Bank of England note issues

| |||||||||||

| ISO 4217 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Code | GBP | ||||||||||

| Denominations | |||||||||||

| |||||||||||

| Demographics | |||||||||||

| Users | United Kingdom Jersey Guernsey Isle of Man South Georgia and the South Sandwich Islands St Helena, Ascension and Tristan da Cunha (Tristan da Cunha only) | ||||||||||

| Legal Tender in | England and Wales | ||||||||||

| Issuance | |||||||||||

| Issued by | Bank of England | ||||||||||

| Printer | De La Rue | ||||||||||

The Bank of England, which is now the central bank of the United Kingdom, British Crown Dependencies and British Overseas Territories, has issued banknotes since 1694. In 1921 the Bank of England gained a legal monopoly on the issue of banknotes in England and Wales, a process that started with the Bank Charter Act 1844, when the ability of other banks to issue notes was restricted.

Banknotes were originally hand-written; although they were partially printed from 1725 onwards, cashiers still had to sign each note and make them payable to someone. Notes were fully printed from 1855. Since 1970, the Bank of England's notes have featured portraits of British historical figures.

Of the eight banks authorised to issue sterling notes in the UK, only the Bank of England can issue banknotes in England and Wales, where its notes are legal tender. Bank of England notes are not legal tender in Scotland and Northern Ireland, but are always accepted by traders.

The Bank of England now issues notes, all in polymer, in four denominations – £5, £10, £20 and £50.

Current banknotes

[edit]There are currently four different denominations of notes – £5, £10, £20 and £50. Each value has its own distinct colour scheme and the size of each note increases in length and width as the value increases. They all feature a portrait of Elizabeth II or Charles III on the obverse. The Bank of England introduced its Series G set of banknotes between 2016 and 2021. Following the death of Elizabeth II, the Bank unveiled new notes, in the same design but featuring Charles III, on 20 December 2022. These notes entered circulation on 5 June 2024.[1][2][3][4]

The table below shows the notes currently in circulation.[5][6] Two issue dates are given for each note – the first is for the Elizabeth II issue: the second date is for the Charles III issue.

| Image | Value | Dimensions (millimetres) |

Material | Main colour | Reverse figure | Issue dates | Notes | ||

|---|---|---|---|---|---|---|---|---|---|

| Obverse | Reverse | ||||||||

| £5 | 125 × 65 | Polymer | Blue | The reverse of the note features the 1941 portrait of Winston Churchill by Yousuf Karsh, the Elizabeth Tower, the maze at Blenheim Palace, the quote "I have nothing to offer but blood, toil, tears and sweat" from a 1940 speech by Churchill and the Nobel Prize medal. | 13 September 2016[7][8] 5 June 2024[1] |

This is the Bank of England's first banknote to be printed in polymer. | |||

| £10 | 132 × 69 | Polymer | Orange | The reverse of the note features a portrait of author Jane Austen (c. 1810) by James Andrews, based on a portrait by her sister, Cassandra, the quote "I declare after all there is no enjoyment like reading!" from Pride and Prejudice, an illustration of Elizabeth Bennet and a view of Godmersham Park in Kent.[9][10][5] | 14 September 2017[11] 5 June 2024[1] | ||||

|

|

£20 | 139 × 73 | Polymer | Purple | The reverse of the note features a Self-portrait of artist J. M. W. Turner (c. 1799), a version of Turner's The Fighting Temeraire, the quote "Light is therefore colour" from an 1818 lecture by Turner and a copy of Turner's signature as made on his will. | 20 February 2020[12] 5 June 2024[1] |

||

|

|

£50 | 146 × 77 | Polymer | Red | The reverse of the note features a photograph of mathematician and computer scientist Alan Turing by Elliott & Fry, with an image of Turing's Automatic Computing Engine, and a table of formulae from Turing's 1936 work On Computable Numbers, with an application to the Entscheidungsproblem. The quotation "This is only a foretaste of what is to come and only the shadow of what is going to be" is from Alan Turing, given in an interview to The Times on 11 June 1949.[13] | 23 June 2021[13] 5 June 2024[1] |

Turing is the first LGBT person to feature on a Bank of England banknote. This is the final Series G polymer note to be issued. | |

These images are to scale at 0.7 pixel per millimetre. For table standards, see the banknote specification table.

Features

[edit]All current Bank of England banknotes are printed by contract with De La Rue at Debden, Essex.[14] They include the printed signature of the Chief Cashier of the Bank of England, Sarah John, for notes issued since mid-2018, and depict the British monarch in full view, facing left. They also include the EURion constellation, a pattern of yellow circles which stops copying of banknotes and is easily identified by photocopiers.[15][16]

Until her death in 2022, Queen Elizabeth II had appeared on all the notes issued since Series C in 1960. The custom of depicting historical figures on the reverse began in 1970 with Series D, designed by the Bank of England's first permanent artist, Harry Eccleston.

Withdrawn banknotes

[edit]| Series D | ||||

|---|---|---|---|---|

| Image | Value | Reverse portrait | Issued | Withdrawn |

| [1] | 10s /50p | Sir Walter Raleigh | Approved in 1964 but never issued[17] | |

| [2] | £1 | Sir Isaac Newton | 9 February 1978 | 11 March 1988 |

| [3] | £5 | Arthur Wellesley, 1st Duke of Wellington | 11 November 1971 | 29 November 1991 |

| [4] | £10 | Florence Nightingale | 20 February 1975 | 20 May 1994 |

| [5] | £20 | William Shakespeare | 9 July 1970 | 19 March 1993 |

| [6] | £50 | Sir Christopher Wren | 20 March 1981 | 20 September 1996 |

| Series E | ||||

| [7] | £5 | George Stephenson | 7 June 1990 | 21 November 2003 |

| [8] | £10 | Charles Dickens | 29 April 1992 | 31 July 2003 |

| [9] | £20 | Michael Faraday | 5 June 1991 | 28 February 2001 |

| [10] | £50 | Sir John Houblon | 20 April 1994 | 30 April 2014 |

| Series E (Variant) | ||||

| [11] | £5 | Elizabeth Fry | 21 May 2002 | 5 May 2017 |

| [12] | £10 | Charles Darwin | 7 November 2000 | 1 March 2018 |

| [13] | £20 | Sir Edward Elgar | 22 June 1999 | 20 June 2010 |

| Series F | ||||

| [14] | £20 | Adam Smith | 13 March 2007 | 30 September 2022 |

| [15] | £50 | Matthew Boulton and James Watt | 2 November 2011 | 30 September 2022 |

History

[edit]The Bank of England now has a monopoly of note issue in England and Wales, but this has not always been the case. Until the middle of the 19th century, private banks in Great Britain and Ireland were free to issue their own banknotes, and notes issued by provincial banking companies were commonly in circulation.[18] Over the years, various acts of Parliament were introduced in the United Kingdom to increase confidence in banknotes in circulation by limiting the rights of banks to issue notes.

Provincial banknote issues

[edit]Attempts to restrict banknote issue by banks other than the Bank of England began in 1708 and 1709, when acts of Parliament[which?] were passed which prohibited banking companies of more than six partners or shareholders.[citation needed] Notes under 1 guinea and 5 guineas were prohibited in the 1770s and thereafter almost all the provincial banks were established by the more substantial merchants, landed gentry etc. of a town and district.[19][20][21][22]

Gold shortages

[edit]Gold shortages in the 18th century, caused by the Seven Years' War and war with Revolutionary France, began to affect the supply of gold bullion reserves, giving rise to the "Restriction period". The Bank of England was unable to pay out gold for its notes, and so under the Bank Restriction Act 1797 began to issue lower denomination £1 and £2 notes in place of gold guineas, that were hoarded as so often was the case in time of war.[23] Confidence in the value of banknotes was rarely affected, except during 1809–11 and 1814–15 under the extreme conditions of war.

Restriction of banknote issues

[edit]The Country Bankers Act 1826 allowed some joint-stock banks outside London to issue notes, and also allowed the Bank of England to open branches in major provincial cities, enabling better distribution of its notes.[23]

Introduction of legal tender

[edit]With the passing of the Bank Notes Act 1833, Bank of England notes over £5 in value were first given the status of "legal tender" in England and Wales, effectively guaranteeing the worth of the Bank's notes and ensuring public confidence in the notes in times of crisis or war.[23] The Currency and Bank Notes Act 1954 extended the definition of legal tender to 10/– and £1 notes; unlike the 1833 act, this law also applied to Scotland, meaning that Bank of England notes under £5 were classed as legal tender. Due to inflation the Bank of England 10/– note was withdrawn in 1969 and the £1 was removed from circulation in 1988,[24] leaving a legal curiosity in Scots law whereby there is now no paper legal tender in Scotland.[25] (Notes issued by Scottish banks were not included in the 1833 or 1954 acts.)

Note-issuing monopoly

[edit]

The Bank Charter Act 1844 began the process which gave the Bank of England exclusive note-issuing powers in England and Wales.[26] Under the act, no new banks could start issuing notes, and note-issuing banks in England and Wales were barred from expanding their note issue.[note 1] Gradually, these banks vanished through mergers, closures and take-overs, and their note issues went with them. The last privately issued banknotes in Wales were withdrawn in 1908, on the closure of the last Welsh bank, the North and South Wales Bank.[27] The last private English banknotes were issued in 1921 by Fox, Fowler and Company, a Somerset bank,[23][28] when it was bought out by Lloyds Bank.[29][30] Under the terms of the Bank Charter Act 1844, the bank lost the legal right to issue banknotes when it merged with Lloyds, and the Bank of England became the sole note-issuing bank in England and Wales.[23]

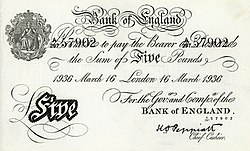

Note printing

[edit]Notes were originally handwritten; although they were partially printed from 1725 onwards, cashiers still had to sign each note and make them payable to someone. Notes were fully printed from 1855, no doubt to the relief of the bank's workers. Until 1928 all notes were the monochromatic Series A type, printed in black with a blank reverse. During the 20th century, notes in Series A were issued in denominations between £5 and £1,000, but in the 18th and 19th centuries there were Series A notes for £1 and £2.

20th century

[edit]

The Bank of England's first issue of 10/– and £1 notes in the 20th century was on 22 November 1928 when it took over responsibility for these denominations from the Treasury. The Treasury had issued notes of these denominations at the start of the First World War in 1914 in order to supplant the sovereign and half-sovereign and remove gold coins from circulation. The notes issued by the Bank of England in 1928 were the first coloured banknotes and also the first notes to be printed on both sides.

The Second World War saw a reversal in the trend of warfare creating more notes when, in order to combat forgery, higher denomination notes (at the time as high as £1,000) were removed from circulation.

Denominations

[edit]Banknotes in various denominations have been issued over time. The denominations are listed in this table, using information from the Bank of England's Withdrawn Banknotes Reference Guide:[24]

| Denomination | First issued | Last issued | Notes |

|---|---|---|---|

| 10/– | 1928 | 1970 | |

| £1 | 1797 | 1988 | |

| £2 | 1797 | 1821 | £2 notes were issued on the orders of British Prime Minister William Pitt the Younger as smaller denomination notes were needed to replace gold coins during the French Revolutionary Wars. |

| £5 | 1793 | Still in circulation | |

| £10 | 1759 | Still in circulation | |

| £15 | 1759 | 1822 | |

| £20 | 1725 | Still in circulation | |

| £25 | 1765 | 1822 | |

| £30 | 1725 | 1852 | |

| £40 | 1725 | 1851 | |

| £50 | 1725 | Still in circulation | |

| £60 | 1725 | Before 1803 | |

| £70 | 1725 | Before 1803 | |

| £80 | 1725 | Before 1803 | |

| £90 | 1725 | Before 1803 | |

| £100 | 1725 | 1943 | Some Scottish and Northern Ireland banks still issue £100 notes.[31] |

| £200 | 1725–45 | 1928 | |

| £300 | 1725–45 | 1855 | |

| £500 | 1725–45 | 1943 | |

| £1,000 | 1725–45 | 1943 |

10/–

[edit]The Bank of England's first 10 shilling (10/-) note, which was issued on 22 November 1928, featured a vignette of Britannia, a feature of the Bank's notes since 1694. The predominant colour was red-brown. Unlike previous notes it, and the contemporaneous £1 note, were not dated but their approximate year of issue can be identified by the signature of the Chief Cashier of the time. In 1940 a metal security thread was introduced, and the colour of the note was changed to mauve for the duration of the Second World War. The original design of the note was replaced by the Series C design on 12 October 1961, when Queen Elizabeth II agreed to allow the use of her portrait on the notes.

As part of the planned Series D, which introduced historical figures, a new 10 shilling note featuring Sir Walter Raleigh was planned. This was to be issued as a 50 pence note in anticipation of the decimalisation of Britain's currency in 1971. However, inflation, particularly after the 1967 sterling devaluation, was eroding the note's lifespan in circulation and it was decided to replace it with a 50 pence coin, which was first issued in 1969.[17] The 10 shilling note was withdrawn from circulation on 20 November 1970.[24]

£1

[edit]

The first Bank of England £1 note was issued on 2 March 1797[24] under the direction of Thomas Raikes, Governor of the Bank of England, and according to the orders of the government of William Pitt the Younger, in response to the need for smaller denomination banknotes to replace gold coin during the French Revolutionary Wars.

The Bank of England's first £1 note since 1845 was issued on 22 November 1928. This note featured a vignette of Britannia, a feature of the Bank's notes since 1694. The predominant colour was green. Unlike previous notes it, and the contemporaneous ten shilling note, were not dated but their approximate year of issue can be identified by the signature of the Chief Cashier of the time. In 1940 a metal security thread was introduced, and the colour of the note was changed to blue and pink for the duration of the Second World War, to combat German counterfeits (see below).

The original design of the note was replaced by the Series C design on 17 March 1960, when Queen Elizabeth II agreed to allow the use of her portrait on the notes. The Series C £1 note was withdrawn on 31 May 1979. On 9 February 1978 the Series D design (known as the "Pictorial Series"), featuring Sir Isaac Newton on the reverse, was issued. However, like the 10/– note in the 1960s, inflation was quickly making production of the note uneconomic and printing was discontinued in favour of a coin. The note was withdrawn from circulation on 11 March 1988.[24]

£5

[edit]

The first Bank of England £5 note was issued in 1793[24] in response to the need for smaller denomination banknotes to replace gold coin during the French Revolutionary Wars. (Previously the smallest note issued had been £10.) The 1793 design, latterly known as the "white fiver" (black printing on white paper), remained in circulation essentially unchanged until 21 February 1957 when the multicoloured (although predominantly dark blue) "Series B" note, depicting the helmeted Britannia, was introduced. The old "white fiver" was withdrawn on 13 March 1961.[24]

The Series B note was replaced in turn on 21 February 1963 by the Series C £5 note which for the first time introduced the portrait of the monarch, Queen Elizabeth II, to the £5 note (the Queen's portrait having first appeared on the Series C ten shilling and £1 notes issued in 1960). The Series C £5 note was withdrawn on 31 August 1973.

On 11 November 1971, the Series D pictorial £5 note was issued, showing a slightly older portrait of the Queen and a battle scene featuring the Duke of Wellington on the reverse. It was withdrawn on 29 November 1991.

On 7 June 1990, the Series E £5 note, by now the smallest denomination issued by the Bank, was issued. For the Series E note (known as the "Historical Series") the denomination's colour was changed to a turquoise blue, and the note incorporated design elements to make photocopying and computer reproduction of it more difficult. Initially the reverse of the Series E £5 note featured the railway engineer George Stephenson, but on 21 May 2002 a new Series E note, in a green colour and featuring the prison reformer Elizabeth Fry, was issued.

The initial printing of several million Stephenson notes was destroyed when it was noticed that the wrong year for his death had been printed. The original issue of the Fry banknote was withdrawn after it was found the ink on the serial number could be rubbed off the surface of the note;[32] these notes are now very rare and sought by collectors. The Stephenson £5 note was withdrawn as legal tender from 21 November 2003, at which time it formed around 54 million of the 211 million £5 notes in circulation.

£10

[edit]

The first Bank of England £10 note was issued in 1759,[24] when the Seven Years' War caused severe gold shortages. It ceased to be produced in 1943. A string of devaluations through the late 1940s and 1950s meant increased demand for notes of higher values than £5 and on the 21 February 1964 a new brown-coloured note was issued in the Series C design. The Series C note was withdrawn on 31 May 1979.

The Series D pictorial note appeared on 20 February 1975, featuring nurse and public health pioneer Florence Nightingale (1820–1910) on the reverse, plus a scene showing her work at the army hospital in Scutari during the Crimean War. It was withdrawn on 20 May 1994.

On 29 April 1992, a new £10 note in Series E, with orange rather than brown as the dominant colour, was issued. The reverse featured author Charles Dickens and a scene from The Pickwick Papers. This note was withdrawn from circulation on 31 July 2003. A second Series E note was issued on 7 November 2000 featuring naturalist and biologist Charles Darwin, HMS Beagle, a hummingbird, and flowers under a magnifying glass, illustrating the Origin of Species. The hummingbird's inclusion was criticised, since Darwin's ideas were spurred by finches and mockingbirds, not hummingbirds.[33]

A newly designed £10 banknote, featuring early 19th-century novelist Jane Austen, was issued on 14 September 2017.[34] The decision to replace Darwin with Austen followed a campaign to have a woman on the back of a Bank of England banknote when it was announced that the only woman to feature on the back of a note — prison reformer Elizabeth Fry on the £5 note — was to be replaced by Winston Churchill.[35][36] Like the £5 note featuring Churchill, the new £10 note is made from polymer rather than cotton paper.[37][38]

£20

[edit]

£20 notes, in white, appeared in 1725 and continued to be issued until 1943. They ceased to be legal tender in 1945.[24]

After the 1967 sterling devaluation increased demand for a higher denomination notes than £10, the Series D £20 note was introduced on 9 July 1970. The note was predominantly purple and featuring a statue of William Shakespeare and the balcony scene from Romeo and Juliet on its reverse. On 5 June 1991 this note was replaced by the first Series E £20 note, featuring the physicist Michael Faraday and the Royal Institution lectures. By 1999 this note had been extensively counterfeited, and therefore it became the first denomination to be replaced on 22 June 1999 by a second Series E design, featuring a bolder denomination figure at the top left of the obverse side, and a reverse side featuring the composer Sir Edward Elgar and Worcester Cathedral.

In February 2006, the Bank announced a new design for the note[39] which featured Scottish economist Adam Smith with a drawing of a pin factory – the institution which supposedly inspired his theory of economics. Smith is the first Scot to appear on a Bank of England note, although the economist has already appeared on Scottish Clydesdale Bank £50 notes.[40] The design of the £20 note was controversial for two reasons: the choice of a Scottish figure on an English note was a break with tradition; and the removal of Elgar took place in the year of the 150th anniversary of the composer's birth, causing a group of English MPs to table a motion in the House of Commons calling for the new design to be delayed.[41] The new note entered circulation on 13 March 2007.[42] The Elgar note ceased to be legal tender on 30 June 2010.[43]

A new polymer £20 note, featuring the artist J. M. W. Turner, was issued in 2020.[44]

£50

[edit]

Series A £50 notes appeared in 1725 and continued to be issued until 1943. They ceased to be legal tender in 1945.[24]

The Series D £50 note was released on 20 March 1981 featuring the architect Christopher Wren and the plan of St Paul's Cathedral on the reverse. In 1994 this denomination was the last of the first Series E issue, when the Bank commemorated its 300th birthday by featuring its first governor, Sir John Houblon, on the reverse. The old Series D £50 note was withdrawn from circulation on 20 September 1996.

In May 2009, the Bank of England announced a new design in Series F, featuring James Watt, Matthew Boulton, the Whitbread Engine and Soho Manufactory.[45] It entered circulation on 2 November 2011[46] and is the first Bank of England note to feature two portraits on the reverse.[47][48] The predominant colour of this denomination banknote is red. This note includes a security feature not present in the other denominations (though it is by no means the only security feature in any of the notes). The interwoven thread ("Motion") is a hologram whose image of a green circle with a "£" sign alternates with a green "50" as the note is rotated. If the note is rotated, the image appears to move up and down, in the opposite plane to the rotation.

A new polymer £50 note, featuring Alan Turing, was issued on 23 June 2021.[49]

£500

[edit]A £500 note, issued by the Bank of England's Leeds branch in 1936, fetched £24,000 at auction in 2023.[50]

£500,000

[edit]The Bank of England held money on behalf of other countries and issued Treasury bills to cover such deposits, on Bank of England paper. Examples include a note issued in London on behalf of the Royal Romanian Government on 21 January 1915, payable on 21 January 1916, for £500,000, and a similar Treasury bill, dated 22 April 1927 and payable on 22 April 1928. These exist in private hands as cancelled specimens.[51]

£1,000,000, £10,000,000 and £100,000,000

[edit]The banknotes issued by commercial banks in Scotland and Northern Ireland are required to be backed pound for pound by Bank of England notes. High denomination notes, for £1 million ("Giants") and £100 million ("Titans"), were used for this purpose.[52] They were used only internally within the Bank and were never seen in circulation.[52] They were based on a much older design of banknote, and are A5 and A4 sized respectively.[53] However, the need for these large notes has been obviated by section 217(2)(c) of the Banking Act 2009.

Nine £1 million notes were issued in connection with the Marshall Plan on 30 August 1948, signed by E. E. Bridges, and were used internally as "records of movement", for a six-week period (along with other denominations, with total face value of £300,000,000, corresponding to a loan from the US to help shore up HM Treasury. These were cancelled on 6 October 1948, and presumably destroyed, except for the £1,000,000 "Number Seven" and "Number Eight" notes (serial numbers 000007 and 000008), which were given to the British and American Treasury Secretaries. These two have been in private hands since 1977, and most recently, the "Number Eight" was auctioned for £69,000. These are "Treasury Notes" issued on Bank of England paper, and they state: "This Treasury note entitles the Bank of England to payment of one million pounds on demand out of the Consolidated Fund of the United Kingdom."[citation needed]

A third note surfaced on the collector market, dated 8 September 2003 and with the serial number R016492; it is signed by Andrew Turnbull, Secretary to the Treasury, and cancelled.

A £10.000,000 Treasury Bill, stamped "cancelled", sold for £17,000 at auction in London on 29 September 2014 by Dix Noonan Webb.[54]

Until 2006, these Treasury Notes were issued by the Bank of England, in the City of London. HM Treasury would manage its cash and ensure that adequate funds were available. London's banks and other financial institutions would bid for these instruments, at a discount, specifying which day the following week they wanted the bills issued. Maturities would be for one, three, six or, theoretically but not practically, twelve months. The tenders were for the face value of the Treasury Notes, less a discount, which represented the interest rate. This system was replaced by a computerised system by the Debt Management Office, an executive agency of the Treasury, and the last Treasury Notes were printed in September 2003. These notes would often get traded to other banks, so they did circulate; this was done without the Bank of England's knowledge, and the notes would be redeemed by the bank on their date of maturity by the bearer. The circulating nature of the notes led to the City bonds robbery on 2 May 1990, when John Goddard, a messenger for the firm Sheppards, was mugged of £292 million in Treasury bills and certificates of deposit. All but two of these bonds were eventually recovered.[55]

The Bank of England £100,000,000 note, also referred to as Titan, is a non-circulating sterling banknote used to guarantee the value of the notes issued by commercial banks in Scotland and Northern Ireland.

Counterfeited and withdrawn notes

[edit]This section needs additional citations for verification. (February 2016) |

William Booth, of South Staffordshire, was a notable forger of English banknotes, and was hanged for the crime in 1812. Several of his forgeries and printing plates are in the collection of Birmingham Museum and Art Gallery.[56]

After the start of the World War II in September 1939 the German Operation Bernhard attempted to counterfeit various denominations between £5 and £50. Although the plans were classified, in November Michael Palairet, Britain's ambassador to Greece, got full details of them from a Russian émigré and reported them to London. Although the Bank considered the existing security measures to be sufficient, in 1940 it released emergency notes with different colour schemes and a magnetic security thread running through the paper.

The original plan was to parachute or smuggle the counterfeit notes into Britain in an attempt to destabilise the British economy, but in 1942 Heinrich Himmler decided it was more useful to use the notes to pay German agents operating throughout Europe, and in 1943 they were producing 500,000 notes monthly. Although most fell into Allied hands at the end of the war and were destroyed, forgeries frequently appeared for years afterwards, so all denominations of banknote above £5 were subsequently removed from circulation. The incident is alluded to in Ian Fleming's James Bond novel Goldfinger.

All banknotes, regardless of when they were withdrawn from circulation, may be presented at the Bank of England where they will be exchanged for current banknotes and coins.[57] In practice, commercial banks will accept most banknotes from their customers and negotiate them with the Bank of England themselves. However, forgeries (including Bernhard notes) will be retained and destroyed by the Bank. If a suspect note is found to be genuine a full refund by cheque will be made. However, it is a criminal offence to knowingly hold or pass a counterfeit bank note without lawful authority or excuse.[58]

In popular culture

[edit]

- The 2007 Austrian-German film The Counterfeiters (Die Fälscher) tells the story of Salomon Sorowitsch (real name Salomon Smolianoff), a Jewish forger who is put to work forging Bank of England notes on Operation Bernhard in Sachsenhausen concentration camp. On 13 March 2009 BBC Radio 4 broadcast The Counterfeiter's Tale, a 30-minute partly dramatised documentary about the production of the notes in Sachsenhausen. It was re-broadcast by Radio 4 Extra on 15 November 2015.

- Mark Twain's 1893 short story "The Million Pound Bank Note" deals with an impoverished American in London who is given the use of a £1,000,000 Bank of England note for thirty days by two wealthy gentlemen betting whether or not he will be able to survive on a note for which he cannot possibly be given change. He does succeed in surviving on the note's promise to pay and marries one of the bettors' daughters. The story was also made into a 1953 film, The Million Pound Note starring Gregory Peck, and was parodied in a 1998 episode of The Simpsons, "The Trouble with Trillions".

- A fictionalised version of the Operation Bernhard story was the topic of a comedy drama serial Private Schulz (starring Michael Elphick and Ian Richardson) broadcast on BBC Two in 1981.

- The 2001 British TV film Hot Money, starring Caroline Quentin, tells the story of three workers at the Bank who come up with a method of stealing from the cages containing old notes waiting to be destroyed.

See also

[edit]Notes

[edit]- ^ The limitations specified in section 11 of the 1844 act only refer to banks in England and Wales:

"Restriction against issue of bank notes". Bank Charter Act 1844. HM Government/The National Archives (United Kingdom). Retrieved 12 December 2015.

References

[edit]- ^ a b c d e "King Charles banknotes to enter circulation in June". BBC News. 21 February 2024. Retrieved 21 February 2024.

- ^ Cohen, Li (27 September 2022). "Images of King Charles III will replace those of Queen Elizabeth II on U.K. currency. Here's when". CBS News. Retrieved 29 September 2022.

- ^ Kerr, Cameron (27 September 2022). "New bank notes with portrait of King Charles III to be unveiled by end of year". LBC News. Retrieved 29 September 2022.

- ^ "King Charles III banknotes unveiled". Bank of England. 20 December 2022. Retrieved 1 March 2023.

- ^ a b "Current banknotes". Bank of England. February 2020. Retrieved 23 February 2020.

- ^ "How to check your banknotes". Bank of England. February 2020. Retrieved 24 February 2020.

- ^ "£5 note". Bank of England. Retrieved 14 August 2024.

- ^ Peachey, Kevin (26 April 2013). "Sir Winston Churchill to feature on new banknote". BBC News. Retrieved 19 August 2014.

- ^ "The new £10 note is here". Bank of England. 14 September 2007. Archived from the original on 14 September 2017. Retrieved 14 September 2007.

- ^ "£10 note". Bank of England. Archived from the original on 8 September 2017. Retrieved 21 March 2024.

- ^ "£10 note". Bank of England. Retrieved 14 August 2024.

- ^ "£20 note". Bank of England. Retrieved 14 August 2024.

- ^ a b "£50 note". Bank of England. Retrieved 14 August 2024.

- ^ "De La Rue signs banknote printing contract with the Bank of England" (Press release). De La Rue. 13 October 2014. Archived from the original on 31 December 2014. Retrieved 31 December 2014.

- ^ Baraniuk, Chris (25 June 2015). "The secret codes of British banknotes". BBC Future. Retrieved 24 February 2020.

- ^ Maybury, Rick (25 June 2011). "Why can't I scan a banknote?". The Daily Telegraph. Retrieved 19 December 2016.

- ^ a b Homren, Wayne (30 May 2010). "Banknote Designer Harry Eccleston, 1923–2010". The E-Sylum. Numismatic Bibliomania Society. Retrieved 2 March 2015.

- ^ "£2 note issued by Evans, Jones, Davies & Co". British Museum. Archived from the original on 18 January 2012. Retrieved 31 October 2011.

- ^ "One Guinea Banknote, Birmingham Bank". Birmingham Museums & Art Gallery. Archived from the original on 18 October 2007. Retrieved 8 October 2007.

- ^ Lobley, Malcolm. "the Swaledale and Wensleydale Banking Company". P-Wood.com. Archived from the original on 13 August 2009. Retrieved 8 October 2007.

- ^ "British Provincial Banknotes". pp. 1–6. Archived from the original on 19 November 2007. Retrieved 8 October 2007.

- ^ "Cardiff and Merthyr Bank note, 1824". Gathering the Jewels/Casglu'r Tlysau. Archived from the original on 18 November 2007. Retrieved 8 October 2007.

- ^ a b c d e Bank of England. "A brief history of banknotes". Retrieved 8 October 2007.

- ^ a b c d e f g h i j "Withdrawn Banknotes Reference Guide" (PDF). Bank of England. Archived from the original (PDF) on 29 March 2017. Retrieved 23 November 2014.

- ^ Committee of Scottish Clearing Bankers. "The legal position with regard to Scottish Banknotes". Country Quest Magazine. Archived from the original on 30 October 2007. Retrieved 10 October 2007.

- ^ "Bank Charter Act 1844" (PDF). Bank of England. Archived (PDF) from the original on 3 December 2010. Retrieved 27 October 2010.

- ^ Stamp, A. H. (1 June 2001). "The Man who printed his own Money" (JPEG). Country Quest Magazine. Retrieved 8 October 2007.

- ^ "Fox, Fowler & Co. £5 note". British Museum. Archived from the original on 2 October 2011. Retrieved 31 October 2011.

- ^ Peter Mathias, The First Industrial Nation, Routledge, pp. 326, ISBN 978-0-415-26672-7

- ^ Lloyds TSB. "History of Lloyds TSB Bank". Archived from the original on 17 September 2008. Retrieved 8 October 2007.

- ^ "Banknotes". The Committee of Scottish Bankers. Retrieved 26 May 2021.

- ^ Adams, Richard (28 May 2002). "New fivers halted as design rubs off". The Guardian. Retrieved 31 December 2014.

- ^ McKie, Robin (16 November 2008). "Darwin art strikes wrong note". The Observer. London. Archived from the original on 11 December 2008. Retrieved 17 November 2008.

- ^ "New £10 goes into circulation". The New £10 Note. Bank of England. Archived from the original on 31 March 2022. Retrieved 3 September 2017.

- ^ Judah, Sam. "Which woman should go on a banknote next?". BBC News. Retrieved 27 April 2016.

- ^ "Author Jane Austen to feature on new £10 note". CBBC Newsround. 24 July 2013. Retrieved 21 March 2024.

- ^ "Why are new banknotes made of polymer?". Banknotes. Bank of England. 2016. Retrieved 27 October 2020.

- ^ Press Association (14 August 2014). "New £5 notes to be made of plastic". Money. AOL. Retrieved 31 December 2014.

- ^ "March launch for Smith £20 note". BBC News. 21 February 2006. Archived from the original on 5 September 2007. Retrieved 10 October 2007.

- ^ Seager, Ashley (30 October 2006). "Adam Smith becomes first Scot to adorn an English banknote". The Guardian. Retrieved 9 October 2021.

- ^ "County MPs join fight for Elgar on £20 note". Peter Luff MP. 2 October 2006. Archived from the original on 25 August 2006. Retrieved 10 October 2007.

- ^ "New Adam Smith £20 note launched". BBC News. 13 March 2007. Archived from the original on 7 October 2007. Retrieved 10 October 2007.

- ^ Adams, Stephen (29 June 2010). "£20 Elgar note withdrawal 'a national disgrace'". The Daily Telegraph. London. Archived from the original on 2 July 2010. Retrieved 29 June 2010.

- ^ "The new £20 note unveiled" (Press release). Bank of England. Retrieved 10 October 2019.

- ^ "Steam engine heroes grace new £50 banknote". Channel 4. 30 September 2011. Retrieved 13 March 2015.

- ^ Stewart, Heather (30 September 2011). "Bank of England to launch new £50 note". The Guardian. London. Retrieved 2 October 2011.

- ^ Irvine, Chris (29 May 2009). "Matthew Boulton and James Watt new faces of £50 note". The Daily Telegraph. London. Archived from the original on 9 July 2010. Retrieved 29 June 2010.

- ^ "Steam giants on new £50 banknote". BBC News. 30 May 2009. Retrieved 29 June 2010.

- ^ "New Alan Turing £50 note design is revealed". BBC News. 25 March 2021. Retrieved 25 March 2021.

- ^ Grierson, Jamie (1 March 2023). "Much appreciated: £500 banknote fetches £24,000 at auction". The Guardian. Retrieved 1 March 2023.

- ^ "Bonds and share certificates of the world". Spink & Son. 28 November 2013. Retrieved 2 May 2015.

- ^ a b "Other British Islands' Notes". Bank of England. Archived from the original on 15 October 2007. Retrieved 8 October 2007.

- ^ "Britain's £1m and £100m banknotes". BBC News Magazine. 26 January 2013. Retrieved 26 January 2013.

- ^ "Lot 5015 29th September 2014". 29 September 2014. Retrieved 22 April 2022.

- ^ Dennis, Jon (18 February 2002). "1990: £292m City bonds robbery". The Guardian. Retrieved 12 December 2015.

- ^ "William Booth by an unknown artist". Digital Handsworth. Birmingham City Council. Archived from the original on 3 April 2012. Retrieved 5 December 2015.

- ^ "Exchanging old banknotes". Bank of England. February 2020. Retrieved 24 February 2020.

- ^ "BOSS and Bank of England encourage retailers to check banknotes". British Oil Security Syndicate. 9 October 2015. Retrieved 24 February 2020.