Chancellorship of George Osborne

Osborne's chancellorship portrait | |

| Chancellorship of George Osborne 11 May 2010 – 13 July 2016 | |

| Party | Conservative |

|---|---|

| Election | 2010, 2015 |

| Nominated by | David Cameron |

| Appointed by | Elizabeth II |

| Seat | 11 Downing Street |

|

| |

George Osborne served as Chancellor of the Exchequer from May 2010 to July 2016 in the David Cameron–Nick Clegg coalition Conservative-Liberal Democrat government and the David Cameron majority Conservative government. His tenure pursued austerity policies aimed at reducing the budget deficit and launched the Northern Powerhouse initiative. He had previously served as Shadow Chancellor in the Shadow Cabinet of David Cameron from 2005 to 2010.

Following the 2010 general election, negotiations led to David Cameron becoming prime minister as the head of a coalition government with the Liberal Democrats. Osborne was appointed Chancellor of the Exchequer in the Cameron–Clegg coalition. He succeeded Alistair Darling, inheriting a large deficit in government finances due to the effects of the 2007–2008 financial crisis and the Great Recession. At age 39, Osborne became the youngest Chancellor of the Exchequer since the appointment of Randolph Churchill over 120 years prior at age 37.[1] As Chancellor, Osborne pursued austerity policies aimed at reducing the budget deficit and launched the Northern Powerhouse initiative.

After the Conservatives won an overall majority in the 2015 general election, Cameron reappointed Osbourne as Chancellor in his second government and gave him the additional title of First Secretary of State. He was widely viewed as a potential successor to David Cameron as Leader of the Conservative Party; one Conservative MP, Nadhim Zahawi, suggested that the closeness of his relationship with Cameron meant that the two effectively shared power during the duration of the Cameron governments. Following the 2016 referendum vote to leave the European Union and Cameron's consequent resignation, he was dismissed by Cameron's successor Theresa May. He was succeeded by Philip Hammond.

The austerity measures are generally now viewed as having failed to reduce unemployment, lower interest rates, or stimulate growth, and have been linked to worsened inequality and poverty and a rise in political instability.

Cameron–Clegg coalition

[edit]2010

[edit]Osborne was appointed Chancellor of the Exchequer on 11 May 2010, and was sworn in as a Privy Counsellor two days later.[2] Osborne acceded to the chancellorship in the continuing wake of the financial crisis. Two of his first acts were setting up the Office for Budget Responsibility and commissioning a government-wide spending review, which was to conclude in autumn 2010 and to set limits on departmental spending until 2014–15.[3] Shortly before the 2010 election, Osborne had pledged to be "tougher than Thatcher" on Britain's budget deficit,[4] and he duly set himself the target of reducing the UK's deficit to the point that, in the financial year 2015–16, total public debt would be falling as a proportion of GDP.[5] On 24 May 2010, Osborne outlined £6.2bn cuts: "We simply cannot afford to increase public debt at the rate of £3bn each week."[6] Documents leaked from the Treasury the following month revealed that Osborne anticipated his tighter spending would lead to 1.3 million jobs being lost over the course of the parliament.[7] Osborne termed those who objected to his policy "deficit-deniers".[8]

In July 2010, whilst seeking cuts of up to 25 per cent in government spending to tackle the deficit, Osborne insisted the £20 billion cost of building four new Vanguard-class submarines to bear Trident missiles had to be considered as part of the Ministry of Defence's core funding, even if that implied a severe reduction in the rest of the Ministry's budget. Liam Fox, the Secretary of State for Defence, warned that if Trident were to be considered core funding, there would have to be severe restrictions in the way that the UK operated militarily.[9]

Osborne presented the Government's Spending Review on 20 October, which fixed spending budgets for each government department up to 2014–15.[10][11] Before and after becoming Chancellor, Osborne had alleged that the UK was on "the verge of bankruptcy",[12][13] though this assertion was criticised by the Treasury Select Committee and others as an effort to try and justify his programme of spending cuts.[14][15]

On 4 October 2010, in a speech at the Conservative conference in Birmingham, Osborne announced a cap on the overall amount of benefits a family can receive from the state, estimated to be around £500 a week from 2013. It was estimated that this could result in 50,000 unemployed families losing an average of £93 a week. He also announced that he would end the universal entitlement to child benefit, and that from 2013 the entitlement would be removed from people paying the 40% and 50% income tax rates.[16]

2011

[edit]

In February 2011 Osborne announced Project Merlin, whereby banks aimed to lend about £190bn to businesses in 2011 (including £76bn to small firms), curb bonuses and reveal some salary details of their top earners; meanwhile, the bank levy would increase by £800m. Liberal Democrat Treasury spokesman Lord Oakeshott resigned after the agreement was announced. Other pledges included providing £200m of capital for David Cameron's Big Society Bank, which was supposed to finance community projects.[17]

In November 2011, Osborne sold Northern Rock to Richard Branson's Virgin Money for a price that was to range from £747m to £1bn.[18] Northern Rock, the first British bank in 150 years to suffer a bank run, had been taken into public ownership in 2008, then divided into two entities on 1 January 2010 – the other half being Northern Rock (Asset Management) plc.[19] The Independent described the entity sold as the "detoxified arm" of the bank, while saying the taxpayers retained "responsibility for £20bn of toxic assets such as bad debts and closed mortgages". The deal valued the bank at somewhat less than its £1.12bn net asset value, and "locks in a minimum loss" for taxpayers of £373m to £453m.[20] Osborne argued the deal would get "more money back than any other deal on the table".[18] and responded to concerns about the timing by saying that a secret deal between the previous Labour government and the European Commission in Brussels obliged them to sell the bank in or before 2013, and "[g]iven we were advised that Northern Rock plc would have been likely to remain loss-making [until] at least well into 2012, which would have depleted taxpayer resources still further, agreeing a sale now was even more imperative."[20]

Osborne's 2011 Autumn Statement was delivered to Parliament on 29 November 2011. It included a programme of supply-side economic reforms such as investments in infrastructure intended to support economic growth.[21]

2012

[edit]The 2012 budget – dubbed the "omnishambles budget" by the then Labour leader Ed Miliband – is viewed as the nadir of Osborne's political fortunes.[22][23] Osborne cut the 50% income tax rate on top earners, which he said had been specially designated by his predecessor as "temporary", to 45%. Figures from Her Majesty's Revenue and Customs showed that the amount of additional-rate tax paid had increased under the new rate from £38 billion in 2012/13 to £46 billion in 2013/14, which Osborne said was caused by the new rate being more "competitive".[24]

Osborne faced criticism for simultaneously proposing imposing Value-added tax (VAT) on food such as Cornish pasties when served at above-ambient temperature. Critics commented on the potential effect on vendors, with members of the Treasury Select Committee suggesting that Osborne was inexperienced with the issue after a comment that he 'couldn't remember' the last time he had bought such a pasty from Greggs.[25] The "pasty tax" proposal was later withdrawn in what was seen as a political "U-turn",[26] as were proposals to cut tax relief on charitable donations and to tax static caravans.[27]

In October 2012, Osborne proposed a new policy to boost the hiring of staff, under which companies would be able to give new appointees shares worth between £2,000 and £50,000, but the appointees would lose the right to claim unfair dismissal and time off for training.[28][29]

Osborne sent a letter in 2012 to Ben Bernanke, the chairman of the U.S. Federal Reserve, in an attempt to help HSBC's leadership avoid criminal charges over the bank's involvement in laundering drug money and in channelling money to countries under economic sanctions.[30] Osborne suggested that if HSBC were to lose its banking license in the U.S., this could have negative consequences for the financial markets in Europe and Asia. HSBC avoided criminal charges, and settled with the U.S. Department of Justice for $1.92 bn.[30]

Budget deficit

[edit]

In February 2013, the UK lost its AAA credit rating—which Osborne had indicated to be a priority when coming to power—for the first time since 1978.[31] His March 2013 budget was made when the Office for Budget Responsibility had halved its forecast for that year's economic growth from 1.2% to 0.6%.[32] It was described by The Daily Telegraph's economics editor as "an inventive, scattergun approach to growth that half-ticked the demands of every policy commentator, wrapped together under the Chancellor's banner of Britain as an 'aspiration nation'."[33] However, it was positively received by the public, with the ensuing boost to Conservative Party support in opinion polls standing in marked contrast to the previous year's budget.[34] The economy subsequently began to pick up in mid-2013, with Osborne's net public approval rating rising from −33 to +3 over the following 12 months.[22]

By March 2015 the annual deficit had been cut by about half of the initial target; thus, the debt-to-GDP ratio was still rising. Also, the United Kingdom national debt increased more during the five-year term than during the previous 13 years.[35]

Moreover, the economy deteriorated after the election owing to the uncertainty caused by the referendum. Reviewing his performance in July 2016, The Guardian said that the UK still had a budget deficit of 4%, a balance-of-payments (trade) deficit of 7% of GDP, and (apart from Italy) the worst productivity among the G7 nations.[36] An Office for National Statistics graph including the period 2010–2016 shows a worsening balance-of-trade deficit.[37]

The Conservative manifesto for the 2015 general election contained a promise not to raise income tax, VAT, or National Insurance for the duration of the parliament. Journalist George Eaton maintains that Osborne did not expect an outright Conservative majority, and expected his Liberal Democrat coalition partners to make him break that promise.[38]

Cameron majority government

[edit]

After the Conservatives won an overall majority at the 2015 general election, Osborne was reappointed Chancellor of the Exchequer by Cameron in his second government. Osborne was also appointed First Secretary of State,[39][40] replacing the retiring William Hague.

July 2015 budget

[edit]Osborne announced on 16 May that he would deliver a second Budget on 8 July, and promised action on tax avoidance by the rich by bringing in a "Google tax" designed to discourage large companies diverting profits out of the UK to avoid tax.[41] In addition, large companies would now have to publish their UK tax strategies; any large businesses that persistently engaged in aggressive tax planning would be subject to special measures.[42] However, comments made by Osborne in 2003 on BBC Two's Daily Politics programme then resurfaced; these regarded the avoidance of inheritance tax and using "clever financial products" to pass the value of homeowners' properties to their children, and were widely criticised by politicians and journalists as hypocritical.[43][44]

The second Budget also increased funding for the National Health Service, more apprenticeships, efforts to increase productivity and cuts to the welfare budget.[45] In response, the Conservative-led Local Government Association, on behalf of 375 Conservative-, Labour- and Liberal Democrat-run councils, said that further austerity measures were "not an option" as they would "devastate" local services. They said that local councils had already had to make cuts of 40% since 2010 and couldn't make any more cuts without serious consequences for the most vulnerable.[46] After the budget, many departments were told to work out the effect on services of spending cuts from 25% to 40% by 2019–20. This prompted fears that services the public takes for granted could be hit,[47] and concern that the Conservative Party had not explained the policy clearly in its manifesto before the 2015 election.[48]

Osborne announced the introduction of a "National Living Wage" of £7.20/hour, rising to £9/hour by 2020, which would apply to those aged 25 or over.[49] This was widely cheered by both Conservative MPs and political commentators.[50] He also announced a raise in the income tax personal allowance to £11,000;[51] measures to introduce tax incentives for large corporations to create apprenticeships, aiming for 3 million new apprenticeships by 2020; and a cut in the benefits cap to £23,000 in London and £20,000 in the rest of the country.[51]

The July budget postponed the predicted arrival of a UK surplus from 2019 to 2020, and included an extra £18 billion more borrowing for 2016–20 than planned for the same period in March.[52]

In the July Budget, Osborne also planned to cut tax credits, which top up pay for low-income workers, prompting claims that this represented a breach of promises made by colleagues before the general election in May.[53] Following public opposition and a House of Lords vote against the changes, Osborne scrapped these changes in the 2015 Autumn Statement, saying that higher-than-expected tax receipts gave him more room for manoeuvre.[54] The Institute for Fiscal Studies noted that Osborne's proposals implied that tax credits would still be cut as part of the switch to Universal Credit in 2018.[53]

FCA

[edit]In July 2015, Osborne was criticised by John Mann of the Treasury Select Committee for ending the contract of Martin Wheatley, head of the Financial Conduct Authority, and undermining the independence of the regulator. Wheatley had angered the banks by cracking down on misselling following the payment protection insurance scandal and fining them £1.4B.[55]

Osborne was also criticised over his perceived inaction on enacting policies set forth by the Organisation for Economic Co-operation and Development (OECD) to combat tax avoidance.[56] MPs called for an inquiry in January 2016, when it was revealed that a retrospective tax deal the Treasury agreed with Google over previous diverted profits allowed it to pay an effective tax rate of just 3% over the previous decade.[57]

BBC licence fee

[edit]According to The Guardian, Osborne was "the driving force" behind the BBC licence fee agreement which saw the BBC responsible for funding the £700m welfare cost of free TV licences for the over-75s, meaning that it lost almost 20% of its income.[58] The Guardian also noted Osborne's four meetings with News Corp representatives and two meetings with Rupert Murdoch before the deal was announced.[59]

Hinkley Point C

[edit]George Osborne strongly supported China's involvement in sensitive sectors such as the Hinkley Point C nuclear power station. The then Home Secretary Theresa May had been unhappy about Osborne's "Gung ho" attitude to the Chinese, and had objected to the project. It has been delayed for final approval after May assumed the Prime Ministership. In 2015, May's political adviser Nick Timothy expressed his worry that China was effectively buying Britain's silence on allegations of Chinese human rights abuse, and criticised David Cameron and Osborne for "selling our national security to China" without rational concerns and "the Government seems intent on ignoring the evidence and presumably the advice of the security and intelligence agencies." He warned that the Chinese could use their role in the programme (designing and constructing nuclear reactors) to build weaknesses into computer systems which allow them to shut down Britain's energy production at will and "...no amount of trade and investment should justify allowing a hostile state easy access to the country's critical national infrastructure."[60][61][62]

2016 budget

[edit]

In Osborne's 2016 budget he introduced a sugar tax and raised the tax-free allowance for income tax to £11,500, as well as lifting the 40% income tax threshold to £45,000. He also gave initial funding for several large infrastructure projects, such as High Speed 3 (an east–west rail line across the north of England), Crossrail 2 (a north–south rail line across London), a road tunnel across the Pennines, and upgrades to the M62 motorway.[66] There would also be a new "lifetime" Individual savings account (ISA) for the under-40s, with the government putting in £1 for every £4 saved. Those saving £4000 towards a house deposit were promised an annual £1000 top-up until they reached 50.[66] £100m was also allocated to tackle rough sleeping.[67] However, many charities complained that they thought Osborne's 2016 budget favoured big business rather than disabled people.[68]

Osborne was criticised by The Daily Telegraph in August 2016 after 500,000 people opened the new ISAs hoping to use them as a house deposit, only to find the bonus would not be paid until the house sale was completed—a flaw which led experts to describe the scheme as useless and a scam.[69]

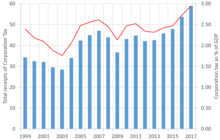

Following the UK's vote to leave the European Union in June 2016, Osborne pledged to further lower corporation tax to "encourage businesses to continue investing in the UK". Osborne had already cut the corporation tax rate from 28% to 20%, with plans to lower it to 17% by 2020.[70][71]

See also

[edit]References

[edit]- ^ Simao, Paul (24 August 2010). "PROFILE - UK Chancellor of the Exchequer George Osborne". Reuters. Archived from the original on 9 October 2022.

- ^ "Privy Council Orders". Privy Council. 13 May 2010. Archived from the original on 11 June 2011. Retrieved 26 July 2010.

- ^ Martin Wolf (10 June 2010). "A question for chancellor Osborne". Financial Times. Archived from the original on 28 December 2010. Retrieved 10 June 2011.

- ^ "Osborne will be 'tougher than Thatcher'". Today. BBC Radio 4. 25 February 2010. Archived from the original on 18 May 2015. Retrieved 15 May 2015.

- ^ Emma Rowley (12 June 2011). "UK economy 'Plan A' – Is George Osborne on the right path?". The Sunday Telegraph. Archived from the original on 15 June 2011. Retrieved 12 June 2011.

- ^ "George Osborne outlines detail of £6.2bn spending cuts". BBC News. 24 May 2010. Archived from the original on 30 August 2017. Retrieved 24 May 2010.

- ^ Larry Elliott (29 June 2010). "Budget will cost 1.3m jobs – Treasury". The Guardian. Archived from the original on 2 October 2013. Retrieved 10 June 2011.

Unpublished estimates of the impact of the biggest squeeze on public spending since the second world war show that the government is expecting between 500,000 and 600,000 jobs to go in the public sector and between 600,000 and 700,000 to disappear in the private sector by 2015. . . . A slide from the final version of a presentation for last week's budget. . . . says: "100–120,000 public sector jobs and 120–140,000 private sector jobs assumed to be lost per annum for five years through cuts. "

- ^ Ed Howker (14 September 2010). "Barber, Blanchflower and the fake debate on double dip". Coffee House. UK. Retrieved 10 June 2011.[permanent dead link]

- ^ Prince, Rosa (29 July 2010). "George Osborne: Trident is not exempt from budget cuts". The Daily Telegraph. London. Archived from the original on 2 August 2010. Retrieved 4 October 2010.

- ^ "Key Spending Review announcements". Spending Review. HM Treasury. 22 November 2010. Archived from the original on 18 May 2011. Retrieved 10 June 2011.

- ^ "Spending Review 2010: Key points at-a-glance". BBC News. 21 October 2010. Archived from the original on 2 June 2011. Retrieved 10 June 2011.

- ^ Sam Coates (25 November 2008). "Parties reveal their battle lines for the next election". The Times. Archived from the original on 9 August 2011. Retrieved 11 June 2011.

- ^ George Osborne (4 October 2010). "George Osborne's speech to the Conservative party conference in full". The Guardian. Archived from the original on 2 October 2013. Retrieved 11 June 2011.

- ^ Martin Wolf (20 October 2010). "A spending review for a diminished country". Financial Times. Archived from the original on 28 January 2011. Retrieved 30 September 2013.

The chancellor presents the hypothesis of looming national 'bankruptcy'. If so, the UK must have been bankrupt for much of the past two centuries.

- ^ Phillip Inman (4 November 2010). "George Osborne accused of misleading public over UK bankruptcy claim". The Guardian. Archived from the original on 19 December 2013. Retrieved 30 September 2013.

- ^ Mulholland, Helene (4 October 2010). "George Osborne to cap welfare payments". The Guardian. London. Archived from the original on 19 December 2013. Retrieved 4 October 2010.

- ^ "Banks agree Project Merlin lending and bonus deal". BBC News. Archived from the original on 10 February 2011. Retrieved 3 November 2014.

- ^ a b Nigel Morris (18 November 2011). "Osborne sells off Northern Rock for £400m loss". The Independent. Archived from the original on 24 February 2012. Retrieved 7 April 2012.

- ^ "Treasury confirms 1 January restructuring of Northern Rock". HM Treasury. 8 December 2009. Archived from the original on 16 December 2009. Retrieved 9 December 2009.

- ^ a b Harry Wilson (20 November 2011). "George Osborne reveals Northern Rock sale forced on him by secret Labour agreement with Brussels". The Sunday Telegraph. Archived from the original on 19 December 2011. Retrieved 7 April 2012.

- ^ H M Treasury, Press Release: Autumn Statement 2011, published 29 November 2011, accessed 17 August 2022

- ^ a b Parker, George (6 March 2015). "The reinvention of George Osborne". Financial Times. Archived from the original on 2 April 2015. Retrieved 28 March 2015.

- ^ Grice, Andrew (29 September 2014). "Analysis: George Osborne inspired the Tory faithful, but will he ever be leader?". Independent. Archived from the original on 2 April 2015. Retrieved 28 March 2015.

- ^ "Cut to top rate of tax helped raise an extra £8bn, Osborne claims". Archived from the original on 2 March 2016.

- ^ Rowena Mason (27 March 2012). "George Osborne 'can't remember' eating in Greggs amid ridicule over pasty tax". The Daily Telegraph. Archived from the original on 27 March 2012. Retrieved 28 March 2012.

- ^ Patrick Wintour; Owen Bowcott; Richard Norton-Taylor (28 May 2012). "George Osborne forced into pasty tax U-turn". The Guardian. Archived from the original on 12 November 2014. Retrieved 21 October 2014.

- ^ "Government confirms U-turn on charity tax". The Guardian. 31 May 2012. Archived from the original on 10 July 2015. Retrieved 28 March 2015.

- ^ Murphy, Joe (8 October 2012). "George Osborne: Workers of the world unite... and give up your rights". London Evening Standard. Archived from the original on 20 March 2017. Retrieved 2 April 2018.

- ^ Mark King; Hilary Osborne (8 October 2012). "George Osborne's 'employee shares for rights' proposal draws scepticism". The Guardian. Archived from the original on 2 February 2017. Retrieved 11 December 2016.

- ^ a b "HSBC avoided US money laundering charges because of 'market risk' fears". BBC. 12 July 2016. Archived from the original on 12 July 2016. Retrieved 12 July 2016.

- ^ "UK's credit rating cut humiliating, Labour says". BBC News. Archived from the original on 21 October 2014. Retrieved 3 November 2014.

- ^ "Budget 2013: Economic growth forecast for 2013 halved". BBC News. 20 March 2013. Archived from the original on 4 February 2017. Retrieved 22 March 2016.

- ^ "Budget 2013: as it happened". The Daily Telegraph. 20 March 2013. Archived from the original on 4 February 2017. Retrieved 22 March 2016.

- ^ "Budgets, polls and their impact on elections: a brief history". The Guardian. 19 March 2015. Archived from the original on 2 April 2015. Retrieved 28 March 2015.

- ^ Asa Bennett (26 March 2015). "National debt, the deficit and cuts: where does each party stand in General Election 2015?". The Daily Telegraph. Archived from the original on 18 May 2015. Retrieved 2 May 2015.

- ^ Larry Elliott (17 July 2016). "The fragile UK economy has a chance to abandon failed policies post-Brexit". Guardian newspapers. Archived from the original on 26 July 2016. Retrieved 24 July 2016.

- ^ "Source dataset: Balance of Payments time series dataset (PNBP)". Office for National Statistics. 30 June 2016. Archived from the original on 11 September 2016. Retrieved 3 September 2016.

- ^ "How George Osborne accidentally laid a trap for his own government". www.newstatesman.com. 10 March 2017. Archived from the original on 13 March 2017. Retrieved 13 March 2017.

- ^ Election 2015: Prime Minister and ministerial appointments Archived 9 May 2015 at the Wayback Machine (press release), Prime Minister's Office (8 May 2015).

- ^ Nicolas Watts, George Osborne made first secretary of state in cabinet reshuffle Archived 2 February 2017 at the Wayback Machine, The Guardian (8 May 2015).

- ^ "Budget 2015: 'Google Tax' introduction confirmed". BBC News. 18 March 2015. Archived from the original on 23 September 2018. Retrieved 20 June 2018.

- ^ "Autumn Statement 2015: Changes to bring in £5bn a year from tax avoidance". Archived from the original on 6 January 2016. Retrieved 24 January 2016.

- ^ "Use 'clever financial products', advised George Osborne in 2003 – video". The Guardian. BBC2 Daily Politics. 16 February 2015. Archived from the original on 30 January 2016. Retrieved 24 January 2016.

- ^ Mason, Rowena (16 February 2015). "Osborne advised using financial loopholes to avoid tax and care costs". The Guardian. Archived from the original on 31 January 2016. Retrieved 24 January 2016.

Gardner, Kashmira (16 February 2015). "George Osborne advised viewer on how to avoid inheritance tax on The Daily Politics show". The Independent. Archived from the original on 30 January 2016. Retrieved 24 January 2016. - ^ "George Osborne plans new Budget on 8 July". BBC News. 16 May 2015. Archived from the original on 17 May 2015. Retrieved 17 May 2015.

- ^ "No more cuts, Tory councils tell George Osborne". The Guardian. 16 May 2015. Archived from the original on 16 May 2015. Retrieved 17 May 2015.

- ^ Preston Robert BBC Treasury want reinvention of public sector Archived 20 March 2017 at the Wayback Machine

- ^ The Independent (London) 27 October 2015 Tax credits: House of Lords votes to delay cuts by three years Archived 1 August 2017 at the Wayback Machine

- ^ "Budget 2015: Osborne unveils National Living Wage". BBC News. Archived from the original on 16 July 2018. Retrieved 20 June 2018.

- ^ "Jon Craig: Osborne's transition from pantomime villain to Tory rock star". publicaffairsnews.com. Archived from the original on 2 October 2015. Retrieved 15 August 2015.

- ^ a b "Budget: The Key Points You Need To Know". Sky News. 8 July 2015. Archived from the original on 9 July 2015. Retrieved 8 July 2015.

- ^ Liam Halligan (11 July 2015). "George Osborne's savvy display lacked tough fiscal action". The Daily Telegraph. Archived from the original on 16 July 2015. Retrieved 12 July 2015.

- ^ a b Hattenstone, Simon (29 October 2015). "Cameron shouldn't be allowed to break his tax credit promise. Here's the solution". The Guardian. Archived from the original on 11 March 2016. Retrieved 5 March 2016.

- ^ "Spending Review: George Osborne scraps cuts to tax credits". Archived from the original on 20 July 2018. Retrieved 20 June 2018.

- ^ Phillip Inman (17 July 2015). "City watchdog chief quits after George Osborne vote of no confidence". The Guardian. Archived from the original on 21 September 2016. Retrieved 24 July 2016.

- ^ "Why multinationals love Generous George". Private Eye. No. 1410. 24 January 2016. Archived from the original on 24 January 2016. Retrieved 24 January 2016.

- ^ Mason, Rowena (26 January 2016). "Google tax deal: MPs launch inquiry after criticism of £130m settlement". The Guardian. Archived from the original on 4 March 2016. Retrieved 5 March 2016.

- ^ Jane Martinson and John Plunkett (6 July 2015). "George Osborne forces BBC to pay for over-75s' TV licences". Guardian Newspapers. Archived from the original on 18 December 2015. Retrieved 19 December 2015.

- ^ Jasper Jackson and Jane Martinson (18 December 2015). "George Osborne met Rupert Murdoch twice before imposing BBC cuts". Guardian Newspapers. Archived from the original on 18 December 2015. Retrieved 19 December 2015.

- ^ Why have ministers delayed final approval for Hinkley Point C? Archived 30 July 2016 at the Wayback Machine. The Guardian. 29 July 2016.

- ^ Theresa May 'raised objections to project as home secretary' Archived 31 July 2016 at the Wayback Machine. The Guardian. 30 July 2016.

- ^ Nick Timothy: The Government is selling our national security to China Archived 31 July 2016 at the Wayback Machine. Conservative Home. 20 October 2015.

- ^ "HMRC Corporation Tax Statistics 2017" (PDF). p. 19. Archived (PDF) from the original on 6 October 2017. Retrieved 3 July 2018.

Includes Bank Levy, Bank Surcharge and Diverted Profits Tax

- ^ "National Statistics dataset – HM Revenue and Customs receipts" (PDF). Archived (PDF) from the original on 3 July 2018. Retrieved 3 July 2018.

- ^ "Gross Domestic Product at market prices: Current price: Seasonally adjusted £m". Archived from the original on 3 July 2018. Retrieved 3 July 2018.

- ^ a b "Budget 2016 summary: Key points at-a-glance". BBC News. 16 March 2016. Archived from the original on 27 September 2018. Retrieved 20 June 2018.

- ^ "George Osborne to announce £100m to tackle homelessness". Archived from the original on 21 March 2016.

- ^ The Independent (London) 17 March 2016 George Osborne put big business ahead of children and disabled people in his Budget, charities say Archived 20 March 2017 at the Wayback Machine

- ^ Katie Morley (19 August 2016). "Help to Buy Isa scandal:500,000 first time buyers told scheme cannot be used for initial deposit on homes". The Daily Telegraph. Archived from the original on 20 August 2016. Retrieved 20 August 2016.

- ^ "Brexit: George Osborne pledges to cut corporation tax". BBC News. 4 July 2016. Archived from the original on 31 August 2018. Retrieved 3 July 2018.

- ^ Chan, Szu Ping (11 September 2016). "Chancellor dismantles key Osborne pledge to cut corporation tax". The Telegraph. Archived from the original on 3 July 2018. Retrieved 3 July 2018.