Rust Belt

The Rust Belt, formerly the Steel Belt, is an area of industrial decline in the United States. From the late 19th century to late 20th century, the region formed the industrial heartland of the country, with its economies largely based on automobile and steel production, coal mining, and processing of raw materials. The term "Rust Belt" is a dysphemism to describe an industry that has "rusted out", referring to the impact of deindustrialization, economic decline, population loss, and urban decay which is attributable to an area's shrinking industrial sector. The term gained popularity in the U.S. beginning in the 1980s[1] when it was commonly contrasted with the Sun Belt, which was then surging. Common definitions of the region stretch from Upstate New York and western Pennsylvania to southeastern Wisconsin and northern Illinois, including large parts of Ohio, Indiana, and Michigan. Some definitions of the Rust Belt also include parts of Iowa, Kentucky, Maryland, Minnesota, Missouri, New Jersey and West Virginia. Much of the Rust Belt is synonymous with the Great Lakes region of the United States.

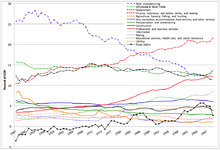

The Rust Belt experienced industrial decline starting in the 1950s and 1960s,[2] with manufacturing peaking as a percentage of the U.S. GDP in 1953 and declining ever since. Demand for coal declined as industry turned to oil and natural gas, and American steel was undercut by German and Japanese firms. High labor costs encouraged companies to move production to the Sun Belt or overseas. The American automotive industry declined as consumers turned to fuel-efficient, imported vehicles after the 1973 oil crisis raised the cost of gasoline, and when foreign manufacturers opened factories in the United States, they largely avoided the strongly unionized Rust Belt. Families moved away, leaving cities with falling tax revenues, declining infrastructure, and abandoned buildings. Notable cities in the Rust Belt include Baltimore, Buffalo, Chicago, Cincinnati, Cleveland, Detroit, Milwaukee, Philadelphia, Pittsburgh, Rochester, and St. Louis.[3]

New England was also hit hard by industrial decline, but cities closer to the East Coast, including in the Boston, New York, and Washington metropolitan areas, adapted by diversifying or transforming their economies to shift focus towards services, advanced manufacturing, and high-tech industries.[4]

Since the 1980s, presidential candidates have devoted much of their time to the economic concerns of the Rust Belt region, which includes several populous swing states, including Michigan, Ohio, Pennsylvania, and Wisconsin. These states were crucial to Donald Trump's victory in the 2016 and 2024 presidential elections, as well as his defeat by Democrat Joe Biden in 2020.[5]

Background

[edit]

In the 20th century, local economies in these states specialized in large-scale manufacturing of finished medium to heavy industrial and consumer products, as well as the transportation and processing of the raw materials required for heavy industry.[6] The area was referred to as the Manufacturing Belt,[7] Factory Belt, or Steel Belt as distinct from the agricultural Midwestern states forming the so-called Corn Belt and Great Plains states that are often called the "breadbasket of America".[8]

The flourishing industrial manufacturing in the region was caused in part by the proximity to the Great Lakes waterways, and abundance of paved roads, water canals, and railroads. After the transportation infrastructure linked the iron ore found in the so-called Iron Range of northern Minnesota, Wisconsin and Upper Michigan with the coking coal mined from the Appalachian Basin in Western Pennsylvania and Western Virginia, the Steel Belt was born. Soon it developed into the Factory Belt with its manufacturing cities: Chicago, Buffalo, Detroit, Milwaukee, Cincinnati, Toledo, Cleveland, St. Louis, Youngstown, and Pittsburgh, among others. This region for decades served as a magnet for immigrants from Austria-Hungary, Poland, and Russia, as well as Yugoslavia, Italy, and the Levant in some areas, who provided the industrial facilities with inexpensive labor.[9] These migrants drawn by labor were also accompanied by African Americans during the Great Migration who were drawn by jobs and better economic opportunity.

Following several "boom" periods from the late-19th to the mid-20th century, cities in this area struggled to adapt to a variety of adverse economic and social conditions. From 1979 to 1982, known as the Volcker shock,[10][11] the U.S. Federal Reserve decided to raise the base interest rate in the United States to 19%. High-interest rates attracted wealthy foreign "hot money" into U.S. banks and caused the U.S. dollar to appreciate. This made U.S. products more expensive for foreigners to buy and also made imports much cheaper for Americans to purchase. The misaligned exchange rate was not rectified until 1986, by which time Japanese imports, in particular, had made rapid inroads into U.S. markets.[12]

From 1987 to 1999, the U.S. stock market went into a stratospheric rise, and this continued to pull wealthy foreign money into U.S. banks, which biased the exchange rate against manufactured goods. Related issues include the decline of the iron and steel industry, the movement of manufacturing to the southeastern states with their lower labor costs,[13] the layoffs due to the rise of automation in industrial processes, the decreased need for labor in making steel products, new organizational methods such as just-in-time manufacturing which allowed factories to maintain production with fewer workers, the internationalization of American business, and the liberalization of foreign trade policies due to globalization.[14] Cities struggling with these conditions shared several difficulties, including population loss, lack of education, declining tax revenues, high unemployment and crime, drugs, swelling welfare rolls, deficit spending, and poor municipal credit ratings.[15][16][17][18][19]

Geography

[edit]

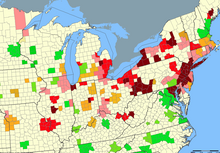

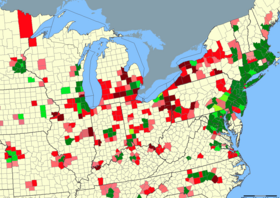

Since the term "Rust Belt" is used to refer to a set of economic and social conditions rather than to an overall geographical region of the U.S., the Rust Belt has no precise boundaries. The extent to which a community may have been described as a "Rust Belt city" depends on how great a role industrial manufacturing played in its local economy in the past and how it does now, as well as on perceptions of the economic viability and living standards of the present day.[citation needed]

News media occasionally refer to a patchwork of defunct centers of heavy industry and manufacturing across the Great Lakes and Midwestern United States as the snow belt,[21] the manufacturing belt, or the factory belt because of their vibrant industrial economies in the past. This includes most of the cities of the Midwest as far west as the Mississippi River, including St. Louis, and many of those in the Great Lakes and Northern New York.[22] At the center of this expanse lies an area stretching from northern Indiana and southern Michigan in the west to Upstate New York in the east, where local tax revenues as of 2004[update] relied more heavily on manufacturing than on any other sector.[23][24]

Prior to World War II, the cities in the Rust Belt region were among the largest in the U.S. However, by the 20th century's end their population had fallen the most in the country.[25]

History

[edit]

The linking of the former Northwest Territory with the once-rapidly industrializing East Coast was effected through several large-scale infrastructural projects, most notably the Erie Canal in 1825, the Baltimore and Ohio Railroad in 1830, the Allegheny Portage Railroad in 1834, and the consolidation of the New York Central Railroad following the end of the American Civil War in 1875. A gate was opened between a variety of burgeoning industries on the interior North American continent and the markets of large East Coast cities and Western Europe.[27]

Coal, iron ore, and other raw materials were shipped in from surrounding regions which emerged as major ports on the Great Lakes and served as transportation hubs for the region with proximity to railroad lines. Coming in the other direction were millions of European immigrants, who populated the cities along the Great Lakes shores with then-unprecedented speed. Chicago was a rural trading post in the 1840s but grew to be as big as Paris by the time of the 1893 Columbian Exposition.[27]

Early signs of the difficulty in the northern states were evident early in the 20th century before the "boom years" were even over. Lowell, Massachusetts, once the center of textile production in the U.S., was described in the magazine Harper's as a "depressed industrial desert" as early as 1931,[28] as its textile concerns were being uprooted and sent southward, primarily to the Carolinas.

In the first half of the 20th century, the Great Depression followed by American entry into World War II was followed by a rapid return to economic growth, during which much of the industrial North reached its peak population and industrial output.

The northern cities experienced changes that followed the end of World War II, with the onset of the outward migration of residents to newer suburban communities,[29] and the declining role of manufacturing in the American economy.

Outsourcing of manufacturing jobs in tradeable goods has been an important issue in the region. One source has been globalization and the expansion of worldwide free trade agreements. Anti-globalization groups argue that trade with developing countries has resulted in stiff competition from countries such as China which pegs its currency to the dollar and has much lower prevailing wages, forcing domestic wages to drift downward. Some economists are concerned that long-run effects of high trade deficits and outsourcing are a cause of economic problems in the U.S.[30] with high external debt (amount owed to foreign lenders) and a serious deterioration in the United States net international investment position (NIIP) (−24% of GDP).[26][31][32]

Some economists contend that the U.S. is borrowing to fund consumption of imports while accumulating unsustainable amounts of debt.[26][32] On June 26, 2009, Jeff Immelt, CEO of General Electric, called for the U.S. to increase its manufacturing base employment to 20% of the workforce, commenting that the U.S. has outsourced too much in some areas and can no longer rely on the financial sector and consumer spending to drive demand.[33]

Since the 1960s, the expansion of worldwide free trade agreements have been less favorable to U.S. workers. Imported goods such as steel cost much less to produce in Third World countries with cheap foreign labor (see steel crisis). The introduction of pollution regulation in the late 1960's, combined with rapidly increasing U.S. energy costs (see 1970s energy crisis) caused much U.S. heavy industry to begin moving to other countries. Beginning with the recession of 1970–71, a new pattern of deindustrializing economy emerged. Competitive devaluation combined with each successive downturn saw traditional U.S. manufacturing workers experiencing lay-offs. In general, in the Factory Belt employment in the manufacturing sector declined by 32.9% between 1969 and 1996.[34]

Wealth-producing primary and secondary sector jobs such as those in manufacturing and computer software were often replaced by much-lower-paying wealth-consuming jobs such as those in retail and government in the service sector when the economy recovered.[35]

In 1984, an incremental expansion of the U.S. trade deficit with China began combined with growing trade deficits with Japan, South Korea, and Taiwan. As a result, the traditional manufacturing workers in the region have experienced economic upheaval. This effect has devastated government budgets across the U.S. and increased corporate borrowing to fund retiree benefits.[31][32] Some economists believe that GDP and employment can be dragged down by large long-run trade deficits.[35]

Free trade, deindustrialization and wage deflation

[edit]

In early 2017, Joseph Stiglitz wrote that "the American middle class is indeed the loser of globalization or free trade" (the diminution of international trade regulations as well as tariffs, taxes) and "China, with its large emerging middle class, is among the big beneficiaries of globalization". "Thanks to globalization, in terms of purchasing-power parity, China actually has already become the largest economy in the world in September 2015".[37]

Studies by David Autor, David Dorn and Gordon Hanson show that free trade with China cost Americans around one million manufacturing workers between 1991 and 2007.Competition from Chinese imports has led to manufacturing job losses and declining wages. They also found that offsetting job gains in other industries never materialized. Closed companies no longer order goods and services from local non-manufacturing firms and former industrial workers may be unemployed for years or permanently. Increased import exposure reduces wages in the non-manufacturing sector due to lower demand for non-manufacturing goods and increased labor supply from workers who have lost their manufacturing jobs. Other work by this team of economists, with Daron Acemoglu and Brendan Price, estimates that competition from Chinese imports cost the U.S. as many as 2.4 million jobs in total between 1999 and 2011.[38][39]

Avraham Ebenstein, Margaret McMillan, Ann Harrison also pointed out in their article “Why are American Workers getting Poorer? China, Trade and Offshoring” these negative effects of trade with China on American workers.[40]

The Economic Policy Institute, a left-leaning think tank, has claimed that free trade created a large trade deficit in the United States for decades which lead to the closure of many factories and cost the United States millions of jobs in the manufacturing sector. Trade deficits lead to significant wage losses, not only for workers in the manufacturing sector, but also for all workers throughout the economy who do not have a university degree. For example, in 2011, 100 million full-time, full-year workers without a university degree suffered an average loss of $1,800 (~$2,438 in 2023) on their annual salary.[41][42] According to the Economic Policy Institute, the workers who lost their jobs in the manufacturing sector and who have to accept a reduction in their wages to find work in other sectors, are creating competition, that reduces the wages of workers already employed in these other sectors. The threat of offshoring of production facilities leads workers to accept wage cuts to keep their jobs.[42]

According to the Economic Policy Institute, trade agreements have not reduced trade deficits but rather increased them. The growing trade deficit with China comes from China's manipulation of its currency, dumping policies, subsidies, trade barriers that give it a very important advantage in international trade. In addition, industrial jobs lost by imports from China are significantly better paid than jobs created by exports to China. So even if imports were equal to exports, workers would still lose out on their wages.[43]

According to the Economic Policy Institute, the manufacturing sector is a sector with very high productivity growth, which promotes high wages and good benefits for its workers. Indeed, this sector accounts for more than two thirds of private sector research and development and employs more than twice as many scientists and engineers as the rest of the economy. The manufacturing sector therefore provides a very important stimulus to overall economic growth. Manufacturing is also associated with well-paid service jobs such as accounting, business management, research and development and legal services. Deindustrialisation is therefore also leading to a significant loss of these service jobs. Deindustrialization thus means the disappearance of a very important driver of economic growth.[43]

In 2010, Paul Krugman called for a general tariff rate of 25% on all Chinese products to halt the deindustrialization of the United States and the offshoring of American industries and factories to China. Paul Krugman notes that the trade deficit caused by free trade has been detrimental to the U.S. manufacturing sector: “There is no doubt that increased imports, particularly from China, have reduced manufacturing employment..., the complete elimination of the U.S. manufacturing trade deficit would add about two million manufacturing jobs. [44][45].In 2010, he expects Chinese surpluses to destroy 1.4 million American jobs by 2011. He therefore proposes taxing the products of certain countries to force them to readjust their currencies. He calls for a general rate of 25% on Chinese products[46][47][48].

In 2010, Krugman wrote that China pursues a mercantilist and predatory policy, leading to massive deindustrialization of the United States. He says it keeps its currency undervalued to accumulate trade surpluses using capital flow controls. The Chinese government sells renminbi and buys foreign currency to keep the renminbi low, giving China's manufacturing sector a cost advantage over its competitors. China's surpluses drain US demand, destroy US industry and slow economic recovery in other countries with which China trades. He notes that trade deficits impoverish the United States and pose a threat. Krugman writes: “This is the most distorted exchange rate policy any major nation has ever followed”. He notes that an undervalued renminbi is tantamount to high tariffs or export subsidies. A cheaper currency improves employment and competitiveness, as it makes imports more expensive while making domestic products more attractive [49] [50] [51][52][53] [54][55][56].

Krugman notes that free trade leads to trade deficits, deindustrialization and lower real wages for less-educated workers due to competition from low-cost imports. Indeed, wages are falling more than import prices, and the problem is getting worse as trade with low-wage countries becomes more frequent[57]. He also notes that free trade has a significant effect on deindustrialization and income inequality in developed countries [58].

Outcomes

[edit]

In 1999, Francis Fukuyama wrote that the social and cultural consequences of deindustrialization and manufacturing decline that turned a former thriving Factory Belt into a Rust Belt as a part of a bigger transitional trend that he called the Great Disruption:[59] "People associate the information age with the advent of the Internet in the 1990s, but the shift from the industrial era started more than a generation earlier, with the deindustrialization of the Rust Belt in the United States and comparable movements away from manufacturing in other industrialized countries. … The decline is readily measurable in statistics on crime, fatherless children, broken trust, reduced opportunities for and outcomes from education, and the like".[60]

Problems associated with the Rust Belt persist even today, particularly around the eastern Great Lakes states, and many once-booming manufacturing metropolises dramatically slowed down.[61] From 1970 to 2006, Cleveland, Detroit, Buffalo, and Pittsburgh lost about 45% of their population and median household incomes fell: in Cleveland and Detroit by about 30%, in Buffalo by 20%, and Pittsburgh by 10%.[62]

During the mid-1990s, several Rust Belt metropolitan areas experienced a suspension in negative growth, indicated by stabilizing unemployment, wages, and populations.[63] During the first decade of the 21st century, however, a negative trend still persisted: Detroit, Michigan lost 25.7% of its population; Gary, Indiana, 22%; Youngstown, Ohio, 18.9%; Flint, Michigan, 18.7%; and Cleveland, Ohio, 14.5%.[64]

| City | State | Population | |||

|---|---|---|---|---|---|

| change | 2020[65] | 2000 | Peak | ||

| Detroit, Michigan | Michigan | -32.81% | 639,111 | 951,270 | 1,849,568 (1950) |

| Gary, Indiana | Indiana | -31.97% | 69,903 | 102,746 | 178,320 (1960) |

| Flint, Michigan | Michigan | -34.97% | 81,252 | 124,943 | 196,940 (1960) |

| Saginaw, Michigan | Michigan | -28.47% | 44,202 | 61,799 | 98,265 (1960) |

| Youngstown, Ohio | Ohio | -26.77% | 60,068 | 82,026 | 170,002 (1930) |

| Cleveland, Ohio | Ohio | -22.11% | 372,624 | 478,403 | 914,808 (1950) |

| Dayton, Ohio | Ohio | -17.17% | 137,644 | 166,179 | 262,332 (1960) |

| Niagara Falls, New York | New York | -12.45% | 48,671 | 55,593 | 102,394 (1960) |

| Baltimore, Maryland | Maryland | -5.7% | 585,708 | 620,961 | 949,708 (1950) |

| St. Louis, Missouri | Missouri | -13.39% | 301,578 | 348,189 | 856,796 (1950) |

| Decatur, Illinois | Illinois | -13.85% | 70,522 | 81,860 | 94,081 (1980) |

| Canton, Ohio | Ohio | -12.29% | 70,872 | 80,806 | 116,912 (1950) |

| Buffalo, New York | New York | -4.89% | 278,349 | 292,648 | 580,132 (1950) |

| Toledo, Ohio | Ohio | -13.63% | 270,871 | 313,619 | 383,818 (1970) |

| Lakewood, Ohio | Ohio | -10.07% | 50,942 | 56,646 | 70,509 (1930) |

| Pittsburgh, Pennsylvania | Pennsylvania | -9.44% | 302,971 | 334,563 | 676,806 (1950) |

| Pontiac, Michigan | Michigan | -7.13% | 61,606 | 66,337 | 85,279 (1970) |

| Springfield, Ohio | Ohio | -10.25% | 58,662 | 65,358 | 82,723 (1960) |

| Akron, Ohio | Ohio | -12.26% | 190,469 | 217,074 | 290,351 (1960) |

| Hammond, Indiana | Indiana | -6.22% | 77,879 | 83,048 | 111,698 (1960) |

| Cincinnati, Ohio | Ohio | -6.63% | 309,317 | 331,285 | 503,998 (1950) |

| Parma, Ohio | Ohio | -5.26% | 81,146 | 85,655 | 100,216 (1970) |

| Lorain, Ohio | Ohio | -6.74% | 64,028 | 68,652 | 78,185 (1970) |

| Chicago, Illinois | Illinois | -5.17% | 2,746,388 | 2,896,016 | 3,620,962 (1950) |

| South Bend, Indiana | Indiana | -4.02% | 103,453 | 107,789 | 132,445 (1960) |

| Charleston, West Virginia | West Virginia | -8.53% | 48,864 | 53,421 | 85,796 (1960) |

In the late 2000s, American manufacturing recovered faster from the Great Recession of 2008 than the other sectors of the economy,[66] and a number of initiatives, both public and private, are encouraging the development of alternative fuel, nano and other technologies.[67]

Along with the neighboring Golden Horseshoe of southern Ontario, the Rust Belt composes one of the world's major manufacturing regions.[68][69]

Transformation

[edit]Delving into the past and musing on the future of Rust Belt states, a 2010 Brookings Institution report suggests that the Great Lakes region has a sizable potential for transformation, citing already existing global trade networks, clean energy/low carbon capacity, developed innovation infrastructure, and higher educational network.[70]

Different strategies were proposed in order to reverse the fortunes of the former Factory Belt including building casinos and convention centers, retaining the creative class through arts and downtown renewal, encouraging the knowledge economy type of entrepreneurship, and other steps. This includes growing new industrial base with a pool of skilled labor, rebuilding the infrastructure and infrasystems, creating research and development-focused university-business partnerships, and close cooperation between central, state and local government, and business.[71]

New types of research and development-intensive nontraditional manufacturing have emerged recently in the Rust Belt, including biotechnology, the polymer industry, infotech, and nanotech. Information technology is seen as representing an opportunity for the Rust Belt's revitalization.[72] Among the successful recent examples is the Detroit Aircraft Corporation, which specializes in unmanned aerial systems integration, testing and aerial cinematography services.[73]

In Pittsburgh, robotics research centers and companies such as the National Robotics Engineering Center and Robotics Institute, Aethon Inc., American Robot Corporation, Automatika, Quantapoint, Blue Belt Technologies, and Seegrid are creating state-of-the-art robotic technology applications. Akron, a former "Rubber Capital of the World" that lost 35,000 jobs after major tire and rubber manufacturers Goodrich, Firestone, and General Tire closed their production lines, is now again well known around the world as a center of polymer research with four hundred polymer-related manufacturing and distribution companies operating in the area. The turnaround was accomplished in part by a partnership between Goodyear Tire & Rubber Company, which chose to stay, the University of Akron, and the city mayor's office. The Akron Global Business Accelerator that jump-started a score of successful business ventures in Akron resides in the refurbished B.F. Goodrich tire factory.[74]

Additive manufacturing, or 3D printing, creates another promising avenue for the manufacturing resurgence. Such companies as MakerGear from Beachwood, Ohio, or ExOne Company from North Huntingdon, Pennsylvania, are designing and manufacturing industrial and consumer products using 3-D imaging systems.[75]

In 2013, The Economist reported a growing trend of reshoring, or inshoring, of manufacturing when a growing number of American companies were moving their production facilities from overseas back home.[76] Rust Belt states can ultimately benefit from this process of international insourcing.

There have also been attempts to reinvent properties in the Rust Belt in order to reverse its economic decline. Buildings with compartmentalization unsuitable for today's uses were acquired and renewed to facilitate new businesses. These business activities suggest that the revival is taking place in the once-stagnant area.[77] The CHIPS and Science Act, which became effective in August 2022, was designed to rebuild the manufacturing sector with thousands of jobs and research programs in states like Ohio focusing on making products like semiconductors due to the global chip shortage of the early 2020s.[78]

In popular culture

[edit]The Rust Belt is depicted in various films, television shows, and songs. It is the subject of the popular Billy Joel song, "Allentown," originally released on The Nylon Curtain album in 1982. The song uses Allentown as a metaphor for the resilience of working class Americans in distressed industrial cities during the recession of the early 1980s.

The Rust Belt is the setting for Philipp Meyer's 2009 novel American Rust and its 2021 television adaptation. A core plot device of both is the economic, social, and population decline[79] facing the fictional Western Pennsylvanian town of Buell, itself brought about by thorough de-industrialization typical of the region.[80]

The 21st century evolution of this region of the U.S. is also depicted through the fictional town of New Canaan, Ohio, in Stephen Markley's 2018 bestseller novel, Ohio. The town is described through both the teenage glamour of high school lens in the early 2000s and the harsh reality lens of what the town became 10 years later.

See also

[edit]References

[edit]- ^ Crandall, Robert W. The Continuing Decline of Manufacturing in the Rust Belt. Washington, D.C.: Brookings Institution, 1993.

- ^ "Competition and the Decline of the Rust Belt | Federal Reserve Bank of Minneapolis". Archived from the original on October 11, 2022. Retrieved October 11, 2022.

- ^ "The Rust Belt is the Industrial Heartland of the United States". Archived from the original on June 19, 2024. Retrieved July 25, 2024.

- ^ David Koistinen, Confronting Decline: The Political Economy of Deindustrialization in Twentieth-Century New England (2013)

- ^ Michael McQuarrie (November 8, 2017). "The revolt of the Rust Belt: place and politics in the age of anger". The British Journal of Sociology. 68 (S1): S120–S152. doi:10.1111/1468-4446.12328. PMID 29114874. S2CID 26010609.

- ^ Teaford, Jon C. Cities of the Heartland: The Rise and Fall of the Industrial Midwest. Bloomington: Indiana University Press, 1993.

- ^ Meyer, David R. 1989. "Midwestern Industrialization and the American Manufacturing Belt in the Nineteenth Century." Journal of Economic History 49(4):921–937.

- ^ "Interactives . United States History Map. Fifty States". www.learner.org. Archived from the original on April 4, 2017. Retrieved June 7, 2013.

- ^ , McClelland, Ted. Nothin' but Blue Skies: The Heyday, Hard Times, and Hopes of America's Industrial Heartland. New York: Bloomsbury Press, 2013.

- ^ Wolf, Zachary B. (July 27, 2022). "This kind of shock to the economy will have consequences". CNN. Archived from the original on October 15, 2023. Retrieved October 3, 2023.

- ^ "Volcker Shock: key economic indicators 1979-1987". Statista. October 10, 2022. Archived from the original on October 15, 2023. Retrieved October 3, 2023.

- ^ Marie Christine Duggan (2017). "Deindustrialization in the Granite State: What Keene, New Hampshire Can Tell Us About the Roles of Monetary Policy and Financialization in the Loss of US Manufacturing Jobs". Dollars & Sense. No. November/December 2017. Archived from the original on December 24, 2021. Retrieved March 12, 2018.

- ^ Alder, Simeon, David Lagakos, and Lee Ohanian. (2012). "The Decline of the US Rust Belt: A Macroeconomic Analysis" (PDF). Archived from the original (PDF) on December 3, 2013.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ High, Steven C. Industrial Sunset: The Making of North America's Rust Belt, 1969–1984. Toronto: University of Toronto Press, 2003.

- ^ Jargowsky, Paul A. Poverty and Place: Ghettos, Barrios, and the American City. New York: Russell Sage Foundation, 1997.

- ^ Hagedorn, John M., and Perry Macon. People and Folks: Gangs, Crime and the Underclass in a Rustbelt City. Lake View Press, Chicago, IL, (paperback: ISBN 0-941702-21-9; clothbound: ISBN 0-941702-20-0), 1988.

- ^ "Rust Belt Woes: Steel out, drugs in," The Northwest Florida Daily News, January 16, 2008. PDF Archived April 6, 2016, at the Wayback Machine

- ^ Beeson, Patricia E. "Sources of the decline of manufacturing in large metropolitan areas." Journal of Urban Economics 28, no. 1 (1990): 71–86.

- ^ Higgins, James Jeffrey. Images of the Rust Belt. Kent, Ohio: Kent State University Press, 1999.

- ^ "Who Makes It?". Archived from the original on September 20, 2019. Retrieved November 28, 2011.

- ^ "Sun On The Snow Belt (editorial)". Chicago Tribune. August 25, 1985. Archived from the original on September 22, 2024. Retrieved September 22, 2011.

The Northern states, once the foundry of the nation, are known now as the Rust Belt or the Snow Belt, in invidious comparison to the supposedly booming Sun Belt.

- ^ Neumann, Tracy (2016). Remaking the Rust Belt. University of Pennsylvania Press. ISBN 9780812292893.

- ^ "Measuring Rurality: 2004 County Typology Codes". USDA Economic Research Service. Archived from the original on September 14, 2011. Retrieved September 21, 2011.

- ^ Garreau, Joel. The Nine Nations of North America. Boston: Houghton Mifflin, 1981.

- ^ Hansen, Jeff; et al. (March 10, 2007). "Which Way Forward?". The Birmingham News. Archived from the original on March 4, 2012. Retrieved September 21, 2011.

- ^ a b c Bivens, L. Josh (December 14, 2004). Debt and the dollar Archived December 17, 2004, at the Wayback Machine Economic Policy Institute. Retrieved on June 28, 2009.

- ^ a b Kunstler, James Howard (1996). Home From Nowhere: Remaking Our Everyday World for the 21st Century. New York: Touchstone/Simon and Schuster. ISBN 978-0-684-83737-6.

- ^ Marion, Paul (November 2009). "Timeline of Lowell History From the 1600s to 2009". Yankee Magazine. Archived from the original on March 4, 2016. Retrieved December 27, 2015.

- ^ "1990 Population and Maximum Decennial Census Population of Urban Places Ever Among the 100 Largest Urban Places, Listed Alphabetically by State: 1790–1990". United States Bureau of the Census. Archived from the original on July 18, 2018. Retrieved September 22, 2011.

- ^ Hira, Ron, and Anil Hira with foreword by Lou Dobbs, (May 2005). Outsourcing America: What's Behind Our National Crisis and How We Can Reclaim American Jobs. (AMACOM) American Management Association. Citing Paul Craig Roberts, Paul Samuelson, and Lou Dobbs, pp. 36–38.

- ^ a b Cauchon, Dennis, and John Waggoner (October 3, 2004).The Looming National Benefit Crisis Archived September 29, 2012, at the Wayback Machine. USA Today.

- ^ a b c Phillips, Kevin (2007). Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism. Penguin. ISBN 978-0-14-314328-4.

- ^ Bailey, David and Soyoung Kim (June 26, 2009).GE's Immelt says the U.S. economy needs industrial renewal Archived June 11, 2015, at the Wayback Machine.UK Guardian.. Retrieved on June 28, 2009.

- ^ Kahn, Matthew E. "The silver lining of rust belt manufacturing decline." Journal of Urban Economics 46, no. 3 (1999): 360–376.

- ^ a b David Friedman (Senior Fellow at the New America Foundation). No Light at the End of the Tunnel Archived September 21, 2023, at the Wayback Machine, Los Angeles Times, June 16, 2002.

- ^ https://hbr .org/2016/05/why-the-global-1 and-the-asian-middle-class-have-the-most-from-globalization

- ^ Stiglitz, Joseph E. (February 17, 2017). "Trump's Most Chilling Economic Lie". Vanity Fair.

- ^ https://www.aeaweb.org/articles?id=10.1257/aer.103.6.2121

- ^ https://web.archive.org/web/20210618091001/http://economics.mit.edu/files/9811

- ^ http://www.nber.org/papers/w21027

- ^ "The China toll deepens: Growth in the bilateral trade deficit between 2001 and 2017 cost 3.4 million U.S. jobs, with losses in every state and congressional district". Economic Policy Institute. Archived from the original on January 15, 2020. Retrieved April 26, 2020.

- ^ a b "Using standard models to benchmark the costs of globalization for American workers without a college degree". Economic Policy Institute. Archived from the original on May 8, 2020. Retrieved April 26, 2020.

- ^ a b "Trading away the manufacturing advantage: China trade drives down U.S. wages and benefits and eliminates good jobs for U.S. workers | Economic Policy Institute". Epi.org. Archived from the original on April 18, 2020. Retrieved October 7, 2019.

- ^ https://www.nytimes.com/2016/07/04/opinion/trump-trade-and-workers.html

- ^ https://economistsview.typepad.com/economistsview/2016/07/paul-krugman-trump-trade-and-workers.html

- ^ https://www.nytimes.com/2010/03/15/opinion/15krugman.html?src=me Taking On China

- ^ https://economistsview.typepad.com/economistsview/2010/09/paul-krugman-taking-on-china.html

- ^ https://krugman.blogs.nytimes.com/2009/12/31/macroeconomic-effects-of-chinese-mercantilism/

- ^ https://www.nytimes.com/2010/03/15/opinion/15krugman.html?src=me

- ^ https://krugman.blogs.nytimes.com/2009/12/31/macroeconomic-effects-of-chinese-mercantilism/

- ^ https://www.nytimes.com/2010/01/01/opinion/01krugman.html?mtrref=blogs.worldbank.org&gwh=B3231576E9FD9BDAEC5EBD56EFDCC866&gwt=pay

- ^ https://economistsview.typepad.com/economistsview/2009/12/paul-krugman-chinese-new-year.html

- ^ https://www.nytimes.com/2010/06/25/opinion/25krugman.html?mtrref=www.google.com&gwh=BC216C8BA8F1415F915F9DE7DFDFCCD14CA846&gwt=pay

- ^ https://economistsview.typepad.com/economistsview/2010/06/paul-krugman-the-renminbi-runaround.html

- ^ https://www.nytimes.com/2010/09/13/opinion/13krugman.html?mtrref=www.google.com&gwh=24A582538B90C0FDEA00892926110017&gwt=pay

- ^ https://economistsview.typepad.com/economistsview/2010/09/paul-krugman-china-japan-america.html

- ^ https://krugman.blogs.nytimes.com/2007/05/14/notes-on-514-column-divided-over-trade/?mtrref=www.google.com&gwh=F5067A4D1B25F775F7867558981E6D6C&gwt=pay

- ^ https://voxeu.org/article/trade-and-inequality-revisited

- ^ Fukuyama, Francis. The Great Disruption: Human Nature and the Reconstitution of Social Order. New York: Free Press, 1999.

- ^ Francis Fukuyama. The Great Disruption Archived July 15, 2018, at the Wayback Machine, The Atlantic Monthly, May 1999, Volume 283, No. 5, pages 55–80.

- ^ Feyrer, James, Bruce Sacerdote, and Ariel Dora Stern. Did the Rust Belt Become Shiny? A Study of Cities and Counties That Lost Steel and Auto Jobs in the 1980s Archived March 5, 2016, at the Wayback Machine. Brookings-Wharton Papers on Urban Affairs (2007): 41–102.

- ^ Daniel Hartley. "Urban Decline in Rust-Belt Cities." Federal Reserve Bank of Cleveland Economic Commentary, Number 2013-06, May 20, 2013. PDF

- ^ Glenn King. Census Brief: "Rust Belt" Rebounds, CENBR/98-7, Issued December 1998. PDF Archived July 18, 2018, at the Wayback Machine

- ^ "Mark Peters, Jack Nicas. "Rust Belt Reaches for Immigration Tide", The Wall Street Journal, May 13, 2013, A3". Archived from the original on December 27, 2019. Retrieved August 8, 2017.

- ^ "City and Town Population Totals: 2020-2021". United States Census Bureau. Archived from the original on July 11, 2022. Retrieved March 12, 2023.

- ^ "Rustbelt recovery: Against all the odds, American factories are coming back to life. Thank the rest of the world for that". The Economist. March 10, 2011. Archived from the original on July 24, 2017. Retrieved September 21, 2011. PDF Archived June 11, 2017, at the Wayback Machine

- ^ "Greening the rustbelt: In the shadow of the climate bill, the industrial Midwest begins to get ready". The Economist. August 13, 2009. Archived from the original on February 16, 2018. Retrieved September 21, 2011.

- ^ Beyers, William. "Major Manufacturing Regions of the World". Department of Geography, the University of Washington. Archived from the original on December 24, 2021. Retrieved September 21, 2011.

- ^ Rust Belt is still the heart of U.S. manufacturing[permanent dead link]

- ^ John C. Austin, Jennifer Bradley, and Jennifer S. Vey (September 27, 2010). "The Next Economy: Economic Recovery and Transformation in the Great Lakes Region". Brookings Institution Paper. Archived from the original on November 16, 2018. Retrieved May 25, 2020.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Joel Kotkin, March Schill, Ryan Streeter. (February 2012). "Clues From The Past: The Midwest As An Aspirational Region" (PDF). Sagamore Institute. Archived (PDF) from the original on June 1, 2020. Retrieved June 7, 2013.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ Circle, Cheetah Interactive, Paul (May 19, 2013). "Silicon Rust Belt » Rethink The Rust Belt". Archived from the original on August 21, 2018. Retrieved May 29, 2013.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ "ASX – Airspace Experience Technologies – Detroit MI – VTOL". ASX. Archived from the original on June 13, 2020. Retrieved June 23, 2019.

- ^ Sherry Karabin (May 16, 2013). "Mayor says attitude is key to Akron's revitalization". The Akron Legal News. Archived from the original on July 15, 2017. Retrieved June 6, 2013.

- ^ Len Boselovic (June 13, 2013). "Conference in Pittsburgh shows growing allure of 3-D printing". Pittsburgh Post-Gazette. Archived from the original on December 30, 2017. Retrieved May 25, 2020.

- ^ "Coming home: A growing number of American companies are moving their manufacturing back to the United States". The Economist. January 19, 2013. Archived from the original on June 22, 2013. Retrieved June 20, 2013.

- ^ Dayton, Stephen Starr in; Ohio (January 5, 2019). "Rust Belt states reinvent their abandoned industrial landscapes". The Irish Times. Archived from the original on November 7, 2020. Retrieved January 26, 2020.

- ^ "Biden touts computer chips bill in battleground Ohio amid tight Senate race". NBC News. September 9, 2022. Archived from the original on October 10, 2022. Retrieved October 11, 2022.

- ^ "Philipp Meyer". Archived from the original on August 8, 2022. Retrieved August 8, 2022.

- ^ "American Rust (Official Series Site) Watch on Showtime". SHO.com. Archived from the original on August 21, 2022. Retrieved August 8, 2022.

Further reading

[edit]- Broughton, Chad (2015). Boom, Bust, Exodus: The Rust Belt, the Maquilas, and a Tale of Two Cities. Oxford University Press. ISBN 978-0199765614. Archived from the original on September 22, 2024. Retrieved August 24, 2020.

- Cooke, Philip. The Rise of the Rustbelt. London: UCL Press, 1995. ISBN 0-203-13454-0

- Coppola, Alessandro. Apocalypse town: cronache dalla fine della civiltà urbana. Roma: Laterza, 2012. ISBN 9788842098409

- Denison, Daniel R., and Stuart L. Hart. Revival in the rust belt. Ann Arbor, Mich: University of Michigan Press, 1987. ISBN 0-87944-322-7

- Engerman, Stanley L., and Robert E. Gallman. The Cambridge Economic History of the United States: The Twentieth Century. New York: Cambridge University Press, 2000.

- Hagedorn, John, and Perry Macon. People and Folks: Gangs, Crime, and the Underclass in a Rust-Belt City. Chicago: Lake View Press, 1988. ISBN 0-941702-21-9

- High, Steven C. Industrial Sunset: The Making of North America's Rust Belt, 1969–1984. Toronto: University of Toronto Press, 2003. ISBN 0-8020-8528-8

- Higgins, James Jeffrey. Images of the Rust Belt. Kent, Ohio: Kent State University Press, 1999. ISBN 0-87338-626-4

- Lopez, Steven Henry. Reorganizing the Rust Belt: An Inside Study of the American Labor Movement. Berkeley: University of California Press, 2004. ISBN 0-520-23565-7

- Meyer, David R. (1989). "Midwestern Industrialization and the American Manufacturing Belt in the Nineteenth Century". The Journal of Economic History. 49 (4): 921–937. doi:10.1017/S0022050700009505. ISSN 0022-0507. JSTOR 2122744. S2CID 154436086.

- Preston, Richard. American Steel. New York: Avon Books, 1992. ISBN 0-13-029604-X

- Rotella, Carlo. Good with Their Hands: Boxers, Bluesmen, and Other Characters from the Rust Belt. Berkeley: University of California Press, 2002. ISBN 0-520-22562-7

- Teaford, Jon C. Cities of the Heartland: The Rise and Fall of the Industrial Midwest. Bloomington: Indiana University Press, 1993. ISBN 0-253-35786-1

- Warren, Kenneth. The American Steel Industry, 1850–1970: A Geographical Interpretation. Oxford: Clarendon Press, 1973. ISBN 0-8229-3597-X

- Winant, Gabriel. The Next Shift: The Fall of Industry and the Rise of Health Care in Rust Belt America (Harvard University Press, 2021), focus on Pittsburgh

External links

[edit]- Industrial Heartland map and photographs

- Rust Belt map

- Changing Gears Documentary Film Collection Digital Media Repository, Ball State University Libraries

- Collection: "Rust Belt" at the University of Michigan Museum of Art