PIGS (economics)

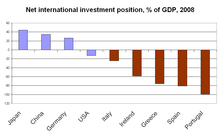

PIGS is a derogatory acronym that has been used to designate the economies of the Southern European countries of Portugal, Italy, Greece, and Spain.[1][2][3][4][5] During the European debt crisis of 2009–14 the variant PIIGS, or GIPSI, was coined to include Ireland. At the time these five EU member states were struggling to refinance their government debt or to bail out over-indebted banks.[6][7][8]

The term originated in the 1990s with the increased integration of the EU economies, and it was often used in reference to the growing debt and economic vulnerability of the Southern European EU countries.[1][3] It was again popularised during the European sovereign-debt crisis of the late 2000s and expanded in use during this period. In the 1990s to late 2000s, Ireland was not included in this term; the country was still in the midst of its "Celtic Tiger" period, with debt significantly below the Eurozone average and a government surplus as late as 2006. However, taking on the guarantee of banks' debt, the Irish government budget deficit rose to 32% of GDP in 2010, which was the world's largest.[9] Ireland then became associated with the term, replacing Italy or changing the acronym to PIIGS,[1][4][5][10] with Italy also indicated as the second "I".[11]

After the crisis started in 2008, Karim Abadir used the term GIPSI to reflect the sequencing he believed would take place.[12] Sometimes, a second G (PIGGS or PIIGGS), for France or the United Kingdom, is added to the acronym.[13][14][15][16][17][18][19]

These terms are widely considered derogatory and their use was curbed by the Financial Times and Barclays Capital in 2010.[1][20][21][22] PIGS is considered a racist framing that was utilized to blame South European populations for the general economic crisis, thereby legitimizing austerity measures and sovereignty losses.[23] GIPSI is deemed even more poignantly racist for its pun on the pejorative English term for the Romani people.[24]

See also

[edit]References

[edit]- ^ a b c d "PIGS slaughtered". Mining Journal. London: Aspermont UK. 21 May 2010. Archived from the original on 27 May 2013. Retrieved 21 August 2012.

With all this uncertainty, an unfortunate acronym is back in fashion (despite being widely considered to be derogatory). PIGS usually refers to the economies of Portugal, Italy, Greece and Spain, and dates back to the 1990s (when it referred generally to the southern economies of the European Union). The currently vulnerable economies of Portugal, Greece and Spain are again being grouped together due to high national budget deficits relative to GDP, and high, or rising, government debt levels. Greece has a government debt to GDP level of 120%, Portugal 90% and Spain 54%. Italy is not suffering to the same extent, and the country's economy returned to growth in the third quarter of 2009. Also, despite a rise in unemployment in March to almost 9%, Italian output has grown rapidly recently. For this reason, Italy is often replaced in the acronym, rather arbitrarily, by Ireland (which, in 2007, became the first eurozone country to enter recession).

- ^ Daniel Vernet (24 April 1997). "L'Allemagne au coeur du débat français". Le Monde.

que l'argot communautaire a affublés d'un sobriquet peu élégant dans sa signification anglaise : « pigs », pour Portugal, Italy, Greece, Spain.

- ^ a b Roberto M. Dainotto (2006), Europe (in Theory), Durham: Duke University Press, p. 2, ISBN 9780822339274,

So, when in 1995 Italy — along with the other southern countries of Portugal, Greece and Spain — finally made it to the borderless Europe, signs of elation were palpable ... The euphoria, however, did not last long. European clerks in Brussels soon started referring to the Giovannios-come-lately with an unflattering acronym: Portugal, Italy, Greece, and Spain — the PIGS, no less, as Lindsay Waters reported.

- ^ a b Sarah Krouse (19 March 2012). "Investing in PIIGS: Portugal". Financial News. Retrieved 21 August 2012.

The acronym "PIGS" was first coined in the 1990s to describe Portugal, Italy, Greece and Spain – four peripheral European Union states with the weakest economies. In 2008, it became PIIGS when Ireland was added after its banking crisis.

- ^ a b John Quiggin (2012), Zombie Economics: How Dead Ideas Still Walk among Us, Princeton University Press, p. 229, ISBN 9781400842087,

The real problem came when this analysis was extended to the rest of the heavily indebted periphery — commonly referred to in such accounts as the PIGS (Portugal, Italy, Greece, and Spain) group. Ireland was sometimes thrown in as a second 'I'. This was unfair and inaccurate, particularly as regards Spain and Ireland, which had been running budget surpluses in the years leading up to the crisis.

- ^ Dawber, Alistair (20 February 2015). "While Greece flails, are the rest of the stricken Pigs taking off?". The Independent. Archived from the original on 2022-05-24.

- ^ "Europe's PIGS: Country by country". BBC News. 11 February 2010. Archived from the original on Jan 31, 2024.

- ^ Kenneth Agutamba (12 July 2015). "Europe's sick 'PIGS' may dampen EAC's monetary union hopes". The New Times Rwanda. Archived from the original on Dec 22, 2017.

- ^ "Ireland". World Factbook. CIA. 22 March 2023. Archived from the original on Feb 16, 2024.

- ^ "An Introduction To The PIIGS", Investopedia.

- ^ "Europe's PIGS: Country by country". BBC News. 11 February 2010. Archived from the original on Jan 31, 2024.

Some analysts use PIIGS to include Italy - Europe's longstanding biggest debtor.

- ^ Abadir, Karim M. (2011-09-30). "Is the economic crisis over (and out)?". Review of Economic Analysis. 3 (2): 102–108. doi:10.15353/rea.v3i2.1457. hdl:10044/1/30058. Archived from the original on Feb 3, 2022.

- ^ Gudrun Hentges; Bettina Lösch (2011). Die Vermessung der sozialen Welt: Neoliberalismus - Extreme Rechte - Migration im Fokus der Debatte. Springer-Verlag. p. 22. ISBN 978-3-531-92756-5.

PIIGGS-Staaten (Portugal, Italien, Irland, Griechenland, Großbritannien, Spanien) gibt einen Hinweis auf Bevorstehendes. Linke Krisenverarbeitungen Die Wahrnehmung dieser dem F inanzmarktkapitalismus innewohnenden neuen ...

- ^ Guido Migliaccio (2013). Squilibri e crisi nelle determinazioni quantitative d'azienda. Il contributo della dottrina italiana. FrancoAngeli. p. 354. ISBN 978-88-204-1460-3.

Da considerare che anche Nazioni diverse dai Paesi PIIGGS hanno dovuto fronteggiare la crisi. [...] ...e poi il Regno Unito con l' acronimo "PIIGGS"

- ^ 김민주; 이정아, 김정원; 이재구 (25 November 2010). 2011 트렌드 키워드. 미래의 창. p. 123. ISBN 978-89-5989-148-1.

김민주, 이정아, 김정원, 이재구 - 2010 - Preview - More editions 김민주, 이정아, 김정원, 이재구. 는 영국(Great Britain)과 아일랜드(Ireland)의 재정 위기도 PIGS 못지 않다고 하여, 두 나라를 더한 PIIGGS라는 말도 나왔다. 2 0 1 1 『 뭄 숀 옌 0 ×

- ^ European Debt Crisis 2011. epubli. 2011-11-02. p. 8. GGKEY:UEDZH7FPXQR.

(65 ) Objections to proposed policies PIGS: Portugal, Italy, Greece and Spain PIIGS: with Ireland PIIGGS: with United Kingdom (Great Britain) The crisis is seen as a justification for imposing fiscal austerity (66 ) on Greece in exchange for ...

- ^ Niels Ruben Ravnaas (2010-05-10). "Banket gjennom giganthjelpen". Na24. Archived from the original on 2011-07-19. Retrieved 2012-04-25.

Disse europeiske landene har i finansverdenen gått under økenavnet PiGS-land (Portugal, Italia, Hellas (Greece) og Spania) siden 1997. Etter at finanskrisen inntraff, og det ble økt fokus på europeiske lands statsfinanser, har også Irland og Storbritannia blitt knyttet til PIGS, noe som gjør at man nå både har samlebetegnelsene PIIGS og PIIGGS.

- ^ S. Gurumurthy (May 26, 2010), "Too small is 'too big' to fail", The Hindu, retrieved 19 August 2012,

Unlike in 2008, now it is no more just PIGS that drag the EU down. The PIGS club has now expanded, with Ireland first, and France next, as the newly qualified members of the PIGS, making it PIIGGS (adding another 'I', for Ireland and another 'G', for Gual (France)).

- ^ Matthew Sparke (5 December 2012). Introducing Globalization: Ties, Tensions, and Uneven Integration. John Wiley & Sons. p. 261. ISBN 978-1-118-24110-3.

an acronym which in a further sign of contagion concerns among financial commentators grew to include Ireland, with PIIGGS, and further still to register the debt-binging United States itself in PIG IS US).

- ^ James Mackintosh (5 February 2010). "STUPID investors in PIGS". Blogs Financial Times.

It isn't just touchy government ministers in Portugal, Italy, Ireland Greece and Spain who don't like the highly appropriate acronym PIGS to sum up the troubled regions of the eurozone (the 'i' seems to be used for Ireland and Italy). The FT has a near-ban on the insulting phrase, and now Barclays Capital has banned it too, for being offensive.

- ^ Alloway, Tracy (2010-02-05). "Anything but porcine at BarCap". Alphaville. Financial Times. Retrieved 2012-04-25.

FT Alphaville and the FT are not allowed to say PIIGS a certain porcine acronym. But we are in good company. Neither, it seems, is Barclays Capital. … For those who haven't experienced the wrath of southern Europe, the forbidden-acronym is said to cause offense because it can be construed as having pejorative undertones. That doesn't solve the problem that 'Portugal, Italy, Ireland, Greece and Spain' is a mouthful.

- ^ Holloway, Robert (15 September 2008). "Pigs in Muck and Lipstick". Archived from the original on April 20, 2010.

The FT was accused of racism after its Lex column ran a piece about four southern European economies on September 1 headlined 'Pigs in muck'. The article almost caused a diplomatic incident when Portugal's Economy Minister Manuel Pinho said 'I am deeply offended that anyone would label my country with this term.' PIGS has been used as an abbreviation for Portugal, Italy, Greece and Spain since at least 1999, when they and eight other countries adopted the euro as a common currency.

- ^ Van Vossole, Jonas (2016). "Framing PIGS: patterns of racism and neocolonialism in the Euro crisis". Patterns of Prejudice. 50 (1): 1–20. doi:10.1080/0031322X.2015.1128056. hdl:10316/41783. ISSN 0031-322X. S2CID 220341363.

- ^ Christou, Anastasia (2018). "The "Wretched of Europe": Greece and the Cultural Politics of Inequality". Humanity & Society. 42 (1): 102–127. doi:10.1177/0160597616664169. ISSN 0160-5976. S2CID 151782073.