Talk:Economic growth/Archive 5

| This is an archive of past discussions about Economic growth. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 | ← | Archive 3 | Archive 4 | Archive 5 |

Dr. Pritchett's comment on this article

Dr. Pritchett has reviewed this Wikipedia page, and provided us with the following comments to improve its quality:

Per capita output is determined by: output per unit of labor input (labor productivity), hours worked (intensity), the percentage of the working age population actually working (participation rate) and the proportion of the working-age population to the total population (demography). "The rate of change of GDP/population is the sum of the rates of change of these four variables plus their cross products."[4]

I would not say :"determined by" as many readers will think the following is a causal statement rather is "arithmetically the product of" or "can be decomposed into"

Increases in labor productivity (the ratio of the value of output to labor input) have historically been the most important source of real per capita economic growth.[5][6][7][8][9] "In a famous estimate, MIT Professor Robert Solow concluded that technological progress has accounted for 80 percent of the long-term rise in U.S. per capita income, with increased investment in capital explaining only the remaining 20 percent."[10]

This should say "in the USA." or "in OECD countries" as there are many exceptions (e.g. the discovery of oil in Kuwait).

- It says "80 percent of the long-term rise in U.S. per capita income,".Phmoreno (talk) 02:50, 8 June 2016 (UTC)

(Note: There are various measures of productivity. The term used here applies to a broad measure of productivity. By contrast, Total factor productivity (TFP) growth measures the change in total output relative to the change capital and labor inputs. Many of the cited references use TFP.) Increases in productivity lower the real cost of goods. Over the 20th century the real price of many goods fell by over 90%.[11]

It seems confusing to the average reader to talk about the "real" price of goods falling 90 percent, why not refer to the "cost per hour of labor"--use the wage (or some unit of equivalent labor) as the numeraire.

- Increasing productivity is not just through saving labor. Productivity can also be increased by saving energy, materials and capital and over time these savings have been significant. Electrification fundamentally restructured the economy of the early 20th century U.S. in ways many economists have failed to appreciate. Electrification and modern power plants dramatically lowered the amount of coal needed to product a kilowatt of electricity and the capital cost of producing power. Energy saving techniques were also employed in numerous other industries. Phmoreno (talk) 02:50, 8 June 2016 (UTC)

Increases in productivity are the major factor responsible for per capita economic growth – this has been especially evident since the mid-19th century. Most of the economic growth in the 20th century was due to reduced inputs of labor, materials, energy, and land per unit of economic output (less input per widget). The balance of growth has come from using more inputs overall because of the growth in output (more widgets or alternately more value added), including new kinds of goods and services (innovations).[17]

This could usefully specify "growth in per capita GDP in the 20th century..." as of course population of the uSA has expanded enormously and hence total GDP is affected by the scale of population.

Mass production of the 1920s created overproduction, which was arguably one of several causes of the Great Depression of the 1930s.[25] Following the Great Depression, economic growth resumed, aided in part by increased demand for existing goods and services, such as automobiles, telephones, radios, electricity and household appliances. New goods and services included television, air conditioning and commercial aviation (after 1950), creating enough new demand to stabilize the work week.[26] The building of highway infrastructures also contributed to post World War II growth, as did capital investments in manufacturing and chemical industries.[27] The post World War II economy also benefited from the discovery of vast amounts of oil around the world, particularly in the Middle East. By John W. Kendrick’s estimate, three-quarters of increase in U.S. per capita GDP from 1889 to 1957 was due to increased productivity.[9]

Earlier the article nicely pointed out that most "growth" theory and data is about "potential" output so why is there a passage on the Great Depression which was about a deviation of actual from potential output? Just not relevant.

- The part about overproduction and the Great Depression can be deleted or moved to a new section. There is an important point to make in that the balance of labor in the U.S. shifted from shortage to surplus after 1910, the same time period as the introduction of widespread electrification and mass production. This shift in labor was recognized by some economists but not all appreciated the causes.[1] Beaudreau somewhat understood what happened.[2] I think Jerome understood it too.Phmoreno (talk) 03:32, 8 June 2016 (UTC)

Economic growth in the United States slowed down after 1973.[28] In contrast growth in Asia has been strong since then, starting with Japan and spreading to Korea, China, the Indian subcontinent and other parts of Asia. In 1957 South Korea had a lower per capita GDP than Ghana,[29] and by 2008 it was 17 times as high as Ghana's.[30] The Japanese economic growth has slackened considerably since the late 1980s.

The use of 1973 may be roughly accurate for the USA but that date ("since then") has nothing to do with growth in the rest of Asia. Rapid economic growth started much earlier in Japan, started in Korea in 1962 whereas growth did not take off in China until 1977 or 1978 and when growth took off in India is in hot dispute but no one dates it to the 1970s (my estimates are in the early 1990s) (I have an article on the timing of growth accelerations and decelerations Kar, et al 2013 called "Looking for a break")

Industrialization creates a demographic transition in which birth rates decline and the average age of the population increases.

I would be hesitant to say "industrialization creates a demographic transition" as it is neither necessary (many countries now have low fertility at very low income) or sufficient (at least "high income" as many Gulf States have high per capita income and high fertility). Something the "The Industrial Revolution was accompanied by a demographic transition" would be more accurate as a specific historical experience.

Political institutions, property rights, and rule of law[edit] See also: Great Divergence § Property rights, Great Divergence § Efficiency of markets and state intervention, and Great Divergence § State prohibition of new technology “As institutions influence behavior and incentives in real life, they forge the success or failure of nations.”[42]

In economics and economic history, the transition to capitalism from earlier economic systems was enabled by the adoption of government policies that facilitated commerce and gave individuals more personal and economic freedom. These included new laws favorable to the establishment of business, including contract law and laws providing for the protection of private property, and the abolishment of anti-usury laws,[43][44] When property rights are less certain, transaction costs can increase, hindering economic development. Enforcement of contractual rights is necessary for economic development because it determines the rate and direction of investments. When the rule of law is absent or weak, the enforcement of property rights depends on threats of violence, which causes bias against new firms because they can not demonstrate reliability to their customers.[45]

In many poor and developing countries much land and housing is held outside the formal or legal property ownership registration system. Much unregistered property is held in informal form through various property associations and other arrangements. Reasons for extra-legal ownership include excessive bureaucratic red tape in buying property and building. In some countries it can take over 200 steps and up to 14 years to build on government land. Other causes of extra-legal property are failures to notarize transaction documents or having documents notarized but failing to have them recorded with the official agency.[46]

Not having clear legal title to property limits its potential to be used as collateral to secure loans, depriving many poor countries one of their most important potential sources of capital. Unregistered businesses and lack of accepted accounting methods are other factors that limit potential capital.[46]

Businesses and individuals participating in unreported business activity and owners of unregistered property face costs such as bribes and pay-offs that offset much of any taxes avoided.[46]

I am not sure how Wikipedia works exactly but this seems better placed in a separate article on "Growth and Institutions" or some such. So far the article has been descriptive whereas this is now ranging into hotly contested views about causation. At the very least it should come down into the section on "theories" as the way in which growth is often discussed is "proximate determinants" and "causal theories" separately.

Supply and demand[edit] In the supply and demand model, technology that improves productivity creates a shift in the supply curve, meaning that the amount of supply available occurs at lower costs, which increases the quantity demanded.

The development of new products and services increases both total supply and demand.

This is not well placed in an article about economic growth as this is a generic phenomena.

Robert Solow[54] and Trevor Swan[55] developed what eventually became the main model used in growth economics in the 1950s.

This makes it sound as if they did it together, which I don't think is true.

The big push[edit] One popular theory in the 1940s was the Big Push, which suggested that countries needed to jump from one stage of development to another through a virtuous cycle, in which large investments in infrastructure and education coupled with private investments would move the economy to a more productive stage, breaking free from economic paradigms appropriate to a lower productivity stage.[60] The idea was revived and formulated rigorously, in the late 1980s by Kevin Murphy, Andrei Shleifer and Robert Vishny.[61]

The ordering of the theories is odd, Big Push came before Solow-Swan and one should mention Harrod Domar as the intermediate step between Big Push and Solow-Swan as it was the knife edged path of Harrod Domar with fixed capital to output ratios that led to the Solow adoption of Cobb Douglas with capital and labor as substitutes.

Institutions and growth[edit] According to Acemoğlu, Simon Johnson and James Robinson, the positive correlation between high income and cold climate is a by-product of history. Europeans adopted very different colonization policies in different colonies, with different associated institutions. In places where these colonizers faced high mortality rates (e.g., due to the presence of tropical diseases), they could not settle permanently, and they were thus more likely to establish extractive institutions, which persisted after independence; in places where they could settle permanently (e.g. those with temperate climates), they established institutions with this objective in mind and modeled them after those in their European homelands. In these 'neo-Europes' better institutions in turn produced better development outcomes. Thus, although other economists focus on the identity or type of legal system of the colonizers to explain institutions, these authors look at the environmental conditions in the colonies to explain institutions. For instance, former colonies have inherited corrupt governments and geo-political boundaries (set by the colonizers) that are not properly placed regarding the geographical locations of different ethnic groups, creating internal disputes and conflicts that hinder development. In another example, societies that emerged in colonies without solid native populations established better property rights and incentives for long-term investment than those where native populations were large.[64]

a) to talk about "institutions" and not discuss Douglas North first is just not right. He was the pioneer of institutions.

b) the "cold climate" is odd placed here and not particularly essential to the AJR argument.

Energy consumption and growth[edit] For more details on Energy efficiency, see Productivity improving technologies (historical) § Energy efficiency. Energy economic theories hold that rates of energy consumption and energy efficiency are linked causally to economic growth. A fixed relationship between historical rates of global energy consumption and the historical accumulation of global economic wealth has been observed.[70] Increases in energy efficiency were a portion of the increase in Total factor productivity.[9] Some of the most technologically important innovations in history involved increases in energy efficiency. These include the great improvements in efficiency of conversion of heat to work, the reuse of heat, the reduction in friction and the transmission of power, especially through electrification.[71][72] "Electricity consumption and economic growth are strongly correlated".[73] "Per capita electric consumption correlates almost perfectly with economic development."[74]

This is certainly misplaced under "theories of economic growth" and as the near perfect correlation of per capita gdp and electricity use could be just a demand phenomena and the result of a a budget expansion path.

Over long periods of time, even small rates of growth, such as a 2% annual increase, have large effects. For example, the United Kingdom experienced a 1.97% average annual increase in its inflation-adjusted GDP between 1830 and 2008.[75] In 1830, the GDP was 41,373 million pounds. It grew to 1,330,088 million pounds by 2008. A growth rate that averaged 1.97% over 178 years resulted in a 32-fold increase in GDP by 2008.

worth mentioning this is not per capita.

- Again, you are not appreciating the changes bbrought about by electrification. Electrification was the most fundamentally transformative technology of the 20th century. Electricity enabled modern production methods and saved enormous amounts of energy. The amount of light from a given quantity of fuel with electricity is over 1000 times that of a kerosene lamp. Electric motors revolutionized factories, businesses and households. People who aren't engineers have no idea how many millions of horsepower supplied by electric motors power the economy, manufacturing products, pumping water to households and businesses, transporting oil and gas through pipelines, etc.Phmoreno (talk) 03:17, 8 June 2016 (UTC)

Happiness has been shown to increase with a higher GDP per capita, at least up to a level of $15,000 per person.[76]

Both Stevenson and Wolfers and Deaton's research suggest there is no upper limit of this type so at the very least this is contested. Plus this is between average and country level GDP per capita, not at all personal and personal income.

Economic growth has the indirect potential to alleviate poverty, as a result of a simultaneous increase in employment opportunities and increased labor productivity.[77]

The connection between economic growth and poverty is much more direct that this as "per capita income" is the summary statistic of an income distribution. An distributionally neutral shift in the distribution of income reduces poverty by definition as mostly "modern" poverty measures are the (distribution intensity weighted) integral of the income distribution up to a poverty line (I would guess the Wikipedia article on poverty says something like this).

A study by researchers at the Overseas Development Institute (ODI) of 24 countries that experienced growth found that in 18 cases, poverty was alleviated.[77]

The evidence of Aart Kraay on growth spells and poverty reduction is much more general and much better.

However, employment is no guarantee of escaping poverty; the International Labour Organization (ILO) estimates that as many as 40% of workers are poor, not earning enough to keep their families above the $2 a day poverty line.[77]

This is a complete non sequitur as "economic growth" and "employment" are very different things.

For instance, in India most of the chronically poor are wage earners in formal employment, because their jobs are insecure and low paid and offer no chance to accumulate wealth to avoid risks; other countries found bigger benefits from focusing more on productivity improvement than on low-skilled work.[77]

I think this means to say "in informal" employment as the statement about "formal" is just wildly wrong. In "informal" employment it is not clear a "job" is the best description as much of this is self-employment in which people work on their own account.

Increases in employment without increases in productivity lead to a rise in the number of working poor, which is why some experts are now promoting the creation of "quality" and not "quantity" in labor market policies.[77] This approach does highlight how higher productivity has helped reduce poverty in East Asia, but the negative impact is beginning to show.[77] In Vietnam, for example, employment growth has slowed while productivity growth has continued.[77] Furthermore, productivity increases do not always lead to increased wages, as can be seen in the United States, where the gap between productivity and wages has been rising since the 1980s.[77] The ODI study showed that other sectors were just as important in reducing unemployment, as manufacturing.[77] The services sector is most effective at translating productivity growth into employment growth. Agriculture provides a safety net for jobs and an economic buffer when other sectors are struggling.[77] This study suggests a more nuanced understanding of economic growth and quality of life and poverty alleviation.

This discussion doesn't belong in an article about economic growth per se as it is veering into other issues like employment. When I use wikipedia I like the focus.

The "income equality" section is a completely different topic (and one whose "neutrality" is rightly questioned)

We hope Wikipedians on this talk page can take advantage of these comments and improve the quality of the article accordingly.

Dr. Pritchett has published scholarly research which seems to be relevant to this Wikipedia article:

- Reference : Hausmann, Ricardo & Pritchett, Lant & Rodrik, Dani, 2004. "Growth Accelerations," CEPR Discussion Papers 4538, C.E.P.R. Discussion Papers.

ExpertIdeasBot (talk) 13:09, 7 June 2016 (UTC)

References

- ^ Vatter, Harold G.; Walker, John F.; Alperovitz, Gar (2005). "The onset and persistence of secular stagnation in the U.S. economy: 1910-1990, Journal of Economic Issues".

{{cite journal}}: Cite has empty unknown parameter:|1=(help); Cite journal requires|journal=(help) - ^ Beaudreau, Bernard C. (1996). Mass Production, the Stock Market Crash and the Great Depression. New York, Lincoln, Shanghi: Authors Choice Press.

Objection to removal of dispute tags

I object to this deletion of the dispute tags by reversion without discussion here. EllenCT (talk) 01:37, 20 June 2016 (UTC)

- Excuse me, but what was your justification for the tag in the first place?Phmoreno (talk) 02:24, 20 June 2016 (UTC)

- The dispute is quite obvious, from the previous section alone. EllenCT (talk) 15:05, 20 June 2016 (UTC)

- No, no it's not. You have been asked before to clearly define the issue at hand and have failed to do so. Can you do that? Volunteer Marek (talk) 15:54, 20 June 2016 (UTC)

Inequality

@Phmoreno: and @Volunteer Marek: please share your thoughts on [1] in re "inequality has increased more than we previously thought...." and similarly as per [2] and [https://www.nerdwallet.com/blog/finance/why-people-are-angry/]. EllenCT (talk) 06:42, 18 June 2016 (UTC)

- This might be relevant for the article on Economic Inequality but not here. Even there it gives me pause because it's a working paper by a grad student. I'd wait till it's published in a peer reviewed journal.Volunteer Marek (talk) 20:04, 18 June 2016 (UTC)

- @Volunteer Marek: I am trying to follow the instructions at RSN so I have questions about where we agree and disagree. (1) What do you think are the best WP:MEDRS-class or better sources on the relationship between economic inequality and growth? (2) Do you agree that [3] is a peer reviewed MEDRS-class literature review published in an academic journal? (3) Do you agree with that literature review's characterization that "Biggs and colleagues studied 22 Latin American countries from 1960 to 2007 and found a substantial relationship between income inequality, life expectancy, infant mortality and tuberculosis mortality rates; they also reported that when inequality was rising, economic growth was related to only a modest improvement in health, whereas during periods of decreasing inequality, there was a very strong effect of rising Gross Domestic Product (Biggs et al., 2013). Other studies have shown an association between income inequality and health across states/regions within nations, including, for example, in Argentina (De Maio et al., 2012), Canada (Daly et al., 2001), Brazil (Rasella et al., 2013), Chile (Subramanian et al., 2003), China (Pei and Rodriguez, 2006), Ecuador (Larrea and Kawachi, 2005), India (Rajan et al., 2013), Italy (De Vogli et al., 2005), Japan (Kondo et al., 2008), and Russia (Walberg et al., 1998)." [emphasis added] on page 319 (PDF page 4)? And (4) regarding [4] do you believe any of your deletions are justified in light of this evidence? EllenCT (talk) 12:22, 19 June 2016 (UTC)

- 1) What do you mean by "best"? Best in the world or best currently in the article or what? 2) I think that the source is not relevant to this topic. "Economic growth" is mentioned only once in that source and in a passing manner. So your question is essentially irrelevant. Do you think this is a reliable source? Does it matter? 3) Again, most of that is irrelevant and the only part that mentions economic growth does so in passing and is the only instance in that article where economic growth is referenced. 4) Your phrasing "in light of this evidence" betrays the fact that you've already answered your own questions for yourself in your mind and are only asking them here as rhetorical questions - you're not really interested in answers or discussion. There is no "evidence" (and btw, this isn't a courtroom so you can drop the lawyer-speak). Furthermore, WHAT. IN. THE. FREAKIN'. WORLD. does this edit which you keep bringing up have to do with the article you're linking to here (for reference [5]). Neither that edit nor the version it corrects mention the Picket and Wilson article. Neither that edit nor the version it corrects mention the Biggs article. I simply have no idea how my edit and your statement, this "evidence" are IN ANY WAY connected. Basically I cannot respond to a nonsensical statement.Volunteer Marek (talk) 06:34, 20 June 2016 (UTC)

- (1) In your opinion, which are the most reliable sources on the relationship between income inequality and economic growth? (2) Please answer the question. Why do you think the source is not relevant? (3) how many sources pertaining to studies of the relationship between economic growth and income inequality does the MEDRS-grade literature review "mention in passing"? I count 11. (4) you have removed that MEDRS-class review three times, and seem determine to prevent the boldfaced passage from being summarized here. Why? EllenCT (talk) 15:04, 20 June 2016 (UTC)

- (1) Published scholarly work. (2) Because it is not about the topic. The source is about economic inequality and health. This article is about economic growth. Growth is not mentioned in the source. All of this is obvious and the fact you're even demanding answers to such questions is telling. (3) You need to count again. In fact, I don't see a single one. Can you list these "11"? (4) Because, again, it's not relevant to this article and in your edit you blatantly misrepresent the source to pretend it says something which it doesn't say.

- Now that I've humored you, please answer my question: why are you claiming that a source says something which it obviously doesn't say? Do you think it's okay to misrepresent sources to push a POV? Which Wikipedia policy supports editors just making stuff up and then tacking irrelevant sources on at the end to pretend that their claims are actually sourced? Volunteer Marek (talk) 16:00, 20 June 2016 (UTC)

- (1) In your opinion, which are the most reliable sources on the relationship between income inequality and economic growth? (2) Please answer the question. Why do you think the source is not relevant? (3) how many sources pertaining to studies of the relationship between economic growth and income inequality does the MEDRS-grade literature review "mention in passing"? I count 11. (4) you have removed that MEDRS-class review three times, and seem determine to prevent the boldfaced passage from being summarized here. Why? EllenCT (talk) 15:04, 20 June 2016 (UTC)

- 1) What do you mean by "best"? Best in the world or best currently in the article or what? 2) I think that the source is not relevant to this topic. "Economic growth" is mentioned only once in that source and in a passing manner. So your question is essentially irrelevant. Do you think this is a reliable source? Does it matter? 3) Again, most of that is irrelevant and the only part that mentions economic growth does so in passing and is the only instance in that article where economic growth is referenced. 4) Your phrasing "in light of this evidence" betrays the fact that you've already answered your own questions for yourself in your mind and are only asking them here as rhetorical questions - you're not really interested in answers or discussion. There is no "evidence" (and btw, this isn't a courtroom so you can drop the lawyer-speak). Furthermore, WHAT. IN. THE. FREAKIN'. WORLD. does this edit which you keep bringing up have to do with the article you're linking to here (for reference [5]). Neither that edit nor the version it corrects mention the Picket and Wilson article. Neither that edit nor the version it corrects mention the Biggs article. I simply have no idea how my edit and your statement, this "evidence" are IN ANY WAY connected. Basically I cannot respond to a nonsensical statement.Volunteer Marek (talk) 06:34, 20 June 2016 (UTC)

- @Volunteer Marek: I am trying to follow the instructions at RSN so I have questions about where we agree and disagree. (1) What do you think are the best WP:MEDRS-class or better sources on the relationship between economic inequality and growth? (2) Do you agree that [3] is a peer reviewed MEDRS-class literature review published in an academic journal? (3) Do you agree with that literature review's characterization that "Biggs and colleagues studied 22 Latin American countries from 1960 to 2007 and found a substantial relationship between income inequality, life expectancy, infant mortality and tuberculosis mortality rates; they also reported that when inequality was rising, economic growth was related to only a modest improvement in health, whereas during periods of decreasing inequality, there was a very strong effect of rising Gross Domestic Product (Biggs et al., 2013). Other studies have shown an association between income inequality and health across states/regions within nations, including, for example, in Argentina (De Maio et al., 2012), Canada (Daly et al., 2001), Brazil (Rasella et al., 2013), Chile (Subramanian et al., 2003), China (Pei and Rodriguez, 2006), Ecuador (Larrea and Kawachi, 2005), India (Rajan et al., 2013), Italy (De Vogli et al., 2005), Japan (Kondo et al., 2008), and Russia (Walberg et al., 1998)." [emphasis added] on page 319 (PDF page 4)? And (4) regarding [4] do you believe any of your deletions are justified in light of this evidence? EllenCT (talk) 12:22, 19 June 2016 (UTC)

RFC on relation of inequality to growth

The following discussion is closed. Please do not modify it. Subsequent comments should be made on the appropriate discussion page. No further edits should be made to this discussion.

Which of these two revisions is better supported by reliable sources? EllenCT (talk) 17:49, 20 June 2016 (UTC)

- I don't think that's going to be very helpful to people looking at this RfC.Volunteer Marek (talk) 18:07, 20 June 2016 (UTC)

- The diff is the standard comparison view on the projects. Please feel free to provide any comments you feel may be helpful. EllenCT (talk) 18:18, 20 June 2016 (UTC)

- EllenCT, this RfC is entitled: "RFC on relation of inequality to growth". OK. So, what it is about the relation of inequality to growth? No one denies that some relation exists. Do you have any section above where this matter has been explained and discussed? Could you please make a link to that section? My very best wishes (talk) 18:25, 20 June 2016 (UTC)

- All of the peer reviewed literature reviews which reach a conclusion on the question say that inequality inhibits growth, and greater income equality stimulates growth through agregate demand. Here is a discussion of some of them. There is at least one secondary source which does not reach a conclusion on the question. The most pertinent discussion here on this talk page are the several paragraphs prior and following the #Section break above. EllenCT (talk) 20:22, 20 June 2016 (UTC)

- No, it does not help at all. This is probably the most ridiculous RfC I have seen in the project. How anyone previously uninvolved suppose to study around 30 publications on each side? Besides, the question is irrelevant. The actual question is apparently: "which version is better?" It well can be that a version referenced to 5 sources is actually much better than version referenced to 20 sources. My very best wishes (talk) 18:52, 21 June 2016 (UTC)

- All of the peer reviewed literature reviews which reach a conclusion on the question say that inequality inhibits growth, and greater income equality stimulates growth through agregate demand. Here is a discussion of some of them. There is at least one secondary source which does not reach a conclusion on the question. The most pertinent discussion here on this talk page are the several paragraphs prior and following the #Section break above. EllenCT (talk) 20:22, 20 June 2016 (UTC)

- EllenCT, this RfC is entitled: "RFC on relation of inequality to growth". OK. So, what it is about the relation of inequality to growth? No one denies that some relation exists. Do you have any section above where this matter has been explained and discussed? Could you please make a link to that section? My very best wishes (talk) 18:25, 20 June 2016 (UTC)

- The diff is the standard comparison view on the projects. Please feel free to provide any comments you feel may be helpful. EllenCT (talk) 18:18, 20 June 2016 (UTC)

- Comment This RfC is not formed well - it looks like it was thrown up just to get an RfC open. There is not enough information in the RfC statement to allow uninvolved editors enough information to give an informed opinion without wading through walls of crap. JbhTalk 20:26, 20 June 2016 (UTC)

- The rules specifically require a terse, neutral question, and when two parties are in a dispute and the locus of the dispute can not be agreed as I attempted at #Inequality above, then asking for a comparison of two versions is established practice. EllenCT (talk) 20:38, 20 June 2016 (UTC)

- Then please at least write out the two options with their sources so participants are not forced to pick them out of diffs and can refer to the wording in discussion. As it is it just looks shoddy and careless and will definitly decrease participation since the relavent issues are not actually on the page. JbhTalk 21:08, 20 June 2016 (UTC)

- The rules specifically require a terse, neutral question, and when two parties are in a dispute and the locus of the dispute can not be agreed as I attempted at #Inequality above, then asking for a comparison of two versions is established practice. EllenCT (talk) 20:38, 20 June 2016 (UTC)

- The version of 19 June is better supported. Just to the RFC as asked, the cites tied to inequality are less than zero value for support to the text shown -- if anything it tends to incline one the other way, that there is no such tie. The cite of Social Science & Medicine indicating economic growth is incorrect - the article is not describing an effect on GDP growth, the article is referring to health effects independent of GDP growth. The cite to Temple makes a causal statement that I did not find in the text at all -- I see mentions that consideration of stability exist but no conclusion nor any mention there that ties stability to inequality. The cite to Clark is a dead weblink, and the quote from WorldBank it is tied to says 'relationship between inequality and growth is relatively small' anyway. The Quintana study seems not a direct support, it seems more focused to unemployment as causing inequality, and mentions effects on GDP as coming from unemployment. ... That's as far as I went. Markbassett (talk) 00:21, 21 June 2016 (UTC)

- If you're referring to the Clarke source above, then that is, if I'm not mistaken, a working paper, so not even peer reviewed.Volunteer Marek (talk) 00:47, 21 June 2016 (UTC)

In addition to the misrepresenting sources in the June 20 version is the fact that the Inequality section interrupts the determinants section. The determinants are from Bjork (1999) where he explains the calculation of growth according to national income accounting and inequality is not a factor in the calculation. Because of the fundamental importance of the explanation of what determines economic growth the full, uninterrupted explanation should follow the lede section. I have yet to see a reference that says income inequality is significant enough to merit more than a couple of paragraphs in additional causes section. In fact EllenCT's own sources specifically state that the effect of income inequality on growth is "relatively small".Phmoreno (talk) 16:47, 21 June 2016 (UTC)

The article also needs to discuss the role of aging population on growth. Japanese stagnation and aging population have been discussed in the literature, but the other developed countries are facing a "demographic waterfall". Oil consumption-Scroll down for demographic chartsPhmoreno (talk) 17:11, 21 June 2016 (UTC)

- I think that's a separate issue.Volunteer Marek (talk) 18:53, 21 June 2016 (UTC)

Dr. Robertson's comment on this article

Dr. Robertson has reviewed growth&oldid=727588253 this Wikipedia page, and provided us with the following comments to improve its quality:

{original}

Before industrialization, technological progress resulted in an increase in population, which was kept in check by food supply and other resources, which acted to limit per capita income, a condition known as the Malthusian trap.[13][14] The rapid economic growth that occurred during the Industrial Revolution was remarkable because it was in excess of population growth, providing an escape from the Malthusian trap.[15] Countries that industrialized eventually saw their population growth slow down, a phenomenon known as the demographic transition.

{suggested correction} Before industrialization per capita income growth rates were much lower than in the modern era. A widely held view is that this is because technological progress resulted in an increase in population, which was kept in check by food supply and other resources, which acted to limit per capita income, a condition known as the Malthusian trap.[13][14] The rapid economic growth that occurred during the Industrial Revolution was remarkable because it was in excess of population growth, providing an escape from the Malthusian trap.[15] Countries that industrialized eventually saw their population growth slow down, a phenomenon known as the demographic transition. Nevertheless the relevance of the Malthusian equilibrium as an explanation for stagnation is debated in the literature [Mokyr and Voth 2010].

Mokyr, Joel, and Hans-Joachim Voth. "Understanding growth in Europe, 1700-1870: theory and evidence." in Stephen Broadberry, Kevin H. O'Rourke (eds) The Cambridge Economic History of Modern Europe 1 (2010): 7-42.

Comment It would be useful to add a section on: The East Asian Miracle; China's economic Miracle;The Lewis Model and urban rural migration

We hope Wikipedians on this talk page can take advantage of these comments and improve the quality of the article accordingly.

We believe Dr. Robertson has expertise on the topic of this article, since he has published relevant scholarly research:

- Reference 1: Peter E Robertson & Jessica Y Xu, 2010. "In China's Wake: Has Asia Gained From China's Growth?," Economics Discussion / Working Papers 10-15, The University of Western Australia, Department of Economics.

- Reference 2: John Landon-Lane & Peter Robertson, 2005. "Barriers to Accumulation and Productivity Differences in a Two Sector Growth Model," Departmental Working Papers 200510, Rutgers University, Department of Economics.

- Reference 3: Clemens Breisinger & Olivier Ecker & Perrihan Al-Riffai & Richard Robertson & Rainer Thiele, 2011. "Climate Change, Agricultural Production and Food Security: Evidence from Yemen," Kiel Working Papers 1747, Kiel Institute for the World Economy.

ExpertIdeasBot (talk) 20:36, 1 July 2016 (UTC)

Dr. Breton's comment on this article

Dr. Breton has reviewed growth&oldid=727588253 this Wikipedia page, and provided us with the following comments to improve its quality:

I have edited the article in Wikipedia, improving or correcting the explanations and grammar and adding a few citations. You can see my changes on 6-28-16. I thought this would be more efficient than submitting all these changes as comments.

We hope Wikipedians on this talk page can take advantage of these comments and improve the quality of the article accordingly.

We believe Dr. Breton has expertise on the topic of this article, since he has published relevant scholarly research:

- Reference : Theodore R. Breton, 2015. "Changes in the Effect of Capital and TFP on Output in Penn World Tables 7 and 8: Improvement or Error?," DOCUMENTOS DE TRABAJO CIEF 012454, UNIVERSIDAD EAFIT.

ExpertIdeasBot (talk) 15:20, 11 July 2016 (UTC)

Larger share of government lowers growth

http://www.ifn.se/wfiles/wp/wp858.pdf

there is a “significant negative correlation” between the size of government and economic

growth. Specifically, “an increase in government size by 10 percentage points is associated with a 0.5% to 1% lower annual growth rate.” This suggests that if spending increases, the government expenditure

multiplier will become more negative over time...

The outer quote is from [6]

The inner quote is from a journal article: Andreas Bergh and Magnus Henrekson, The Journal of Economic Surveys (2011) Phmoreno (talk) 01:06, 14 July 2016 (UTC)

- This strikes me as nonsense. I think that for such a categorical claim there should be an unimpeachable author published in a first-tier international journal. SPECIFICO talk 02:16, 14 July 2016 (UTC)

- Out of context, there is no differentiation between a government that grows its customs, tarrif, and border security apparatus, and a government which grows its public domain research spending. Or government spending growth on prisons and speed traps vs. education and healthcare. Or on finance industry regulation to protect consumers and citizens versus the growth of captured regulations to entrench and enrich banks and bankers. 75.171.242.124 (talk) 18:18, 14 July 2016 (UTC)

Sources

These are some sources I dug up last year which may be of some use. I did not see them when I glanced through the References section so they may bring something new to the table. The first book in particular has a very good literature review as its first chapter. I have linked the WorldCat listings for the books and I believe I still have PDFs of all of the material if anyone wants extracts.

- Grossmann, Volker (2001). Inequality, Economic Growth, and Technological Change. Berlin Heidelberg: Springer-Verlag. pp. 7–56. ISBN 978-3-7908-1364-7.

- Cornia, Giovanni Andrea - Editor (2004). Inequality, Growth, and Poverty in an Era of Liberalization and Globalization. New York: Oxford University Press. ISBN 9780199271412.

{{cite book}}:|author=has generic name (help) - Philippe Aghion; Eve Caroli; Cecilia García-Peñalosa (December 1999). "Inequality and Economic Growth: The Perspective of the New Growth Theories" (PDF). Journal of Economic Literature. 37 (4): 1615–1660.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - Davis, John B and Dolfsma, Wilfred Dolfsma - Ed. (2008). The Elgar Companion to Social Economics. Cheltenham UK: Edward Elgar Publishing Limited. pp. 209–248. ISBN 9781845422806.

{{cite book}}: CS1 maint: multiple names: authors list (link) - Welch, Finis (1999). "In Defense of Inequality". American Economic Review. 89 (2): 1–17. doi:10.1257/aer.89.2.1.

JbhTalk 16:48, 22 June 2016 (UTC)

- Do you think those are representative? I tried Google Scholar looking for meta-analyses, and the first hit says, "the effect of inequality on growth is negative," in Neves et al, "A Meta-Analytic Reassessment of the Effects of Inequality on Growth" (2016.) TKuznetsov (talk) 21:58, 25 June 2016 (UTC)

- I hope it wasn't deliberate, but that's a cherry-picked quote, which has a different meaning in context.

- The full sentence:

- After correcting for these two forms of publication bias, we conclude that the high degree of heterogeneity of the reported effect sizes is explained by study conditions, namely the structure of the data, the type of countries included in the sample, the inclusion of regional dummies, the concept of inequality and the definition of income. In particular, our meta-regression analysis suggests that: cross-section studies systematically report a stronger negative impact than panel data studies; the effect of inequality on growth is negative and more pronounced in less developed countries than in rich countries; the inclusion of regional dummies in the growth regression of the primary studies considerably weakens such effect; expenditure and gross income inequality tend to lead to different estimates of the effect size; land and human inequality are more pernicious to subsequent growth than income inequality is.

- The study doesn't make an absolute conclusion that the impact of inequality on growth is negative. (As an important aside, that type of statement is meaningless, if you think about it.) The long sentence makes a statement about the relative impact of inequality in less developed countries compared to rich countries. It also goes on to to conclude that income inequality is less important than other factors such as land and human inequality.--S Philbrick(Talk) 21:41, 1 July 2016 (UTC)

- I believe you are mistaken. Does "Wealth inequality is more pernicious to growth than income inequality" not mean that both are pernicious to growth? Does "Inequality exerts a stronger negative impact on growth in developing countries" not mean that it also exerts a negative impact in developed countries? The full text of a preprint is at [7]. Why do you say such statements are meaningless? TKuznetsov (talk) 16:19, 4 July 2016 (UTC)

- The reason I said it is meaningless is that it is not sensible to talk simplistically about the impact of inequality on growth. Even ignoring the interactions with other variables, the interaction of inequality with growth is not a linear function. At complete equality, a situation probably not possible, the economy would grind to a halt so negative growth would occur. At higher levels of inequality, growth would be possible. Then there would be a maximum, a level of inequality consistent with the highest possible growth, and then it may be the case that further increases in inequality, all other things being equal) would result in decreased growth. However, this simplistic explanation has two real issues - we don't know where we are on the curve, although my guess is that we are beyond the maximum, and all other things are decidedly not equal. It is easy to imagine societal forces that increase inequality and increase growth. It is easy to imagine societal forces that increase inequality and decrease growth. Big data approaches which simply and mindlessly do linear regression of inequality and growth miss what is really going on. The paper you cited is a step in the right direction - identifying that land and human inequality are more important factors.--S Philbrick(Talk) 15:45, 11 July 2016 (UTC)

- I believe you are mistaken. Does "Wealth inequality is more pernicious to growth than income inequality" not mean that both are pernicious to growth? Does "Inequality exerts a stronger negative impact on growth in developing countries" not mean that it also exerts a negative impact in developed countries? The full text of a preprint is at [7]. Why do you say such statements are meaningless? TKuznetsov (talk) 16:19, 4 July 2016 (UTC)

- "At complete equality ... the economy would grind to a halt...."

- If we have the same net worth and the same income, we can still trade. If you have zero net worth, you can only trade labor at the discount wages offered by an employer who is willing to feed you for work in advance. 75.171.242.124 (talk) 18:26, 14 July 2016 (UTC)

Dr. Crespo Cuaresma's comment on this article

Dr. Crespo Cuaresma has reviewed this Wikipedia page, and provided us with the following comments to improve its quality:

The discussion is (necessarily) superficial, given the breadth of the subject. The differentiation between "Determinants of per capita GDP growth" and "Other factors affecting growth" is extremely confusing and misleading, in particular due to the fact that capital is included under "other factors".

We hope Wikipedians on this talk page can take advantage of these comments and improve the quality of the article accordingly.

We believe Dr. Crespo Cuaresma has expertise on the topic of this article, since he has published relevant scholarly research:

- Reference : Jesus Crespo Cuaresma & Martin Labaj & Patrik Pruzinsky, 2014. "Prospective Ageing and Economic Growth in Europe," Department of Economics Working Papers wuwp165, Vienna University of Economics and Business, Department of Economics.

ExpertIdeasBot (talk) 22:42, 24 September 2016 (UTC)

External links modified

Hello fellow Wikipedians,

I have just modified one external link on Economic growth. Please take a moment to review my edit. If you have any questions, or need the bot to ignore the links, or the page altogether, please visit this simple FaQ for additional information. I made the following changes:

- Added archive http://www.webcitation.org/5Xu64dbNz?url=http://www.wired.com/wired/archive/5.02/ffsimon_pr.html to http://www.wired.com/wired/archive/5.02/ffsimon_pr.html

When you have finished reviewing my changes, please set the checked parameter below to true or failed to let others know (documentation at {{Sourcecheck}}).

This message was posted before February 2018. After February 2018, "External links modified" talk page sections are no longer generated or monitored by InternetArchiveBot. No special action is required regarding these talk page notices, other than regular verification using the archive tool instructions below. Editors have permission to delete these "External links modified" talk page sections if they want to de-clutter talk pages, but see the RfC before doing mass systematic removals. This message is updated dynamically through the template {{source check}} (last update: 5 June 2024).

- If you have discovered URLs which were erroneously considered dead by the bot, you can report them with this tool.

- If you found an error with any archives or the URLs themselves, you can fix them with this tool.

Cheers.—InternetArchiveBot (Report bug) 17:21, 19 December 2016 (UTC)

Dr. Tarp's comment on this article

Dr. Tarp has reviewed this Wikipedia page, and provided us with the following comments to improve its quality:

This is a sensible overview. My own assessment of the literature is that the evidence for the negative growth impact of inequality is far more convincing than often assumed.

We hope Wikipedians on this talk page can take advantage of these comments and improve the quality of the article accordingly.

We believe Dr. Tarp has expertise on the topic of this article, since he has published relevant scholarly research:

- Reference : Arndt, Channing & Jones, Sam & Tarp, Finn, 2013. "Assessing Foreign Aid.s Long-Run Contribution to Growth in Development," Working Paper Series UNU-WIDER Research Paper , World Institute for Development Economic Research (UNU-WIDER).

ExpertIdeasBot (talk) 11:33, 22 December 2016 (UTC)

Reverting a deletion by an IP number

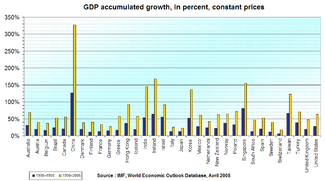

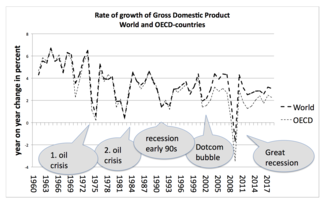

IP number 109.97.73.128, not signed in as a regular Wikipedian, just deleted the following two plots from this article:

I'm reverting those deletions, because those plots seem to belong here. I think they are both quite interesting and communicate very effectively information that is relevant to this article.

Anyone who thinks those plots should be deleted should first initiate a discussion here on why those plots should NOT be part of this article. DavidMCEddy (talk) 19:24, 25 December 2016 (UTC)

- At 2016-12-25T21:58:58, IP number 109.97.70.161 made the same deletion as reported above without providing any rationale. I will look for an administrator and request semi-protection for this article. This will force whoever is edit this page to either quit or identify themselves. That should further help in getting them to explain why they are doing this. And I will revert this edit as I did the previous one unless someone else beats me to it. DavidMCEddy (talk) 00:51, 26 December 2016 (UTC)

Drain the swamp

This article is chock full of OR, UNDUE, and SYNTH that does little to convey mainstream thinking about this topic. We should begin by paring all the off-center theories and viewpoints stated in WP's voice. SPECIFICO talk 21:57, 15 February 2018 (UTC)

Position of theories in article

Theories belong after causes, which is the section Other factors affecting growth. The models use these or they are considered exogenous. Causes are well covered in the literature. I know people were awarded Nobel prizes for models, but that does not make them particularly useful at explaining or predicting anything, in part because of the exogenous factors. One critic said for models to be useful they have to incorporate a minimum number of factors, but that makes them less accurate. Also, most factors are not quantifiable, such as capitalism, national intelligence and new products. There are several criticisms of mathematizing economics as taking a wrong turn.Phmoreno (talk) 13:46, 27 December 2018 (UTC)

The long standing arrangement was to have "Growth theories and models" as section #4, but suddenly on December 26 you decided to put them at the end of the page, after someone else had moved the section. If you want to keep them after the cause, it's fine. But then, in order to be consistent, you should bring theories as section #4. — Preceding unsigned comment added by VDB 1999 (talk • contribs) 19:05, 28 December 2018 (UTC)

- Theories going in Section 4 is acceptable. I only moved them because the were moved to the middle of the article flow.Phmoreno (talk) 21:30, 28 December 2018 (UTC)

Innovation vs. productivity

Doesn't innovation cause increases in productivity, and not the other way around? I don't see why this article puts productivity on a pedestal and only mentions innovation in passing when productivity is strictly dependent on its causes. Nobody ever invents productivity increases, they invent goods, services, and methods which cause productivity to increase. It's like if an article on health explained that increased health is because of lengthening lifespans. 73.222.1.26 (talk) 02:47, 2 January 2019 (UTC)

- Innovation is about change, usually about new methods of making things, improving products or introducing new products and services. Improving productivity is about lowering labor or capital used in production, although some measures also include using less energy and materials. If new or improved products do not reduce labor and capital they do not boost productivity unless they somehow add to output. Usually the effect of new products is indirect in that because of increases in productivity total output would have contracted if it were not for new products.Phmoreno (talk) 22:37, 2 January 2019 (UTC)

- Are the changes in productivity you are talking about not legitimately innovations? 73.222.1.26 (talk) 23:20, 2 January 2019 (UTC)

- All increases in productivity are the result of innovations, but not all innovations improve productivity.Phmoreno (talk) 00:12, 3 January 2019 (UTC)

- Are the changes in productivity you are talking about not legitimately innovations? 73.222.1.26 (talk) 23:20, 2 January 2019 (UTC)

It is widely recognised that Four Tigers are Singapore, Taiwan, Hong Kong and South Korea.

Wiki Friends, new comer is here. I would appreciate your advices.

I recently read this article about Economic growth. Main part of the article is about the growth models provided by the fore-running great economists which I really enjoyed reading. Before the elaboration of the models, the article provides brief history of the worldwide economic development. I was amazed about the statement that the “Four Tigers” are Japan, China, Singapore and South Korea. And a few days later it was revised to China, Singapore, South Korea and Indian subcontinent, and then, the current edition as excerpted in following paragraph.

Economic growth in the United States slowed down after 1973.[33] In contrast growth in Asia has been strong since then, starting with Japan and spreading to Four Asian Tigers, China, Southeast Asia, the Indian subcontinent and Asia Pacific.[34][35] In 1957 South Korea had a lower per capita GDP than Ghana,[36] and by 2008 it was 17 times as high as Ghana's.[37] The Japanese economic growth has slackened considerably since the late 1980s.

It is well known that the “Four Tigers” are Singapore, Taiwan, Hong Kong and South Korea. This is not a strict academic issue, rather a loosely used term to describe the history of the economic development. Back to 1970’s, Singapore and Hong Kong were successful in changing themselves as regional financial and management centers and Taiwan and S. Korea were developing “manufacturing” to grow the export to earn and build foreign exchange. The article makes a lot of sense to describe the history of the worldwide economic growth track. It is not that I don’t admire China’s great achievement in rapid economic growth in recent 20 years, but back to 1973, the strides have not yet begun.

Also the reference number 33 & 34 are totally irrelevant. I am unable to trace what is the original and suggest putting in the reference of Olivier Blanchard’s Macroeconomics, page 236, 6th edition, which states what Four Tigers are. Blanchard has been teaching in Harvard and MIT and worked for government and organizations, including World Bank, IMF and OCED.

I would appreciate any input. — Preceding unsigned comment added by Raymond TM Lee (talk • contribs) 08:16, 8 May 2020 (UTC)

- Maybe your comments are better targeted at the talk page for the Four Asian Tigers page. Or make the changes yourself. Sanpitch (talk) 02:37, 27 September 2021 (UTC)

Purchasing Power Parity (PPP)?

Are the numbers in this article PPP or just nominal adjusted for inflation without adjusting for cost of living?

I read, "Real GDP is measured in 2008 dollars" in [6]:

- Mankiw, Gregory (2011). Principles of Macroeconomics (6th ed.). p. 236. ISBN 978-0538453066.

Am I to assume it's PPP? I also cannot find the source in that source: It says, "World Development Report 2010, Table 1", but I cannot find that reference. I found something that claimed to be that, but I could not find the numbers in that report that appear in this table.

Thanks, DavidMCEddy (talk) 14:41, 8 November 2021 (UTC)

Wiki Education Foundation-supported course assignment

![]() This article was the subject of a Wiki Education Foundation-supported course assignment, between 28 August 2018 and 22 December 2018. Further details are available on the course page. Peer reviewers: Edwardv96.

This article was the subject of a Wiki Education Foundation-supported course assignment, between 28 August 2018 and 22 December 2018. Further details are available on the course page. Peer reviewers: Edwardv96.

Above undated message substituted from Template:Dashboard.wikiedu.org assignment by PrimeBOT (talk) 20:04, 16 January 2022 (UTC)

Geography

The impact of berg wind on human, economy and environment 41.114.96.196 (talk) 21:29, 4 February 2022 (UTC)

{{Cite book ... vs. Cite Q

@Trappist the monk: Why do you replace a use of {{Cite Q with a poor incomplete {{Cite book citation?

Are you familiar with Template:Cite Q?

Are you aware that the link to the Wikidata entry for that book includes a link to the Wikipedia article on that book as well as substantial additional information on the book including a link to an electronic copy of it available for check out anywhere in the world from the Internet Archive?

The book is by an economist Robert J. Gordon, who is different from an attorney named Robert J. Gordon, Wikidata Q16224376.

AND any additions or corrections to a citation in Wikidata are instantly available to every reference to that Wikidata item. If, for example, a new edition of that book becomes available, the connection can be made in Wikidata and it will become immediately available to all references to that Wikidata item.

??? Thanks, DavidMCEddy (talk) 01:04, 7 April 2022 (UTC)

| unnamed refs | 129 | ||

|---|---|---|---|

| named refs | 48 | ||

| self closed | 37 | ||

| cs1 refs | 161 | ||

| cs1 templates | 162 | ||

| cs1-like refs | 4 | ||

| cs1-like templates | 4 | ||

| harv refs | 1 | ||

| harv templates | 1 | ||

| sfn templates | 14 | ||

| rp templates | 2 | ||

| cleanup templates | 7 | ||

| webarchive templates | 9 | ||

| use xxx dates | dmy [ly] | ||

| cs1|2 dmy dates | 5 | ||

| cs1|2 mdy dates | 8 | ||

| cs1|2 ymd dates | 9 | ||

| cs1|2 dmy access dates | 7 | ||

| cs1|2 mdy access dates | 5 | ||

| cs1|2 ymd access dates | 18 | ||

| cs1|2 dmy archive dates | 1 | ||

| cs1|2 ymd archive dates | 15 | ||

| cs1|2 last/first | 149 | ||

| cs1|2 author | 3 | ||

| |||

| |||

| |||

| |||

| explanations | |||

- Of course I know about

{{cite q}}; I wrote the initial version of Module:Cite Q on which the template depends. But, that does not mean that I think that{{cite q}}is ready-for-prime-time. It is not and may never be until en.wiki editors form a consensus that accepts wikidata as a reliable repository and solves some very basic WP:CITEVAR-related issues (author names split into|last<n>=/|first<n>=but{{cite q}}uses|author<n>=for example, because that is how wikidata represents author names). At present, the consensus is against wikidata. - I published my edit at 00:27, 7 April 2022. At 00:53, 7 April 2022, 26 minutes after my edit, you added the Robert J. Gordon author claim to The Rise and Fall of American Growth (Q97627911) with further additions in the minutes following. Because the wikidata were incomplete, of course, the translation that I made from Q97627911 to a readable citation was incomplete. But, at least the citation was readable which, for me is most important. Most editors, myself included, won't bother with wikidata no matter what advantages may exist in using

{{cite q}}. And readers, almost certainly, will not follow the wikidata link to see that the book is available at internet archive; if anything they will follow the title link to our article about the book where there is mostly nothing more than would be found on the publisher's website; it would be better to write that citation as a{{cite book}}and include|url=https://archive.org/details/risefallofameric0000gord. - WP:SAYWHEREYOUGOTIT applies. If Gordon's first edition stated something and that something were cited from that edition and then a second edition comes out that doesn't state that same something, someone changing the wikidata to point to the second edition all-of-a-sudden breaks the article-source integrity.

- Of the six

{{cite q}}templates, two show error messages:{{cite Q|Q97627911}}→- Robert J. Gordon (2016), The Rise and Fall of American Growth, Wikidata Q97627911

'"`UNIQ--syntaxhighlight-00000025-QINU`"'

- Robert J. Gordon (2016), The Rise and Fall of American Growth, Wikidata Q97627911

{{cite Q|Q111450202}}→- François Bourguignon (2003). "Growth Elasticity of Poverty Reduction: Explaining Heterogeneity across Countries and Time Periods". Inequality and Growth: Theory and policy implications: 3–26. Wikidata Q111450202.

{{cite journal}}:|chapter=ignored (help)'"`UNIQ--syntaxhighlight-00000029-QINU`"'

- François Bourguignon (2003). "Growth Elasticity of Poverty Reduction: Explaining Heterogeneity across Countries and Time Periods". Inequality and Growth: Theory and policy implications: 3–26. Wikidata Q111450202.

- this one is a conference paper so

{{cite journal}}is inappropriate{{cite Q|Q111455533}}→- Dale W. Jorgenson; Mun S. Ho; Jon D. Samuels (12 May 2014). "Long-term Estimates of U.S. Productivity and Growth" (PDF). World KLEMS Conference. Wikidata Q111455533.

'"`UNIQ--syntaxhighlight-0000002D-QINU`"'

- Dale W. Jorgenson; Mun S. Ho; Jon D. Samuels (12 May 2014). "Long-term Estimates of U.S. Productivity and Growth" (PDF). World KLEMS Conference. Wikidata Q111455533.

- this violates WP:CITEVAR by using

{{citation}}instead of{{cite book}}; this one also seems to be a self-published source and the title at wikidata does not match the title at the linked source:- Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer – deanbaker.net

- Rigged: How globalization and the rules to the modern economy were structured to make the rich richer – wikidata

{{cite Q|Q100216001}}→- Dean Baker (2016), Rigged: How globalization and the rules to the modern economy were structured to make the rich richer, Center for Economic and Policy Research, Wikidata Q100216001

'"`UNIQ--syntaxhighlight-00000031-QINU`"'

- Dean Baker (2016), Rigged: How globalization and the rules to the modern economy were structured to make the rich richer, Center for Economic and Policy Research, Wikidata Q100216001

- this one also violates WP:CITEVAR by using

{{citation}}instead of{{cite book}}{{cite Q|Q111450348}}→- Allan Schnaiberg (1980), The environment, from surplus to scarcity, Oxford University Press, Wikidata Q111450348

'"`UNIQ--syntaxhighlight-00000035-QINU`"'

- Allan Schnaiberg (1980), The environment, from surplus to scarcity, Oxford University Press, Wikidata Q111450348

- so in the end, of the six, this is the only one that is a proper citation:

{{cite Q|Q56032205}}→- Manfred Max-Neef (November 1995). "Economic growth and quality of life: a threshold hypothesis". Ecological Economics. 15 (2): 115–118. CiteSeerX 10.1.1.321.4576. doi:10.1016/0921-8009(95)00064-X. ISSN 0921-8009. Wikidata Q56032205.

'"`UNIQ--syntaxhighlight-00000039-QINU`"'

- Manfred Max-Neef (November 1995). "Economic growth and quality of life: a threshold hypothesis". Ecological Economics. 15 (2): 115–118. CiteSeerX 10.1.1.321.4576. doi:10.1016/0921-8009(95)00064-X. ISSN 0921-8009. Wikidata Q56032205.

{{cite q}}is not ready for primetime.- —Trappist the monk (talk) 14:18, 7 April 2022 (UTC)

Effects of income inequality in the US

@SPECIFICO: You reverted my recent insertion pertaining to the effect of inequality on growth and recovery time in the US. Why do you believe it is WP:UNDUE? I note that you did not reply to my statement two weeks ago at Talk:Economics that I intended to add it here. Dan Ratan (talk) 12:19, 11 June 2022 (UTC)

- I don't (yet, if ever) have an opinion about the content, but I almost reverted it just because it was stuck randomly under a top subheading in a section with more than one sub-sub-subsection. Besides content, if it comes back, please work to place it smoothly with the rest of the presentation. NewsAndEventsGuy (talk) 12:32, 11 June 2022 (UTC)