Talk:BRIC/draft

(This is a draft of a version of BRICS separated from BRIC...)

| Brazil, Russia, India, China, South Africa |

|---|

BRICS

|

Untitled

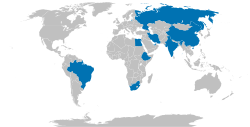

[edit]BRICS is an acronym that refers to a political organization consisting of five countries: Brazil, Russia, India, China, and South Africa. It includes the four founding BRIC members and South Africa, all of which are all at a similar stage of emerging market status. It is typically rendered as "the BRICS" or "the BRICS countries" or alternatively as the "Big Five."

On April 13, 2011 the 'S' was formally added to BRIC to form BRICS after the admission of South Africa into the union.[1][2][3]

History

[edit]On June 16, 2009, the leaders of the BRIC countries held their first summit in Yekaterinburg, and issued a declaration calling for the establishment of an equitable, democratic and multipolar world order. Since then they have met in Brasília in 2010 and will meet in China in 2011.[4]

South Africa sought BRIC membership over 2010 and the process for formal admission began as early as August 2010.[5] South Africa was officially admitted as a BRIC nation on December 24, 2010 after being invited by China and the other BRIC countries to join the group.[5] The acronym was ammended to BRICS, with the "S" representing "South Africa". President Jacob Zuma is expected to attend the BRICS summit in Beijing in April 2011 as a full member. South Africa stands at a unique position to influence African economic growth and investment. According to Jim O'Neill of Goldman Sachs who originally coined the term, Africa's combined current gross domestic product is reasonably similar to that of Brazil and Russia, and slightly above that of India.[6] South Africa is a "gateway" to Southern Africa and Africa in general as the most developed African country.[6] China is South Africa’s largest trading partner, and India wants to increase commercial ties to Africa.[5] South Africa is also Africa’s largest economy, but as number 31 in global GDP economies it is far behind its new partners.[5]

Jim O'Neill expressed surprise when South Africa joined BRIC since South Africa's economy is a quarter of the size of Russia's (the least economically powerful BRIC nation).[7] He believed that the potential was there but did not anticipate inclusion of South Africa at this stage.[6] Martyn Davies, a South African emerging markets expert, argued that the decision to invite South Africa made little commercial sense but was politically astute given China's attempts to establish a foothold in Africa. Further, South Africa's inclusion in BRICS may translate to greater South African support for China in global fora.[7]

African credentials are important geopolitically, giving BRICS a four-continent breadth, influence and trade opportunities.[5] South Africa's addition is a deft political move that further enhances BRICS’ power and status.[5] In the original essay that coined the term, Goldman Sachs did not argue that the BRICs would organize themselves into an economic bloc, or a formal trading association which this move signifies.[8]

By 2010 BRICS countries collectively combined economy output accounted for 18 percent of the total global economy output and is expected to pass the G-7's output by 2035.[9]

-

São Paulo, Brazil

-

Moscow, Russia

-

Mumbai, India

-

Shanghai, China

-

Johannesburg, South Africa

Member countries

[edit]| Member | Leader | Finance Minister | Central Bank Governor | GDP (nominal·PPP) $Million USD |

GDP per capita (nominal·PPP) $USD |

HDI | Population | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| President | Dilma Rousseff | Minister of Finance | Guido Mantega | Alexandre Tombini | 2,023,518 | 2,181,677 | 10,471 | 11,289 | 0.699 | 193,088,765 | |

| President | Dmitry Medvedev | Minister of Finance | Alexei Leonidovich Kudrin | Sergey Mikhaylovich Ignatyev | 1,476,912 | 2,218,764 | 10,521 | 15,807 | 0.719 | 141,927,297 | |

| Prime Minister | Manmohan Singh | Minister of Finance | Pranab Mukherjee | Duvvuri Subbarao | 1,430,020 | 4,001,103 | 1,176 | 3,290 | 0.519 | 1,180,251,000 | |

| President | Hu Jintao | Minister of Finance | Xie Xuren | Zhou Xiaochuan | 5,878,257 | 10,085,708 | 4,382 | 7,518 | 0.663 | 1,338,612,968 | |

| President | Jacob Zuma | Minister of Finance | Pravin Gordhan | Gill Marcus | 354,414 | 524,341 | 7,101 | 10,505 | 0.597 | 49,320,500 | |

Summits

[edit]| Summit | Participant | Date | Host country | Host leader | Location |

|---|---|---|---|---|---|

| 1st | BRIC | June 16, 2009 | Dmitry Medvedev | Yekaterinburg | |

| 2nd | BRIC | April 16, 2010 | Luiz Inácio Lula da Silva | Brasília | |

| 3rd | BRICS | April 14, 2011 | Hu Jintao | Sanya | |

| 4th | BRICS | 2012 | Manmohan Singh | New Delhi |

BRIC summits

[edit]

The BRIC countries met for their first official summit on 16 June 2009, in Yekaterinburg, Russia,[10] with Luiz Inácio Lula da Silva, Dmitry Medvedev, Manmohan Singh, and Hu Jintao, the respective leaders of Brazil, Russia, India and China, all attending.[11] The core focus of the summit was related to improving the current global economic situation and discussing how the four countries can better work together in the future, as well as a more general push to reform financial institutions.[10][11] There was also discussion surrounding how developing nations, such as those members of BRIC, could be better involved in global affairs in the future.[11] In the aftermath of the summit the BRIC nations suggested that there was a need for a new global reserve currency that is 'diversified, stable and predictable'.[12] The statement that was released stopped short of making a direct attack on the perceived 'dominance' of the US dollar, something which the Russians have been critical of; however, it still led to a fall in the value of the dollar against other major currencies.[13]

The foreign ministers of the BRIC countries had met previously on May 16, 2008 also in Yekaterinburg.[14]

One week prior to the summit, Brazil offered $10 billion to the International Monetary Fund.[15] It was the first time that the country had ever made such a loan.[15] Brazil had previously received loans from the IMF and this announcement was treated as a significant demonstration of how Brazil's economic position had changed.[15] China also announced plans to invest a total of $50.1 billion and Russia planned to invest $10 billion.[15]

BRICS summits

[edit]South Africa will attend the summit for the first time in 2011 in Sanya, Hainan province which may be renamed as BRICS, after receiving a formal invitation from China in 2010.[14][16][17]

International law

[edit]Brazilian lawyer and author Adler Martins has published the article "Contratos Internacionais entre os países do BRIC"[18] (International agreements among BRIC countries) which highlights that the international conventions ratified by the BRICS countries would allow them to maintain trade and investment activities safely within the group. Mr. Martin's study is being further developed by the Federal University of Minas Gerais State (UFMG[19]), in Brazil.

Proposed inclusions

[edit]Mexico and South Korea are currently the world's 13th and 15th largest by nominal GDP,[20] just behind the BRIC and G7 economies, while both are experiencing rapid GDP growth of 5% every year, a figure comparable to Brazil from the original BRICs. Jim O'Neill, expert from the same bank and creator of the economic thesis, stated that in 2001 when the paper was created, it did not consider Mexico, but today it has been included because the country is experiencing the same factors that the other countries first included present.[21][22] While South Korea was not originally included in the BRICs, recent solid economic growth led to Goldman Sachs proposing to add Mexico and South Korea to the BRICs, changing the acronym to BRIMCK, with Jim O'Neill pointing out that Korea "is better placed than most others to realize its potential due to its growth-supportive fundamentals.[23]

A Goldman Sachs paper published later in December 2005 explained why Mexico and South Korea weren't included in the original BRICs. According to the paper,[24] among the other countries they looked at, only Mexico and South Korea have the potential to rival the BRICs, but they are economies that they decided to exclude initially because they looked to them as already more developed. However, due to the popularity of the Goldman Sachs thesis, "BRIMC" and "BRICK" are becoming more generic marketing terms to refer to these six countries.

In their paper "BRICs and Beyond", Goldman Sachs stated that "Mexico, the four BRIC countries and South Korea should not be really thought of as emerging markets in the classical sense", adding that they are a "critical part of the modern globalised economy" and "just as central to its functioning as the current G7".[25]

The term is primarily used in the economic and financial spheres as well as in academia. Its usage has grown specially in the investment sector, where it is used to refer to the bonds emitted by these emerging markets governments.[26][27][28]

Mexico

[edit]Primarily, along with the BRICs,[29] Goldman Sachs argues that the economic potential of Brazil, Russia, India, Mexico and China is such that they may become (with the USA) the six most dominant economies by the year 2050. Due to Mexico's rapidly advancing infrastructure, increasing middle class and rapidly declining poverty rates it is expected to have a higher GDP per capita than all but three European countries by 2050, this new found local wealth also contributes to the nation's economy by creating a large domestic consumer market which in turn creates more jobs.

| GDP in USD | $9.340 trillion |

| GDP per capita | $63,149 |

| GDP growth (2015–2050) | 4.0% |

| Total population | 142 million |

South Korea

[edit]South Korea is by far the most highly developed country when compared to the BRICs and N-11s, with a GDP per capita higher than Italy and Spain and HDI higher than Switzerland, France and the United Kingdom. Yet, it has been achieving growth rates of 4-6%, a figure more than double that of other advanced economies. More importantly, it has a significantly higher Growth Environment Score (Goldman Sachs' way of measuring the long-term sustainability of growth) than all of the BRICs or N-11s.[25] Commentators such as William Pesek Jr. from Bloomberg argue that Korea is "Another 'BRIC' in Global Wall", suggesting that it stands out from the Next Eleven economies. By GDP (PPP), South Korea already overtook a G7 and G8 economy, Canada, in 2009. It then surpassed Spain in 2010 and at current speed, will take over Italy before 2018.[31] Economists from other investment firms argue that Korea will have a GDP per capita of over $96,000 by 2050, surpassing the United States and by far the wealthiest among the G7, BRIC and N-11 economies, suggesting that wealth is more important than size for bond investors, stating that Korea's credit rating will be rated AAA sooner than 2050.[32]

| GDP in USD | $6.056 trillion | $4.073 trillion | $1.982 trillion |

| GDP per capita | $86,000 | $96,000 | $70,000 |

| GDP growth (2015–2050) | 4.8% | 3.9% | 11.4% |

| Total population | 71 million | 42 million | 28 million |

United Korea

[edit]In September 2009, Goldman Sachs published its 188th Global Economics Paper titled "A United Korea?" which highlighted in detail the potential economic power of a United Korea, which will surpass all current G7 countries except the United States, such as Japan, the United Kingdom, Germany and France within 30–40 years of reunification, estimating GDP to surpass $6 trillion by 2050.[34] The young, skilled labor-force and the extensive natural resources of the North combined with advanced technology, infrastructure and the large amount of capital in the South, as well as Korea's strategic location connecting three economic powers, could fuel an economy larger than the bulk of the G7. According to some opinions, a reunited Korea could occur before 2050,[34] or even between 2010 and 2020.[35] If it occurred, Korean reunification would immediately create a single country of over 70 million.[36]

See also

[edit]- Potential superpower

- Emerging markets

- Next Eleven

- Emerging and Growth-Leading Economies

- North American Union

- CIVETS

- G8

- G20

- BASIC countries + Russia = BASICR

- PIGS (economics)

References

[edit]- ^ S. Africa Joins; BRIC Now BRICS, April 13, 2011

- ^ BRICS Gain Global Influence as South Africa Joins, President of Russia Medvedev, April 13, 2011

- ^ Emerging Bloc Adds South Africa, April 13, 2011

- ^ Halpin, Tony (2009-06-17). "Brazil, Russia, India and China form bloc to challenge US dominance". The Times, 17 June 2009. Retrieved from http://www.timesonline.co.uk/tol/news/world/us_and_americas/article6514737.ece.

- ^ a b c d e f Graceffo, Antonio (2011-01-21). "BRIC Becomes BRICS: Changes on the Geopolitical Chessboard". Foreign Policy Journal. Retrieved 2011-04-14.

- ^ a b c "How Africa can become the next Bric". Ft.com. 2010-08-26. Retrieved 2011-04-14.

- ^ a b "South Africa | Economy | BRIC". Globalpost.com. 2011-01-08. Retrieved 2011-04-14.

- ^ http://en.wikipedia/BRIC

- ^ MacKinnon, Mark. "Best not to ignore growing weight of BRICS". The Globe and Mail. Retrieved 2011-04-14.

- ^ a b "First summit for emerging giants". BBC News. 2009-06-16. Retrieved 2009-06-16.

- ^ a b c Bryanski, Gleb (2009-06-26). "BRIC demands more clout, steers clear of dollar talk". Reuters. Retrieved 2009-06-16.

- ^ "BRIC wants more influence". Euronews. Retrieved 2009-06-16.

- ^ "Dollar slides after Russia comments, BRIC summit". London: Guardian. 2009-06-16. Retrieved 2009-06-16.

- ^ a b "South Africa joins BRIC as full member". News.xinhuanet.com. 2010-12-24. Retrieved 2011-04-14.

- ^ a b c d Duffy, Gary (2009-06-11). "Brazil to make $10bn loan to IMF". BBC News. Retrieved 2009-06-11.

- ^ "BRICS countries need to further enhance coordination: Manmohan Singh". Times Of India. 2011-04-12. Retrieved 2011-04-14.

- ^ "BRICS should coordinate in key areas of development: PM". Indianexpress.com. 2011-04-10. Retrieved 2011-04-14.

- ^ MARTINS, Adler. Available at http://jus.uol.com.br/revista/texto/17419/contratos-internacionais-entre-os-paises-do-bric

- ^ "UFMG - Universidade Federal de Minas Gerais". Ufmg.br. Retrieved 2011-04-14.

- ^ See List of countries by GDP (nominal)

- ^ Le Figaro, newspaper, interview with expert Jim 0'Neill (in French)

- ^ "Opinion Page" (PDF). Retrieved 2010-10-15.

- ^ Pesek, William (2005-12-08). "South Korea, Another `BRIC' in Global Wall: William Pesek Jr". Bloomberg. Retrieved 2010-10-15.

- ^ "How Solid are the BRICs?" (PDF). Global Economics. Retrieved 2010-09-21.

- ^ a b http://www2.goldmansachs.com/ideas/brics/book/BRIC-Full.pdf

- ^ Correio Da Manha, newspaper[dead link]

- ^ Business Standard, "Emerging risk and return"[dead link]

- ^ Company News Group, "L'oreal, first quarter sales report"[dead link]

- ^ "BRIC thesis Goldman Sachs Investment Bank, "BRIC"" (PDF). Gs.com. Retrieved 2010-10-15.

- ^ Global Economics Paper No: 153 The N-11m: More Than an Acronym, March 28, 2007.

- ^ List of countries by future GDP (PPP) estimates

- ^ http://www.strattonstreetcapital.com/abf/reports/a%20pile%20of%20brics.pdf

- ^ "Global Economics Paper No: 188 "A United Korea?"" (PDF). Retrieved 2010-10-15.

- ^ a b "Unified Korea to Exceed G7 in 2050". Koreatimes.co.kr. 2009-09-21. Retrieved 2010-10-15.

- ^ "Questia Online Library". Questia.com. Retrieved 2010-10-15.

- ^ List of countries by population

Bibliography

[edit]- Elder, Miriam, and Leahy, Joe, et al., Who's who: Bric leaders take their place at the top table, Financial Times, London, September 25, 2008

- O'Neill, Jim, BRICs could point the way out of the Economic Mire, Financial Times, London, September 23, 2008, p. 28.

- Mark Kobayashi-Hillary, 'Building a Future with BRICs: The Next Decade for Offshoring' (Nov 2007). ISBN 978-3-540-46453-2.

- J. Vercueil, Les pays émergents. Brésil-Russie-Inde-Chine... Mutations économiques et nouveaux défis (Emerging Countries. Brazil - Russia - India - China... Economic Transformations and new Challenges) (in French), Paris : Bréal, 2010, 207 p. ISBN 978-2-7495-0957-0