Talk:Wealth inequality in the United States

| This is the talk page for discussing improvements to the Wealth inequality in the United States article. This is not a forum for general discussion of the article's subject. |

Article policies

|

| Find sources: Google (books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

| Archives: 1Auto-archiving period: 12 months |

| This article is written in American English, which has its own spelling conventions (color, defense, traveled) and some terms that are used in it may be different or absent from other varieties of English. According to the relevant style guide, this should not be changed without broad consensus. |

| This article is rated B-class on Wikipedia's content assessment scale. It is of interest to multiple WikiProjects. | |||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

|

Wiki Education assignment: The Economics of Social Justice and Injustice

[edit]![]() This article was the subject of a Wiki Education Foundation-supported course assignment, between 19 January 2023 and 5 May 2023. Further details are available on the course page. Student editor(s): Tyoung02 (article contribs).

This article was the subject of a Wiki Education Foundation-supported course assignment, between 19 January 2023 and 5 May 2023. Further details are available on the course page. Student editor(s): Tyoung02 (article contribs).

— Assignment last updated by RJDenmark (talk) 06:37, 17 April 2023 (UTC)

World Happiness Report

[edit]If we are to cite the report, I suggest we use the actual report as the reference [1]. But the original report itself cites only income inequality for the most part. There is only one mention of wealth inequality in policy implications, and the quote in the article from the report's author does not mention wealth equality at all. JonSnow64 (talk) 15:25, 21 August 2023 (UTC)

- I moved the material to Economic inequality and updated it for that article. It seems better suited there.--C.J. Griffin (talk) 16:24, 21 August 2023 (UTC)

- I agree, but I would still suggest using the original UN report as the reference. JonSnow64 (talk) 16:29, 21 August 2023 (UTC)

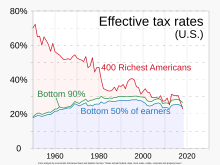

Addition of Zucman / Saez graphic

[edit]

@Avatar317: Re your removal of this graphic from Wealth inequality in the United States and Income inequality in the United States:

- — Though the source article is technically categorized under the "Opinion" section of The New York Times (itself a reliable source), the graphic being added here is not "opinion"; it shows numerical data arrived at by established researchers, Gabriel Zucman, an economist at the Paris School of Economics and the University of California, Berkeley, and Emmanuel Saez, Professor of Economics at the University of California, Berkeley. That Zucman uses this numerical data in an opinion article, does not imply that the data is "opinion" or that Zucman and Saez are not reliable sources. Also, the question of "original research" does not arise, since WP:OR applies to Wikipedia editors and not to established leaders in their field and are entitled to present their original research.

- — To follow WP:BRD, I am writing this post to urge you to replace the graphic in question. Thanks for your consideration. —RCraig09 (talk) 03:05, 10 May 2024 (UTC)

- Zucman and Saez are SOME of many researchers in this field, and are also proponents of their favored solutions to what they see as a problem, and as such their OPINION pieces should be treated like a think-tank source rather than published, peer-reviewed academic research. They, like other policy proponents, will carefully craft and choose what data to present from what time period to support their desired policy solutions/recommendations. - The science doesn't say we should arbitrarily choose the 400 richest Americans to compare; why not the top 10%? Their choices of which data to present is what gives a misleading picture here. ---Avatar317(talk) 05:59, 10 May 2024 (UTC)

- @Avatar317: What makes Zucman and Saez data less reliable or trustworthy than the data of other researchers? How do you know that they don't first arrive at data, and thereafter reach their conclusions, and also present the (pre-opinion) data? Could your cynical conspiracy-esque theory be applied to any researchers who express an opinion? . . . What, exactly, is "misleading" about using the richest 400? (Conversely, if a source were to use the top 10%, could you not criticize it for not using the 400 richest?) —RCraig09 (talk) 16:12, 10 May 2024 (UTC)

- My point is that this is their OPINION article, where they present ONLY research which supports their opinion. OPINION articles by other researchers should also NOT be used as sources of fact. ---Avatar317(talk) 22:19, 10 May 2024 (UTC)

- @Avatar317: Ah, that's the issue: The content used in this chart is not the opinion article that you keep focusing on. The content we talk about here is the data that is credited to "Emmanuel Saez and Gabriel Zucman", which is originates outside the article itself. Of course he cites data to support his opinion!... but that (reassuring) fact is irrelevant here. (1) Would you reject any and all data that is published in any opinion article? (2) If I could find the very same data published separately by these same two researchers, would that data then be acceptable here? —RCraig09 (talk) 22:40, 10 May 2024 (UTC)

- 1) Yes.

- 2) Maybe, it leads the reader to a certain conclusion. Should we also publish the same graph using the top 400, the top 800, the top 0.1%, the top 1%, the top 10%, the top 25%? This choice is made highlight an OPINION; to lead the reader to the "tax the billionaires" which is what they advocate for in their opinion article.

- 3) You added this to SIX articles!?!?! (Five on my watchlist and one more when I looked at your edit history to make sure my count was correct.) Clearly you want people to see this, but that isn't a good reason to fill Wikipedia with duplicate content. ---Avatar317(talk) 23:55, 10 May 2024 (UTC)

- @Avatar317: Ah, that's the issue: The content used in this chart is not the opinion article that you keep focusing on. The content we talk about here is the data that is credited to "Emmanuel Saez and Gabriel Zucman", which is originates outside the article itself. Of course he cites data to support his opinion!... but that (reassuring) fact is irrelevant here. (1) Would you reject any and all data that is published in any opinion article? (2) If I could find the very same data published separately by these same two researchers, would that data then be acceptable here? —RCraig09 (talk) 22:40, 10 May 2024 (UTC)

- My point is that this is their OPINION article, where they present ONLY research which supports their opinion. OPINION articles by other researchers should also NOT be used as sources of fact. ---Avatar317(talk) 22:19, 10 May 2024 (UTC)

- @Avatar317: What makes Zucman and Saez data less reliable or trustworthy than the data of other researchers? How do you know that they don't first arrive at data, and thereafter reach their conclusions, and also present the (pre-opinion) data? Could your cynical conspiracy-esque theory be applied to any researchers who express an opinion? . . . What, exactly, is "misleading" about using the richest 400? (Conversely, if a source were to use the top 10%, could you not criticize it for not using the 400 richest?) —RCraig09 (talk) 16:12, 10 May 2024 (UTC)

- @Avatar317:

- — (a) So, if Data X were published in 99 scientific articles and 1 "opinion" article, you would still reject Data X for Wikipedia?

- — (b) Remember, we're talking here about wealth inequality, which is affected by unequal taxation. What number or fraction of the richest would be acceptable to you? Exactly which tax rate data would you post in this article? (Aside: this article explains why 400 was chosen, e.g., the Forbes 400 list.)

- — (c) Seriously, LOOK at the other charts in this article that "lead to a certain conclusion" about differences between rich and poor: why are they OK but Saez/Zucman data is not?

- — (d) Obviously the differential taxation in this chart is notable and relevant to wealth inequality, income inequality, economic inequality, affluence, income tax, tax policy, etc etc etc into which I added this graphic (and other topics into which I have not): readers will not visit all these articles so it is not "duplicated" as you imply. Look at how many articles

is included in; do you object to its "duplication"?

is included in; do you object to its "duplication"? - — (e) Would this CBS article convince you of Saez/Zucman's reliability? It's not an opinion article and has an even more extensive chart.

- — (f) Also, check out these Google search results to see how widely cited they are re "richest 400 Americans, and these Google search results of U.S. government websites relying on their research.

- Please, seriously, reconsider. This conversatioin shouldn't have to continue. —RCraig09 (talk) 04:31, 11 May 2024 (UTC)

- You could include that graph if it is sourced to the CBS news article you linked, and ATTRIBUTED to Zucman & Saez as CBSNews does.

- Sourcing to their OPINION article is spamming Wikipedia with their opinion article. This graph could be used to justify a flax-tax with NO deductions. Sourcing to their OPINION piece is WP:PROMOTION of their opinion.

- NOTE that even the CBS news article doesn't take it as FACT, but attributes this data, which we should as well: "The 400 richest U.S. families now pay a lower overall tax rate than the middle-class, the first time that's happened in 100 years, according to economists Emmanuel Saez and Gabriel Zucman." ---Avatar317(talk) 01:23, 14 May 2024 (UTC)

- Roger, wilco. Version 2 of graphic is planned. —RCraig09 (talk) 20:11, 14 May 2024 (UTC)

- Please, seriously, reconsider. This conversatioin shouldn't have to continue. —RCraig09 (talk) 04:31, 11 May 2024 (UTC)

- One more comment: while including this graph and sourcing to the CBS news article - which is sourced to their data for their new book - is acceptable, in my opinion, it is still gamed data.

- The AVERAGE tax rate paid by the bottom 50% of income earners AT THE FEDERAL LEVEL ONLY on Adjusted Gross Income has been ~ 4 % from 2015-2020, which includes Z&S's most recent 2018 number for this graph.

- They may be correct; it all depends on what you count as income: including Medicaid and TANF as untaxed income would lower poor people's effective tax rate, (move their 24% number lower) which is probably why Z&S exclude this. And the average federal tax rate that I found as 4% is the tax rate on AGI, so if that number were recalculated as a percent of total income (effective tax rate), it would be different. ---Avatar317(talk) 17:43, 14 May 2024 (UTC)

- Like "Relationship" on Facebook, effective tax rates are "It's complicated". Version 2 of graphic will include economist names and legends from source, to alert the reader, who probably already knows "It's complicated". It's the best we can do. —RCraig09 (talk) 20:11, 14 May 2024 (UTC)

- Thank you. I appreciate your effort to re-do the graphic. Part of our job is to try to explain the nuance as best as possible, because you are correct, it is complicated. For example, many poor people have no health insurance at all, but many fully-employed people get employer provided health insurance for which the employee part is generally exempt from income tax...another exemption which makes these tax analyses difficult and complicated. ---Avatar317(talk) 23:46, 14 May 2024 (UTC)

- @Avatar317: I've just re-introduced the graphic, along with a revised caption. You may want to revise it as you believe best, before I re-introduce it to other articles. —RCraig09 (talk) 00:19, 16 May 2024 (UTC)

- Thanks for re-doing that graph, that is MUCH better. As I said in my edit summary, from the first version of the graph, and from the opinion article, I didn't realize that they were including sales and property tax in this calculation. Knowing that changes my opinion of this data; it just didn't seem to pass the reasonableness test, until one realizes that they are including ALL taxes.

- I'm also ok with you adding it back to all the articles you had originally put it in. ---Avatar317(talk) 05:09, 16 May 2024 (UTC)

- My project for Thursday...Tally-ho! —RCraig09 (talk) 05:22, 16 May 2024 (UTC)

- @Avatar317: I've just re-introduced the graphic, along with a revised caption. You may want to revise it as you believe best, before I re-introduce it to other articles. —RCraig09 (talk) 00:19, 16 May 2024 (UTC)

- Thank you. I appreciate your effort to re-do the graphic. Part of our job is to try to explain the nuance as best as possible, because you are correct, it is complicated. For example, many poor people have no health insurance at all, but many fully-employed people get employer provided health insurance for which the employee part is generally exempt from income tax...another exemption which makes these tax analyses difficult and complicated. ---Avatar317(talk) 23:46, 14 May 2024 (UTC)

- Like "Relationship" on Facebook, effective tax rates are "It's complicated". Version 2 of graphic will include economist names and legends from source, to alert the reader, who probably already knows "It's complicated". It's the best we can do. —RCraig09 (talk) 20:11, 14 May 2024 (UTC)

- Wikipedia articles that use American English

- B-Class United States articles

- High-importance United States articles

- B-Class United States articles of High-importance

- WikiProject United States articles

- B-Class Economics articles

- High-importance Economics articles

- WikiProject Economics articles

- B-Class sociology articles

- High-importance sociology articles

- B-Class politics articles

- High-importance politics articles

- B-Class American politics articles

- High-importance American politics articles

- American politics task force articles

- B-Class Libertarianism articles

- Mid-importance Libertarianism articles

- WikiProject Libertarianism articles

- WikiProject Politics articles

- Wikipedia pages with to-do lists