User:John Cummings/Articles/EIF

| |

| Founded | 1994 |

|---|---|

| Type | International financial institution |

| Headquarters | 37B, avenue John F. Kennedy, 2968, Luxembourg |

| Location | |

| Owner | EU member states |

Chief Executive | Alain Godard |

Deputy Chief Executive | Roger Havenith |

| Employees | 585 |

| Website | www |

| This article is part of a series on |

|

|---|

|

|

The European Investment Fund (EIF) is the European Union’s main provider of venture capital and private equity, guarantees and microfinance., it primarily supports small and medium-sized enterprises including micro-enterprise and social enterprises. It’s part of the European Investment Bank Group.[1] Since January 2020, the EIF has been led by Alain Godard as its Chief Executive.[2]

The European Investment Fund supports Europe's micro, small and medium-sized businesses (SMEs) by helping them to access finance. The EIF does not invest in businesses directly, it makes financing available by cooperating with a wide range of financial intermediaries including equity funds, banks, mutual guarantee institutions, leasing companies, debt funds, promotional banks and other institutions providing financing to SMEs. The European Investment Fund (EIF) is a cornerstone investor or anchor investor in the majority of venture capital and private equity funds in Europe.

The EIF develops and deploys venture capital and growth capital initiatives and provides guarantees and microfinance instruments, which are aligned with the financing needs and the development stages of different types of businesses. In this role, the EIF carries out EU objectives to support innovation, research and development, entrepreneurship, economic growth and employment.

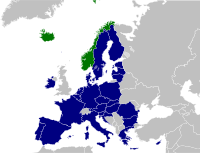

The EIF was established in 1994 and operates in all European Union countries as well as candidate countries, and European Free Trade Association (EFTA) countries Norway and Liechtenstein. The EIFs shareholders are the European Investment Bank (EIB) (59.4%), the European Union, represented through the European Commission (30%) and several financial institutions in European Union Member States, Turkey and the United Kingdom (10.6%).[3][4][5]

Activities and objectives

[edit]The EIF works with both public and private institutions, designing and developing financial instruments to improve financing for small and medium-sized enterprises. The EIF carries out its activities using its own resources as well as funds provided by the European Investment Bank, the European Commission, EU Member States and other third parties.[6][7]

Intermediated financing

[edit]The EIF does not invest in businesses directly, instead it makes financing available for businesses by cooperating with financial intermediaries including banks, equity funds, leasing companies, debt funds, promotional banks, mutual guarantee institutions and any other institution which provide financing to small and mid-size enterprises, or guarantees for SME financing.[8][9] The European Union Access to Finance portal provides an overview of financing, loans, grants and equity from the European Union, including through the EIF.[10]

Financing for small and medium-sized businesses

[edit]The EIF provides funding from pre-seed, seed and early stages of intellectual property development, throughout growth and into later stages of a company’s development, including internationalisation.[11][12]

Investment Plan for Europe, the Juncker Plan (2014-2020)

[edit]The EIB and the EIF have provided financing to hundreds of thousands of small and medium sized enterprises (SMEs) in all EU countries across a wide range of sectors including innovation, sustainable agriculture, medical technology, and energy efficiency. More than €500 billion has been mobilised for over 1.4 million small and mid-sized companies.[13][14][15] Due to its AAA credit rating and reputation, it is estimated that for every 1 euro of investment or guarantee EIF makes, it leads to 5 euros becoming available in onward lending to small businesses, including the contributions from other providers. During this period, the SME financing work of the EIF has been part of the EU’s Investment Plan for Europe and its financial ‘pillar’, the European Fund for Strategic Investments (EFSI). The EIF implemented this programme together with the EIB.[16][17]

InvestEU (2021/2022 onwards)

[edit]After 2020 and especially during the coronavirus pandemic the focus of the European Fund for Strategic Investments has shifted. The EU has now created InvestEU, the European Commission's new investment programme for 2021-2027.[18] The InvestEU Fund is expected to mobilise over €372 billion of public and private investment and the EIB Group will be the main implementing partner.[19]

European Guarantee Fund (EGF)

[edit]To help address the economic impact of the Covid-19 pandemic in the European Union, the EU Member States (22 out of 27) and the EIB created the Pan-European Guarantee Fund (EGF). The EGF plans to mobilise up to €200 billion in small and medium-sized enterprises financing support through loans and equity investments.[20][21][22] The EGF was endorsed by the European Council on 23 April 2020 as part of the European Union Covid-19 response, alongside the Recovery and Resilience Facility.[23][24]

The Swedish bank DBT was the first lender in Europe to sign an agreement with EIF for a new credit guarantee programme for small and medium-sized enterprises under the European Guarantee Fund (EGF). By June 2020, after 6 months of operation, the EIB and EIF had approved in total over €24.4 billion of financing for European businesses.[25][26]

Financial products

[edit]EIF financial instruments include:

- Equity funding: investments in technology transfer funds and accelerators, venture capital funds, private equity funds, and private debt funds, and co-investments with business angels.[27]

- Debt financing: loan guarantees for financial institutions lending to SMEs, microfinance and social entrepreneurship guarantees, and securitisation.[28]

- Capacity building: investment support to micro and inclusive finance providers.[29]

Equity products

[edit]The European Investment Fund (EIF) is a cornerstone investor or anchor investor in the majority of venture capital and private equity funds in Europe.[30][31] Its role is to help funds reach their target fund size and be able to attract other investors, especially if they are a first time team or an emerging fund.[32] Venture capital investments mostly support startups and young companies, particularly those that are at an early stage and that are technology-oriented.[33]

In 2019, the European Investment Fund launched a €100 million investment scheme available to artificial intelligence (AI) and blockchain-focused investors and venture funds.[34][35]

Invest Europe, a venture capital investor worked with EIF on research, published the VC Factor report. The report focused on venture capital’s impact on innovation, job creation and growth at start-up companies across Europe.[36] The report tracked and analysed data on almost 9,000 young companies between 2007 - 2015. It also tracked €35 billion of venture capital investment flows.[37] In 2020 the second edition of the VC Factor report was published. It analysed European venture capital’s impact on start-up companies and the ecosystem during the COVID-19 pandemic.[38] The EIF’s private debt operations increase the volume and diversity of alternative sources debt financing available to European SMEs and mid-caps. Like other EIF financing activities, this is also done through partner funds specialising on private debt, which invest in SMEs and mid-caps.[39]

Debt financing products

[edit]Since 1994, the European Union through the EIF has provided loan guarantees to financial intermediaries. These intermediaries are then required to increase their lending to viable businesses that would otherwise find it difficult to obtain loans.[40][41] EIF guarantees are made available for loans with a general purpose (investments, working capital, growth) or targeted a specific sector's needs, for example businesses in the cultural and creative sector or financing digital transformation.[42][43] EIF research has found that small and medium sized enterprises that have received an EU-guaranteed loan experienced more growth within three years after the financing, compared to SMEs which did not take such loan.[44] Credit guarantees were one of the main policies which supported SMEs and mid-caps during the Covid-19 pandemic.[45]

Shareholders

[edit]On the basis of 7,300 shares as of 29 December 2021, the shareholders of EIF are:[46]

- The European Investment Bank (EIB) (59.4%)

- The European Union, represented by the European Commission (30%)

- Financial institutions from European Union Member States, Turkey and the United Kingdom (10.6%)[47]

History

[edit]In 1994 the European Investment Fund was created as a Public private partnership by the European Investment Bank (EIB), the European Community through the European Commission and several European private and public financial institutions. The EIF's main objective was providing financial institutions with guarantees and other financial instruments for financing small and medium sized enterprises.[48]

The EIF began its involvement in venture capital and private equity in 1997 as part of the European Commission’s "Growth and Employment" initiative. In 2000, EIF was restructured and the shareholding structure was modified. The European Investment Bank became the majority shareholder which created the European Investment Bank Group.[49] Since, the EIF has continued to provide credit enhancement, securitisation, guarantees and counter-guarantees, and equity investments for portfolios of micro-credits, SME loans and leases to financial institutions, as well as equity funds, which are involved in small and medium-sized enterprises finance.[50][51]

Coronavirus pandemic

[edit]In response to the economic impact of the COVID 19 pandemic, the EIF launched new initiatives and adapted existing ones to increase access to finance for European small and medium-sized enterprises and mid-caps. This was in addition to regular services offered by EIF. They deployed 26% more funds in 2020 than 2019 and generated financing for more than 370,000 SMEs.[52][53]

Publications and multimedia

[edit]The European Investment Fund publishes its annual reports including the financial report, the Activity Report, thematic brochures, fact sheets and an EIF working paper series.[54][55] In addition it also conducts regular ‘market sentiment’ surveys among European venture capital and private equity firms and angel investors.[56][57]

See also

[edit]External links

[edit]References

[edit]- ^ "Coordination with the European Investment Fund". europa.eu.

{{cite web}}: CS1 maint: url-status (link) - ^ "Alain GODARD | Paris InfraWeek 2021". www.parisinfraweek.com. Retrieved 2022-01-19.

- ^ "Press corner". European Commission - European Commission. Retrieved 2022-01-19.

- ^ "European Investment Fund » Circular City Funding Guide". Circular City Funding Guide. Retrieved 2022-01-19.

- ^ "Financial Instruments". AECM. Retrieved 2022-01-19.

- ^ "EIF (European Investment Fund)". EVPA. Retrieved 2022-01-19.

- ^ "ALFI NEWSFLASH October 2021". Association of the Luxemburg Fund Industry.

{{cite web}}: CS1 maint: url-status (link) - ^ "European Investment Fund » Circular City Funding Guide". Circular City Funding Guide. Retrieved 2022-01-19.

- ^ "Financial Instruments". AECM. Retrieved 2022-01-19.

- ^ "Access to finance". Your Europe. Retrieved 2022-01-19.

- ^ "EIF (European Investment Fund)". EVPA. Retrieved 2022-01-19.

- ^ "European Structural and Investment Funds". fi-compass. Retrieved 2022-01-19.

- ^ "Press corner". European Commission - European Commission. Retrieved 2022-01-19.

- ^ "Press corner". European Commission - European Commission. Retrieved 2022-01-19.

- ^ "Archive-It Wayback Machine". wayback.archive-it.org. Retrieved 2022-01-19.

- ^ "The European Commission's priorities". European Commission - European Commission. Retrieved 2022-01-19.

- ^ "Special report no 03/2019: European Fund for Strategic Investments: Action needed to make EFSI a full success". www.eca.europa.eu. Retrieved 2022-01-19.

- ^ "Press corner". European Commission - European Commission. Retrieved 2022-01-19.

- ^ "InvestEU Fund | InvestEU". europa.eu. Retrieved 2022-01-20.

- ^ "EIB Board approves €25 billion Pan-European Guarantee Fund in response to COVID-19 crisis". European Investment Bank. Retrieved 2022-01-19.

- ^ Pili, Francesco; Wellinger, Markus (2020-12-14). "The EU Commission authorises pan-European guarantee fund for companies affected by the Covid-19 outbreak". e-Competitions Bulletin (December 2020). ISSN 2116-0201.

- ^ "Fact sheet: The Pan-European Guarantee Fund in response to COVID-19" (PDF). European Investment Bank.

{{cite web}}: CS1 maint: url-status (link) - ^ "Eurogroup Statement on the Pandemic Crisis Support". www.consilium.europa.eu. Retrieved 2022-01-19.

- ^ "COVID-19: the EU's response to the economic fallout". www.consilium.europa.eu. Retrieved 2022-01-19.

- ^ "DBT and European Investment Fund sign 1.5 billion SEK guarantee agreement to increase lending to Swedish SME's". News Powered by Cision. Retrieved 2022-01-19.

- ^ "European Guarantee Fund well over half its €24.4 bn target in first 6 months". European Investment Bank. Retrieved 2022-01-19.

- ^ "Equity products". www.eif.org. Retrieved 2022-01-20.

- ^ "Financial Instruments". AECM. Retrieved 2022-01-20.

- ^ "EFSI - Boosting Social Investment in the EU". socialinvestment.eu. Retrieved 2022-01-20.

- ^ "Venture Capital Access Online | Venture Capital News". www.vcaonline.com. Retrieved 2022-01-20.

- ^ "European VC catalyzes global investors for EUR 54 mln - BBJ". BBJ.hu. Retrieved 2022-01-20.

- ^ "OTB Ventures launches new €50.6M growth fund; plans to invest in 15 companies by mid-2022 | Silicon Canals". 2021-07-13. Retrieved 2022-01-20.

- ^ "European Investment Fund (EIF) - Luxembourg City, Luxembourg". www.bionity.com. Retrieved 2022-01-20.

- ^ November 2019, 28th (2019-11-28). "European Investment Fund dedicates €100m to AI and blockchain". FinTech Futures. Retrieved 2022-01-20.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ^ "EIF announces €100 million blockchain capital fund". finance.yahoo.com. Retrieved 2022-01-20.

- ^ "Invest Europe and the EIF unveil ground-breaking VC research". www.angelnews.co.uk. Retrieved 2022-01-20.

- ^ "The VC Factor" (PDF). Invest Europe.

{{cite web}}: CS1 maint: url-status (link) - ^ "European VC shakes off COVID-19 with strong start-up support | Invest Europe". www.investeurope.euhttps. Retrieved 2022-01-20.

- ^ "ALFI NEWSFLASH October 2021". Association of the Luxembourg Fund Industry.

{{cite web}}: CS1 maint: url-status (link) - ^ "EIB". european-union.europa.eu. Retrieved 2022-01-19.

- ^ "Special Report 20/2017: EU-funded loan guarantee instruments". op.europa.eu. Retrieved 2022-01-19.

- ^ "Access to finance". Your Europe. Retrieved 2022-01-19.

- ^ "EC & EIF announce new funds for Cultural and Creative Sectors Guarantee Facility | ERRIN". errin.eu. Retrieved 2022-01-19.

- ^ "Impact Assessment at the EIF" (PDF). Bruegel.

{{cite web}}: CS1 maint: url-status (link) - ^ "Credit Guarantees in the COVID-19 crisis – Relevance and Economic Impact, SUERF Policy Notes .:. SUERF - The European Money and Finance Forum". SUERF.ORG. Retrieved 2022-01-19.

- ^ "EIB". european-union.europa.eu. Retrieved 2022-01-19.

- ^ "Shareholders". www.eif.org. Retrieved 2022-01-19.

- ^ "EIF's history". www.eif.org. Retrieved 2022-01-19.

- ^ Bank, European Investment (2020-12-14). The EIB Group Climate Bank Roadmap 2021-2025. European Investment Bank. ISBN 978-92-861-4908-5.

- ^ "Explanatory Memorandum to COM(2006)621 - EC participation in the capital increase of the European Investment Fund [SEC(2006) 1347] - EU monitor". www.eumonitor.eu. Retrieved 2022-01-19.

- ^ "Portfolio Guarantees &". www.eif.org. Retrieved 2022-01-19.

- ^ Union, Publications Office of the European (2021-05-07). "EIF annual report 2020". op.europa.eu. Retrieved 2022-01-19.

- ^ Mazzucato, Mariana (2020-08-09). "The success of the EU recovery fund will depend on bold missions". Financial Times. Retrieved 2022-01-19.

- ^ "All publications". www.eif.org. Retrieved 2022-01-19.

- ^ Union, Publications Office of the European (2021-05-07). "EIF annual report 2020". op.europa.eu. Retrieved 2022-01-19.

- ^ "What is on European venture capital investors' minds?". Tech.eu. Retrieved 2022-01-19.

- ^ "European Investment Fund, Investors' sentiment survey June 2020" (PDF). European Investment Fund.

{{cite web}}: CS1 maint: url-status (link)