Economy of China

Shanghai, the financial center of China | |

| Currency | Renminbi (CNY, ¥) |

|---|---|

| Calendar year | |

Trade organizations | WTO, BRICS, SCO, APEC, RCEP, G20, G77 and others |

Country group | |

| Statistics | |

| Population | |

| GDP | |

| GDP rank | |

GDP growth |

|

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

GDP by component |

|

| 1.0% (2024)[5] | |

Population below poverty line | |

| |

Labor force | |

Labor force by occupation |

|

| Unemployment | |

Average gross salary | US$ 1,305 (urban non-private sector) US$ 747 (urban private sector) per month (2022) |

| US$ 1,002 (urban non-private sector) US$ 578 (urban private sector) per month (2022) | |

Final consumption expenditure | |

Gross capital formation | |

| Gross savings | |

| 10-Year Bond 2.831% (April 2023)[16] | |

Main industries |

|

| External | |

| Exports | $3.380 trillion (2023)[19] |

Export goods |

|

Main export partners |

|

| Imports | $2.557 trillion (2023)[19] |

Import goods |

|

Main import partners |

|

FDI stock | |

Gross external debt | |

| Public finances | |

| |

| |

| Revenues | ¥33.229 trillion[15] 26.5% of GDP (2023) |

| Expenses | ¥42.140 trillion[15] 33.6% of GDP (2023) |

All values, unless otherwise stated, are in US dollars. | |

The economy of the People's Republic of China is a developing mixed socialist market economy, incorporating industrial policies and strategic five-year plans.[29] China is the world's second largest economy by nominal GDP, behind the United States, and since 2017 has been the world's largest economy when measured by purchasing power parity (PPP).[30][note 2] China accounted for 19% of the global economy in 2022 in PPP terms,[31] and around 18% in nominal terms in 2022.[31][32] The economy consists of state-owned enterprises (SOEs) and mixed-ownership enterprises, as well as a large domestic private sector which contribute approximately 60% of the GDP, 80% of urban employment and 90% of new jobs, the system also consist of a high degree of openness to foreign businesses. According to the annual data of major economic indicators released by the National Bureau of Statistics since 1952, China's GDP grew by an average of 6.17% per year in the 26 years from 1953 to 1978. China implemented economic reform in 1978, and from 1979 to 2023, the country's GDP growth rate grew by an average of 8.93% per year in the 45 years since its implementing economic reform. According to preliminary data released by the authorities, China's GDP in 2023 was CN¥126.06 trillion (US$ 17.89 trillion)[33] with a real GDP increase of at least 5.2% from 2022.[34][35]

China is the world's largest manufacturing industrial economy and exporter of goods. Its production exceeds that of the nine next largest manufacturers combined.[36][37] However, exports as a percentage of GDP has steadily dropped to just around 20%, reflecting its decreasing importance to the Chinese economy. Nevertheless, it remains the largest trading nation in the world and plays a prominent role in international trade.[38][39] Manufacturing has been transitioning toward high-tech industries such as electric vehicles, renewable energy, telecommunications and IT equipment, and services has also grown as a percentage of GDP. It is also the world's fastest-growing consumer market and second-largest importer of goods.[40] China is also the world's largest consumer of numerous commodities, and accounts for about half of global consumption of metals.[41] China is a net importer of services products.[42] China was the largest recipient of foreign direct investment (FDI) in the world as of 2020, receiving inflows of $163 billion.[43] but more recently, inbound FDI has fallen sharply to negative levels.[44][45] It has the second largest outbound FDI, at US$136.91 billion for 2019.[46]

China has the world's largest foreign-exchange reserves worth $3.1 trillion,[47] but if the foreign assets of China's state-owned commercial banks are included, the value of China's reserves rises to nearly $4 trillion.[48] China faced a mild economic slowdown during the 2007–2008 financial crisis and initiated a massive stimulus package, which helped to regain its economic growth. More recently, the imposition of the "3 Red Lines" on developer borrowing has sparked a real estate crisis and has raised questions on the accuracy of China's claims for the severity of this crisis.[49][50][51] China's economic growth is slowing down in the 2020s as it deals with a range of challenges from a rapidly aging population, higher unemployment and a property crisis.[52] China has the world's sixth largest gold reserve, with over 2,000 tonnes of gold.[53] It spends around 2.43% of GDP on advance research and development across various sectors of the economy.[54][55]

With 791 million workers, the Chinese labor force was the world's largest as of 2021, according to The World Factbook. In 2022, China was ranked the 11th most innovative country in the world, 3rd in Asia & Oceania region and 2nd for countries with a population of over 100 million. It is the only middle-income economy and the only newly industrialized economy in the top 30.[56][57] It also leads in several measures of global patent filings,[58][59] as well as research and scientific output.[60] It is also the world's largest high technology exporter.[61] China has the second-largest financial assets in the world, valued at $17.9 trillion as of 2021.[62] As of 2022[update], China was second in the world in total number of billionaires.[63] and second in millionaires with 6.2 million. China has the largest middle-class in the world, with over 500 million people earning over RMB 120,000 a year.[64]

China has bilateral free trade agreements with many nations and is a member of the Regional Comprehensive Economic Partnership (RCEP).[65] China is widely regarded as the "powerhouse of manufacturing" or "the factory of the world".[66] Of the world's 500 largest companies, 142 are headquartered in China.[67] It has four of the world's top ten most competitive financial centers[68] and three of the world's ten largest stock exchanges (both by market capitalization and by trade volume).[69] Public social expenditure in China was around 10% of GDP.[70] Additionally, the public pension expenditure in China accounted for 5.2% of GDP.[71]

History

[edit]

Historically, China was one of the world's foremost economic powers for most of the two-millennia Pax Sinica from the 1st until the 19th century.[73][74] China accounted for around one-quarter to one-third of global GDP until the mid-1800s. China's share of global GDP was one-third in 1820 as the Industrial Revolution was beginning in Great Britain.[75][76][77][78] China's GDP in 1820 was six times as large as Britain's, the largest economy in Europe – and almost twenty times the GDP of the nascent United States.[79]

At the end of the Chinese Civil War, the economy was devastated.[80] As the defeated Nationalists fled to Taiwan, they stripped China of liquid assets including gold, silver, and the country's dollar reserves.[80] By the time the KMT was defeated, commerce had been destroyed, the national currency rendered valueless, and the economy was based on barter.[80]

The People's Republic of China's development from one of the poorest countries to one of the largest economies was the quickest of any country.[81]: 11 From 1949 until the Chinese economic reform in 1978, the economy was state-led with market activity remaining underground.[82] Economic reforms began under Deng Xiaoping.[82] China subsequently became the world's fastest-growing major economy, with growth rates averaging 10% over 30 years.[83][84] Many scholars consider the Chinese economic model as an example of authoritarian capitalism,[85][86] state capitalism[87] or party-state capitalism.[88][89]

China brought more people out of extreme poverty than any other country in history[90][91]—between 1978 and 2018, China reduced extreme poverty by 800 million.[92] Between 1981 and 2019, the percentage of the population living in extreme poverty decreased from 88.1% to 0.2%.[93] Its current account surplus increased by a factor of 53 between 1982 and 2021, from $5.67 billion to $317 billion.[94] During this time, China also became an industrial powerhouse, moving beyond initial successes in low-wage sectors like clothing and footwear to the increasingly sophisticated production of computers, pharmaceuticals, and automobiles. China's factories generated $3.7 trillion real manufacturing value added, more than the US, South Korea, Germany and the UK combined. China's manufacturing sector benefits from one of the world's largest domestic markets, immense manufacturing scale, and highly developed manufacturing supply chains.[95] It also has two (Shenzhen-Hong Kong-Guangzhou and Beijing in the 2nd and 3rd spots respectively) of the global top 5 science and technology clusters, which is more than any other country.[56][96]

China has sustained growth due to export relations, its manufacturing sector, and low-wage workers.[97] China's was the only major world economy to experience GDP growth in 2020, when its GDP increased by 2.3%.[98] However, it posted one of its worst economic performances in decades because of the COVID-19 pandemic in 2022.[99] In 2023, IMF predicted China to continue being one of the fastest growing major economies.[100] China's economy is both a contributor to rising global greenhouse gas (GHG) emissions causing climate change and severely affected by its adverse impacts, although its per capita emissions are still much lower than developed economies such as the United States.[101]

Regional economies

[edit]

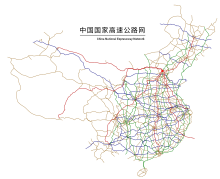

China's unequal transportation system, combined with important differences in the availability of natural and human resources and in industrial infrastructure, has produced significant variations in the regional economies of China.[102] The economic development of Shenzhen has caused the city to be referred to as the world's next Silicon Valley.[103][104]

Economic development has generally been more rapid in coastal provinces than in the interior and there are large disparities in per capita income between regions. The three wealthiest regions are the Yangtze Delta in East China; the Pearl River Delta in South China; and Jing-Jin-Ji region in North China. It is the rapid development of these areas that is expected to have the most significant effect on the Asian regional economy as a whole and Chinese government policy is designed to remove the obstacles to accelerated growth in these wealthier regions. By 2035, China's four cities (Shanghai, Beijing, Guangzhou and Shenzhen) are projected to be among the global top ten largest cities by nominal GDP according to a report by Oxford Economics.[105]

GDP by administrative division

[edit]| provinces | CN¥ | US$ | share (%) |

|---|---|---|---|

| China (mainland) |

141,020.72 | 19,700.70 | 100 |

| Guangdong | 13,911.86 | 2,119.67 | 10.67 |

| Jiangsu | 12,287.56 | 1,826.85 | 10.15 |

| Shandong | 8,743.51 | 1,299.94 | 7.22 |

| Zhejiang | 7,771.54 | 1,155.43 | 6.42 |

| Henan | 6,134.51 | 912.05 | 5.07 |

| Sichuan | 10,674.98 | 1,843.73 | 4.69 |

| Hubei | 5,373.49 | 798.90 | 4.44 |

| Fujian | 5,310.99 | 789.61 | 4.39 |

| Hunan | 4,867.04 | 723.61 | 4.02 |

| Anhui | 4,504.50 | 669.70 | 3.72 |

| Shanghai | 4,465.28 | 663.87 | 3.69 |

| Hebei | 4,237.04 | 629.94 | 3.50 |

| Beijing | 4,161.10 | 618.65 | 3.44 |

| Shaanxi | 3,277.27 | 487.25 | 2.71 |

| Jiangxi | 3,207.47 | 476.87 | 2.65 |

| Chongqing | 2,912.90 | 433.07 | 2.41 |

| Liaoning | 2,897.51 | 430.79 | 2.39 |

| Yunnan | 2,895.42 | 430.48 | 2.39 |

| Guangxi | 2,630.09 | 391.03 | 2.17 |

| Shanxi | 2,564.26 | 381.24 | 2.12 |

| Inner Mongolia | 2,315.87 | 344.31 | 1.91 |

| Guizhou | 2,016.46 | 299.80 | 1.67 |

| Xinjiang | 1,774.13 | 263.77 | 1.47 |

| Tianjin | 1,631.13 | 242.51 | 1.35 |

| Heilongjiang | 1,590.10 | 236.41 | 1.31 |

| Jilin | 1,307.02 | 194.32 | 1.08 |

| Gansu | 1,120.16 | 166.54 | 0.93 |

| Hainan | 681.82 | 101.37 | 0.56 |

| Ningxia | 506.96 | 75.37 | 0.42 |

| Qinghai | 361.01 | 53.67 | 0.30 |

| Tibet | 213.26 | 31.71 | 0.18 |

Hong Kong and Macau

[edit]In accordance with the one country, two systems policy, the economies of the former British colony of Hong Kong and Portuguese colony of Macau formally preserve a capitalist system separate from mainland China.[106][107]

Regional development

[edit]

| ||

| The East Coast (w/ existing development programmes) | ||

| "Rise of Central China" | ||

| "Revitalize Northeast China" | ||

| "China Western Development" | ||

These strategies are aimed at the relatively underdeveloped regions of China in an attempt to address unequal development:

- China Western Development, designed to increase the economic situation of the western provinces through investment and development of natural resources.

- Revitalize Northeast China, to rejuvenate the industrial bases in Northeast China. It covers the three provinces of Heilongjiang, Jilin, and Liaoning, as well as the five eastern prefectures of Inner Mongolia.

- Rise of Central China Plan, to accelerate the development of its central regions. It covers six provinces: Shanxi, Henan, Anhui, Hubei, Hunan, and Jiangxi.

- Third Front of the Cold War period, which focused on the southwestern provinces.

Government

[edit]

China engages in state-led investment and industrial policy and with a significant state-owned enterprise sector.[109]: 11 The Chinese Communist Party (CCP) describes China's economic system as the socialist market economy. To guide economic development, the Chinese central government adopts five-year plans that detail its economic priorities and essential policies. The fourteenth five-year plan (2021–2025) is currently being implemented, placing an emphasis on consumption-driven growth and technological self-sufficiency while China transitions from being an upper middle-income economy to a high-income economy.[110]

The public sector plays a central role in China's economy.[111] This development is also in line with the planning goals of the Chinese central government to achieve the Two Centenaries, namely the material goal of China becoming a moderately prosperous society in all respects by 2021 and the modernization goal of China becoming a "strong, democratic, civilized, harmonious and modern socialist country" by 2049, the 100th anniversary of the founding of the People's Republic.[112] China retains state control over the commanding heights of the economy in key industries like infrastructure, telecommunications, and finance despite significant marketization of the economy since reform and opening up.[113]: 20 Specific mechanisms implementing government control of the commanding heights of the economy include public property rights, pervasive administrative involvement, and CCP supervision of senior managers.[113]: 20

The state is more likely to intervene in areas where the prices of goods and services are socially and politically sensitive.[114]: 105 For example, China's government intervenes more actively in the commercial banking sector than in private equity, where significantly fewer households participate.[114]: 100 The state's involvement in the allocation of finance, contracts, and resources facilitates Chinese government efforts to minimize the effects of market volatility.[115]: 3

Local governments' level of authority and autonomy in economic decision-making is high, and they have played a major role in national economic development.[116]: 1 Local governments may also offer incentives or subsidies to attract business.[116]: 41 One common tax incentive is "three tax-free and three half-tax", through which businesses can be allowed not to pay corporate income tax for their first three years of operation, and paying half rate for the next three years.[116]: 41

State-owned enterprises

[edit]China's SOEs perform important functions that benefit the state.[117] Academic Wendy Leutert writes, "They contribute to central and local governments revenues through dividends and taxes, support urban employment, keep key input prices low, channel capital towards targeted industries and technologies, support sub-national redistribution to poorer interior and western provinces, and aid the state's response to natural disasters, financial crises and social instability."[117]

Almost 867,000 enterprises in China have a degree of state ownership, according to Franklin Allen of Imperial College London.[118] As of 2017, China has more SOEs than any other country, and the most SOEs among large national companies.[117] State-owned enterprises accounted for over 60% of China's market capitalization in 2019[119] and generated 40% of China's GDP of US$15.98 trillion dollars (101.36 trillion yuan) in 2020, with domestic and foreign private businesses and investment accounting for the remaining 60%.[120][121] As of the end of 2019, the total assets of all China's SOEs, including those operating in the financial sector, reached US$58.97 trillion In 2015.[122] Ninety-one (91) of these SOEs belong to the 2020 Fortune Global 500 companies.[123] As of 2023[update], private firms only represent 37% of the country's top-100 listed firms, according to the Peterson Institute for International Economics.[118]

Disputes over economic data

[edit]There exists disputes over reliability of official economic data. Foreign and some Chinese sources have claimed that official Chinese government statistics overstate China's economic growth.[124] However, several Western academics and institutions have stated that China's economic growth is higher than indicated by official figures.[125] Others, such as the Economist Intelligence Unit, state that while there's evidence China's GDP data is "smoothed", they believe that China's nominal and real GDP data are broadly accurate.[126] Still others, state that reported GDP growth is irreconcilable with data coming out of China.[127] In 2024, the United States Department of Agriculture stopped relying on official Chinese government data over reliability concerns.[128] According to 2007 documents obtained by WikiLeaks, Liaoning Party Secretary and future Premier Li Keqiang said he is far from confident in the country's GDP estimates, calling them "man-made" and unreliable and that data releases, especially the GDP numbers, should be used "for reference only".[129] In its place, he developed the Li Keqiang index is an alternative measurement of Chinese economic performance that uses three variables he preferred.[130]

Chinese provinces and cities have long been suspected of cooking their numbers, with the focus on local government officials, whose performance are often assessed based on how well their respective economies have performed.[131] Local governments have come under increased scrutiny over the last few years over economic data, with CCP general secretary Xi Jinping stating that economic data forgery "not only hurt our judgment of the economic situation, but also seriously undermined the Communist Party's ideas and truth-seeking style".[124][132]

According to a 2019 research paper published by the Brookings Institution adjusting the historical GDP time series using value-added tax data, which the authors said are "highly resistant to fraud and tampering",[133][134] China's economic growth may have been overstated by 1.7 percent each year between 2008 and 2016, meaning that the government may have been overstating the size of the Chinese economy by 12–16 percent in 2016.[134][135]

Several Western academics and institutions have supported the claim that China's economy is likely to be underestimated.[136][137][138][125][139][140][141] A paper by the US-based National Bureau of Economic Research claimed that China's economic growth may be higher than what is reported by official statistics.[142] An article by Hunter Clarka, Maxim Pinkovskiya and Xavier Sala-i-Martin published by the Elsevier Science Direct in 2018 employs an innovative method of satellite-recorded nighttime lights, which the authors claim to be a best-unbiased predictor of the economic growth in Chinese cities. The results suggest that the Chinese economic growth rate is higher than the official reported data.[136]

Satellite measurements of light pollution are used by some analysts to model Chinese economic growth and suggest growth rate numbers in Chinese official data are more reliable, though are likely to be smoothed.[143] According to an article by the Federal Reserve Bank of St. Louis, China's official statistics are of a high quality compared to other developing, middle-income and low-income countries. In 2016, China was at the 83rd percentile of middle and low-income countries, up from the 38th percentile in 2004.[144] A study by the Federal Reserve Bank of San Francisco found that China's official GDP statistics are "significantly and positively correlated" with externally verifiable measures of economic activity such as import and export data from China's trade partners, suggesting that China's economic growth was no slower than the official figures indicated.[125]

The study by Daniel H. Rosen and Beibei Bao, published by the Center for Strategic and International Studies in 2015, showed that GDP in 2008 was actually 13–16 percent bigger than the official data, while 2013 GDP was accurately at $10.5 trillion rather than the official figure at $9.5 trillion.[139] According to a research conducted by Arvind Subramanian, a former economist at the International Money Fund (IMF) and a senior fellow at the Peterson Institute for International Economics, the size of the Chinese economy by Purchasing Power Parity in 2010 was about $14.8 trillion rather than an official estimate at $10.1 trillion by IMF, meaning that China's GDP was underestimated by 47 percent.[138]

National debt

[edit]In 2022, China's total government debt stood at approximately CN¥ 94 trillion (US$ 14 trillion), equivalent to about 77.1% of GDP.[145] In 2014, many analysts expressed concern over the overall size of China's government debt.[146][147][148][149] At the end of 2014, the International Monetary Fund reported that China's general government gross debt-to-GDP ratio was 41.44 percent.[150][151] In 2015, a report by the International Monetary Fund concluded that China's public debt is relatively low "and on a stable path in all standard stress tests except for the scenario with contingent liability shocks", such as "a large-scale bank recapitalization or financial system bailout to deal, for example, with a potential rise in NPLs from deleveraging".[152] Per the State Administration of Foreign Exchange's 2019 balance of payments report, the external debt balance of the entire Chinese government at year end was 2% of GDP.[116]: 104

Chinese authorities have dismissed analysts' worries, insisting "the country still has room to increase government debt".[153] Former Fed Chairman Ben Bernanke, earlier in 2016, commented that "the ... debt pile facing China [is] an 'internal' problem, given the majority of the borrowings was issued in local currency.[154] A 2019 survey by the OECD found that China's corporate debt is higher than other major countries.[155]

Shadow banking has risen in China, posing risks to the financial system.[156][157] Off the books debt is a grey area, but estimates place the amount for local governments alone as high as $9 trillion[158] or 63 trillion yuan, up from estimates of around 30 trillion yuan in 2020.[159]

Regulatory environment and government revenues

[edit]Though China's economy has expanded rapidly, its regulatory environment has not kept pace. Since Deng Xiaoping's open market reforms, the growth of new businesses has outpaced the government's ability to regulate them. This has created a situation where businesses, faced with mounting competition and poor oversight, take drastic measures to increase profit margins, often at the expense of consumer safety. This issue became more prominent in 2007, with a number of restrictions being placed on problematic Chinese exports by the United States.[160]

Anti-monopoly and competition law

[edit]The Chinese technology sector has been characterized as being dominated by few, larger entities including Ant Group and Tencent.[161] There have been attempts by the Xi Jinping Administration to enforce economic competition rules, and probes into Alibaba and Tencent have been launched by Chinese economic regulators.[162]

The crackdown on tech giants and internet companies during the 2020–2021 Xi Jinping Administration reform spree were followed with calls by the Politburo against monopolistic practices by commercial retail giants like Alibaba.[163]

In March 2021, Xi stated China would strengthen its antitrust enforcement in an effort to advance what he described as the healthy and sustainable development of the platform economy.[164]: 100 Two major institutional changes resulted.[164]: 100 In November 2021, China upgraded the bureaucratic status of the State Administration for Market Regulation's antitrust bureau.[164]: 100–101 In June 2022, it made major amendments to the Anti-Monopoly Law, including explicit language focused on regulation of the platform economy.[164]: 101

Data

[edit]This section needs to be updated. (December 2023) |

The following table shows the main economic indicators in 1980–2022 (with IMF staff estimates in 2023–2028). Inflation below 5% is in green.[145]

| Year | GDP

(in Bil. US$PPP) |

GDP per capita

(in US$ PPP) |

GDP

(in Bil. US$nominal) |

GDP per capita

(in US$ nominal) |

GDP growth

(real) |

Inflation rate

(in Percent) |

Unemployment

(in Percent) |

Government debt

(in % of GDP) |

|---|---|---|---|---|---|---|---|---|

| 1980 | 302.8 | 306.7 | 303.0 | 307.0 | n/a | 4.9% | n/a | |

| 1981 | n/a | |||||||

| 1982 | n/a | |||||||

| 1983 | n/a | |||||||

| 1984 | n/a | |||||||

| 1985 | n/a | |||||||

| 1986 | n/a | |||||||

| 1987 | n/a | |||||||

| 1988 | n/a | |||||||

| 1989 | n/a | |||||||

| 1990 | n/a | |||||||

| 1991 | n/a | |||||||

| 1992 | n/a | |||||||

| 1993 | n/a | |||||||

| 1994 | n/a | |||||||

| 1995 | 21.6% | |||||||

| 1996 | ||||||||

| 1997 | ||||||||

| 1998 | ||||||||

| 1999 | ||||||||

| 2000 | ||||||||

| 2001 | ||||||||

| 2002 | ||||||||

| 2003 | ||||||||

| 2004 | ||||||||

| 2005 | ||||||||

| 2006 | ||||||||

| 2007 | ||||||||

| 2008 | ||||||||

| 2009 | ||||||||

| 2010 | ||||||||

| 2011 | ||||||||

| 2012 | ||||||||

| 2013 | ||||||||

| 2014 | ||||||||

| 2015 | ||||||||

| 2016 | ||||||||

| 2017 | ||||||||

| 2018 | ||||||||

| 2019 | ||||||||

| 2020 | ||||||||

| 2021 | ||||||||

| 2022 | ||||||||

| 2023 | ||||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| 2028 |

Inflation

[edit]

Pork is an important part of the Chinese economy with a per capita consumption of 90 grams per day. The worldwide rise in the price of animal feed associated with increased production of ethanol from corn resulted in steep rises in pork prices in China in 2007. Increased cost of production interacted badly with increased demand resulting from rapidly rising wages. The state responded by subsidizing pork prices for students and the urban poor and called for increased production. Release of pork from the nation's strategic pork reserve was considered.[165]

Investment cycles

[edit]

Chinese investment has always been highly cyclical.[166]

In China, the majority of investment is carried out by entities that are at least partially state-owned. Most of these are under the control of local governments. Thus, booms are primarily the result of perverse incentives at the local-government level.[167] Unlike entrepreneurs in a free-enterprise economy, Chinese local officials are motivated primarily by political considerations. As their performance evaluations are based, to a large extent, on GDP growth within their jurisdictions, they have a strong incentive to promote large-scale investment projects.[168][169]

A typical cycle begins with a relaxation of central government credit and industrial policy. This allows local governments to push investment aggressively, both through state-sector entities they control directly and by offering investment-promotion incentives to private investors and enterprises outside their jurisdictions.[170] The resulting boom puts upward pressure on prices and may also result in shortages of key inputs such as coal and electricity (as was the case in 2003).[171] Once inflation has risen to a level at which it begins to threaten social stability, the central government will intervene by tightening enforcement of industrial and credit policy. Projects that went ahead without required approvals will be halted. Bank lending to particular types of investors will be restricted. Credit then becomes tight and investment growth begins to decline.[172]

Financial and banking system

[edit]

China has the world's largest total banking sector assets of around $45.838 trillion (309.41 trillion CNY) with $42.063 trillion in total deposits and other liabilities.[173] Most of China's financial institutions are state-owned and governed.[174] The chief instruments of financial and fiscal control are the People's Bank of China (PBC) and the Ministry of Finance, both under the authority of the State Council. The People's Bank of China replaced the Central Bank of China in 1950 and gradually took over private banks. It fulfills many of the functions of other central and commercial banks. It issues the currency, controls circulation, and plays an important role in disbursing budgetary expenditures. Additionally, it administers the accounts, payments, and receipts of government organizations and other bodies, which enables it to exert thorough supervision over their financial and general performances in consideration of the government's economic plans. The PBC is also responsible for international trade and other overseas transactions. Remittances by overseas Chinese are managed by the Bank of China (BOC), which has a number of branch offices in several countries.[citation needed]

Other financial institutions that are crucial, include the China Development Bank (CDB), which funds economic development and directs foreign investment; the Agricultural Bank of China (ABC), which provides for the agricultural sector; the China Construction Bank (CCB), which is responsible for capitalizing a portion of overall investment and for providing capital funds for certain industrial and construction enterprises; and the Industrial and Commercial Bank of China (ICBC), which conducts ordinary commercial transactions and acts as a savings bank for the public.[citation needed] China initiated the founding of the Asian Infrastructure Investment Bank in 2015 and the Silk Road Fund in 2014, an investment fund of the Chinese government to foster increased investment and provide financial supports in countries along the One Belt, One Road.[175]

China's economic reforms greatly increased the economic role of the banking system. In theory any enterprises or individuals can go to the banks to obtain loans outside the state plan, in practice, 75% of state bank loans go to State Owned Enterprises. (SOEs)[176] Even though nearly all investment capital was previously provided on a grant basis according to the state plan, policy has since the start of the reform shifted to a loan basis through the various state-directed financial institutions. It is estimated that, as of 2011, 14 trillion Yuan in loans was outstanding to local governments. Much of that total is believed by outside observers to be nonperforming.[177] Increasing amounts of funds are made available through the banks for economic and commercial purposes. Foreign sources of capital have also increased. China has received loans from the World Bank and several United Nations programs, as well as from countries (particularly Japan) and, to a lesser extent, commercial banks. Hong Kong has been a major conduit of this investment, as well as a source itself. On 23 February 2012, the PBC evinced its inclination to liberalize its capital markets when it circulated a telling ten-year timetable.[178] Following on the heels of this development, Shenzhen banks were able to launch cross-border yuan remittances for individuals, a significant shift in the PBC's capital control strictures since Chinese nationals had been previously barred from transferring their yuan to overseas account.[179]

China has four of the world's top ten most competitive financial centers (Shanghai, Hong Kong, Beijing, and Shenzhen), more than any other country.[68] China has three of the world's ten largest stock exchanges (Shanghai, Hong Kong and Shenzhen), both by market capitalization and by trade volume.[69][180] As of 12 October 2020, the total market capitalization of mainland Chinese stock markets, consisting of the Shanghai Stock Exchange and Shenzhen Stock Exchange, topped US$10 trillion, excluding the Hong Kong Stock Exchange, with about US$5.9 trillion.[181]

As of the end of June 2020, foreign investors had bought a total of US$440 billion in Chinese stocks, representing about 2.9% of the total value, and indicating that foreign investors scooped up a total of US$156.6 billion in the stocks just in the first half of 2020.[182] The total value of China's bond market topped US$15.4 trillion, ranked above that of Japan and the U.K., and second only to that of the U.S. with US$40 trillion, as of the beginning of September 2020.[183] As of the end of September 2020, foreign holdings of Chinese bonds reached US$388 billion, or 2.5%, of the total value, notwithstanding an increase by 44.66% year on year.[184]

Stock markets

[edit]

As of at least 2024, China has the second largest equity markets and futures markets in the world, as well as the third largest bond market.[185]: 153

China's stock market exchanges include the Beijing Stock Exchange, the Shanghai Stock Exchange (including the STAR Market), the Shenzhen Stock Exchange, and the Hong Kong Stock Exchange. China's stock market is relatively underdeveloped in comparison to other aspects of its economy.[186]: 148–150

To be listed on China's stock exchange, companies must demonstrate good financial standing (including sustained profitability), solid corporate governance, including a board of independent directors, supervisory board, auditing, and no history of misreporting or fraud, and have a market capitalization equivalent to at least US$4 million.[98]: 271–272

The government regulates initial public offerings, encouraging them when the market is high in an effort to cool down prices and prohibiting them when the market is low.[114]: 109

When the stock markets re-opened in the PRC period in 1990, most of the listed companies were state-owned enterprises; this was part of an experiment in subjecting SOEs to market discipline.[186]: 152–153 The Shanghai and Shenzhen stock exchanges were under municipal control and termed "experimental points" until 1997.[113]: 102–103 In 1997, the central government brought the exchanges under central government control and affirmed that the exchanges had a legitimate role in the socialist market economy.[113]: 102

In 2015, a stock market plunge in China eliminated $2 trillion of global stock market value.[186]: 147

Currency system

[edit]

The renminbi ("people's currency") is the currency of China, denominated as the yuan, subdivided into 10 jiao or 100 fen. The renminbi is issued by the People's Bank of China, the monetary authority of China. The ISO 4217 abbreviation is CNY, although also commonly abbreviated as "RMB". As of 2005, the yuan was generally considered by outside observers to be undervalued by about 30–40%.[187][188] However, in 2017, the IMF stated that the yuan was correctly valued.[189]

The renminbi is held in a floating exchange-rate system managed primarily against the US dollar. On 21 July 2005, China revalued its currency by 2.1% against the US dollar and, since then has moved to an exchange rate system that references a basket of currencies and has allowed the renminbi to fluctuate at a daily rate of up to half a percent.[citation needed]

There is a complex relationship between China's balance of trade, inflation, measured by the consumer price index and the value of its currency. Despite allowing the value of the yuan to "float", China's central bank has decisive ability to control its value with relationship to other currencies. Inflation in 2007, reflecting sharply rising prices for meat and fuel, is probably related to the worldwide rise in commodities used as animal feed or as fuel. Thus rapid rises in the value of the yuan permitted in December 2007 are possibly related to efforts to mitigate inflation by permitting the renminbi to be worth more.[190] An article published in International Review of Economics & Finance in 2010 by Mete Feridun (University of Greenwich Business School) and his colleagues provide empirical evidence that financial development fosters economic growth in China.[191]

During the week of 10 August 2015, against the background of a slowing Chinese economy and appreciation of the U.S. dollar, the People's Bank of China devalued the renminbi by about 5%.[192] The devaluation was accomplished by pegging the official rate to closing market rates. A market-based "representative" exchange rate against the U.S. dollar is one of the requirements for designation of a currency as one with Special Drawing Rights (SDR) by the International Monetary Fund (IMF), one of China's goals.[193] Since the late-2000s, China has sought to internationalize the renminbi.[194] As of 2013, the RMB is the 8th most widely traded currency in the world.[195] In November 2015 in advance of G-20 and IMF meetings, IMF director Christine Lagarde announced her support for adding the yuan to the SDR currency basket. The announcement gave 'green-light' to official approval at 30 November IMF meeting.[196] The internationalization of the Chinese economy continues to affect the standardized economic forecast officially launched in China by the Purchasing Managers Index in 2005.

Sectors

[edit]According to Fortune Global, of the world's 500 largest companies, 135 are headquartered in China.[197] As of 2023, mainland China and Hong Kong were home to 324 largest listed companies measured by revenue in the Fortune Global 2000, ranking second globally.[198] China is also home to more than two hundred privately held technology startups (tech unicorns), each with a valuation of over $1 billion, the highest number in the world.[199]

Agriculture

[edit]This section needs additional citations for verification. (January 2021) |

China is the world's largest producer and consumer of agricultural products – and some 300 million Chinese farm workers are in the industry, mostly laboring on pieces of land about the size of U.S. farms. Virtually all arable land is used for food crops. China is the world's largest producer of rice and is among the principal sources of wheat, corn (maize), tobacco, soybeans, potatoes, sorghum, peanuts, tea, millet, barley, oilseed, pork, and fish. Major non-food crops, including cotton, other fibers, and oilseeds, furnish China with a small proportion of its foreign trade revenue. Agricultural exports, such as vegetables and fruits, fish and shellfish, grain and meat products, are exported to Hong Kong. Yields are high because of intensive cultivation, for example, China's cropland area is only 75% of the U.S. total, but China still produces about 30% more crops and livestock than the United States. China hopes to further increase agricultural production through improved plant stocks, fertilizers, and technology.

According to the government statistics issued in 2005,[200] after a drop in the yield of farm crops in 2000, output has been increasing annually.

According to the United Nations World Food Programme, in 2022, China fed eighteen percent of the world's population with only seven percent of the world's arable land.[201]

Animal husbandry constitutes the second most important component of agricultural production. China is the world's leading producer of pigs, chickens, and eggs, and it also has sizable herds of sheep and cattle. Since the mid-1970s, greater emphasis has been placed on increasing the livestock output. China has a long tradition of ocean and freshwater fishing and of aquaculture. Pond raising has always been important and has been increasingly emphasized to supplement coastal and inland fisheries threatened by overfishing and to provide such valuable export commodities as prawns. China is also unmatched in the size and reach of its fishing armada with anywhere from 200,000 to 800,000 boats, some as far afield as Argentina. Fueled primarily by government subsidies, its growth and activities have largely gone unchecked.[202]

Environmental problems such as floods, drought, and erosion pose serious threats to farming in many parts of the country. The wholesale destruction of forests gave way to an energetic reforestation program that proved inadequate, and forest resources are still fairly meagre.[203] The principal forests are found in the Qin Mountains and the central mountains and on the Yunnan–Guizhou Plateau. Because they are inaccessible, the Qinling forests are not worked extensively, and much of the country's timber comes from Heilongjiang, Jilin, Sichuan, and Yunnan.

Western China, comprising Tibet, Xinjiang, and Qinghai, has little agricultural significance except for areas of floriculture and cattle raising. Rice, China's most important crop, is dominant in the southern provinces and many of the farms here yield two harvests a year. In the north, wheat is of the greatest importance, while in central China wheat and rice vie with each other for the top place. Millet and kaoliang (a variety of grain sorghum) are grown mainly in the northeast and some central provinces, which, together with some northern areas, also provide considerable quantities of barley. Most of the soybean crop is derived from the north and the northeast; corn (maize) is grown in the center and the north, while tea comes mainly from the warm and humid hilly areas of the south. Cotton is grown extensively in the central provinces, but it is also found to a lesser extent in the southeast and in the north. Tobacco comes from the center and parts of the south. Other important crops are potatoes, sugar beets, and oilseeds.

In the past decade, the government has been encouraging agricultural mechanization and land consolidation to raise yields and compensate for the loss of rural workers who have migrated to the cities.[204] According to statistics by the UN Food and Agriculture Organization, the annual growth rate of agricultural mechanization in China is 6.4%. By 2014, the integrated mechanization rate had risen to nearly 60%, with the rate for wheat surpassing 90% and that for maize approaching 80%.[205] In addition to standard agricultural equipment like tractors, China's agriculture cooperatives have begun using high-tech equipment, including unmanned aerial vehicles, which are used to spay crops with pesticides.[206] Good progress has been made in increasing water conservancy, and about half the cultivated land is under irrigation.

In the late 1970s and early 1980s, economic reforms were introduced. First of all this began with the shift of farming work to a system of household responsibility and a phasing out of collectivized agriculture. Later this expanded to include a gradual liberalization of price controls; fiscal decentralization; massive privatization of state enterprises, thereby allowing a wide variety of private enterprises in the services and light manufacturing; the foundation of a diversified banking system (but with large amounts of state control); the development of a stock market; and the opening of the economy to increased foreign trade and foreign investment.

Housing and construction

[edit]In 2010, China became the world's largest market for construction.[185]: 112 It has remained the world's largest through at least 2024.[185]: 112

The real estate industry is about 20% of the Chinese economy.[207] As of 2023, real property accounts for 60% of Chinese household assets.[186]: 161 Also as of 2023, China has the highest rate of home ownership in the world.[186]: 170 90% of urban households own their home.[186]: 170

Compared to other nations, investing in stock markets and other assets is harder due to currency controls within the country. As a result, many Chinese citizens own multiple properties, as they are one of the few ways in which it is comparatively easy to grow and preserve wealth. Due to this, many economists have speculated about a property bubble within the Chinese economy[208] On 16 July 2020, the Wall Street Journal reported that the housing market within the Chinese economy had grown to US$52 trillion, eclipsing the US 2008 housing market before the Financial Crisis.[209]

Despite the possibility of a housing bubble, many people still choose to invest their assets in real estate market. On 19 December 2021, according to a report by McKinsey Global Institute, China's net worth reached $120 trillion in 2020 to overtake the U.S.'s $89 trillion as a red-hot real estate market drove up property value.[210]

Energy and mineral resources

[edit]

- Production: 6.5 trillion kWh (2017)[211]

- Consumption: 7.7620 trillion kWh (2020)[6]

- Exports: 21.8 billion kwh (2020)[6]

- Imports: 6.2 billion kwh (2015)[6]

Electricity – production by source (2023):[212]

- Coal: 60.5%

- Hydro: 13.2%

- Wind: 9.4%

- Solar: 6.2%

- Nuclear: 4.6%

- Natural gas: 3.3%

- Bioenergy: 2.2%

Oil:

- Production: 3,527,000 bbl/d (560,700 m3/d) (2022)

- Consumption: 6,534,000 bbl/d (1,038,800 m3/d) (2005) and expected 9,300,000 bbl/d (1,480,000 m3/d) in 2030

- Exports: 443,300 bbl/d (70,480 m3/d) (2005)

- Imports: 10,170,000 bbl/d (1,617,000 m3/d) (2022)[213]

- Net imports: 2,740,000 barrels per day (436,000 m3/d) (2005)

- Proved reserves: 16.3 Gbbl (2.59×109 m3) (1 January 2006)

Natural gas:

- Production: 47.88 km3 (2005 est.)

- Consumption: 44.93 km3 (2005 est.)

- Exports: 2.944 km3 (2005)

- Imports: 0 m3 (2005)

- Proved reserves: 1,448 km3 (1 January 2006 est.)

China has natural resources with an estimated worth of $23 trillion, 90% of which are coal and rare earth metals.[214] Over the years, large subsidies were built into the price structure of certain commodities and these subsidies grew substantially in the late 1970s and 1980s.[215] Since 1980, China's energy production has grown dramatically, as has the proportion allocated to domestic consumption. Some 80 percent of all power is generated from fossil fuel at thermal plants, with about 17 percent at hydroelectric installations; only about two percent is from nuclear energy, mainly from plants located in Guangdong and Zhejiang.[216] Though China has rich overall energy potential, most have yet to be developed. In addition, the geographical distribution of energy puts most of these resources relatively far from their major industrial users. The northeast is rich in coal and oil, the central part of north China has abundant coal, and the southwest has immense hydroelectric potential. But the industrialized regions around Guangzhou and the Lower Yangtze region around Shanghai have too little energy, while there is relatively little heavy industry located near major energy resource areas other than in the southern part of the northeast.

Due in large part to environmental concerns, China has wanted to shift China's current energy mix from a heavy reliance on coal, which accounts for 70–75% of China's energy, toward greater reliance on oil, natural gas, renewable energy, and nuclear power. China has closed thousands of coal mines over the past five to ten years to cut overproduction. According to Chinese statistics, this has reduced coal production by over 25%. As of at least 2023, solar power has become cheaper than coal-fired power in China.[114]: 167

Since 1993, China has been a net importer of oil, a large portion of which comes from the Middle East. Imported oil accounts for 20% of the processed crude in China.[citation needed] Net imports are expected to rise to 3.5 million barrels (560,000 m3) per day by 2010.[citation needed] China is interested in diversifying the sources of its oil imports and has invested in oil fields around the world. China is developing oil imports from Central Asia and has invested in Kazakhstani oil fields.[217] Beijing also plans to increase China's natural gas production, which currently accounts for only 3% of China's total energy consumption and incorporated a natural gas strategy in its 10th Five-Year Plan (2001–2005), with the goal of expanding gas use from a 2% share of total energy production to 4% by 2005 (gas accounts for 25% of U.S. energy production).[citation needed]

Since the early 2000s, China's clean energy sector has rapidly developed.[218]: 23 This growth has enabled renewable energy to have an important role in China's international cooperation, including South-South cooperation in which China is a major source of clean energy technology transfer to other developing countries.[218]: 4, 23 As of at least 2023, China is the world's leading producer of solar panels and wind turbines.[114]: 167

The 11th Five-Year Program (2006–10), announced in 2005 and approved by the National People's Congress in March 2006, called for greater energy conservation measures, including development of renewable energy sources and increased attention to environmental protection. Guidelines called for a 20% reduction in energy consumption per unit of GDP by 2010. Moving away from coal towards cleaner energy sources including oil, natural gas, renewable energy, and nuclear power is an important component of China's development program. Beijing also intends to continue to improve energy efficiency and promote the use of clean coal technology. China has abundant hydroelectric resources; the Three Gorges Dam, for example, will have a total capacity of 18 gigawatts when fully on-line (projected for 2009). In addition, the share of electricity generated by nuclear power is projected to grow from 1% in 2000 to 5% in 2030. China's renewable energy law, which went into effect in 2006, calls for 10% of its energy to come from renewable energy sources by 2020.[citation needed]

By 2010, rapidly rising wages and a general increase in the standard of living had put increased energy use on a collision course with the need to reduce carbon emissions in order to control global warming.[101] There were diligent efforts to increase energy efficiency and increase use of renewable sources; over 1,000 inefficient power plants had been closed, but projections continued to show a dramatic rise in carbon emissions from burning fossil fuels.[219]

While not the largest source of historical cumulative emissions, today China accounts for one quarter of global greenhouse gas emissions.[220] On a per capita basis, China's emissions in 2019 (9 tonnes CO2-equivalent [tCO2e] per year) surpass those of the European Union (7.6 tCO2e) but remain slightly below the Organisation for Economic Co-operation and Development (OECD) average (10.7 tCO2e) and well below the United States average (17.6 tCO2e). However, the carbon intensity of China's GDP—the amount of carbon used to generate a unit of output—remains relatively high.[101] To avoid the long-term socioeconomic cost[221] of environmental pollution in China,[222][223] it has been suggested by Nicholas Stern and Fergus Green of the Grantham Research Institute on Climate Change and the Environment that the economy of China be shifted to more advanced industrial development with low carbon dioxide emissions and better allocation of national resources to innovation and R&D for sustainable economic growth in order to reduce the impact of China's heavy industry. This is in accord with the planning goals of the central government.[224] Contrary to the publicized goals, China is building a large number of coal fired power plants and it carbon emissions could further increase.[225][226]

Mining

[edit]China's mineral resources are diverse and rich. As of at least 2022, more than 200 types of minerals are actively explored or mined in China. These resources are widely but not evenly distributed throughout the country. Taken as a whole, China's economy and exports do not rely on the mining industry, but the industry is critical to various subnational Chinese governments.

Mining is extensively regulated in China and involves numerous regulatory bodies. The Chinese state owns all mineral rights, regardless of the ownership of the land on which the minerals are located. Mining rights can be obtained upon government approval, and payment of mining and prospecting fees.

During the Mao Zedong era, mineral exploration and mining was limited to state-owned enterprises and collectively-owned enterprises and private exploration of mineral resources was largely prohibited. The industry was opened to private enterprises during the Chinese economic reform in the 1980s and became increasingly marketized in the 1990s. In the mid-2000s, the Chinese government sought to consolidate the industry due to concerns about underutilization of resources, workplace safety, and environmental harm. During that period, state-owned enterprises purchased smaller privately-owned mines. China's mining industry grew substantially and the period from the early 2000s to 2012 is often referred to as a "golden decade" in the mining industry.Hydroelectric resources

[edit]

China has an abundant potential for hydroelectric power production due to its considerable river network and mountainous terrain. Most of the total hydroelectric capacity is situated in the southwest of the country, where coal supplies are poor but demand for energy is rising swiftly. The potential in the northeast is fairly small, but it was there that the first hydroelectric stations were built – by the Japanese during its occupation of Manchuria.[227]

Thirteen years in construction at a cost of $24 billion, the immense Three Gorges Dam across the Yangtze River was essentially completed in 2006 and produced more than 100TWh of energy in 2018.

Coal

[edit]

China is well endowed with mineral resources,[228] the most important of which is coal. China's mineral resources include large reserves of coal and iron ore, plus adequate to abundant supplies of nearly all other industrial minerals. Although coal deposits are widely scattered (some coal is found in every province), most of the total is located in the northern part of the country. The province of Shanxi, in fact, is thought to contain about half of the total; other important coal-bearing provinces include Heilongjiang, Liaoning, Jilin, Hebei, and Shandong.[229] Apart from these northern provinces, significant quantities of coal are present in Sichuan, and there are some deposits of importance in Guangdong, Guangxi, Yunnan, and Guizhou.[229] A large part of the country's reserves consists of good bituminous coal, but there are also large deposits of lignite. Anthracite is present in several places (especially Liaoning, Guizhou, and Henan), but overall, it is not very significant.[230]

To ensure a more even distribution of coal supplies and to reduce the strain on the less than adequate transportation network, the authorities pressed for the development of a large number of small, locally run mines throughout the country. This campaign was energetically pursued after the 1960s, with the result that thousands of small pits have been established, and they produce more than half the country's coal. This output, however, is typically expensive and is used for local consumption. It has also led to a less than stringent implementation of safety measures in these unregulated mines, which cause several thousands of deaths each year.[231]

Coal makes up the bulk of China's energy consumption (70% in 2005, 55% in 2021), and China is the largest producer and consumer of coal in the world. As China's economy continues to grow, China's coal demand is projected to rise significantly. Although coal's share of China's overall energy consumption will decrease, coal consumption will continue to rise in absolute terms. China's continued and increasing reliance on coal as a power source has contributed significantly to putting China on the path to becoming the world's largest emitter of acid rain-causing sulfur dioxide and greenhouse gases, including carbon dioxide.

Oil and natural gas

[edit]

China's onshore oil resources are mostly located in the Northeast and in Xinjiang, Gansu, Qinghai, Sichuan, Shandong, and Henan provinces. Oil shale is found in a number of places, especially at Fushun in Liaoning, where the deposits overlie the coal reserves, as well as in Guangdong. High quality light oil has been found in the Pearl River estuary of the South China Sea, the Qaidam Basin in Qinghai, and the Tarim Basin in Xinjiang. The country consumes most of its oil output but does export some crude oil and oil products. China has explored and developed oil deposits in the South China Sea and East China Sea, the Yellow Sea, the Gulf of Tonkin, and the Bohai Sea.

In 2013, the pace of China's economic growth exceeded the domestic oil capacity and floods damaged the nation's oil fields in the middle of the year. Consequently, China imported oil to compensate for the supply reduction and surpassed the US in September 2013 to become the world's largest importer of oil.[232]

The total extent of China's natural gas reserves is unknown, as relatively little exploration for natural gas has been done.[233] Sichuan accounts for almost half of the known natural gas reserves and production.[234] Most of the rest of China's natural gas is associated gas produced in the Northeast's major oil fields, especially Daqing oilfield. Other gas deposits have been found in the Qaidam Basin, Hebei, Jiangsu, Shanghai, and Zhejiang, and offshore to the southwest of Hainan.[235] According to an article published in Energy Economics in 2011 by economists Mete Feridun (University of Greenwich) and Abdul Jalil (Wuhan University in China), financial development in China has not taken place at the expense of environmental pollution and financial development has led to a decrease in environmental pollution. Authors conclude that carbon emissions are mainly determined by income, energy consumption and trade openness and their findings confirm the existence of an Environmental Kuznets Curve in the case of China.[236]

Metals and nonmetals

[edit]Iron ore reserves are found in most provinces, including Hainan. Gansu, Guizhou, southern Sichuan, and Guangdong provinces have rich deposits. The largest mined reserves are located north of the Yangtze River and supply neighboring iron and steel enterprises. With the exception of nickel, chromium, and cobalt, China is well supplied with ferroalloys and manganese. Reserves of tungsten are also known to be fairly large. Copper resources are moderate, and high-quality ore is present only in a few deposits. Discoveries have been reported from Ningxia. Lead and zinc are available, and bauxite resources are thought to be plentiful. China's antimony reserves are the largest in the world. Tin resources are plentiful, and there are fairly rich deposits of gold. China is the world's fifth largest producer of gold and in the early 21st century became an important producer and exporter of rare metals needed in high-technology industries.

China also produces a fairly wide range of nonmetallic minerals. One of the most important of these is salt, which is derived from coastal evaporation sites in Jiangsu, Hebei, Shandong, and Liaoning, as well as from extensive salt fields in Sichuan, Ningxia, and the Qaidam Basin. There are important deposits of phosphate rock in a number of areas, Jiangxi, Guangxi, Yunnan and Hubei. Production has been accelerating every year. As of 2013 China is producing 97,000,000 metric tons of phosphate rock a year.[237] Pyrites occur in several places; Liaoning, Hebei, Shandong, and Shanxi have the most important deposits. China also has large resources of fluorite (fluorspar), gypsum, asbestos, and has the world's largest reserves and production of cement, clinker and limestone.

Industry and manufacturing

[edit]

China has a strong global position in the production of industrial goods and some of its companies are global leader in the areas of steel, solar energy, and telecommunications accessories.[238]: 131 As of 2023[update], industry accounts for 38.3% of China's GDP.[6] From 2010 until at least 2023, China produces more industrial goods than any other country.[115]: 1 As of 2023, China manufactures approximately one fifth of the world's total output of industrial products.[238]: 133

Major industries include mining and ore processing; iron and steel; aluminium; coal; machinery; armaments; textiles and apparel; petroleum; cement; chemical; fertilizers; food processing; automobiles and other transportation equipment including rail cars and locomotives, ships, and aircraft; consumer products including footwear, toys, and electronics; telecommunications and information technology.

Since the founding of the People's Republic, industrial development has been given considerable attention; as of 2011 46% of China's national output continued to be devoted to investment; a percentage far higher than any other nation.[239] Among the various industrial branches the machine-building and metallurgical industries have received the highest priority. These two areas alone now account for about 20–30 percent of the total gross value of industrial output.[240] In these, as in most other areas of industry, however, innovation has generally suffered at the hands of a system that has rewarded increases in gross output rather than improvements in variety, sophistication and quality. China, therefore, still imports significant quantities of specialized steels. Overall industrial output has grown at an average rate of more than ten percent per year, having surpassed all other sectors in economic growth and degree of modernization.[241]

Following its 2001 entry into the World Trade Organization, China quickly developed a reputation as the "world's factory" through its manufacturing exports.[116]: 256 The complexity of its exports increased over time, and as of 2019 it accounts for approximately 25% of all high tech goods produced globally.[116]: 256

The predominant focus of development in the chemical industry is to expand the output of chemical fertilizers, plastics, and synthetic fibers. The growth of this industry has placed China among the world's leading producers of nitrogenous fertilizers. In the consumer goods sector the main emphasis is on textiles and clothing, which also form an important part of China's exports. Textile manufacturing, a rapidly growing proportion of which consists of synthetics, account for about ten percent of the gross industrial output and continues to be important, but less so than before. The industry tends to be scattered throughout the country, but there are a number of important textile centers, including Shanghai, Guangzhou, and Harbin.[242][243] There is a growing consumer culture in China.

As of at least 2024, China has significant industrial capacity in excess of its domestic needs.[115]: 34 The government has sought to alleviate industrial capacity by channeling it abroad, including through the Belt and Road Initiative.[115]: 34

Steel industry

[edit]

In 2020, China produced over 1053 million tonnes of steel, over half of the world total. This was an increase of 5.6% over the previous year as global steel production fell by 0.9%. China's share of global crude steel production increased from 53.3% in 2019 to 56.5% in 2020. Decreasing -2.1% in 2021.[244]

Iron ore production kept pace with steel production in the early 1990s but was soon outpaced by imported iron ore and other metals in the early 2000s. Steel production, an estimated 140 million tons in 2000 increased to 419 million tons in 2006 and 928 million tons by 2018.

China was the top exporter of steel in the world in 2018; export volumes in 2018 were 66.9 million tons, a nine percent decrease over the previous year. It again decreased in 2021 to 66.2 million tons.[245] The decline slowed China's decade-old steel export growth. As of 2012 steel exports faced widespread anti-dumping taxes and had not returned to pre-2008 levels.[246] Domestic demand remained strong, particularly in the developing west where steel production in Xinjiang was expanding.[247]

Of the 45 largest steel producing companies in the world, 21 are Chinese, including the world's largest, China Baowu Steel Group.

Automotive industry

[edit]China is the world's largest automobile producer, manufacturing more than 30.16 million vehicles in 2023, with 4.91 million of those being exported overseas.[248] As of 2024[update], China is the world's largest automobile market in terms of both sales and ownership.[114]: 105

By 2006 China had become the world's third largest automotive vehicle manufacturer (after US and Japan) and the second largest consumer (only after the US). However, four years later, in 2010, China was manufacturing more vehicles than the U.S. and Japan combined. Automobile manufacturing has soared during the reform period. In 1975 only 139,800 automobiles were produced annually, but by 1985 production had reached 443,377, then jumped to nearly 1.1 million by 1992 and increased fairly evenly each year up until 2001, when it reached 2.3 million. In 2002 production rose to nearly 3.25 million and then jumped to 4.44 million in 2003, 5.07 million in 2004, 5.71 million in 2005, 7.28 million in 2006, 8.88 million in 2007, 9.35 million in 2008 and 13.83 million in 2009. China has become the number-one automaker in the world as of 2009. Domestic sales have kept pace with production. After respectable annual increases in the mid- and late 1990s, passenger car sales soared in the early 2000s.

In 2010, China became the world's largest automotive vehicle manufacturer as well as the largest consumer ahead of the United States with an estimated 18 million new cars sold.[249]

China's automotive industry has been so successful that it began exporting car parts in 1999. China began to plan major moves into the automobile and components export business starting in 2005. A new Honda factory in Guangzhou was built in 2004 solely for the export market and was expected to ship 30,000 passenger vehicles to Europe in 2005. By 2004, twelve major foreign automotive manufacturers had joint-venture plants in China. They produced a wide range of automobiles, minivans, sport utility vehicles, buses, and trucks. In 2003 China exported US$4.7 billion worth of vehicles and components. The vehicle export was 78,000 units in 2004, 173,000 units in 2005, and 340,000 units in 2006. The vehicle and component export is targeted to reach US$70 billion by 2010.[citation needed] China's exports of cars increased significantly since 2020, boosted by new energy vehicles. It overtook Germany and Japan in 2022 and 2023 respectively in vehicle exports, becoming the world's largest exporter of cars.[250]

The market for domestically produced cars, under a local name, is likely to continue to grow both inside China and outside. Companies such as Geely, Qiantu and Chery are constantly evaluating new international locations, both in developing and developed countries.[251]

Electric vehicle industry

[edit]

The electric vehicle industry in China is the largest in the world, accounting for around 58% of global consumption of EVs.[252] In 2023, CAAM reported China had sold 9.05 million passenger electric vehicles, consisting 6.26 million BEVs (battery-only EVs) and 2.79 million PHEV (plug-in hybrid electric vehicles).[253] China also dominates the plug-in electric bus and light commercial vehicle market, reaching over 500,000 buses (98% of global stock) and 247,500 electric commercial vehicles (65% of global stock) in 2019,[254] and recording new sales of 447,000 commercial EVs in 2023.[253]

Plug-in electric vehicle (BEV and PHEV) sales were 37% of the overall automotive sales in China in 2023, with BEVs and PHEVs having 25% and 12% market share respectively. This is a significant increase from 2020, when plug-in electric vehicles accounted for only 6.3% of total sales.[255] The plug-in market in China was dominated by Chinese companies, with BYD Auto and SAIC Motor occupying the top two spots, and 5 out of the top 7 spots.[256]

The battery industry is closely related to the EV industry as batteries constitute around 1/3 of the cost of EVs[258] and around 80% of lithium-ion batteries in the world are used in EVs.[259] The industry also has significant Chinese presence, with major players including world's largest CATL, BYD, CALB, Gotion, SVOLT and WeLion.[260]

Semiconductor industry

[edit]The Chinese semiconductor industry, including IC design and manufacturing, forms a major part of China's IT industry. China's semiconductor industry consists of a wide variety of companies, from integrated device manufacturers to pure-play foundries to fabless semiconductor companies. Integrated device manufacturers (IDMs) design and manufacture integrated circuits. Pure-play foundries only manufacture devices for other companies, without designing them, while fabless semiconductor companies only design devices. Examples of Chinese IDMs are YMTC and CXMT, examples of Chinese pure-play foundries are SMIC, Hua Hong Semiconductor and Wingtech, and examples of Chinese fabless companies are Zhaoxin, HiSilicon and UNISOC.

China is the currently the world's largest semiconductor market in terms of consumption. In 2020, China represented 53.7% of worldwide chip sales, or $239.45 billion out of $446.1 billion. However, a large percentage are imported from multinational suppliers. In 2020, imports took up 83.38% ($199.7 billion) of total chip sales. In response, the country has launched a number of initiatives to close the gap, including investing $150 billion into its domestic IC industry, with a "Made in China 2025" goal of 70% domestic production.[261][262][263]

China leads the world in terms of number of new fabs under construction, with 8 out of 19 worldwide in 2021, and 17 fabs in total are expected to start construction from 2021 to 2023. Total installed capacity of Chinese-owned chipmakers will also increase from 2.96 million wafers per month (wpm) in 2020 to 3.572 million wpm in 2021.[261]

Other industries

[edit]Substantial investments were made in the manufacture of solar panels and wind generators by a number of companies, supported by liberal loans by banks and local governments. However, by 2012 manufacturing capacity had far outstripped domestic and global demand for both products, particularly solar panels, which were subjected to anti-dumping penalties by both the United States and Europe. The global oversupply has resulted in bankruptcies and production cutbacks both inside and outside China. China has budgeted $50 billion to subsidize production of solar power over the two decades following 2015 but, even at the sharply reduced price resulting from oversupply, as of 2012 cost of solar power in China remained three times that of power produced by conventional coal-fired power plants.[264]

China is the world's biggest sex toy producer and accounts for 70% of the worldwide sex toys production.[265] In the country, 1,000 manufacturers are active in this industry, which generates about two billion dollars a year.[265]

As of 2011, China was the world's largest market for personal computers.[266] China has the second largest reserve of computers in the world as of at least 2024.[114]: 16-17

Services

[edit]Prior to the onset of economic reforms in 1978, China's services sector was characterized by state-operated shops, rationing, and regulated prices – with reform came private markets, individual entrepreneurs, and a commercial sector. The wholesale and retail trade has expanded quickly, with numerous shopping malls, retail shops, restaurant chains and hotels constructed in urban areas. Public administration remains a main component of the service sector, while tourism has become a significant factor in employment and a source of foreign exchange.[267]

Telecommunications

[edit]The affordability of mobile phones and internet data in China has resulted in the number of mobile internet users in China surpassing the number of computer internet users.[268]: 178

By 2023, the number of Internet users in China increased to over 1.09 billion. The proportions of Chinese netizens accessing the Internet via mobile phones, desktop computers, laptop computers. TVs and tablet computers were 99.9%, 33.9%, 30.3%, 22.5% and 26.6%, respectively.[269]

Consumer internet

[edit]China's economy is one of the world's leaders in consumer internet and mobile payments.[238]: 130 As of 2024[update], China has more internet users than any other country.[114]: 18 Internet users in China generate large amounts of data, thereby providing a competitive benefit in the development of machine learning for artificial intelligence technology.[114]: 18

Mobile payment methods via apps including Alipay and WeChat Pay were quickly adopted in China in part due to the relative lack of credit cards in the country.[238]: 130 This technological leapfrogging also led to a boom in online shopping and retail banking.[238]: 130

Platform economy

[edit]China's platform economy has grown substantially since the early 2010s, with its transactional volume reaching RMB 3.7 trillion in 2021.[164]: 155 The platform economy has absorbed a large number of workers from China's decreasing manufacturing workforce and from its population of internal migrant workers.[164]: 155 As of 2020, 84 million people worked as platform economy service providers and 6 million were employees of platform companies.[164]: 155

The platform economy sector is highly concentrated in Alibaba and Tencent, both of which have ride-hailing and food delivery businesses as key assets in their investment portfolios.[164]: 155 Ride-hailing and food delivery businesses have significantly consolidated since 2016.[164]: 155–156

Mass media

[edit]In 2020, China's market for films surpassed the U.S. market to become the largest such market in the world.[114]: 16

Tourism

[edit]

China hosts the world's largest number of World Heritage Sites (59). China's tourism industry is one of the fastest-growing industries in the national economy and is also one of the industries with a very distinct global competitive edge. According to the World Travel and Tourism Council, travel and tourism directly contributed CNY 1,362 billion (US$216 billion) to the Chinese economy (about 2.6% of GDP).[270] In 2011, total international tourist arrivals was 58 million, and international tourism receipts were US$48 billion.[271]

The Chinese tourism industry has been hit hard by both the COVID-19 lockdowns and strained relations with many foreign nations.[272][273] Foreign flights into China, both for business and tourism are way down, especially from the US.[274][275][276] Recent much increased internal security activity decreases the desire of foreigners to live in China, or to go to China, for fear of being targeted and not allowed to leave. Thus many foreigners are leaving and others crossing it off as a travel destination.[277][278]

Luxury goods

[edit]Hong Kong and Macau benefit from favorable taxation rules and are favored locations for tourists from elsewhere in China to purchase luxury goods like cosmetics, jewelry, and designer fashion goods.[279]: 116

Porcelain has long been one of China's most important luxury exports.[279]: 226 It was especially important to early trade between China and the West, with much of that trade being conducted through Macau.[279]: 226

After a 2012 ban on government agencies purchasing luxury goods, often used as "gifts", sales of luxury goods in China remained strong but slowed, even falling slightly for luxury retailers in the 4th quarter of 2012,[280] with sales of shark fins and edible swallow nests, once staples of lavish government banquets, down sharply.[281]

Many shops in international travel destinations have specialized staff devoted to Chinese customers.[280]

Income and wealth

[edit]China has the largest national proportion of the global middle class.[116]: 204 As of 2020, China had 400 million middle-income citizens.[114]: 159 It is projected to reach 1.2 billion by 2027, making up one fourth of the world total.[282] According to a 2021 Pew Research Center survey, there were 23 million Chinese individuals with a per capita daily income of $50 or more, 242 million with a daily income between $20–50 per day, 493 million between $10–20, 641 million $2–10 per day, and 4 million under $2 per day; all the figures are expressed in international dollars and 2011 purchasing power parity values.[283] In 2022, the National Bureau of Statistics reported that China's average disposable income per capita was ¥36,883, of which ¥20,590 was from wages and salaries, ¥6,175 was net business income, ¥3,227 was net income from property, and ¥6,892 was net transfer income.[284]