File:CBO Budget Deficit Assuming Continuation of Policies.png

Original file (960 × 720 pixels, file size: 319 KB, MIME type: image/png)

Summary

[edit]| Description |

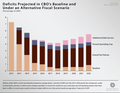

U.S. Budget Deficit Assuming Continuation of Policies |

|---|---|

| Source |

Congressional Budget Office (CBO) |

| Date |

04:10, 5 January 2012 (UTC) |

| Author | |

| Permission (Reusing this file) |

See below.

|

Chart Explanation

[edit]This is a CBO chart taken verbatim from "An Update to the Budget and Economic Outlook: Fiscal Years 2012 to 2022" from August 2012.[1]

CBO baseline assumes certain tax cuts and spending will expire per current law, which significantly reduces future budget deficits. The baseline assumes the Bush tax cuts of 2001 and 2003 (extended by President Obama in 2009) will expire at the end of 2012 as scheduled, along with other Obama tax cuts in 2009 and 2010. If these tax cuts are extended and spending continued, the budget deficit is considerably higher, by 3.5% GDP in 2021 for example.[2]

However, CBO has reported it unlikely that the baseline scenario will come to pass, as Congress has consistently voted to extend the tax cuts and defer spending reduction.[3]

Specifically, allowing laws on the books in 2011 to take effect would reduce future debts by up to $7.1 trillion over a decade:

- $3.3T from letting temporary income and estate tax cuts enacted in 2001, 2003, 2009, and 2010 expire on schedule at the end of 2012;

- $1.2T from letting the sequestration of spending required if the Joint Committee does not produce $1.2 trillion in deficit reduction take effect (i.e., implementing the Budget Control Act of 2011);

- $0.8T other temporary tax cut expirations (the “extenders” that Congress has regularly extended on a “temporary” basis) expire on schedule;

- $0.3T from letting cuts in Medicare physician reimbursements scheduled under current law (required under the Medicare Sustainable Growth Rate formula enacted in 1997, but which have been postponed since 2003) take effect (i.e., no longer applying the Doc fix);

- $0.7T from letting the temporary increase in the exemption amount under the Alternative Minimum Tax expire, thereby returning the exemption to the level in effect in 2001;

- $0.9T in lower interest payments on the debt as a result of the deficit reduction achieved from not extending these current policies.[4]

References

[edit]- ^ CBO-An Update to the Budget and Economic Outlook: Fiscal Years 2012 to 2022-August 22, 2012

- ^ CBO Chart-August 2011 Long-Term Budget Outlook Charts-August 2011

- ^ CBO 2011 Long-Term Budget Outlook-June 2011

- ^ Washington Post-EJ Dionne-Why Doing Nothing Yields $7.1 trillion in deficit cuts-November 16, 2011

Licensing

[edit]| This United States Congress image is in the public domain in the US. This may be because it is an official congressional portrait, because it was taken by an official employee of the Congress, or because it has been released into the public domain by a member of Congress. |  |

| This graph image was uploaded in a raster graphics format such as PNG, GIF, or JPEG. However, it contains information that could be stored more efficiently and/or accurately in the SVG format, as a vector graphic. If possible, please upload an SVG version of this image. After confirming it is of comparable quality, please replace all instances of the previous version throughout Wikipedia (noted under the "File links" header), tag the old version with {{Vector version available|NewImage.svg}}, and remove this tag. For more information, see Wikipedia:Preparing images for upload. For assistance with converting to SVG, please see the Graphics Lab.Do not re-draw or auto-trace non-free images; instead, seek out vector versions from official sources. |  |

| This file is a candidate to be copied to Wikimedia Commons.

Any user may perform this transfer; refer to Wikipedia:Moving files to Commons for details. If this file has problems with attribution, copyright, or is otherwise ineligible for Commons, then remove this tag and DO NOT transfer it; repeat violators may be blocked from editing. Other Instructions

| ||

| |||

File history

Click on a date/time to view the file as it appeared at that time.

| Date/Time | Thumbnail | Dimensions | User | Comment | |

|---|---|---|---|---|---|

| current | 04:12, 27 November 2012 |  | 960 × 720 (319 KB) | Guest2625 (talk | contribs) | Reverted to version as of 07:23, 6 November 2012 |

| 03:46, 27 November 2012 |  | 927 × 715 (306 KB) | Guest2625 (talk | contribs) | using inverted colors for clarity and uniformity with white background images | |

| 07:23, 6 November 2012 |  | 960 × 720 (319 KB) | Farcaster (talk | contribs) | ||

| 04:10, 5 January 2012 |  | 960 × 720 (310 KB) | Farcaster (talk | contribs) | {{Information |Description = U.S. Budget Deficit Assuming Continuation of Policies |Source = Congressional Budget Office (CBO) |Date = ~~~~~ |Author = ~~~~ |Permission = |other_versions = }} |

You cannot overwrite this file.

File usage

The following 5 pages use this file: