, and we could then categorize the redirect (WP:CAT-R). Or perhaps there is some way to have this article list it with that name in the category. Anyway.. that's my thoughts on it. Morphh (talk) 13:45, 04 May 2008 (UTC)

Number of Taxpayers

The number of taxpayers references an article that indicates how many people were eligible to receive rebate checks. This does not seem like a valid approximation to me, as it excludes taxpayers with incomes over a certain level (how many I do not know). Better statistics are likely to be found at the IRS website: http://www.irs.gov/taxstats/indtaxstats/index.html

- I agree. I've removed those references. People who get some percentage of their payroll tax back are not paying "no taxes" -- there's some heavy spinning going on, I don't think that website is a WP:RS. -- Kendrick7talk 06:09, 23 October 2008 (UTC)

- I'm ok with the removal of the content as It did not contain any critical information but the information was accurate with regard to effective income taxes paid (regardless of proper withholding) and it is a reliable source per Wikipedia policy (regardless of their pov). Payroll taxes are discussed in the next paragraph, which includes the regressive nature and that most Americans pay more of this tax. They are discussed separately as they are different taxes and the payroll tax is technically not an income tax. Although, from the standpoint of an employee who has the FICA taxes (both Social Security and Medicare) withheld from his or her paycheck, it might be difficult to see the difference. The FICA tax is actually an "employment tax" imposed under Subtitle C of the Internal Revenue Code. By contrast, "income" taxes (individual, corporate, etc.) are imposed under Subtitle A. The estate and gift taxes are "transfer" taxes (taxes on some, but not all, transfers of ownership of property), and are imposed under Subtitle B. Morphh (talk) 13:04, 23 October 2008 (UTC)

I found the above article in the list of those to be wikified. Moreover, it reads like a how-to. I'm hoping that editors here will know if there is anything useful in it to be salvaged, and if so, if it should be brought in here. Itsmejudith (talk) 13:18, 23 March 2009 (UTC)

Created article for tax statute -- how to add to the template?

I noticed there's this cool template with all the tax statutes in it. I just created Tax_Relief_and_Health_Care_Act_of_2006 last night and I don't know how to add it to that template, will someone please do that for me? Thanks. Agradman talk/contribs 20:34, 15 July 2009 (UTC)

- Added it. Morphh (talk) 23:47, 15 July 2009 (UTC)

Tax of 100% on everything over 25K

While I heard about this proposal, I had heard it was more like he floated the idea in a cabinet meeting or something but that no bill was ever drafted. If that, or something like it, is the case, it is definitely a stretch to say "Franklin D. Roosevelt tried to impose a 100% tax on all incomes over $25,000 to help with the war effort." JoshNarins (talk) 20:58, 15 April 2010 (UTC)

gini as measure of progresivity

I removed the gini coefficient as a measure of progresivity graph. The reason I did this is that the payrole taxes are regressive, so I'm not really sure how they can be progressive. In addition, as I noted in my edit comment, this needs to be referenced. Morphh writes, "The image is sourced and a Gini Coefficent is a standard measure of progressivity". Please show me the non-self published ref. The current website link is a self-published source. 018 (talk) 22:45, 17 January 2010 (UTC)

- For one, the term progressivity does not mean progressive. It is used to describe both regressive and progressive taxes - it is the range of the tax incidence and is essentially short for Progressiveness/Regressiveness. Second, Payroll taxes being regressive is somewhat matter of opinion since it is payed back progressively. Aside from that, the Gini coefficient is a widely used measure of inequality that varies from 0 (perfect income equality) to 1 (perfect income inequality). So if you're expecting some negative number for regressive, you're misunderstanding the metric. The graph's purpose is to show the relative progressivity in comparison to other taxes. It shows the fact that the payroll tax is the most regressive or least progressive tax, and that the estate tax is the most progressive using a standard measure. As for the source, it's not a self-published source, it's a primary source, which is acceptable. It was written by Economist Karen Walby, Ph.D., and Economist Laurence Kotlikoff, Ph.D. If you have a better one that's fine, but it's not reason to remove it. Morphh (talk) 0:29, 18 January 2010 (UTC)

- I understand the gini coefficient and how it works, I also understand why fairtax.org would want to use it. It's properties are very favorable to them: changes near the median affect the gini coefficient more than changes at the extremes. But, it is a measure of income inequality, using it for tax inequality is novel, and since this is not a reliable source, having it on the page that way amounts to original research.

- I'd also point out that the source cited by fairtax does not in fact talk about the figure you include. The file they link to does not include any gini coefficients (they even say to look at table 5 which only has federal income tax rates, no gini coefficients). This is something that fairtax.org added and do not explain their methods for. In addition, the file that they link to is itself self-published. They claim it is revision to an NBER working paper, but the working paper that NBER publishes does not even share a title with the linked file. In any case, the version published by NBER is the one that should be considered to be non-self-published. 018 (talk) 00:51, 18 January 2010 (UTC)

- I think you may misunderstand the difference between a self-published source and a primary source. I also think you're misunderstanding a WP:RS as there is no basis to call it unreliable for an opinion on U.S. taxes (they're one of the larger tax reform groups) - certainly they have a pov and if we have other sources that balance it out, great. But they're not unreliable and it's not self-published (at least how Wikipedia describes self-published) - if we took that broad definition, then most primary sites would be self-published. It is not our purpose to verify their work. They published the information, and we can source them as a primary source for that data. Morphh (talk) 1:05, 18 January 2010 (UTC)

- Note, I started a discussion of this source at [7]

- I've started a new discussion regarding your general argument that advocacy groups can't be used as sources, that such sources are self-publishing, and that sources require academic review. None of which is based on policy. If consensus agrees and policy reflects this, than I concede the issue. Further discussion was required, a single their opinion saying the same thing without basis in policy does not override the general consensus and policy requirements. Oddly I don't even care that much for the image... it's an issue of misunderstanding or clarifying policy - I object to the reasoning. Morphh (talk) 16:51, 19 January 2010 (UTC)

- You beat me to it.. I was actually undoing my edit as a sign of good faith until further discussion, but your majority of one is lacking in policy discussion.. and now your pissing me off edit warring over it. That image has been in there for quite a while... giving it consensus through use. Policy has been there for a while, which you seem to ignore. Again, I don't care if the image is there or not, but you've irritated me enough over it that I now want to make sure you don't take this absurd logic anywhere else. Morphh (talk) 17:05, 19 January 2010 (UTC)

Expand Tax Topic

This broad topic deserves some interesting subtopics like 1) the 47% tax bracket (i.e. the 47% of Americans who pay no income taxes and how they do it) and the other brackets. 2) the tax freedom day this year figured to be April 9 where one's taxes for the year are considered paid by the work done to that point (about 1/3 of your work year pays your taxes) 3) the origin of the 1040 IRS form which suspiciously looks like half the 2080 work hours in a year which may indicate intent to conscript half of every citizen's labor to government service. 4) the actual slavery implications of economic slavery created by taxes.75.139.214.136 (talk) 22:07, 16 April 2010 (UTC)

Tax Withholding section -- dubious claim

I was reading this in the withholding section:

"Conversely, other individuals withhold as little as possible, using the rule that withholding need only be 100% of the previous year's tax liability, and thus pay a large amount on April 15."

What rule is this that withholding need only be 100% of previous year's liability? By that reasoning, if one had no liability in 2007 (if one was a student, say), then one would not have to withhold anything in their new job regardless of the salary. This appears to directly contradict Publication 505. I've placed a dubious tag on the sentence and will wait to see if anyone finds a reference. --Meowist (talk) 22:46, 23 July 2008 (UTC)

- What I think the article was talking about is the rule about the penalty for underpayment of estimated tax. This has little if anything to do with whether your employer is required to withhold federal income tax on the new job.

- The employer is generally required to withhold based on the published withholding tables and schedules and the Form W-4 the employee provides to the employer (with some exceptions not material here).

- By contrast, what the article is talking about is: "How much must I have paid in (whether in the form of witholding, prior year credits, or 'estimated tax Form 1040-ES payments') by April 15, 2009 to avoid the so-called 'Form 2210 penalty' for failure to timely pay 'estimated tax' for the tax year 2008?"

- I edited the article to clarify this, although more clarification might be needed, 'cause it's a bit complicated. Hope this helps. Yours, Famspear (talk) 17:22, 24 July 2008 (UTC)

- I've read the form 2210. This still is a bit unclear - from reading this form and others it seems that one doesn't incur a penalty for underpayment if one withheld at least as much as one had tax liability in the previous year. So in the student example above, it seems withholding nothing works. However, looking on the W-4 form, there is no way to make the employer not withhold without claiming "exempt" which requires two, not one, conditions: no liability last year and you "expect" no liability this year. Is this another one of the IRS' catch-22 tricks? If you claim that you don't expect to have liability and then end up with some amount like $10k due but form 2210 says you owe no penalty, you still appear to get a $500 penalty. Meowist (talk) 02:12, 25 July 2008 (UTC)

Dear Meowist: I'm not following you. What $500 penalty? How are you computing it? Famspear (talk) 16:40, 25 July 2008 (UTC)

PS: If you're thinking of the $500 penalty mentioned in IRS Publication 505 (rev. Feb. 2008), page 13, you're comparing apples and oranges, in a way. Famspear (talk) 17:38, 25 July 2008 (UTC)

- Yes, I was speaking of that penalty. Yes, it is a bit of an apples and oranges comparison since it's for estimated tax and this is withholding, which is apparently for wages only. I'm wondering about this "expect" clause... I suppose you can always "expect" to make enough charitable contributions to bring your tax down within some credits.Meowist (talk) 05:11, 30 July 2008 (UTC)

I have a gripe about the statement that the FICA is essentially a forced savings plan. This isn't accurate. The money collected passes through to the general fund, and an IOU is left in it's place. Further, there is not direct connection between how much you put in and how much you get out! It is tied to the level you contribute at. So if I pay at the maximum rate for most of my adult life (the case...) then I'll certainly get the maximum benefit for whatever my retirement age - but it has no bearing on how much I actually paid in taxes through FICA. I would simply remove the "forced savings" from the description. —Preceding unsigned comment added by Ka6s (talk • contribs) 16:09, 28 July 2010 (UTC)

- Ka6s, the more you pay in to SS, the more you get out. Generally, people pay in much closer to what they get out than you would think looking at the formula used, which decreases the payout relative to what you put in after a certain point. The reason is that higher wage workers also live longer and so receive the benefit for longer. Also, what is so bad about an IOU? In this case they are more valuable than cash since they pay interest. 018 (talk) 17:19, 28 July 2010 (UTC)

- Not really. Only the top 35 (or was it 40) years of earnings are used, and the taxable earnings, rather than the actual withholding, is used to compute the payment. There is a correlation between the payments and the payout, but the actual factor used is allowable taxable earnings.—Arthur Rubin (talk) 08:30, 29 July 2010 (UTC)

Highest marginal tax rates, US federal income tax on individuals

I pretty much re-wrote the section on the highest marginal tax rates for individuals for the federal income tax, by going back to the actual Instructions for Form 1040 as published by the Internal Revenue Service/Bureau of Internal Revenue of the U.S. Department of the Treasury. I have all the Form 1040 forms and related instructions published by the Treasury, going back to the tax year 1913 (which was actually only for the period March 1 - Dec. 31, 1913), but for this Wikipedia article I included only those since the early 1940s (at least for now). There were a few errors in the material prior to this edit. Famspear (talk) 03:12, 29 September 2010 (UTC)

I would like to point out that the conclusions to be drawn from this review of the highest marginal income tax rates for individuals are somewhat limited. Famspear (talk) 03:20, 29 September 2010 (UTC)

All this editing apparently has put a big white space in the middle of the article, but after all these years I still don't know how to fix it. Hellllppp! Famspear (talk) 03:25, 29 September 2010 (UTC)

One thing we may want to add to the article later is that the highest marginal tax rate on individuals can be misleading. For example, the highest marginal tax rate for 1980 was 70% for individuals -- but that rate applied only to CERTAIN kinds of income. Interest and dividend income could be taxed as high as 70% above a certain income level, but "earned" income (in the sense of compensation for service, such as salary or wage) was taxed at no higher than a 50% rate for that same year. Most average folks presumably derive the bulk of their income, at least in their working years, as compensation for personal services (as an employee for example), and not from dividends or interest income, etc. Too busy to deal with that right now, though. Famspear (talk) 04:50, 29 September 2010 (UTC)

- With all the phase-outs, the highest marginal tax rate may not correspond to the highest income, or may not be the nominally highest marginal tax rate. For example, if someone in the 35% tax bracket still has itemized deductions, the actual marginal tax rate may be 35.7%, due to the itemized deduction phase-out. If the taxpayer also has medical deductions, it could be 35*1.095 = 38.325% . It's possible that someone in the EIC phaseout area might actually have a higher marginal tax rate than someone in the 35% tax bracket.—Arthur Rubin (talk) 08:11, 29 September 2010 (UTC)

- Hello, Arthur!

- Also, the terminology can get confusing. I would tend to want to refer to the highest marginal tax rate as stated in the law itself for a given year as the "nominally" highest marginal rate for that year, while referring to an "actual" highest marginal tax rate (due to the effects of deduction phase-outs, etc., as described by Arthur) as being the "effective highest marginal tax rate." But of course, that could be confusing as well, since we use a similar term -- the term "effective rate" -- to refer to something else. At least right now, the article uses the term "highest marginal rate" to refer to what I like to call the nominal rate -- the rate stated in the statute and in the actual tax form instructions. Incidentally, I'm using the terms as I think lawyers and accountants would tend to use them. Arthur Rubin is definitely our mathematics expert here.

- Another phenomenon that affects the marginal tax rate (as explained by Arthur above) would be the phase out of the exclusion for social security benefits received. Too complicated for me to explain this early in the morning, though.... Famspear (talk) 11:56, 29 September 2010 (UTC)

I can't agree strongly enough with anyone looking to prevent the abuse of marginal tax rates in articles like this. This is a sensitive political area in America today. Let's remember that the AMT was created to stop millionaires from paying nothing at all, and this was in an era of historically high marginal rates! Deductions, credits, etc have always made it difficult to determine true effective taxation from mere marginal rates. Any presentation of marginal rates should come with a presentation of effective rates as well as explanation for the difference. MrJD March 20, 2011

Article needs massive work

This article is lopsided in topics, inaccurate in numerous places, replete with POV, and very poorly cited. It needs a massive overhaul, or simply replacement with redirects to other articles better covering the same topics. Oldtaxguy (talk) 04:23, 8 November 2010 (UTC)

Proposed organization of article

I believe the entire article should be an overview rather than detailed coverage on each topic. We should refer to a main article on nearly every section or subsection. Here's a proposed outline:

- Intro

- Levels and types of taxation

- Income tax

- Basic concepts

- Worldwide taxable income

- Graduated tax rates

- Federal rates overview: no tables

- State rates overview: no tables

- Income (including reference to tax exempt)

- Deductions and exemptions

- Credits

- Withholding of taxes

- Individuals and entities

- State variations

- Nonresidents

- Alternative tax bases (AMT, states)

- Book/tax differences for businesses

- Reporting under self assessment system

- Basic concepts

- Payroll taxes

- Social Security and Medicare

- State taxes on employers

- Reporting and payment

- Sales and excise taxes

- State and local sales taxes

- Contrast to VAT

- Federal excise taxes

- Property tax

- Levels at which tax imposed

- Types of property taxed

- Assessment and collection

- Customs duties

- Variable duty rates

- Impact of treaties

- Estate and gift taxes

- Imposed on deceased or donor

- Taxable amount

- Effects on income tax

- Worldwide estate for residents

- License and user fees

- Tax administrations

- Federal IRS and Customs are different

- State administrations

- Local administrations

- Judicial appeal

- Legal basis

- Constitutions (Federal and state)

- Federal law

- State laws

- Local laws

- History overview: no historical rate tables

- Early taxes: pre-Civil War

- Tariffs and excise taxes

- Pre-1913 income tax

- Federal income tax

- State tax after 1913

- Social Security and payroll taxes

- Measures to combat avoidance

- AMT

- State alternative taxes

- International provisions

- Early taxes: pre-Civil War

This article gets about 2k hits per day, so it needs to be taken seriously. The time budget to get this to true C class is likely to exceed 50 man hours. Getting to B class should be our goal for the short term (by say March 1), but that's likely a very stretch goal. Comments here, suggestions & volunteers very needed. Oldtaxguy (talk) 00:07, 23 November 2010 (UTC) Updated with proposed outline Oldtaxguy (talk) 19:14, 6 December 2010 (UTC)

- That method of organization looks just right to me... Sugar-Baby-Love (talk) 19:29, 6 December 2010 (UTC)

- Looks like a good outline and idea. 018 (talk) 20:52, 6 December 2010 (UTC)

- Most impressive </vader> Really drives home the scope of the article. Ravensfire (talk) 21:32, 6 December 2010 (UTC)

- I think all this is great, but only focuses on federal taxation. State taxation is significant and is largely undocumented within this article. For instance, in California there are an expected $120 billion in taxes for 2010-2011. In California this is largely split into: (California Enacted Budget 2010-2011, Summary Charts)

- Personal Income Tax: $48 billion

- Sales Tax: $31 billion

- Corporation Taxes: $11 billion

- Highway Users Taxes: $5.5 billion

- Motor Vehicle Fees: $6.8 billion

- Insurance Taxes: $2.2 billion

- Estate Taxes: $0.7 billion

- That's about $2531 per person in state taxes for Californians, compared to about $4820 per person in federal taxes for every American. That significant. And there are other states, with significant differences in setup. I am unsure how these should be incorporated into this article ATM. Int21h (talk) 06:21, 3 January 2011 (UTC)

- I did some work on this in early December (see User:Ravensfire/Taxation in the United States for me early work) and did some off-line stuff over the holiday. You can see how some sections fairly easily mapped over. I started to get into trouble with the breakdown into Federal, State, and local levels. The purpose of those taxes changes at the different levels which is something I think is important to work into the article. I also think there is too much emphasis on the income tax for this article (example - AMT is important, but really not for this article beyond a single line mention at most). I haven't forgotten about this! BTW - if anyone else would like to work in my little sandbox, please feel free. I put the sections as sub-articles as a personal preference - would obviously need to put them in the main article at some point. Ravensfire (talk) 15:59, 3 January 2011 (UTC)

- The proposed outline is organized by TYPE of tax, not JURISDICTION. If we organize by jurisdiction, there will be a lot of repitition in many areas. Note that property taxes have no Federal counterpart, but income tax definitions for most states follow Federal. In the sales and excise area, many of the principles but few of the details are the same among jurisdictions. Gasoline taxes are identical except as to rates; but Federal motor vehicle fees apply only to commercial vehicles. I strongly favor organization by type of tax.

- As some examples of same vs. different: in the income tax area: California, New York, Illinois all either refer to Federal rules or incorporate them with very few differences (mostly related to things inherent in the state vs. Federal, like tax exempt interest); NJ has no itemized deductions, but follows most of Federal definition of AGI. Estate and gift taxes at the state level are almost all imposed based on Federal taxable estate or gifts. Oldtaxguy (talk) 03:29, 4 January 2011 (UTC)

- This article needs to discuss both, although I am not opposed to being organized by type. There are many tax topics that will be intricately linked with a particular jurisdictional level, like customs and estate taxes. These different taxes must be referenced to make the article complete, and mixing them all up together may be confusing. The state estate taxes, for example, are based on a system of state (usually county) assessors. I am not aware of the federal government doing so independently, and probably base their assessments on such values. My fear is that with this type setup, either it will be mainly federal, or with 50 state systems all mixed in it will be difficult to understand or find the material that someone is looking for that is a state issue. We can't just ignore certain state issue or hide them because they don't fit nicely into the current scheme. Int21h (talk) 21:22, 6 January 2011 (UTC)

- I agree that state and local issues MUST be covered in depth. This is one area in which the U.S. differs highly from most other countries: our system is a federal system, with independent taxation by states and municipalities. In some areas, the states rely on Federal rules, so those rules must be explained before the state rules can make sense; examples: income tax, estate tax. In other areas, there is a complete disconnect between Federal and states; example: sales and excise tax. In yet other areas, there is no Federal counterpart; example: property tax. Finally, states are prohibited from imposing customs duties. Thus, the broad spectrum of U.S. tax must cover all of these areas. Obviously, the topic is so broad that coverage cannot be deep in ANY one area. Thus, I believe each piece of the article must be the 20,000 foot summary, with all details left to "main" articles.

- On a separate note, I believe your information on estate tax is incorrect, and confused with property tax. Most states impose estate tax on the gross estate, as defined in the IRC and reported on IRS Form 706, sometimes with adjustments and different deductions. Many states "piggy back" the state estate tax calculation as equal to the Federal credit for state estate tax, pro rated among states. There is no involvement of counties or assessors with the estate tax, as far as I'm aware. Also, few states do any independent examinations of estate tax returns, relying on the IRS to contest values. These observations apply to NJ and NY, whose estate tax returns start with Federal gross estate. California "piggy backs" and has a one page estate tax return (with some optional schedules), carrying numbers from the Federal return. Oldtaxguy (talk) 23:41, 6 January 2011 (UTC)

- This article needs to discuss both, although I am not opposed to being organized by type. There are many tax topics that will be intricately linked with a particular jurisdictional level, like customs and estate taxes. These different taxes must be referenced to make the article complete, and mixing them all up together may be confusing. The state estate taxes, for example, are based on a system of state (usually county) assessors. I am not aware of the federal government doing so independently, and probably base their assessments on such values. My fear is that with this type setup, either it will be mainly federal, or with 50 state systems all mixed in it will be difficult to understand or find the material that someone is looking for that is a state issue. We can't just ignore certain state issue or hide them because they don't fit nicely into the current scheme. Int21h (talk) 21:22, 6 January 2011 (UTC)

- Well, OK, I may have confused the estate and property taxes. The California 2011 budget did not seem to differentiate between the two... And yes, I agree with the "20,000 foot summary", which is what I was going for with the federal taxation article. It would seem the current outline looks good. Int21h (talk) 23:54, 6 January 2011 (UTC)

Article redundancy