Phillips curve

This article needs additional citations for verification. (October 2011) |

| Part of a series on |

| Macroeconomics |

|---|

|

The Phillips curve is an economic model, named after Bill Phillips, that correlates reduced unemployment with increasing wages in an economy.[1] While Phillips did not directly link employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman[2] and Edmund Phelps[3][4] put the theoretical structure in place.

While there is a short-run tradeoff between unemployment and inflation, it has not been observed in the long run.[5] In 1967 and 1968, Friedman and Phelps asserted that the Phillips curve was only applicable in the short run and that, in the long run, inflationary policies would not decrease unemployment.[2][3][4][6] Friedman correctly predicted the Stagflation of the 1970's.[7]

In the 2010s[8] the slope of the Phillips curve appears to have declined and there has been controversy over the usefulness of the Phillips curve in predicting inflation. A 2022 study found that the slope of the Phillips curve is small and was small even during the early 1980s.[9] Nonetheless, the Phillips curve is still used by central banks in understanding and forecasting inflation.[10]

History

[edit]

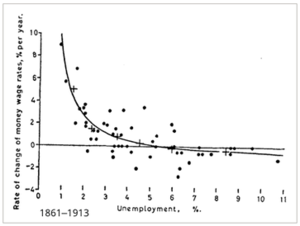

Bill Phillips, a New Zealand born economist, wrote a paper in 1958 titled "The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861–1957", which was published in the quarterly journal Economica.[11] In the paper Phillips describes how he observed an inverse relationship between money wage changes and unemployment in the British economy over the period examined. Similar patterns were found in other countries and in 1960 Paul Samuelson and Robert Solow took Phillips' work and made explicit the link between inflation and unemployment: when inflation was high, unemployment was low, and vice versa.[12]

In the 1920s, an American economist Irving Fisher had noted this relationship between unemployment and prices. However, Phillips' original curve described the behavior of money wages.[13]

In the years following Phillips' 1958 paper, many economists in advanced industrial countries believed that his results showed a permanently stable relationship between inflation and unemployment.[citation needed] One implication of this was that governments could control unemployment and inflation with a Keynesian policy. They could tolerate a reasonably high inflation as this would lead to lower unemployment – there would be a trade-off between inflation and unemployment. For example, monetary policy and/or fiscal policy could be used to stimulate the economy, raising gross domestic product and lowering the unemployment rate. Moving along the Phillips curve, this would lead to a higher inflation rate, the cost of enjoying lower unemployment rates.[citation needed] Economist James Forder disputes this history and argues that it is a 'Phillips curve myth' invented in the 1970s.[14]

Since 1974, seven Nobel Prizes have been given to economists for, among other things, work critical of some variations of the Phillips curve. Some of this criticism is based on the United States' experience during the 1970s, which had periods of high unemployment and high inflation at the same time. The authors receiving those prizes include Thomas Sargent, Christopher Sims, Edmund Phelps, Edward Prescott, Robert A. Mundell, Robert E. Lucas, Milton Friedman, and F.A. Hayek.[15]

Stagflation

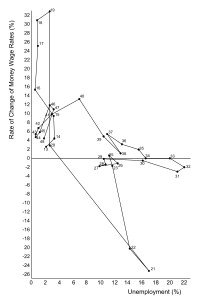

[edit]In the 1970s, many countries experienced high levels of both inflation and unemployment also known as stagflation. Theories based on the Phillips curve suggested that this would not occur, and the curve came under attack from a group of economists headed by Milton Friedman.[7] Friedman argued that the Phillips curve relationship was only a short-run phenomenon. This followed eight years after Samuelson and Solow [1960] wrote "All of our discussion has been phrased in short-run terms, dealing with what might happen in the next few years. It would be wrong, though, to think that our Figure 2 menu that related obtainable price and unemployment behavior will maintain its same shape in the longer run. What we do in a policy way during the next few years might cause it to shift in a definite way."[12] As Samuelson and Solow had argued 8 years earlier, Friedman said that in the long run, workers and employers will take inflation into account, resulting in employment contracts that increase pay at rates near anticipated inflation. Unemployment would then begin to rise back to its previous level, but with higher inflation. This implies that over the longer-run there is no trade-off between inflation and unemployment. This is significant because it implies that central banks should not set unemployment targets below the natural rate.[5]

More recent research suggests that there is a moderate trade-off between low-levels of inflation and unemployment. Work by George Akerlof, William Dickens, and George Perry,[16] implies that if inflation is reduced from two to zero percent, unemployment will be permanently increased by 1.5 percent because workers have a higher tolerance for real wage cuts than nominal ones. For example, a worker will more likely accept a wage increase of two percent when inflation is three percent, than a wage cut of one percent when the inflation rate is zero.

Modern application

[edit]

Most economists no longer use the Phillips curve in its original form because it was too simplistic.[17] A cursory analysis of US inflation and unemployment data from 1953 to 1992 shows no single curve will fit the data, but there are three rough aggregations—1955–71, 1974–84, and 1985–92—each of which shows a general, downwards slope, but at three very different levels with the shifts occurring abruptly. The data for 1953–54 and 1972–73 do not group easily, and a more formal analysis posits up to five groups/curves over the period.[5]

However, modified forms of the Phillips curve that take inflationary expectations into account remain influential. The theory has several names, with some variation in its details, but all modern versions distinguish between short-run and long-run effects on unemployment. Modern Phillips curve models include both a short-run Phillips Curve and a long-run Phillips Curve. This is because in the short run, there is generally an inverse relationship between inflation and the unemployment rate; as illustrated in the downward sloping short-run Phillips curve. In the long run, that relationship breaks down and the economy eventually returns to the natural rate of unemployment regardless of the inflation rate.[18]

The "short-run Phillips curve" is also called the "expectations-augmented Phillips curve", since it shifts up when inflationary expectations rise, Edmund Phelps and Milton Friedman argued. In the long run, this implies that monetary policy cannot affect unemployment, which adjusts back to its "natural rate", also called the "NAIRU". The popular textbook of Blanchard gives a textbook presentation of the expectations-augmented Phillips curve.[19]

An equation like the expectations-augmented Phillips curve also appears in many recent New Keynesian dynamic stochastic general equilibrium models. As Keynes mentioned: "A Government has to remember, however, that even if a tax is not prohibited it may be unprofitable, and that a medium, rather than an extreme, imposition will yield the greatest gain".[20] In these macroeconomic models with sticky prices, there is a positive relation between the rate of inflation and the level of demand, and therefore a negative relation between the rate of inflation and the rate of unemployment. This relationship is often called the "New Keynesian Phillips curve". Like the expectations-augmented Phillips curve, the New Keynesian Phillips curve implies that increased inflation can lower unemployment temporarily, but cannot lower it permanently. Two influential papers that incorporate a New Keynesian Phillips curve are Clarida, Galí, and Gertler (1999),[21] and Blanchard and Galí (2007).[22]

Mathematics

[edit]There are at least two different mathematical derivations of the Phillips curve. First, there is the traditional or Keynesian version. Then, there is the new Classical version associated with Robert E. Lucas Jr.

The traditional Phillips curve

[edit]The original Phillips curve literature was not based on the unaided application of economic theory. Instead, it was based on empirical generalizations. After that, economists tried to develop theories that fit the data.

Money wage determination

[edit]The traditional Phillips curve story starts with a wage Phillips Curve, of the sort described by Phillips himself. This describes the rate of growth of money wages (gW). Here and below, the operator g is the equivalent of "the percentage rate of growth of" the variable that follows.

The "money wage rate" (W) is shorthand for total money wage costs per production employee, including benefits and payroll taxes. The focus is on only production workers' money wages, because (as discussed below) these costs are crucial to pricing decisions by the firms.

This equation tells us that the growth of money wages rises with the trend rate of growth of money wages (indicated by the superscript T) and falls with the unemployment rate (U). The function f is assumed to be monotonically increasing with U so that the dampening of money-wage increases by unemployment is shown by the negative sign in the equation above.

There are several possible stories behind this equation. A major one is that money wages are set by bilateral negotiations under partial bilateral monopoly: as the unemployment rate rises, all else constant worker bargaining power falls, so that workers are less able to increase their wages in the face of employer resistance.

During the 1970s, this story had to be modified, because (as the late Abba Lerner had suggested in the 1940s) workers try to keep up with inflation. Since the 1970s, the equation has been changed to introduce the role of inflationary expectations (or the expected inflation rate, gPex). This produces the expectations-augmented wage Phillips curve:

The introduction of inflationary expectations into the equation implies that actual inflation can feed back into inflationary expectations and thus cause further inflation. The late economist James Tobin dubbed the last term "inflationary inertia", because in the current period, inflation exists which represents an inflationary impulse left over from the past.

It also involved much more than expectations, including the price-wage spiral. In this spiral, employers try to protect profits by raising their prices and employees try to keep up with inflation to protect their real wages. This process can feed on itself, becoming a self-fulfilling prophecy.

The parameter λ (which is presumed constant during any time period) represents the degree to which employees can gain money wage increases to keep up with expected inflation, preventing a fall in expected real wages. It is usually assumed that this parameter equals 1 in the long run.

In addition, the function f() was modified to introduce the idea of the non-accelerating inflation rate of unemployment (NAIRU) or what's sometimes called the "natural" rate of unemployment or the inflation-threshold unemployment rate:

| (1) |

Here, U* is the NAIRU. As discussed below, if U < U*, inflation tends to accelerate. Similarly, if U > U*, inflation tends to slow. It is assumed that f(0) = 0, so that when U = U*, the f term drops out of the equation.

In equation (1), the roles of gWT and gPex seem to be redundant, playing much the same role. However, assuming that λ is equal to unity, it can be seen that they are not. If the trend rate of growth of money wages equals zero, then the case where U equals U* implies that gW equals expected inflation. That is, expected real wages are constant.

In any reasonable economy, however, having constant expected real wages could only be consistent with actual real wages that are constant over the long haul. This does not fit with economic experience in the U.S. or any other major industrial country. Even though real wages have not risen much in recent years, there have been important increases over the decades.

An alternative is to assume that the trend rate of growth of money wages equals the trend rate of growth of average labor productivity (Z). That is:

| (2) |

Under assumption (2), when U equals U* and λ equals unity, expected real wages would increase with labor productivity. This would be consistent with an economy in which actual real wages increase with labor productivity. Deviations of real-wage trends from those of labor productivity might be explained by reference to other variables in the model.

Pricing decisions

[edit]Next, there is price behavior. The standard assumption is that markets are imperfectly competitive, where most businesses have some power to set prices. So the model assumes that the average business sets a unit price (P) as a mark-up (M) over the unit labor cost in production measured at a standard rate of capacity utilization (say, at 90 percent use of plant and equipment) and then adds in the unit materials cost.

The standardization involves later ignoring deviations from the trend in labor productivity. For example, assume that the growth of labor productivity is the same as that in the trend and that current productivity equals its trend value:

- gZ = gZT and Z = ZT.

The markup reflects both the firm's degree of market power and the extent to which overhead costs have to be paid. Put another way, all else equal, M rises with the firm's power to set prices or with a rise of overhead costs relative to total costs.

So pricing follows this equation:

- P = M × (unit labor cost) + (unit materials cost)

- = M × (total production employment cost)/(quantity of output) + UMC.

UMC is unit raw materials cost (total raw materials costs divided by total output). So the equation can be restated as:

- P = M × (production employment cost per worker)/(output per production employee) + UMC.

This equation can again be stated as:

- P = M×(average money wage)/(production labor productivity) + UMC

- = M×(W/Z) + UMC.

Now, assume that both the average price/cost mark-up (M) and UMC are constant. On the other hand, labor productivity grows, as before. Thus, an equation determining the price inflation rate (gP) is:

- gP = gW − gZT.

Price

[edit]Then, combined with the wage Phillips curve [equation 1] and the assumption made above about the trend behavior of money wages [equation 2], this price-inflation equation gives us a simple expectations-augmented price Phillips curve:

- gP = −f(U − U*) + λ·gPex.

Some assume that we can simply add in gUMC, the rate of growth of UMC, in order to represent the role of supply shocks (of the sort that plagued the U.S. during the 1970s). This produces a standard short-term Phillips curve:

- gP = −f(U − U*) + λ·gPex + gUMC.

Economist Robert J. Gordon has called this the "Triangle Model" because it explains short-run inflationary behavior by three factors: demand inflation (due to low unemployment), supply-shock inflation (gUMC), and inflationary expectations or inertial inflation.

In the long run, it is assumed, inflationary expectations catch up with and equal actual inflation so that gP = gPex. This represents the long-term equilibrium of expectations adjustment. Part of this adjustment may involve the adaptation of expectations to the experience with actual inflation. Another might involve guesses made by people in the economy based on other evidence. (The latter idea gave us the notion of so-called rational expectations.)

Expectational equilibrium gives us the long-term Phillips curve. First, with λ less than unity:

- gP = [1/(1 − λ)]·(−f(U − U*) + gUMC).

This is nothing but a steeper version of the short-run Phillips curve above. Inflation rises as unemployment falls, while this connection is stronger. That is, a low unemployment rate (less than U*) will be associated with a higher inflation rate in the long run than in the short run. This occurs because the actual higher-inflation situation seen in the short run feeds back to raise inflationary expectations, which in turn raises the inflation rate further. Similarly, at high unemployment rates (greater than U*) lead to low inflation rates. These in turn encourage lower inflationary expectations, so that inflation itself drops again.

This logic goes further if λ is equal to unity, i.e., if workers are able to protect their wages completely from expected inflation, even in the short run. Now, the Triangle Model equation becomes:

- - f(U − U*) = gUMC.

If we further assume (as seems reasonable) that there are no long-term supply shocks, this can be simplified to become:

- −f(U − U*) = 0 which implies that U = U*.

All of the assumptions imply that in the long run, there is only one possible unemployment rate, U* at any one time. This uniqueness explains why some call this unemployment rate "natural".

To truly understand and criticize the uniqueness of U*, a more sophisticated and realistic model is needed. For example, we might introduce the idea that workers in different sectors push for money wage increases that are similar to those in other sectors. Or we might make the model even more realistic. One important place to look is at the determination of the mark-up, M.

New classical version

[edit]The Phillips curve equation can be derived from the (short-run) Lucas aggregate supply function. The Lucas approach is very different from that of the traditional view. Instead of starting with empirical data, he started with a classical economic model following very simple economic principles.

Start with the aggregate supply function:

where Y is log value of the actual output, is log value of the "natural" level of output, is a positive constant, is log value of the actual price level, and is log value of the expected price level. Lucas assumes that has a unique value.

Note that this equation indicates that when expectations of future inflation (or, more correctly, the future price level) are totally accurate, the last term drops out, so that actual output equals the so-called "natural" level of real GDP. This means that in the Lucas aggregate supply curve, the only reason why actual real GDP should deviate from potential—and the actual unemployment rate should deviate from the "natural" rate—is because of incorrect expectations of what is going to happen with prices in the future. (The idea has been expressed first by Keynes, General Theory, Chapter 20 section III paragraph 4).

This differs from other views of the Phillips curve, in which the failure to attain the "natural" level of output can be due to the imperfection or incompleteness of markets, the stickiness of prices, and the like. In the non-Lucas view, incorrect expectations can contribute to aggregate demand failure, but they are not the only cause. To the "new Classical" followers of Lucas, markets are presumed to be perfect and always attain equilibrium (given inflationary expectations).

We re-arrange the equation into:

Next we add unexpected exogenous shocks to the world supply :

Subtracting last year's price levels will give us inflation rates, because

and

where and are the inflation and expected inflation respectively.

There is also a negative relationship between output and unemployment (as expressed by Okun's law). Therefore, using

where is a positive constant, is unemployment, and is the natural rate of unemployment or NAIRU, we arrive at the final form of the short-run Phillips curve:

This equation, plotting inflation rate against unemployment gives the downward-sloping curve in the diagram that characterizes the Phillips curve.

New Keynesian version

[edit]The New Keynesian Phillips curve was originally derived by Roberts in 1995,[23] and since been used in most state-of-the-art New Keynesian DSGE models like the one of Clarida, Galí, and Gertler (2000).[24][25]

where

The current expectations of next period's inflation are incorporated as .

NAIRU and rational expectations

[edit]

In the 1970s, new theories, such as rational expectations and the NAIRU (non-accelerating inflation rate of unemployment) arose to explain how stagflation could occur. The latter theory, also known as the "natural rate of unemployment", distinguished between the "short-term" Phillips curve and the "long-term" one. The short-term Phillips curve looked like a normal Phillips curve but shifted in the long run as expectations changed. In the long run, only a single rate of unemployment (the NAIRU or "natural" rate) was consistent with a stable inflation rate. The long-run Phillips curve was thus vertical, so there was no trade-off between inflation and unemployment. Milton Friedman in 1976 and Edmund Phelps in 2006 won the Nobel Prize in Economics in part for this work. [26] [27] However, the expectations argument was in fact very widely understood (albeit not formally) before Friedman's and Phelps's work on it.[28]

In the diagram, the long-run Phillips curve is the vertical red line. The NAIRU theory says that when unemployment is at the rate defined by this line, inflation will be stable. However, in the short-run policymakers will face an inflation-unemployment rate trade-off marked by the "Initial Short-Run Phillips Curve" in the graph. Policymakers can, therefore, reduce the unemployment rate temporarily, moving from point A to point B through expansionary policy. However, according to the NAIRU, exploiting this short-run trade-off will raise inflation expectations, shifting the short-run curve rightward to the "new short-run Phillips curve" and moving the point of equilibrium from B to C. Thus the reduction in unemployment below the "Natural Rate" will be temporary, and lead only to higher inflation in the long run.

Since the short-run curve shifts outward due to the attempt to reduce unemployment, the expansionary policy ultimately worsens the exploitable trade-off between unemployment and inflation. That is, it results in more inflation at each short-run unemployment rate. The name "NAIRU" arises because with actual unemployment below it, inflation accelerates, while with unemployment above it, inflation decelerates. With the actual rate equal to it, inflation is stable, neither accelerating nor decelerating. One practical use of this model was to explain stagflation, which confounded the traditional Phillips curve.

The rational expectations theory said that expectations of inflation were equal to what actually happened, with some minor and temporary errors. This, in turn, suggested that the short-run period was so short that it was non-existent: any effort to reduce unemployment below the NAIRU, for example, would immediately cause inflationary expectations to rise and thus imply that the policy would fail. Unemployment would never deviate from the NAIRU except due to random and transitory mistakes in developing expectations about future inflation rates. In this perspective, any deviation of the actual unemployment rate from the NAIRU was an illusion.

However, in the 1990s in the US, it became increasingly clear that the NAIRU did not have a unique equilibrium and could change in unpredictable ways. In the late 1990s, the actual unemployment rate fell below 4% of the labor force, much lower than almost all estimates of the NAIRU. But inflation stayed very moderate rather than accelerating. So, just as the Phillips curve had become a subject of debate, so did the NAIRU.

Furthermore, the concept of rational expectations had become subject to much doubt when it became clear that the main assumption of models based on it was that there exists a single (unique) equilibrium in the economy that is set ahead of time, determined independently of demand conditions. The experience of the 1990s suggests that this assumption cannot be sustained.

Theoretical questions

[edit]To Milton Friedman there is a short-term correlation between inflation shocks and employment. When an inflationary surprise occurs, workers are fooled into accepting lower pay because they do not see the fall in real wages right away. Firms hire them because they see the inflation as allowing higher profits for given nominal wages. This is a movement along the Phillips curve as with change A. Eventually, workers discover that real wages have fallen, so they push for higher money wages. This causes the Phillips curve to shift upward and to the right, as with B. Some research underlines that some implicit and serious assumptions are actually in the background of the Friedmanian Phillips curve. This information asymmetry and a special pattern of flexibility of prices and wages are both necessary if one wants to maintain the mechanism told by Friedman. However, as it is argued, these presumptions remain completely unrevealed and theoretically ungrounded by Friedman.[29]

Gordon's triangle model

[edit]Robert J. Gordon of Northwestern University has analyzed the Phillips curve to produce what he calls the triangle model, in which the actual inflation rate is determined by the sum of

- demand pull or short-term Phillips curve inflation,

- cost push or supply shocks, and

- built-in inflation.

The last reflects inflationary expectations and the price/wage spiral. Supply shocks and changes in built-in inflation are the main factors shifting the short-run Phillips curve and changing the trade-off. In this theory, it is not only inflationary expectations that can cause stagflation. For example, the steep climb of oil prices during the 1970s could have this result.

Changes in built-in inflation follow the partial-adjustment logic behind most theories of the NAIRU:

- Low unemployment encourages high inflation, as with the simple Phillips curve. But if unemployment stays low and inflation stays high for a long time, as in the late 1960s in the U.S., both inflationary expectations and the price/wage spiral accelerate. This shifts the short-run Phillips curve upward and rightward, so that more inflation is seen at any given unemployment rate. (This is with shift B in the diagram.)

- High unemployment encourages low inflation, again as with a simple Phillips curve. But if unemployment stays high and inflation stays low for a long time, as in the early 1980s in the U.S., both inflationary expectations and the price/wage spiral slow. This shifts the short-run Phillips curve downward and leftward, so that less inflation is seen at each unemployment rate.

In between these two lies the NAIRU, where the Phillips curve does not have any inherent tendency to shift, so that the inflation rate is stable. However, there seems to be a range in the middle between "high" and "low" where built-in inflation stays stable. The ends of this "non-accelerating inflation range of unemployment rates" change over time.

See also

[edit]Notes

[edit]- ^ A. W. Phillips, ‘The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom 1861–1957’ (1958) 25 Economica 283, referring to unemployment and the "change of money wage rates".

- ^ a b Friedman, Milton (1968). "The Role of Monetary Policy". American Economic Review. 58 (1): 1–17. JSTOR 1831652.

- ^ a b Phelps, Edmund S. (1968). "Money-Wage Dynamics and Labor Market Equilibrium". Journal of Political Economy. 76 (S4): 678–711. doi:10.1086/259438. S2CID 154427979.

- ^ a b Phelps, Edmund S. (1967). "Phillips Curves, Expectations of Inflation and Optimal Unemployment over Time". Economica. 34 (135): 254–281. doi:10.2307/2552025. JSTOR 2552025.

- ^ a b c Chang, R. (1997) "Is Low Unemployment Inflationary?" Archived 2016-10-05 at the Wayback Machine Federal Reserve Bank of Atlanta Economic Review 1Q97:4-13

- ^ Phelan, John (23 October 2012). "Milton Friedman and the rise and fall of the Phillips Curve". thecommentator.com. Retrieved September 29, 2014.

- ^ a b Krugman, Paul R. (1995). Peddling prosperity: economic sense and nonsense in the age of diminished expectations. New York: W. W. Norton. p. 43. ISBN 978-0393312928.

- ^ "The Phillips curve may be broken for good". The Economist. 2017.

- ^ Hazell, Jonathon; Herreño, Juan; Nakamura, Emi; Steinsson, Jón (2022). "The Slope of the Phillips Curve: Evidence from U.S. States" (PDF). Quarterly Journal of Economics. 137 (3): 1299–1344. doi:10.1093/qje/qjac010.

- ^ "Speech by Chair Yellen on inflation, uncertainty, and monetary policy". Board of Governors of the Federal Reserve System. Retrieved 2017-09-30.

- ^ Phillips, A. W. (1958). "The Relationship between Unemployment and the Rate of Change of Money Wages in the United Kingdom 1861-1957". Economica. 25 (100): 283–299. doi:10.1111/j.1468-0335.1958.tb00003.x.

- ^ a b Samuelson, Paul A.; Solow, Robert M. (1960). "Analytical Aspects of Anti-Inflation Policy". American Economic Review. 50 (2): 177–194. JSTOR 1815021.

- ^ Fisher, Irving (1973). "I discovered the Phillips curve: 'A statistical relation between unemployment and price changes'". Journal of Political Economy. 81 (2): 496–502. doi:10.1086/260048. JSTOR 1830534. S2CID 154013344. Reprinted from 1926 edition of International Labour Review.

- ^ Forder, James (2014). Macroeconomics and the Phillips Curve Myth. Oxford University Press. ISBN 978-0-19-968365-9.

- ^ Domitrovic, Brain (10 October 2011). "The Economics Nobel Goes to Sargent & Sims: Attackers of the Phillips Curve". Forbes.com. Retrieved 12 October 2011.

- ^ Akerlof, George A.; Dickens, William T.; Perry, George L. (2000). "Near-Rational Wage and Price Setting and the Long-Run Phillips Curve". Brookings Papers on Economic Activity. 2000 (1): 1–60. CiteSeerX 10.1.1.457.3874. doi:10.1353/eca.2000.0001. S2CID 14610294.

- ^ Oliver Hossfeld (2010) "US Money Demand, Monetary Overhang, and Inflation Prediction" Archived 2013-11-13 at the Wayback Machine International Network for Economic Research working paper no. 2010.4

- ^ Jacob, Reed (2016). "AP Macroeconomics Review: Phillips Curve". APEconReview.com.

- ^ Blanchard, Olivier (2000). Macroeconomics (Second ed.). Prentice Hall. pp. 149–55. ISBN 978-0-13-013306-9.

- ^ Keynes, John Maynard (1924). Monetary Reform. New York: Hancourt. pp. 54–55. doi:10.1086/318607.

- ^ Clarida, Richard; Galí, Jordi; Gertler, Mark (1999). "The science of monetary policy: a New-Keynesian perspective" (PDF). Journal of Economic Literature. 37 (4): 1661–1707. doi:10.1257/jel.37.4.1661. hdl:10230/360. JSTOR 2565488.

- ^ Blanchard, Olivier; Galí, Jordi (2007). "Real Wage Rigidities and the New Keynesian Model" (PDF). Journal of Money, Credit, and Banking. 39 (s1): 35–65. doi:10.1111/j.1538-4616.2007.00015.x. hdl:1721.1/64018.

- ^ Roberts, John M. (1995). "New Keynesian Economics and the Phillips Curve". Journal of Money, Credit and Banking. 27 (4): 975–984. doi:10.2307/2077783. JSTOR 2077783.

- ^ Clarida, Richard; Galí, Jordi; Gertler, Mark (2000). "Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory". The Quarterly Journal of Economics. 115 (1): 147–180. CiteSeerX 10.1.1.111.7984. doi:10.1162/003355300554692.

- ^ Romer, David (2012). "Dynamic Stochastic General Equilibrium Models of Fluctuation". Advanced Macroeconomics. New York: McGraw-Hill Irwin. pp. 312–364. ISBN 978-0-07-351137-5.

- ^ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1976". The Nobel Prize. 14 October 1976. Retrieved 25 March 2022.

- ^ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2006". The Nobel Prize. 9 October 2006. Retrieved 25 March 2022.

- ^ Forder, James (2010). "The historical place of the 'Friedman-Phelps' expectations critique" (PDF). European Journal of the History of Economic Thought. 17 (3): 493–511. doi:10.1080/09672560903114875. S2CID 154920593.

- ^ Galbács, Peter (2015). The Theory of New Classical Macroeconomics. A Positive Critique. Contributions to Economics. Heidelberg/New York/Dordrecht/London: Springer. doi:10.1007/978-3-319-17578-2. ISBN 978-3-319-17578-2.

References

[edit]- Federal Reserve Bank of Boston, "Understanding Inflation and the Implications for Monetary Policy: A Phillips Curve Retrospective" Archived 2013-08-26 at the Wayback Machine, FRBB Conference Series 53, June 9–11, 2008, Chatham, Massachusetts.

- Gordon, Robert J. (2011). "The History of the Phillips Curve: Consensus and Bifurcation". Economica. 78 (309): 10–50. doi:10.1111/j.1468-0335.2009.00815.x. S2CID 759217.

- Herbener, Jeffrey M. (1992). "The Fallacy of the Phillips Curve". Dissent on Keynes: A Critical Appraisal of Keynesian Economics. New York: Praeger. pp. 51–71. ISBN 978-0-275-93778-2.

- John Komlos, “The Real U.S. Unemployment Rate is Twice the Official Rate, and the Phillips Curve,” Challenge: The Magazine of Economic Affairs 64 (2021) 1: 54-74; CesIfo working paper No 7859, (2019); https://[https://www.cesifo.org/DocDL/cesifo1_wp7859.pdf www.cesifo.org/DocDL/cesifo1_wp7859.pdf].

- M Friedman, ‘The Role of Monetary Policy’ (1968) 58(1) American Economic Review 1

- Hoover, Kevin D. (2008). "Phillips Curve". In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- E McGaughey, 'Will Robots Automate Your Job Away? Full Employment, Basic Income, and Economic Democracy' (2018) SSRN, part 2(1)

- RD Gabriel, 'Monetary Policy and the Wage Inflation-Unemployment Tradeoff' (2021) [1]

- A. W. Phillips, ‘The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom 1861–1957’ (1958) 25 Economica 283

- Qin, Duo (2011). "The Phillips Curve from the Perspective of the History of Econometrics". History of Political Economy. 43 (Suppl. 1): 283–308. doi:10.1215/00182702-1158763.

External links

[edit]- "Of Hume, Thornton, the Quantity Theory, and the Phillips Curve." by Thomas M. Humphrey. Federal Reserve Bank of Richmond Economic Review, 1982.

![{\displaystyle \pi _{t}=\beta E_{t}[\pi _{t+1}]+\kappa y_{t}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/0ef7dd57c38352c58215d6a0a3e102a4218956f6)

![{\displaystyle \kappa ={\frac {\alpha [1-(1-\alpha )\beta ]\phi }{1-\alpha }}.}](https://wikimedia.org/api/rest_v1/media/math/render/svg/2308e25a3e2a1727dfe3c9d1dcbee53719a2a260)

![{\displaystyle \beta E_{t}[\pi _{t+1}]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/665311ff5571a987a4e48a2435270b77aa595d37)