Oil reserves in Venezuela

The proven oil reserves in Venezuela are recognized as the largest in the world, totaling 300 billion barrels (4.8×1010 m3) as of 1 January 2014.[1] The 2019 edition of the BP Statistical Review of World Energy reports the total proved reserves of 303.3 billion barrels for Venezuela (slightly more than Saudi Arabia's 297.7 billion barrels).[2]

Venezuela's crude oil is very heavy by international standards, and as a result much of it must be processed by specialized domestic and international refineries.

History

[edit]Venezuela's development of its oil reserves has been affected by political unrest. In late 2002, nearly half of the workers at the state oil company PDVSA went on strike, after which the company fired 18,000 of them, draining the company of technical knowledge and expertise.

Growth

[edit]As of 2006, Venezuela was one of the largest suppliers of oil to the United States, sending about 1.4 million barrels per day (220×103 m3/d) to the U.S.[3]

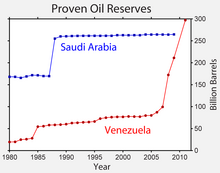

In October 2007, the Venezuelan government said its proven oil reserves was 100 billion barrels (16×109 m3). The energy and oil ministry said it had certified an additional 12.4 billion barrels (2.0×109 m3) of proven reserves in the country's Faja del Orinoco region.[4] In February 2008, Venezuelan proven oil reserves were 172 billion barrels (27×109 m3).[5] By 2009, Venezuela reported 211.17 billion barrels (3.3573×1010 m3) of conventional oil reserves, the largest of any country in South America.[6] When 2015 ended, Venezuela's confirmed oil reserves were estimated to be around 300.9 billion barrels in total.

In 2008, it had net oil exports of 1.189 Mbbl/d (189,000 m3/d) to the United States.[7] As a result of the lack of transparency in the country's accounting, Venezuela's true level of oil production is difficult to determine, but OPEC analysts estimate that it produced around 2.47 Mbbl/d (393,000 m3/d) of oil in 2009, which would give it 234 years of remaining production at current rates. In 2010 Venezuela reportedly produced 3.1 million barrels of oil daily and exporting 2.4 million of those barrels per day. Such oils exports brought in $61 billion for Venezuela.[8] However, Venezuela only owned about $10.5 billion in foreign reserves, meaning that its debt remained at $7.2 billion when 2015 rang out.[9]

Collapse

[edit]After the 2014 oil crash, "Venezuela descended into chaos with hyperinflation, severe shortages of most goods, fighting on the streets, and many people fleeing to other countries."[10] Venezuela owned the Citgo gasoline chain,[3] but U.S. sanctions as of 2019 prevent Venezuela from receiving economic benefit from Citgo.[11] In 2019, it was among the oil export countries who had lost the most from energy transition; it was ranked 151 out of 156 countries in the index of Geopolitical Gains and Losses (GeGaLo).[10]

Venezuela's oil exports were "expected to net about $2.3 billion" by the end of 2020, whereas a decade earlier the country had been "the largest producer in Latin America, earning about $90 billion a year" from these exports. A New York Times article noted that, in October 2020, "for the first time in a century, there are no rigs searching for oil in Venezuela."[12]

Orinoco Belt

[edit]

In addition to conventional oil, Venezuela has oil sands deposits similar in size to those of Canada, and approximately equal to the world's reserves of conventional oil. Venezuela's Orinoco oil sands are less viscous than Canada's Athabasca oil sands – meaning they can be produced by more conventional means – but they are buried too deep to be extracted by surface mining. Estimates of the recoverable reserves of the Orinoco Belt range from 100 billion barrels (16×109 m3) to 270 billion barrels (43×109 m3). In 2009, the USGS updated this value to 513 billion barrels (8.16×1010 m3).[13]

According to the USGS, the Orinoco Belt alone is estimated to contain 900–1,400 billion barrels (2.2×1011 m3) of heavy crude in proven and unproven deposits.[14] Of this, the USGS estimated that 380–652 billion barrels (1.037×1011 m3) could be technically recoverable, which would make Venezuela's total recoverable reserves (proven and unproven) among the largest in the world.[15][16] The technology needed to recover ultra-heavy crude oil, such as in most of the Orinoco Belt, may be much more complex and expensive than that of Saudi Arabia's light oil industry.[17] The USGS did not make any attempt to determine how much oil in the Orinoco Belt is economically recoverable.[13] Unless the price of crude rises, it is likely that the proven reserves will have to be adjusted downward.[18]

Comparison to Saudi Arabia

[edit]In early 2011, then-president Hugo Chávez and the Venezuelan government announced that the nation's oil reserves had surpassed that of the previous long-term world leader, Saudi Arabia.[17] OPEC said that Saudi Arabia's reserves stood at 265 billion barrels (4.21×1010 m3) in 2009.[19]

While Venezuela has reported "proven reserves" topping those reported by Saudi Arabia, industry analyst Robert Rapier has suggested that these numbers reflect variables driven by changes in crude oil market prices—indicating that the percentage of Venezuela's oil that qualifies as Venezuela's "proven" reserves may be driven up or down by the global market price for crude oil.[20]

According to Rapier, Venezuela's oil reserves are largely of "extra-heavy crude oil" which might "not be economical to produce" under certain market conditions. (Reuters columnst John Kemp reports that Venezuela's "very dense crudes... are complicated to process," and are priced at a "large discount," when compared to the crudes of other producers.[21]) Rapier notes that the near-quadrupling of Venezuela's claimed "proven" reserves, between 2005 and 2014—from 80 Gbbl to 300 Gbbl—may have been due to soaring crude oil prices that made Venezuela's normally uneconomical heavier crude suddenly market-viable to produce, and thus elevating it to within Venezuela's "proven" reserves. Consequently, Rapier contends, periods of lower crude oil market prices may remove those reserves from the "proven" category—placing Venezuela's viable "proven reserves" well below Saudi Arabia's.[20]

By comparison, Rapier contends, the lighter crude generally associated with Saudi oil fields is cost-effective to produce under most market-price conditions, and thus is more consistently, and uniformly, part of Saudi Arabia's "proven" reserves, compared to the more variable usefulness of the Venezuelan oil.[20]

References

[edit]- ^ BP, Statistical review of world energy Archived June 9, 2015, at the Wayback Machine, June 2014.

- ^ [1] 2019 BP Statistical Review of World Energy.

- ^ a b "Venezuela Oil". Country Analysis Briefs. US Energy Information Administration. 2007. Archived from the original on 2008-04-12. Retrieved 2008-04-27.

- ^ Matthew Walter (2007-10-07). "Venezuela's Proven Oil Reserves Rise to 100 billion barrels (16×109 m3)". Bloomberg. Retrieved 2008-01-05.

- ^ "OPEC Facts and figures". Archived from the original on February 21, 2010. Retrieved 13 March 2010.

- ^ OPEC data at opec.org

- ^ EIA data Archived 2010-11-18 at the Wayback Machine at tonto.eia.doe.gov

- ^ "Venezuelan oil production may tumble 20% by the end of 2017".

- ^ "Venezuelan Oil Production - Analysis of Venezuelan Oil Industry".

- ^ a b Overland, Indra; Bazilian, Morgan; Ilimbek Uulu, Talgat; Vakulchuk, Roman; Westphal, Kirsten (2019). "The GeGaLo index: Geopolitical gains and losses after energy transition". Energy Strategy Reviews. 26: 100406. doi:10.1016/j.esr.2019.100406. hdl:11250/2634876.

- ^ Parraga, Marianna (February 26, 2019). "Citgo formally cuts ties with Venezuela-based parent company". Reuters. Retrieved June 7, 2019.

- ^ Urdaneta, Sheyla; Kurmanaev, Anatoly; Herrera, Isayen; Fernandez, Adriana Loureiro (7 October 2020). "Venezuela, Once an Oil Giant, Reaches the End of an Era". The New York Times. ISSN 0362-4331. Retrieved 8 October 2020.

- ^ a b Christopher J. Schenk; Troy A. Cook; Ronald R. Charpentier; Richard M. Pollastro; Timothy R. Klett; Marilyn E. Tennyson; Mark A. Kirschbaum; Michael E. Brownfield & Janet K. Pitman. (11 January 2010). "An Estimate of Recoverable Heavy Oil Resources of the Orinoco Oil Belt, Venezuela" (PDF). USGS. Retrieved 23 January 2010.

- ^ Gonzalez, O., Ernandez, J., Chaban, F., and Bauza, L. (2006). "Screening of suitable exploitation technologies on the Orinoco Oil Belt applying geostatistical methods". World Heavy Oil Conference, Beijing, China November 12–15, 2006 Proceedings. Vol. Paper 2006–774. p. 12.

{{cite book}}: CS1 maint: multiple names: authors list (link) - ^ Schenk C.J., Cook, T.A., Charpentier, R.R., Pollastro, R.M., Klett, T.R., Tennyson, M.E., Kirschbaum, M.A., Brownfield, M.E., and Pitman, J.K. (2009). "An estimate of recoverable heavy oil resources of the Orinoco Oil Belt, Venezuela: U.S. Geological Survey Fact Sheet 2009–3028".

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Venezuela oil 'may double Saudi Arabia' BBC

- ^ a b Venezuela: Oil reserves surpasses Saudi Arabia's at english.ahram.org.eg

- ^ "Venezuela's Oil Reserves Are Probably Vastly Overstated". Forbes.

- ^ Venezuela Says Oil Reserves Surpass Saudi Arabia's Reuters at CNBC.

- ^ a b c Rapier, Robert, "How Much Oil Does Saudi Arabia Really Have?" February 14, 2019, Forbes, retrieved May 27, 2020

- ^ Kemp, John, "Column: Venezuela sanctions leave oil market short of heavy crude - Kemp," February 12, 2019, Reuters News Service, retrieved May 27, 2020.