Big Oil

| Company | Revenue (USD)[3] | Profit (USD) | Brands |

|---|---|---|---|

| ExxonMobil | $286 billion | $23 billion | Mobil Esso Imperial Oil |

| Shell plc | $273 billion | $20 billion | Jiffy Lube Pennzoil Z Energy |

| TotalEnergies | $185 billion | $16 billion | Elf Aquitaine SunPower |

| BP | $164 billion | $7.6 billion | Amoco Aral AG |

| Chevron | $163 billion | $16 billion | Texaco Caltex Havoline |

| Marathon | $141 billion | $10 billion | ARCO[4] |

| Phillips 66 | $115 billion | $1.3 billion | 76 Conoco JET |

| Valero | $108 billion | $0.9 billion | — |

| Eni | $77 billion | $5.8 billion | — |

| ConocoPhillips | $48.3 billion | $8.1 billion | — |

Big Oil is a name sometimes used to describe the world's six or seven largest publicly traded and investor-owned oil and gas companies, also known as supermajors.[5][6][7][8] The term, particularly in the United States, emphasizes their economic power and influence on politics. Big Oil is often associated with the fossil fuels lobby and also used to refer to the industry as a whole in a pejorative or derogatory manner.[9]

Sources conflict on the exact makeup of Big Oil today, though the companies which are most frequently mentioned as supermajors are ExxonMobil, Shell, TotalEnergies, BP, Chevron and Eni, with ConocoPhillips frequently being included as well prior to spinning off its downstream operations into Phillips 66. The phrase "Super-Major" emanated from a report published by Douglas Terreson of Morgan Stanley in February 1998. The report foretold a substantial consolidation phase of "Major" Oil companies which would result in a group of dominant "Super-Major" entities. [10][11][12][13] Big Oil previously referred to seven oil companies which formed the Consortium for Iran; such "Seven Sisters" were the Anglo-Persian Oil Company (a predecessor of BP), Shell plc, three of Chevron's predecessors (Standard Oil of California, Gulf Oil and Texaco), and two of ExxonMobil's predecessors (Jersey Standard and Standard Oil of New York).

The term, analogous to others such as Big Steel, Big Tech, and Big Pharma which describe industries dominated by a few giant corporations, was popularized in print from the late 1960s.[14][15] Today it is often used to refer specifically to the seven supermajors.[16] The use of the term in the popular media often excludes the national producers and OPEC oil companies who have a much greater global role in setting prices than the supermajors.[17][18][19] China's two state-owned oil companies, Sinopec and the China National Petroleum Corporation, as well as Saudi Aramco, had greater revenues in 2022 than any investor-owned oil company.[20]

In the maritime industry, six to seven large oil companies that decide a majority of the crude oil tanker chartering business are called "Oil Majors".[21]

History

[edit]As the Seven Sisters

[edit]The expression "Seven Sisters" was coined by the head of the Italian state oil company (Eni), Enrico Mattei,[22] who sought membership for his company, but was rejected.

The history of the supermajors traces back to the seven oil companies which formed the "Consortium for Iran" cartel and dominated the global petroleum industry from the mid-1940s to the 1970s.[23][24] The Seven Sisters were:

- Anglo-Persian Oil Company (BP)

- Gulf Oil (Chevron)

- Shell

- Standard Oil of California (Chevron)

- Standard Oil of New Jersey (Exxon, later ExxonMobil)

- Standard Oil of New York (Mobil, later ExxonMobil)

- Texaco (Chevron)

By the 1930s, the Seven Sisters dominated oil production in the world.[25] The companies owned nearly all rights to the oil in Iran, Iraq, Saudi Arabia, and the Persian Gulf.[25] The companies established jointly owned companies (such as the Iraq Petroleum Company) to legally tie their hands together, facilitate cooperation, and prevent cheating on one another.[25] The companies sought to limit the supply of oil by controlling the speed at which oil fields were developed. From the 1920s to 1940s, they had agreements not to produce oil in the Middle East unless it was in coordination with one another.[25] After the 1940s, the companies continued to collude.[25] The discovery of massive oil fields in Saudi Arabia threatened to scuttle the cartel, as control of the oil fields by two companies could undermine existing supply management schemes.[25] However, the Saudi oil production ultimately became jointly controlled by four of the seven sisters, thus making it easier to maintain coordination between the Seven Sisters.[25]

According to Jeff Colgan, the Seven Sisters faced two major problems. The first revolved around coordinating the activities of the companies so that oil prices would be kept high.[25] The second revolved around cooperation with the governments of the territories containing the oil reserves: the companies sought to minimize the taxes and royalties paid to the governments.[25] In terms of dealing with host governments, the Seven Sisters benefitted from the willingness of British and American governments to pressure and coerce the host governments.[25] The oil companies also slowed down production when taxes and royalties were increased by one host government while ramping up production in other territories with lower taxes and royalties, thus pressuring host governments to keep taxes and royalties low.[25]

Host governments faced a number of hurdles in terms of nationalizing the oil production. First, a number of oil-producing countries did not have independence and were controlled by empires. Second, great powers had installed compliant heads of state in several oil-producing countries, making those leaders reliant on the support of the great powers and unwilling to upset them. Third, a number of oil-producing countries lacked the capital and technical expertise to run the oil production, as well as needed access to North American and European markets. Fourth, oil-producing countries feared that they would be punished by Western governments and firms if they nationalized oil production (as Mohammad Mossadegh was when he nationalized the Iranian oil industry).[25]

In 1951, Iran nationalized its oil industry, previously controlled by the Anglo-Iranian Oil Company (now BP), and Iranian oil was subjected to an international embargo. In an effort to bring Iranian oil production back to international markets, the U.S. State Department suggested the creation of a consortium of major oil companies, several of which were daughter corporations of John D. Rockefeller's original Standard Oil monopoly.[26]

In 1959, the Seven Sisters reduced the price of oil for Venezuela and Middle Eastern producers, which provoked anger among oil-producing governments.[27] This prompted the oil-producing governments to take the initial steps to establish OPEC.[27] The Seven Sisters threatened the OPEC founders that they would lose market access if they went ahead with their plans.[27]

The head of the Italian state oil company (Eni), Enrico Mattei, sought membership for his company, but was rejected and since then spread the expression "Seven Sisters".[28][29] British writer Anthony Sampson took over the term when he wrote the book The Seven Sisters in 1975, to describe the oil cartel that tried its best to eliminate competitors and keep control of the world's oil resource.[30] The term for the oil cartel was further popularized, along with a fictional logo, in Mad Max 2: The Road Warrior, a 1981 post-apocalyptic dystopian action film about apocalyptic fuel shortages.[31]

Being politically influential, vertically integrated, well organized, and able to negotiate cohesively as a cartel, the Seven Sisters were initially able to exert considerable power over Third World oil producers.[28] Despite their market power, the Seven Sisters kept prices stable at moderate levels.[32] This was done to not incentivize governments in both the consumer and producer countries to impose regulations on the oil industry.[32]

1973 oil crisis

[edit]Preceding the 1973 oil crisis, the Seven Sisters controlled around 85 per cent of the world's petroleum reserves.[33] In the 1970s, many countries with large reserves nationalized holdings of all major oil companies. Since then, industry dominance has shifted to the OPEC cartel and state-owned oil and gas companies in emerging-market economies, such as Saudi Aramco, Gazprom (Russia), China National Petroleum Corporation, National Iranian Oil Company, PDVSA (Venezuela), Petrobras (Brazil), and Petronas (Malaysia). In 2007, the Financial Times called these "the new Seven Sisters".[34][35] According to consulting firm PFC Energy, by 2012 only 7% of the world's known oil reserves were in countries that allowed private international companies free rein. Fully 65% were in the hands of state-owned companies.[36][37][38]

"The Era of the Super-Major"

[edit]The Era of the Super Major was an industry report published by Douglas Terreson of Morgan Stanley on 13 February 1998. Mr. Terreson was the top-rated Integrated Oil analyst according to Institutional Investor magazine at the time and had a broad following within the global investment community. After many years of poor industry performance by the Energy sector. Mr. Terreson suggested that business models had become obsolete, and that major strategic change was needed across the global Energy sector for value propositions to become competitive with the other parts of the market.

The premise of the report was that "a confluence of industry dynamics would conspire to produce a strategic and financial environment that was conducive to major consolidation activity in the Integrated Oil sector. Significant modifications to the strategic landscape would result, dictating competitive placement and equity market performance for years to come". The report indicated that the phase would be driven by the competitive implications of: (1) the globalization of privatized national oil companies and (2) the rising stature of specialized multinationals. Combinations were expected primarily between Major Oils which would then become "Super-Majors" which was a phrase created at Morgan Stanley in the late 1990's to denote the prototype model for success in the Integrated Oil industry as gains in globalization and scale unfolded.

Within 6 months of publication of "The Era of the Super-Major", BP and Amoco merged, representing the largest industrial combination on Wall Street at that time. The combined value of the stocks of those 2 companies rose significantly and that merger was followed by ExxonMobil, BP-Amoco-Arco, ConocoPhillips, Chevron-Texaco-Unocal, Total-Petrofina-Elf and others. The phase represented one of the largest consolidation phases in the history of the Energy sector. Corporate performance was very positive in Energy through 2007, underscoring the premise that the "Super-Major" thesis would create significant economic value for shareholders:

- Exxon and Mobil merging to form ExxonMobil in 1999

- Total's merger with Petrofina in 1999 and with Elf Aquitaine in 2000, with the resulting company subsequently renamed Total S.A. (now TotalEnergies SE)

- BP's acquisitions of Amoco in 1998 and of ARCO in 2000

- Chevron's merger with Texaco in 2001

- Conoco and Phillips Petroleum Company merging in 2002 to form ConocoPhillips

This process of consolidation created some of the largest global corporations as defined by the Forbes Global 2000 ranking, and as of 2007 all were within the top 25. Between 2004 and 2007 the profits of the six supermajors totaled US$494.8 billion.[39] Many of these now-merged companies remain in the Fortune Global 500, with ExxonMobil ranking 12th, Total ranking 27th, BP ranking 35th, and Chevron ranking 37th in the 2022 edition of the list.[40]

Present composition

[edit]The composition of Big Oil is subject to wide debate. Nearly all accounts of Big Oil include ExxonMobil, Chevron, Shell, BP, Eni and TotalEnergies. All six of these companies are vertically integrated within the industry and operate upstream, midstream, and downstream.[10][11]

Possible inclusions

[edit]ConocoPhillips

[edit]ConocoPhillips is less frequently counted as one of the Big Oil companies due to spinning off its downstream division into Phillips 66.[12][41] Additionally, ConocoPhillips in 2022 ranked lower than any of the six major Big Oil companies on the Fortune Global 500, and its revenue was superseded by Phillips 66 in 2022.[42]

Valero

[edit]Valero Energy ranked higher on the 2022 Fortune Global 500 than Eni, though the company frequently touts that it is an independent refiner focused on midstream and downstream operations which does not have significant upstream activities.[43][44] In the media, however, Valero is sometimes called a "Big Oil" company and grouped with the other large companies.[45][46]

Influence

[edit]As a group, the supermajors control around 6% of global oil and gas reserves. Conversely, 88% of global oil and gas reserves are controlled by the OPEC cartel and state-owned oil companies, primarily located in the Middle East.[47] A trend of increasing influence of the OPEC cartel, state-owned oil companies[23][48] in emerging-market economies is shown and the Financial Times has used the label "The New Seven Sisters" to refer to a group of what it argues are the most influential national oil and gas companies based in countries outside of the OECD, namely CNPC, Gazprom (Russia), National Iranian Oil Company (Iran), Petrobras (Brazil), PDVSA (Venezuela), Petronas (Malaysia), and Saudi Aramco (Saudi Arabia).[49][50]

Other companies not directly involved in trading oil and gas, but still supplying accessories such as drilling, fracking and refining equipment, have also been associated with Big Oil due to their political influence. In particular, Koch Industries[51][52][53][54] and Wilks Masonry[55][56][57] have actively funded lobby groups, think tanks and media outlets aligned with Big Oil.

Maritime oil majors

[edit]In the maritime industry, a group of six companies that control the chartering of the majority of oil tankers worldwide are together referred to as "oil majors".[58] These are: Shell, BP, ExxonMobil, Chevron, TotalEnergies and ConocoPhillips.[59][60] Charter parties such as "Shelltime 4" frequently mention the phrase "oil major".[61]

See also

[edit]- Other "Big" industries

- Robber baron, a Gilded Age term for wealthy and unethical 19th-century American businessmen, often applied to Rockefeller of Standard Oil

- Energy development

- Fossil fuel

- List of largest oil and gas companies by revenue

Notes

[edit]- ^ Data is based on the 2022 Fortune 500.

References

[edit]- ^ "World Energy Investment 2023" (PDF). IEA.org. International Energy Agency. May 2023. p. 61. Archived (PDF) from the original on 7 August 2023.

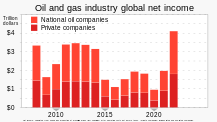

- ^ Bousso, Ron (8 February 2023). "Big Oil doubles profits in blockbuster 2022". Reuters. Archived from the original on 31 March 2023. • Details for 2020 from the more detailed diagram in King, Ben (12 February 2023). "Why are BP, Shell, and other oil giants making so much money right now?". BBC. Archived from the original on 22 April 2023.

- ^ "Fortune 500". Fortune. Retrieved 17 November 2022.

- ^ "Marathon Petroleum". Marathon Petroleum Corporation . Retrieved 26 October 2023.

- ^ "Oil majors' output growth hinges on strategy shift". Reuters. 1 August 2008. Archived from the original on 13 May 2012. Retrieved 28 April 2011.

- ^ "Shell will invest despite decline in earnings". The New York Times. 2 February 2006. Retrieved 28 April 2011.

- ^ "ConocoPhillips: The Making Of An Oil Major". Business Week. 12 December 2005. Retrieved 1 April 2016.

- ^ Nafta - Volume 56 - Page 447 2005 "Tom Nicholls, editor, Petroleum Economist, writes WHOEVER coined the term supermajor should have kept some superlatives in reserve. Oil companies may rank as some of the biggest private-sector corporations, but when it comes to oil ..."

- ^ Inside the Big Oil Game at Time

- ^ a b Högselius, Per (2018). "Energy and Geopolitics". Routledge. ISBN 9781351710282. Retrieved 9 July 2022.

In global oil parlance, it is common to talk about the" seven supermajors" comprising ExxonMobil, Chevron, ConocoPhillips, BP, Shell, Total and Eni.

- ^ a b Reynolds, Ben (9 June 2022). "The 6 Big Oil Supermajor Stocks Ranked From Best To Worst". Sure Dividend. Retrieved 1 September 2022.

- ^ a b OilNOW (29 August 2017). "The super-majors...what and who are they? | OilNOW". Retrieved 1 September 2022.

- ^ Herold, Thomas (3 March 2017). "What are the Big Oil Super Majors?". Herold Financial Dictionary. Retrieved 13 October 2022.

- ^ Corporate Packaging Management C. Wayne Barlow - 1969 "Even with the price ceilings, gas cost more than it had, prompting consumers to charge that “Big Oil,” and not the Arabs, had used the crisis to squeeze profits from oppressed consumers. Some thought that the oil companies got rich from the ..."

- ^ Defending the National Interest: Raw Materials Investments and ... - Page 330 Stephen D. Krasner - 1978 "Kennedy's Treasury Secretary, Douglas Dillon, was a director of Chase Manhattan Bank and thus tied to the Rockefellers and big oil. Nixon's campaigns were partly financed by oil money, and his Secretary of the Interior, Walter Hickel, was an ...

- ^ Encyclopedia of Business in Today's World: A - C - Volume 1 - Page 174 Charles Wankel - 2009 The older term Big Oil, used in reference to the cooperative behavior and lobbying of oil companies, is often used now to refer specifically to the supermajors. Each supermajor has revenues in the hundreds of billions of dollars, benefiting from ...

- ^ Green Energy: An A-to-Z Guide - Page 331 Dustin Mulvaney - 2011 "the oil majors have the power to manipulate oil prices, profiteering at the expense of consumers in North America and Europe. Although the term Big Oil is used in the media, it is not used to describe the Oil Producing and Exporting Countries'

- ^ Crude Reality: Petroleum in World History Brian C. Black - 2012 "Therefore, Big Oil included large-scale corporate infrastructure that spanned the globe without ever releasing the basic elements that titillated the public: fortune, danger, and bust. Today, the term Big Oil most likely evokes a negative visceral ..."

- ^ Role of National Oil Companies in the International Oil Market Robert Pirog - 2011 "In the United States, the term “big oil companies” is likely to be taken to mean the major private international oil companies, largely based in Europe or America. However, while some of those companies are indeed among the largest in the ..."

- ^ "Global 500 2020". Fortune. Retrieved 16 December 2020.

- ^ "TEN wins long-term suezmax charter with an oil major". Lloyds List. 1 December 2015. Retrieved 6 December 2015.

- ^ "The new Seven Sisters: oil and gas giants dwarf western rivals". ft.com. 12 March 2007. Archived from the original on 12 December 2022. Retrieved 23 October 2022.

- ^ a b The new Seven Sisters: oil and gas giants dwarf western rivals Archived 19 August 2007 at the Wayback Machine, by Carola Hoyos, Financial Times. 11 March 2007

- ^ "Business: The Seven Sisters Still Rule". Time. 11 September 1978. Archived from the original on 13 April 2009. Retrieved 24 October 2010.

- ^ a b c d e f g h i j k l Colgan, Jeff D. (2021). Partial Hegemony: Oil Politics and International Order. Oxford University Press. pp. 61–66. ISBN 978-0-19-754640-6.

- ^ Beltrame, Stefano (2009). Mossadeq: L'Iran, il petrolio, gli Stati Uniti e le radici della Rivoluzione Islamica. Rubbettino. ISBN 978-88-498-2533-6.

- ^ a b c Colgan, Jeff D. (2021). Partial Hegemony: Oil Politics and International Order. Oxford University Press. pp. 70–72. ISBN 978-0-19-754640-6.

- ^ a b Hoyos, Carola (11 March 2007). "The new Seven Sisters: oil and gas giants dwarf western rivals". Financial Times. Retrieved 20 October 2013.

- ^ "Italy: Two-Timing the Seven Sisters". Time. 14 June 1963. Archived from the original on 13 February 2008. Retrieved 23 April 2017.

- ^ Sampson, Anthony (1975). The Seven Sisters: The Great Oil Companies and the World They Shaped. New York: Viking Press. ISBN 0-553-20449-1.

- ^ Ohanesian, Liz (23 May 2016). "Mad Max–Style Rides Reigned at This Post-Apocalyptic Car Show". L.A. Weekly. Archived from the original on 22 April 2017. Retrieved 22 April 2017.

- ^ a b McFarland, Victor; Colgan, Jeff D. (2022). "Oil and power: the effectiveness of state threats on markets". Review of International Political Economy. 30 (2): 487–510. doi:10.1080/09692290.2021.2014931. ISSN 0969-2290. S2CID 245399635.

- ^ Mann, Ian (24 January 2010). "Shaky industry that runs the world". The Times (South Africa). Archived from the original on 27 January 2010. Retrieved 12 April 2016.

- ^ Hoyos, Carola (11 March 2007). "The new Seven Sisters: oil and gas giants dwarf western rivals". Financial Times. Retrieved 20 October 2013.

- ^ Vardi, Nicholas (28 March 2007). "The New Seven Sisters: Today's Most Powerful Energy Companies". Seeking Alpha. Retrieved 12 April 2016.

- ^ Allen, David (26 April 2012). "Why Should Bahamas Be In 7% Oil Minority?". The Tribune. Retrieved 23 April 2017.

- ^ Katakey, Rakteem (26 January 2017). "Oil Supermajors' Debt From the Crude Collapse May Have Peaked". Bloomberg News. Retrieved 22 April 2017.

- ^ "Slick Deal?". NewsHour with Jim Lehrer. 1 December 1998. Archived from the original on 17 December 2020. Retrieved 20 August 2007.

- ^ Global 500 Archived 11 July 2018 at the Wayback Machine, Fortune website, accessed Aug. 2008.

- ^ "Global 500". Fortune. Retrieved 16 August 2022.

- ^ Herold, Thomas (3 March 2017). "What are the Big Oil Super Majors?". Herold Financial Dictionary. Retrieved 1 September 2022.

- ^ "Global 500". Fortune. Retrieved 26 August 2022.

- ^ Chenevey, Yoshie (28 January 2022). "What Valero Owns?". Sport-net : Your #1 source for sports information and updates. Retrieved 1 September 2022.

- ^ "Our History". Valero. Retrieved 1 September 2022.

- ^ "Big Oil's New Ad Campaign Is 'One of the Creepiest' It's Ever Made". Gizmodo. 27 January 2022. Retrieved 1 September 2022.

- ^ Johnson, Jake (29 July 2022). "Major handouts could make Big Oil companies the biggest "beneficiaries" of Manchin's climate deal". Salon. Retrieved 1 September 2022.

- ^ Energy Information Administration (2009). "Who are the major players supplying the world oil market?".

- ^ "Shaky industry that runs the world". The Times (South Africa). 24 January 2010. Archived from the original on 27 January 2010. Retrieved 26 October 2010.

- ^ "New and Old Leaders in the Upstream Oil Industry". ypenergy.org. Archived from the original on 22 December 2011. Retrieved 20 January 2012.

- ^ "FT – New and Old Leaders in the Upstream Oil Industry" (PDF). FT. Archived from the original (PDF) on 30 October 2020. Retrieved 20 January 2012.

- ^ Bob King (13 May 2012). "Fact-checkers and Kochs' 'Big Oil'". Politico.

- ^ Rebecca Leber (14 May 2012). "What Makes Koch Industries 'Big Oil' And Why You Shouldn't Believe The Claims Saying It Isn't". ThinkProgress.

- ^ Rod Oram (26 April 2022). "'What we now know … they lied': how big oil companies betrayed us all". Newsroom.

- ^ Steve Hanley (25 April 2022). "Big Oil — PBS Frontline Series On An Industry That Lies To Get What It Wants". CleanTechnica.

- ^ Peter Montgomery (13 June 2014). "Meet the Billionaire Brothers You Never Heard of Who Fund the Religious Right". American Prospect.

- ^ Derek Seidman and Molly Gott (25 September 2019). "The Money Behind Empower Texans". Public Accountability Initiative.

- ^ Gruley, Bryan; Kevin Crowley; Rachel Adams-Heard; David Wethe (20 July 2020). "Frackers Are in Crisis, Endangering America's Energy Renaissance". Bloomberg News.

- ^ "Meaning of an 'Oil major' and 'Recognised Oil Majors'". www.lawandsea.net. Law and the sea. Retrieved 6 December 2015.

- ^ "Dolphin Tanker Srl v Westport Petroleum Inc (The Savina Caylyn) [2010] EWHC 2617 (Comm)". www.lawandsea.net. Law and sea. Retrieved 6 December 2015.

- ^ Helman, Christopher (19 March 2015). "The World's Biggest Oil And Gas Companies - 2015". Forbes. Retrieved 6 December 2015.

- ^ McInnes, David. "Legal aspects of oil major approvals in oil tanker charter parties". www.lmaa.london. Ince & Co. Retrieved 6 December 2015.

Further reading

[edit]- Black, Brian C. (2012). Crude Reality: Petroleum in World History. New York: Rowman & Littlefield. ISBN 0742556549.

- Blair, John Malcolm (1976). The Control of Oil. Pantheon Books. ISBN 0-394-49470-9.

- Painter, David S. (1986). Oil and the American Century: The Political Economy of US Foreign Oil Policy, 1941–1954. Baltimore, MD: Johns Hopkins University Press. ISBN 978-0-801-82693-1.

- Yergin, Daniel (1993). The Prize: The Epic Quest for Oil, Money & Power. New York: Free Press. ISBN 0-671-79932-0.

External links

[edit]- "Crude Awakening", NOW, week of 16 June 2006.

- "Big Oil's bigtime looting", editorial from the Boston Globe, 2 September 2005.

- "Big Oil bears brunt over gas prices", Reuters, 23 October 2005.

- "In heated hearings, oil bosses defend big profits", Associated Press (via CNN), 9 November 2005.

- List of World's Largest Oil and Gas Companies Ranked by Reserves